For many individuals living in the United States without a Social Security Number (SSN), building and monitoring credit is still possible—thanks to the Individual Taxpayer Identification Number (ITIN). While an ITIN was originally created by the IRS for tax reporting purposes, it has become a vital tool for immigrants, freelancers, and foreign nationals seeking financial inclusion. One of the most important aspects of financial health is knowing your credit score. The good news? You can check your credit score with an ITIN. This guide walks you through the process, outlines the limitations, and offers actionable strategies to build credit even without an SSN.

Understanding ITINs and Credit Reporting

An ITIN is a nine-digit number issued by the Internal Revenue Service (IRS) to individuals who are required to have a U.S. taxpayer identification number but do not qualify for an SSN. Unlike an SSN, an ITIN does not authorize work or provide eligibility for Social Security benefits. However, it can be used on tax returns, bank account applications, and in some cases, to apply for financial products.

Credit bureaus—Equifax, Experian, and TransUnion—do not use ITINs as primary identifiers. Instead, they rely on personal information such as name, date of birth, address, and employment history to match consumer data. If you’ve used your ITIN consistently across financial accounts and filed taxes with it, there’s a chance that your credit activity is being tracked—even if indirectly.

“While credit bureaus don’t track ITINs directly, consistent financial behavior tied to your identity can still contribute to a credit file.” — Maria Gonzalez, Financial Inclusion Advocate at UnidosUS

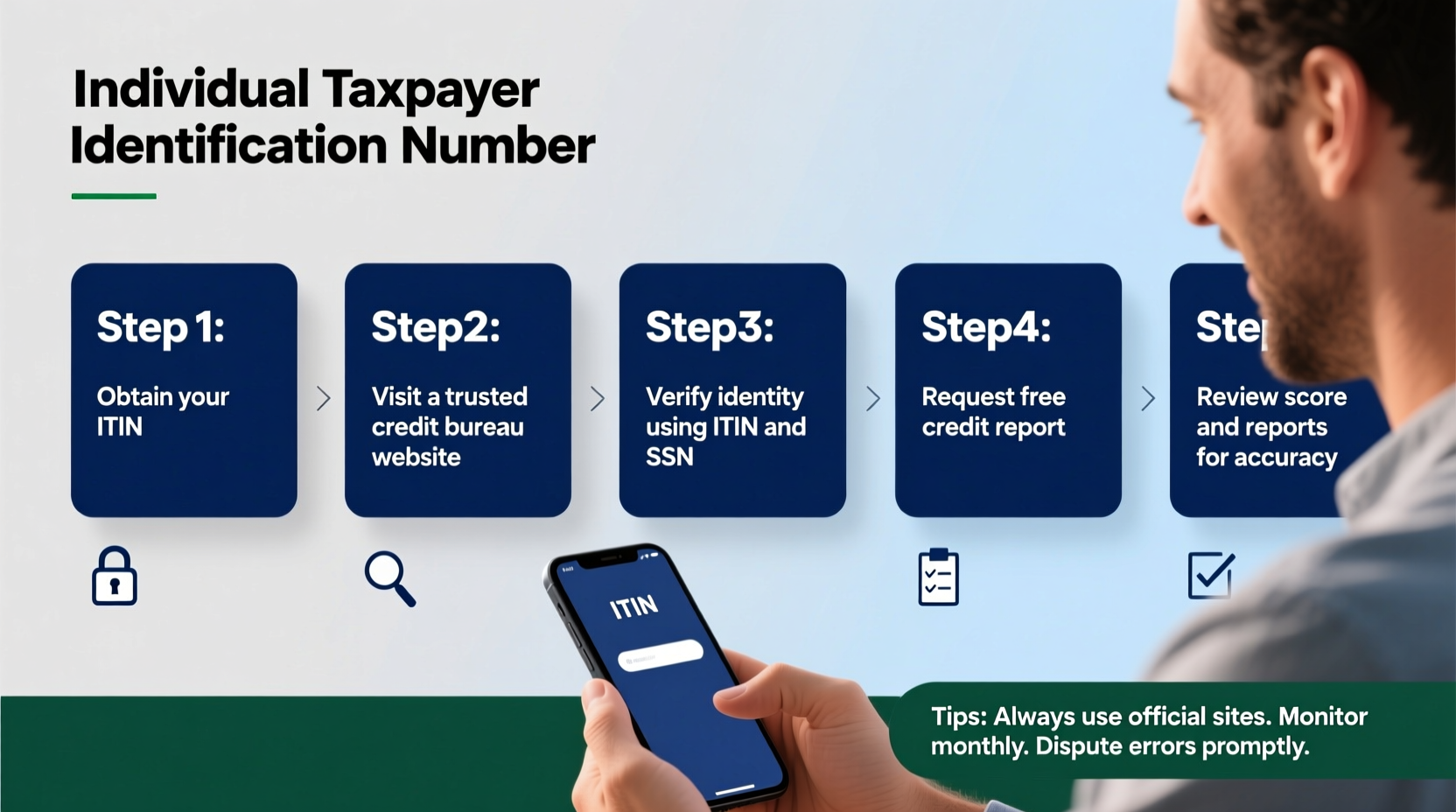

Step-by-Step Guide to Checking Your Credit Score with an ITIN

Although major credit scoring models like FICO and VantageScore typically require an SSN, there are alternative pathways for ITIN holders to access their credit information. Follow these steps to get started:

- Establish a Credit History: Before checking your score, ensure you have active credit accounts. These may include secured credit cards, credit-builder loans, or rent reporting services linked to your ITIN and personal details.

