Understanding how to calculate time and a half for overtime pay is essential for both employers ensuring legal compliance and employees verifying they are fairly compensated. In the United States, the Fair Labor Standards Act (FLSA) mandates that non-exempt employees receive overtime pay at a rate of at least one and a half times their regular hourly rate for hours worked beyond 40 in a workweek. Missteps in calculation can lead to underpayment, payroll disputes, or regulatory penalties. This guide breaks down the process into precise, actionable steps with real-world examples and expert insights to ensure accuracy.

What Is Time and a Half?

Time and a half refers to an employee’s regular hourly wage multiplied by 1.5. It is the minimum overtime rate required under federal law when a non-exempt employee works more than 40 hours in a single workweek. For example, if an employee earns $20 per hour, their time-and-a-half rate would be $30 per hour for each overtime hour worked.

It's important to note that not all employees qualify for overtime. Exempt employees—typically salaried professionals in executive, administrative, or certain technical roles—are not entitled to overtime pay regardless of hours worked. Always confirm employee classification before applying overtime rules.

“Accurate overtime calculation isn’t just about fairness—it’s a legal obligation. One miscalculation can trigger audits or back-pay claims.” — Laura Simmons, HR Compliance Specialist

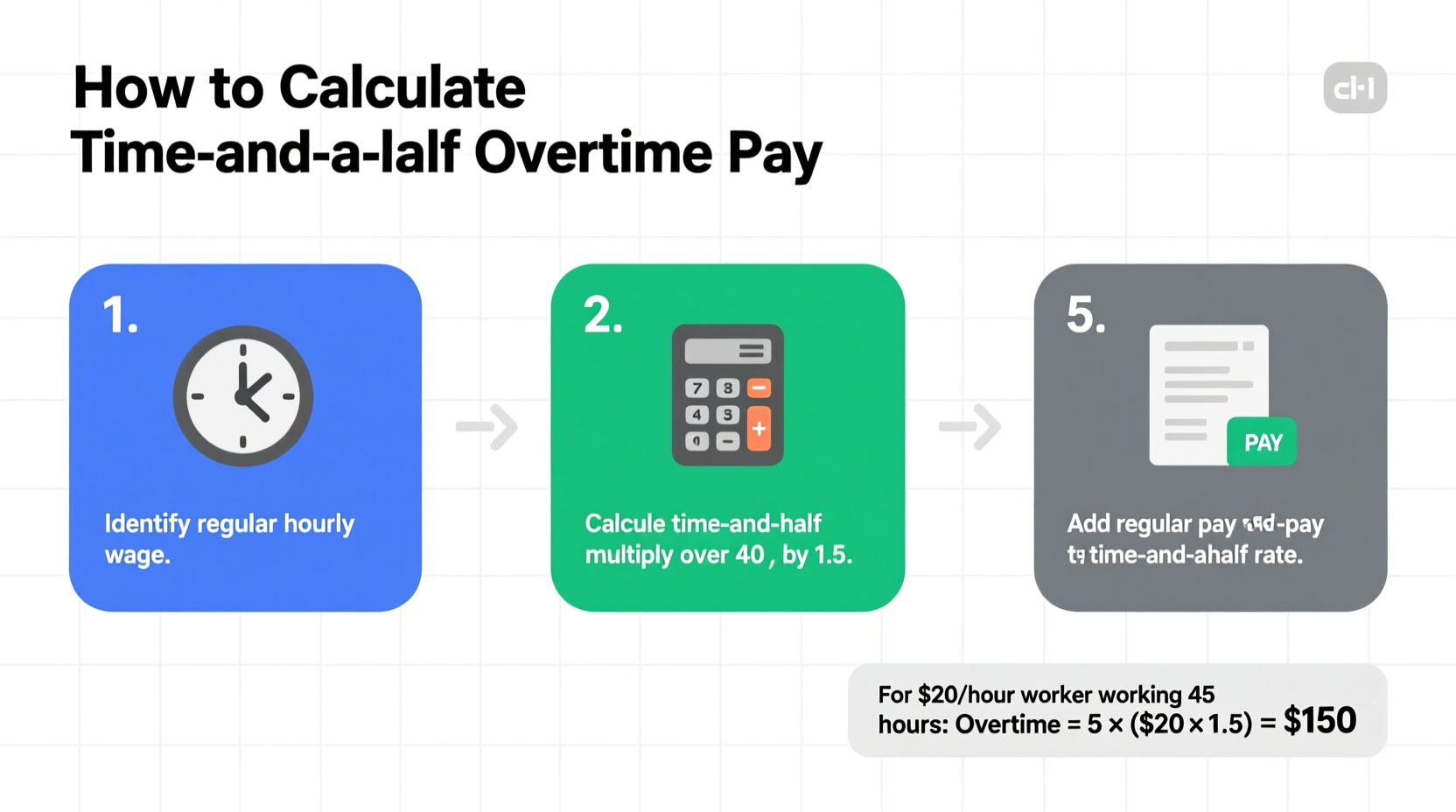

Step-by-Step Guide to Calculating Overtime Pay

Follow these six steps to correctly compute time and a half for any non-exempt employee.

