College tuition costs can vary dramatically depending on whether a student qualifies for in-state or out-of-state rates. For many families, the difference amounts to tens of thousands of dollars per year. While public universities offer lower tuition to residents of the state, qualifying for that status is not always straightforward. Understanding the rules, timelines, and documentation needed to establish residency can make higher education significantly more affordable.

This guide breaks down the key factors colleges consider when determining residency, outlines actionable steps to meet in-state requirements, and provides real-world examples to help students and families navigate the process effectively.

Understanding In-State vs. Out-of-State Tuition

Public universities are funded by state governments, which subsidize tuition for residents. As a result, in-state students typically pay 30% to 70% less than their out-of-state peers. For example, at the University of Michigan, in-state tuition for the 2023–2024 academic year was approximately $16,000, while out-of-state tuition exceeded $57,000—a difference of over $41,000 annually.

Despite these savings, institutions enforce strict criteria to prevent abuse of the system. Simply attending school in a state does not automatically grant in-state status. Residency must be established through verifiable ties such as employment, tax filings, vehicle registration, and permanent address.

Key Factors That Determine Residency Status

Each state sets its own rules, but most follow similar guidelines when evaluating residency for tuition purposes. The following elements are commonly assessed:

- Physical Presence: Continuous residence within the state for a minimum period, usually 12 consecutive months.

- Domicile: Intent to remain in the state permanently, demonstrated through actions like securing full-time employment or signing a lease.

- Financial Independence: For dependent students, the parent’s residency often determines eligibility. Independent students must show self-sufficiency.

- Tax Filings: Filing state income taxes as a resident strengthens the case.

- Driver’s License & Vehicle Registration: Transferring these documents to the new state is a strong indicator of intent.

- Voter Registration: Registering to vote in the state supports claims of domicile.

“Residency isn’t just about where you live—it’s about demonstrating intent to make that location your permanent home.” — Dr. Laura Simmons, Higher Education Policy Analyst