- Gather Required Documents: Prepare your ITIN letter from the IRS, government-issued ID, proof of address, and recent financial statements.

- Apply for a Secured Credit Card: Many banks and credit unions offer secured cards that report to credit bureaus. Use your ITIN during the application process.

- Use Alternative Credit Monitoring Services: Some fintech platforms allow users to create profiles using an ITIN. Examples include Credit Karma (in limited cases), Self Financial, and Nova Credit.

- Request a Free Credit Report: Under federal law, you’re entitled to one free credit report annually from each bureau via AnnualCreditReport.com. While you may need to verify identity manually, submitting your ITIN alongside other documents can help initiate the process.

- Follow Up with Bureaus: If your request is denied due to lack of SSN, contact the bureau directly via phone or mail. Provide your ITIN, tax returns, and any account statements to support your identity claim.

Top Tools and Platforms That Accept ITINs

Not all credit services are equipped to handle ITIN-based applications. Below is a comparison of reliable platforms that support ITIN users:

| Platform | Accepts ITIN? | Reports to Bureaus? | Free Credit Score Access? | Notes |

|---|---|---|---|---|

| Self Financial | Yes | Yes (Experian) | Limited | Secured loan builds credit over time |

| Nova Credit | Yes | Partner lenders only | Yes | Used by international movers; cross-border credit transfer |

| Deserve EDU Card | Yes | Yes | Yes | No SSN needed; designed for students and visa holders |

| Chime Credit Builder | Yes | Yes (TransUnion) | Yes | Requires ITIN for identity verification |

| AnnualCreditReport.com | Limited | N/A | Report Only | Manual verification may be required |

Real Example: How Ana Built Credit with Her ITIN

Ana, a freelance graphic designer from Mexico, moved to Texas in 2020. Unable to obtain an SSN, she applied for an ITIN to file her taxes. Determined to build credit, she opened a Chime checking account using her ITIN and enrolled in the Credit Builder program. She loaded $200 onto the secured card each month and paid it off in full. After six months, her TransUnion report reflected a thin but positive credit history. By year-end, she qualified for a small unsecured personal loan with a local credit union that accepted her ITIN and banking history as proof of reliability. Today, Ana has a FICO score of 682—achieved entirely without an SSN.

Common Challenges and How to Overcome Them

- Delayed Credit Reporting: Some lenders that accept ITINs do not report to credit bureaus. Always confirm reporting practices before opening an account.

- Identity Verification Issues: Online systems may reject ITINs as invalid identifiers. Switch to phone or paper applications when necessary.

- Limited Access to Premium Credit Cards: Most rewards or travel cards require an SSN. Focus first on secured options to build a foundation.

- Mismatched Personal Information: Slight variations in name or address can fragment your credit file. Maintain consistency across all documents.

Frequently Asked Questions

Can I get a credit score with only an ITIN?

Yes, although traditional scoring models often require an SSN, alternative services like Nova Credit or Self Financial can generate credit scores based on your financial behavior and ITIN-linked accounts. Over time, consistent reporting to bureaus can lead to a conventional FICO score.

Does having an ITIN hurt my credit?

No. An ITIN itself does not impact your credit score. What matters is how you manage credit accounts tied to your identity. Using your ITIN responsibly across financial institutions helps establish a verifiable history.

Will banks accept my ITIN instead of an SSN?

Some banks will accept an ITIN for account opening, especially for savings or checking accounts. For credit products, acceptance varies. Credit unions and online banks tend to be more flexible than large national banks.

Action Checklist: Building Credit with an ITIN

- Obtain your ITIN from the IRS if you haven’t already.

- Open a bank account using your ITIN for identity verification.

- Apply for a secured credit card or credit-builder loan that reports to at least one bureau.

- Enroll in rent or utility reporting services (e.g., Rental Kharma, Experian Boost).

- Check your credit report annually via AnnualCreditReport.com, following up manually if needed.

- Monitor progress using ITIN-friendly platforms like Self or Chime.

- Dispute inaccuracies directly with credit bureaus using supporting documentation.

Take Control of Your Financial Future

Your financial journey doesn’t depend on having an SSN. With determination and the right tools, an ITIN can serve as a powerful stepping stone toward creditworthiness. Monitoring your credit score isn’t just about numbers—it’s about empowerment, access, and long-term stability. Whether you're planning to rent an apartment, finance a car, or eventually apply for a mortgage, every responsible financial decision adds up.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?