Despite the rise of digital payments, personal checks remain a necessary part of managing finances—whether for rent, taxes, or small businesses that don’t accept electronic transfers. Yet many people overlook the importance of choosing the right check provider. Poor quality checks can lead to processing delays, fraud risks, or unnecessary costs. This guide walks you through everything you need to know when ordering personal checks, from security features to pricing models, ensuring you make an informed, cost-effective decision.

Why the Right Personal Checks Matter

Personal checks are more than just payment tools—they’re financial documents tied directly to your bank account. Using outdated, low-quality, or insecure checks increases your exposure to fraud and banking errors. A well-designed check includes security elements like microprinting, chemical sensitivity, and counterfeit detection patterns. Beyond security, the design and durability of your checks affect readability at banks and retailers. Choosing a reputable provider ensures clarity, professionalism, and peace of mind.

Key Features to Look for in Personal Checks

Not all checks are created equal. When evaluating providers, pay close attention to the following features:

- Security Elements: Look for watermarks, erasure-resistant ink, and holographic overlays that deter tampering.

- Design Flexibility: Choose a provider that allows customization—adding personal photos, logos, or color schemes without compromising readability.

- Paper Quality: Thicker, durable paper resists tearing and smudging, especially important if you write checks frequently.

- Magnetic Ink Character Recognition (MICR): This specialized ink ensures accurate scanning by banks. Never order checks without confirmed MICR compliance.

- Check Register Inclusion: Some packages include a matching register, helping you track payments manually—a useful feature for budgeting.

“High-security checks reduce the risk of altered amounts and unauthorized duplication by up to 70%.” — National Check Fraud Prevention Council

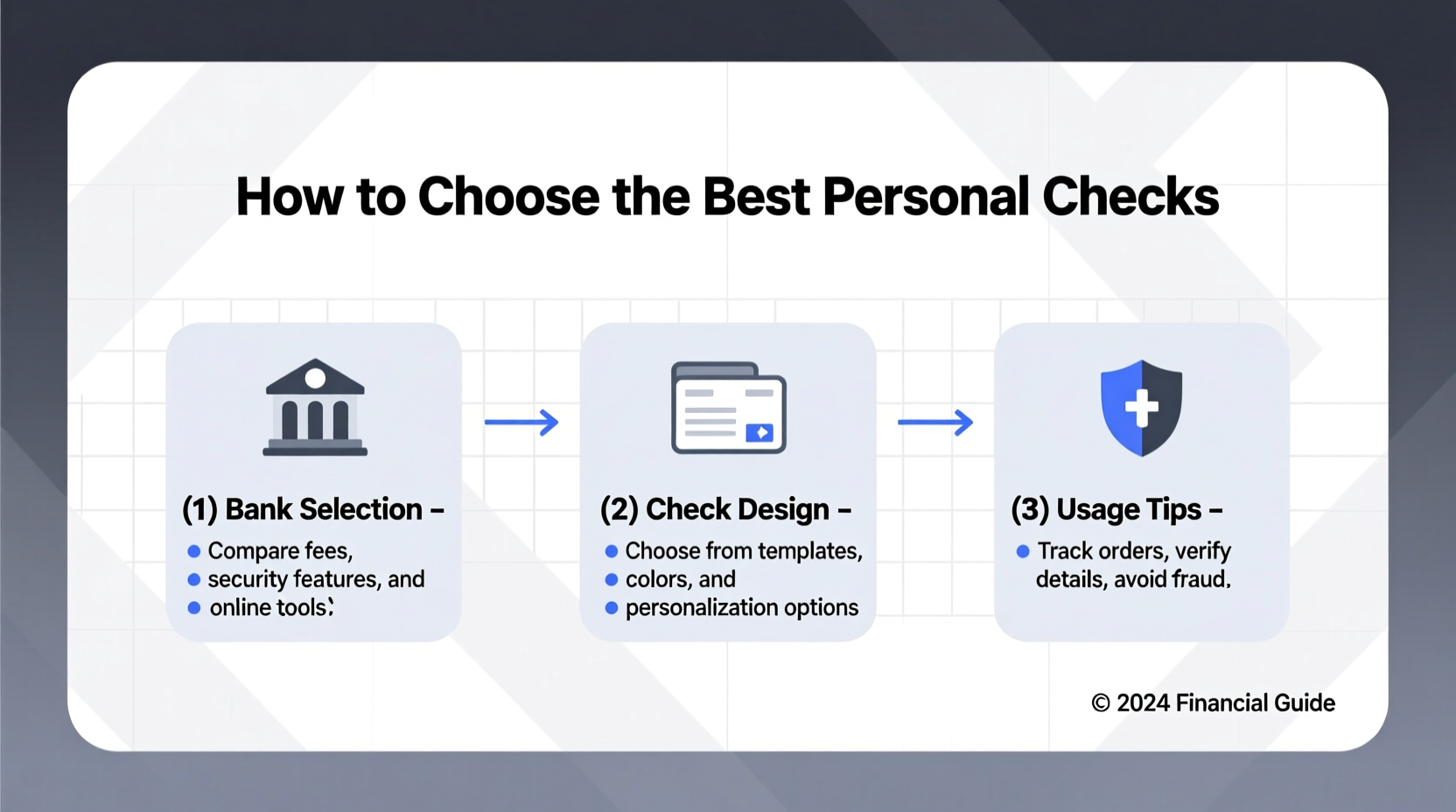

Step-by-Step Guide to Ordering Personal Checks

Ordering checks doesn’t have to be complicated. Follow this clear process to ensure accuracy and safety:

- Gather Your Bank Information: You’ll need your routing number, account number, and personal details (name, address, phone).

