Investing can feel overwhelming for newcomers, especially with the sheer number of options available. Exchange Traded Funds (ETFs) offer an accessible, cost-effective entry point into the financial markets. Unlike individual stocks or mutual funds, ETFs combine diversification, transparency, and flexibility—making them ideal for investors just starting out. This guide breaks down how ETFs work, why they matter, and how to use them strategically to build a resilient, balanced portfolio.

What Are Exchange Traded Funds?

An Exchange Traded Fund (ETF) is a collection of securities—such as stocks, bonds, or commodities—that trades on a stock exchange like a single stock. Most ETFs are passively managed and designed to track a specific index, such as the S&P 500 or the Bloomberg U.S. Aggregate Bond Index. Because they hold multiple assets, ETFs inherently reduce risk through diversification.

For example, instead of buying shares in 30 different technology companies, you can purchase one ETF that holds all of them. This simplifies decision-making and reduces exposure to any single company’s performance. ETFs also typically have lower expense ratios than actively managed mutual funds, which helps preserve returns over time.

Why ETFs Are Ideal for Beginners

New investors benefit from ETFs in several key ways:

- Diversification: A single ETF can hold hundreds or even thousands of securities, instantly spreading risk.

- Liquidity: ETFs trade throughout the day on exchanges, allowing investors to buy and sell at current market prices.

- Transparency: Most ETFs disclose their holdings daily, so you always know what you own.

- Low minimum investment: You can buy a single share, making ETFs affordable even with limited capital.

- Tax efficiency: Due to their structure, ETFs typically generate fewer capital gains distributions than mutual funds.

“ETFs democratize access to diversified investing. They allow individuals to build portfolios once reserved for institutional investors.” — Dr. Christine Brown, Financial Economist, University of Virginia