- Determine the employee’s regular hourly rate.

If the employee is paid hourly, this is straightforward. For salaried employees, divide their weekly salary by the number of hours the salary is intended to cover (usually 40). - Confirm total hours worked in the workweek.

A workweek is any fixed and regularly recurring period of 168 hours (7 consecutive 24-hour periods), as defined by the employer. Track all hours actually worked, including time spent on tasks before or after scheduled shifts if they are integral to the job. - Identify overtime hours.

Subtract 40 from the total hours worked. Any result greater than zero is considered overtime. Example: 47 hours worked – 40 = 7 overtime hours. - Calculate the overtime rate (time and a half).

Multiply the regular hourly rate by 1.5. For example: $18/hour × 1.5 = $27/hour. - Multiply the overtime rate by the number of overtime hours.

Using the above example: $27 × 7 hours = $189 in overtime pay. - Add overtime pay to base pay for total gross wages.

Base pay: $18 × 40 = $720

Overtime pay: $189

Total: $720 + $189 = $909

Handling Salaried Non-Exempt Employees

Salaried employees who are non-exempt must still receive overtime pay. The key is converting their salary into an effective hourly rate.

To do this:

- Divide the employee’s weekly salary by the number of hours it covers (typically 40).

- Apply the same time-and-a-half formula to any hours over 40.

For example, an employee earning $600 per week and working 45 hours:

- Hourly rate: $600 ÷ 40 = $15/hour

- Overtime rate: $15 × 1.5 = $22.50/hour

- Overtime pay: $22.50 × 5 = $112.50

- Total pay: $600 + $112.50 = $712.50

Note: Some states require additional calculations for salaried workers, such as using a fluctuating workweek method. Always consult state-specific labor laws when applicable.

Real-World Example: Overtime Calculation in Action

Meet James, a warehouse associate paid $17.50 per hour. During one busy week, he logs the following hours:

- Monday: 9 hours

- Tuesday: 10 hours

- Wednesday: 8 hours

- Thursday: 9 hours

- Friday: 10 hours

- Saturday: 5 hours

Total hours: 51

Step 1: Regular rate = $17.50

Step 2: Hours over 40 = 51 – 40 = 11

Step 3: Overtime rate = $17.50 × 1.5 = $26.25

Step 4: Overtime pay = $26.25 × 11 = $288.75

Step 5: Regular pay = $17.50 × 40 = $700

Step 6: Total gross pay = $700 + $288.75 = $988.75

James should receive $988.75 for the week. Employers who round down his hours or fail to include Saturday hours risk violating FLSA regulations.

Common Mistakes to Avoid

Even small errors can have significant consequences. Here are frequent pitfalls and how to prevent them:

| Mistake | Why It’s Wrong | How to Fix It |

|---|---|---|

| Not counting all hours worked | Pre-shift setup or post-shift cleanup may be compensable work time. | Train supervisors to record all work-related time. |

| Using “average” rates for multiple jobs | FLSA requires weighted average for employees with two pay rates. | Calculate combined rate based on total earnings divided by total hours. |

| Paying straight time instead of time and a half | Violates federal law and invites liability. | Automate overtime alerts in payroll software. |

| Ignoring state-specific rules | Some states (e.g., California) have daily overtime or double-time requirements. | Verify local labor laws; don’t rely solely on federal standards. |

FAQ: Frequently Asked Questions

Do bonuses count when calculating overtime?

Yes, non-discretionary bonuses (such as production, attendance, or incentive bonuses) must be included in the regular rate of pay. To calculate: add the bonus to total earnings for the period, then recalculate the weighted hourly rate before determining overtime.

Is there a maximum limit on overtime hours?

Federal law does not cap the number of hours employees aged 16 and older can work. However, overtime must be paid for all hours over 40 in a workweek. Some states impose additional limits or daily overtime rules.

Can employees volunteer to work off the clock?

No. All hours worked must be recorded and compensated. Even if an employee agrees to “stay late without pay,” the employer remains liable for unpaid wages under the FLSA.

Essential Checklist for Employers

Use this checklist to ensure accurate and compliant overtime processing:

- ✅ Classify each employee correctly as exempt or non-exempt

- ✅ Maintain accurate time records for all employees

- ✅ Define a consistent 7-day workweek

- ✅ Calculate regular rate of pay—including shift differentials or non-discretionary bonuses

- ✅ Apply time and a half to all hours over 40 in the workweek

- ✅ Review state and local overtime laws for stricter requirements

- ✅ Train managers on proper timekeeping and reporting procedures

- ✅ Conduct regular payroll audits

Conclusion: Accuracy Builds Trust and Compliance

Calculating time and a half correctly protects both employees and employers. For workers, it ensures fair compensation for extra effort. For businesses, it prevents costly legal issues and fosters a culture of transparency. Whether you manage payroll manually or use automated software, understanding the fundamentals of overtime calculation is non-negotiable. By following the steps outlined here, reviewing real examples, and avoiding common errors, you can maintain compliant, accurate, and ethical payroll practices.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?