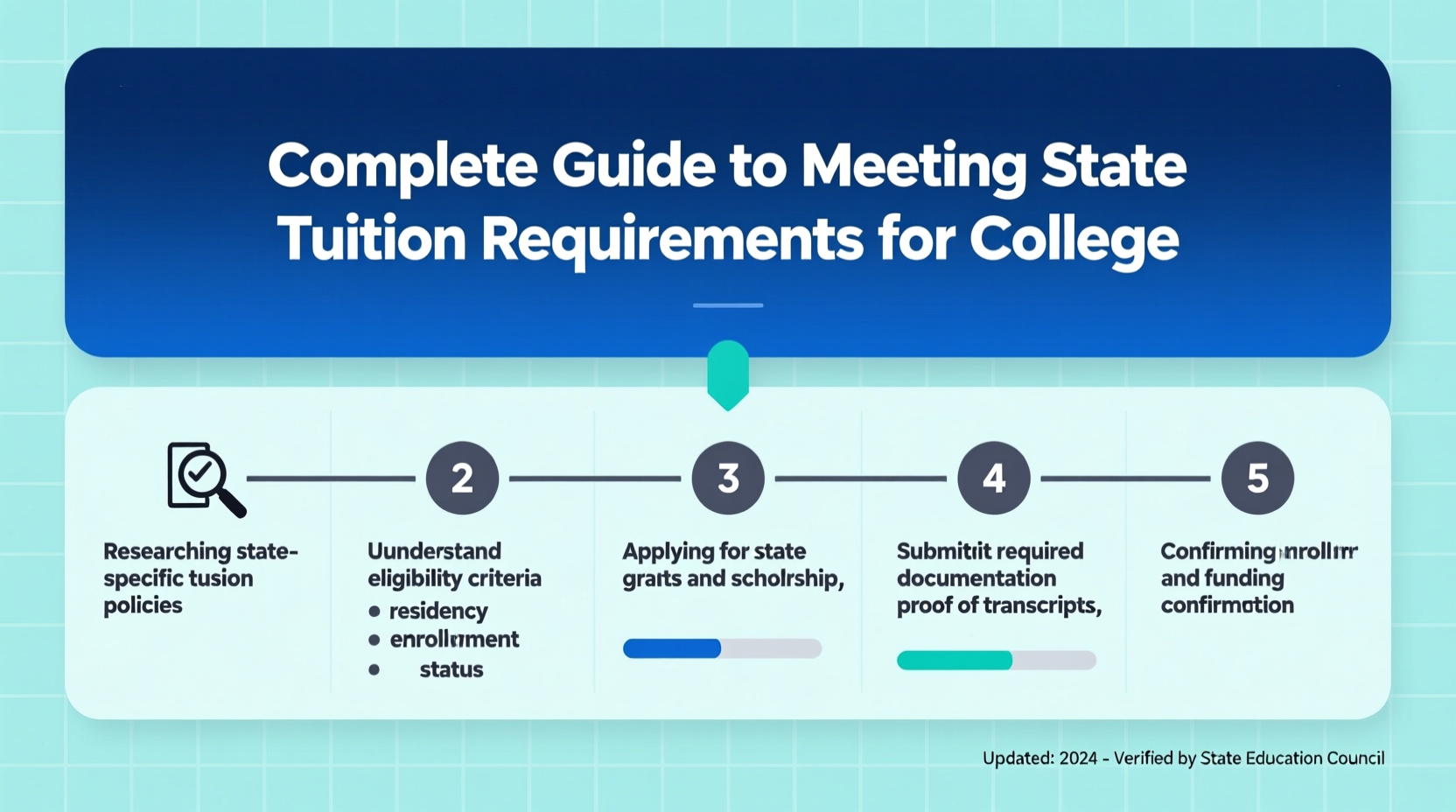

Step-by-Step Guide to Establishing In-State Residency

Gaining in-state tuition status requires careful planning and documentation. Follow this timeline to improve your chances of approval:

- Research Early (6–12 Months Before Enrollment): Review the residency policies of your target university and state. Some schools have waivers for regional programs (e.g., WUE, Academic Common Market).

- Relocate Permanently: Move into a long-term rental or purchase property. Avoid short-term leases or temporary housing.

- Secure Employment: Obtain a full-time job in the state. Pay stubs and W-2 forms serve as strong evidence.

- Update Legal Documents: Transfer your driver’s license, register your vehicle, and update your Social Security record if necessary.

- File State Taxes: Claim residency on your next tax return. Keep copies of all filings.

- Register to Vote: Submit a voter registration form with your new address.

- Open Local Bank Accounts: Use a local bank or credit union to further demonstrate financial ties.

- Submit Residency Application: Apply through the university’s residency classification office with all supporting documents.

Common Pitfalls and How to Avoid Them

Many students assume that enrolling in a state university automatically grants in-state rates. Others believe part-time work or a P.O. box suffices for residency. These misconceptions lead to denials. Below is a comparison of common mistakes versus best practices.

| Don’t | Do |

|---|---|

| Maintain a permanent address in another state | Close ties to previous state; terminate leases, cancel utilities |

| Claim dependent status on parents’ out-of-state taxes | File independently and claim in-state residency |

| Use an out-of-state driver’s license | Obtain a new license within 30 days of moving |

| Rely solely on student status for residency | Show non-academic ties: employment, family, property ownership |

Case Study: Achieving In-State Status in Texas

Jamal, a graduate student from Florida, planned to attend the University of Texas at Austin. Knowing the cost difference—$12,000 in-state vs. $38,000 out-of-state—he began preparing a year in advance.

He secured a research assistant position that provided a steady paycheck, signed a 12-month lease, transferred his Florida license to a Texas one, registered his car, and filed a Texas voter registration. He also closed his Florida bank account and opened one in Austin.

When he applied for residency, he submitted pay stubs, lease agreement, utility bills, tax documents, and a sworn affidavit of domicile. His application was approved, saving him over $100,000 over the course of his degree.

Special Considerations and Exceptions

Not all students need to go through the full 12-month process. Several programs and exemptions exist:

- Regional Exchange Programs: The Western Undergraduate Exchange (WUE) offers reduced tuition for students from participating western states.

- Academic Common Market: Available in Southern states, allowing students to pursue specific degrees not offered in their home state at in-state rates.

- Military Members and Families: The GI Bill and DoD policies allow service members and dependents to qualify for in-state tuition regardless of formal residency.

- Border Commuters: Some states allow students living near the border to qualify based on proximity and employment.

Frequently Asked Questions

Can international students qualify for in-state tuition?

Generally, no. Most states require U.S. citizenship or permanent residency. However, some states like California and Texas allow undocumented students who meet AB 540 or House Bill 1403 criteria to pay in-state rates if they attended high school in the state.

Does getting married to a state resident help?

In many cases, yes. If you marry a legal resident and establish joint domicile—such as shared housing, bank accounts, or tax filings—you may qualify sooner. However, documentation must clearly show shared financial and residential life.

What if my residency application is denied?

You can appeal the decision. Gather additional evidence—employment records, affidavits from landlords or employers, or proof of community involvement—and submit it during the appeals process. Many universities have a formal review board for contested cases.

Final Checklist for In-State Tuition Eligibility

Use this checklist to ensure you’re on track:

- ✅ Lived in the state continuously for at least 12 months

- ✅ Established a permanent address (lease, mortgage, deed)

- ✅ Obtained a state-issued ID or driver’s license

- ✅ Registered vehicle in-state

- ✅ Filed state income taxes as a resident

- ✅ Registered to vote in the state

- ✅ Secured full-time employment (if independent)

- ✅ Closed significant ties to previous state

- ✅ Submitted all required forms to the university’s residency office

Take Control of Your College Costs

Meeting in-state tuition requirements is one of the most effective ways to reduce the financial burden of college. While the process demands time, intentionality, and thorough documentation, the payoff can be life-changing. Thousands of students successfully transition to in-state status each year by planning ahead and building genuine connections to their new state.

If you're considering a public university outside your home state, start researching residency policies now. Every step you take toward establishing true domicile brings you closer to substantial savings. Don’t let assumptions or procrastination cost you tens of thousands—take action today.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?