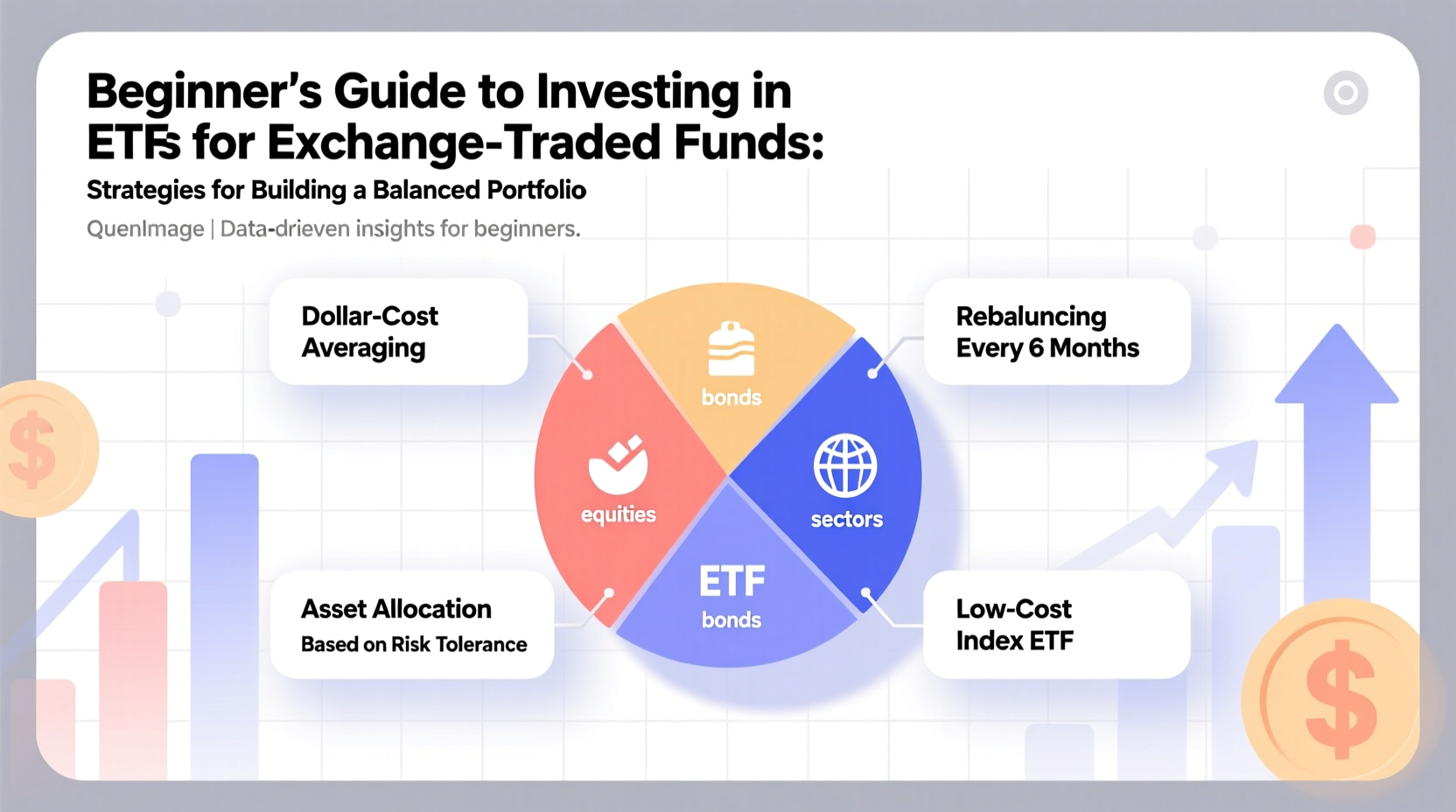

Strategies for Building a Balanced Portfolio with ETFs

A balanced portfolio aims to manage risk while pursuing consistent growth. The foundation lies in asset allocation—the distribution of investments across different categories such as stocks, bonds, and real assets. Below is a step-by-step approach to constructing a well-rounded ETF-based portfolio.

Step 1: Define Your Investment Goals and Risk Tolerance

Before selecting any ETF, clarify your objectives. Are you saving for retirement in 30 years? Or building a short-term emergency fund? Long-term goals typically allow for higher risk, meaning more exposure to equities. Shorter timelines call for stability, favoring bond or money market ETFs.

Assess your risk tolerance honestly. If market swings cause anxiety, a conservative mix with more fixed-income assets may be appropriate.

Step 2: Choose Core Asset Classes

A basic balanced portfolio includes three primary components:

- Equity ETFs: Provide growth potential. Examples include large-cap U.S. stocks (e.g., SPY), international stocks (e.g., VXUS), and small-cap value funds (e.g., IJS).

- Bond ETFs: Offer income and stability. Consider intermediate-term Treasuries (e.g., AGG) or high-quality corporate bonds (e.g., LQD).

- Alternative Assets: Add diversification. Real estate (e.g., VNQ) or commodities (e.g., GLD) can help hedge against inflation.

Step 3: Allocate Based on Your Profile

The following table outlines sample allocations based on risk profiles:

| Risk Profile | Stocks (Equities) | Bonds (Fixed Income) | Alternatives |

|---|---|---|---|

| Conservative | 40% | 50% | 10% |

| Moderate | 60% | 35% | 5% |

| Aggressive | 80% | 15% | 5% |

This framework can be adjusted as your life circumstances change. Rebalance annually or when allocations drift more than 5% from targets.

Step 4: Select High-Quality ETFs

Not all ETFs are created equal. Prioritize funds with:

- Low expense ratios

- High average daily trading volume (liquidity)

- A proven track record of tracking their index closely

- Reputable providers like Vanguard, iShares, or State Street

Mini Case Study: Building Sarah’s First Portfolio

Sarah is 28, earns a steady income, and wants to start investing for retirement. She has $5,000 to begin and prefers a moderate risk level. After assessing her goals, she decides on a 60/35/5 split between stocks, bonds, and alternatives.

She chooses:

- VTI (Vanguard Total Stock Market ETF): 60% allocation – broad U.S. equity exposure.

- BND (Vanguard Total Bond Market ETF): 35% allocation – diversified bond holdings.

- GLD (SPDR Gold Shares): 5% allocation – inflation hedge.

Sarah sets up automatic monthly contributions of $300 and plans to rebalance every 12 months. By staying disciplined and avoiding emotional reactions to market noise, she positions herself for long-term compounding growth.

Common Mistakes to Avoid

Even simple strategies can go off track without awareness. Watch out for these pitfalls:

- Chasing performance: Buying ETFs because they’ve recently surged often leads to buying high and selling low.

- Overcomplicating the portfolio: Holding too many ETFs increases complexity without meaningful diversification benefits.

- Ignoring tax implications: Frequent trading in taxable accounts can trigger unnecessary capital gains taxes.

- Failing to rebalance: Letting winners dominate your portfolio increases risk over time.

Checklist: Launching Your ETF Portfolio

Follow this actionable checklist to get started:

- Open a brokerage account with low fees and strong research tools.

- Determine your risk tolerance and investment timeline.

- Select 3–5 core ETFs covering major asset classes.

- Set initial allocations based on your risk profile.

- Automate regular contributions to maintain consistency.

- Schedule annual reviews to assess performance and rebalance if needed.

Frequently Asked Questions

How much money do I need to start investing in ETFs?

You can start with the price of a single share, which for many broad-market ETFs ranges from $50 to $300. Some brokerages now offer fractional shares, allowing investments of as little as $1.

Are ETFs safer than individual stocks?

Yes, in general. Because ETFs spread investments across many companies or sectors, they reduce the impact of any single company failing. However, they are not risk-free—market-wide downturns still affect ETF values.

Do ETFs pay dividends?

Many equity ETFs distribute dividends from the underlying stocks they hold. These are typically paid quarterly. Bond ETFs distribute interest income on a similar schedule.

Conclusion: Start Simple, Stay Consistent

Building wealth doesn’t require complex strategies or insider knowledge. For beginners, ETFs offer a straightforward path to owning a diversified portfolio with minimal effort and cost. The key is to start early, stay consistent, and avoid emotional decisions during market fluctuations. Over time, compound returns will do the heavy lifting.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?