- Choose a Reputable Provider: Compare independent printers with your bank’s offerings. Don’t assume your bank offers the best price.

- Select Check Type: Decide between top-checks, duplicate checks, or business-style checks based on your needs.

- Customize Design: Upload images or choose templates. Avoid overly busy backgrounds that could interfere with scanning.

- Review Proof Carefully: Most companies provide a digital proof. Double-check all numbers, names, and formatting before approving.

- Place Order and Track Delivery: Confirm shipping timelines. Reputable vendors deliver within 7–10 business days.

Comparing Top Check Providers: What You Need to Know

The market is flooded with check printing services, each offering different pricing tiers and features. The table below compares leading providers across key criteria:

| Provider | Avg. Price per Box | Security Features | Customization Options | Delivery Time |

|---|---|---|---|---|

| Your Bank (e.g., Chase, Bank of America) | $35–$50 | Basic (MICR, standard paper) | Limited | 7–14 days |

| Harland Clarke | $25–$40 | Advanced (microprint, scannable voids) | Extensive | 7–10 days |

| Vistaprint | $20–$35 | Moderate (MICR, some anti-fraud) | High (photo uploads, themes) | 5–8 days |

| Checks.com | $18–$30 | Strong (chemical reactive paper, holograms) | Flexible | 6–9 days |

Note: While third-party providers often offer better prices and designs, confirm they are certified by the Check Printers’ Association (CPA) to ensure legitimacy.

Mini Case Study: Sarah’s Smart Switch

Sarah, a freelance graphic designer, had been ordering checks through her bank for years at $45 per box. She rarely used them but needed them for client invoices and tax payments. After noticing a Vistaprint ad offering a first-time discount, she compared features and realized she was overpaying. She switched to Checks.com, where she found a box of 100 duplicate checks with enhanced security and custom artwork for $26. Not only did she save nearly 40%, but the duplicate copies helped her track payments more efficiently. When one check was delayed in processing due to a postal error, the carbon copy provided instant verification with her client.

Sarah’s experience highlights how a simple comparison can yield both financial savings and functional improvements.

Avoiding Common Mistakes When Ordering Checks

Even experienced users make errors that compromise check usability or security. Stay alert to these pitfalls:

- Using Unverified Printers: Some online vendors lack proper banking certifications, risking rejected checks.

- Over-Customizing Backgrounds: Dark or complex images can interfere with bank scanners, causing processing failures.

- Skipping Proof Review: Typos in your name or account number can invalidate checks.

- Ignoring Expiration Dates: Checks older than six months may not be honored. Consider ordering smaller quantities if you write infrequently.

- Storing Checks Improperly: Keep unused checks in a dry, secure place away from moisture and direct sunlight to prevent warping or ink degradation.

Checklist: Preparing to Order Personal Checks

Before placing your order, run through this essential checklist:

- ✅ Confirm your bank’s routing and account numbers

- ✅ Verify the printer is CPA-certified or bank-approved

- ✅ Choose check type (top, bottom, duplicates, etc.)

- ✅ Select design with readable font and minimal background clutter

- ✅ Include optional phone number or driver’s license field for added ID verification

- ✅ Request a digital proof before final approval

- ✅ Set up delivery tracking and retain order confirmation

Frequently Asked Questions

Can I use any company to print my personal checks?

Yes, but only if the company follows banking industry standards. Ensure they use MICR toner, comply with ANSI X9.100-140 specifications, and are certified by recognized associations like the Check Printers’ Association. Avoid unknown or non-specialized print shops.

Are personalized checks safe to order online?

Reputable providers use encrypted websites and secure data handling practices. Look for HTTPS in the URL, privacy policies, and customer reviews. Never submit your banking information over public Wi-Fi or unsecured networks.

How long do personal checks last before expiring?

Most banks consider checks “stale” after six months (180 days). While not automatically invalid, merchants and institutions may refuse them. If you write checks infrequently, consider ordering smaller boxes to avoid waste.

Final Thoughts: Make Every Check Count

Ordering personal checks might seem routine, but the choices you make impact your financial security, efficiency, and even professional image. By selecting a trusted provider, prioritizing security features, and avoiding common mistakes, you protect your account and streamline your transactions. Whether you're a homeowner paying contractors, a freelancer billing clients, or someone managing household expenses, taking the time to choose the right checks is a small step with lasting benefits.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?