Investing in the stock market doesn’t require a middleman. While most beginners turn to brokers, many overlook a simpler, cost-effective alternative: buying stocks directly from companies. This method eliminates trading commissions, reduces ongoing fees, and fosters a more intentional investing approach. Whether you're building long-term wealth or seeking dividend income, direct stock purchases offer autonomy and transparency often missing in traditional brokerage accounts.

Direct stock plans (DSPs), including Direct Stock Purchase Plans (DSPPs) and Dividend Reinvestment Plans (DRIPs), allow investors to buy shares straight from issuing companies or their transfer agents. These programs were once niche tools for loyal shareholders but have evolved into accessible entry points for everyday investors. With minimal fees and automatic investment options, they’re ideal for disciplined savers who prefer consistency over speculation.

How Direct Stock Purchases Work

Instead of routing orders through a brokerage platform, direct stock plans let individuals purchase equity directly from a corporation. The company—or its appointed transfer agent—handles share registration, dividend distribution, and account management. Investors typically enroll online, fund their accounts via bank transfers, and buy shares at regular intervals or as lump-sum investments.

These plans fall into two main categories:

- Direct Stock Purchase Plans (DSPPs): Allow new investors to buy shares directly, often with low minimums and optional automatic investments.

- Dividend Reinvestment Plans (DRIPs): Enable existing shareholders to reinvest dividends into additional shares, sometimes at a discount and without commission.

Many companies offer both. Enrollment is usually free or has a nominal setup fee. Once registered, investors receive quarterly statements and can manage holdings through a secure portal provided by the transfer agent, such as Computershare or Broadridge.

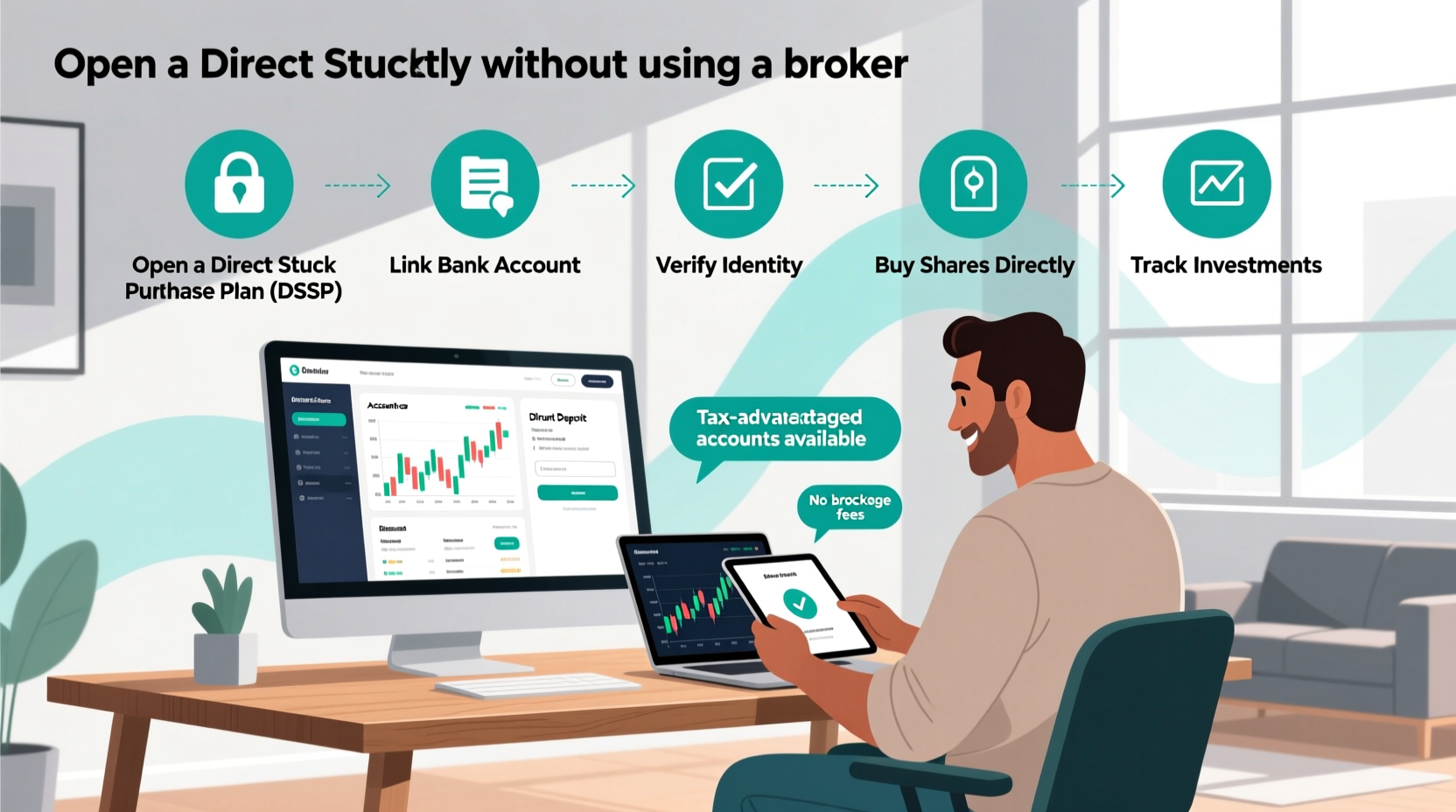

Step-by-Step: How to Buy Stocks Without a Broker

Starting with direct stock investing requires research and careful planning. Follow this sequence to begin building your portfolio without relying on a brokerage firm.

- Identify eligible companies: Research firms offering DSPPs or DRIPs. Use resources like Computershare’s investor center, Shareowner Services, or the Morningstar DRIP database.

- Verify plan availability: Confirm whether the company accepts new investors. Some plans are closed to the public or restricted to current shareholders.

- Review fees and terms: Check enrollment costs, transaction fees, and minimum investment requirements. Some plans charge $2–$5 per purchase but waive fees for automatic investments.

- Enroll online or by mail: Complete the application through the transfer agent’s website. You’ll need personal details, bank information, and tax ID.

- Set up funding: Link your checking account and schedule one-time or recurring purchases.

- Monitor and manage: Track performance via your shareholder account and adjust contributions as needed.

The entire process can take 7–14 days from enrollment to first purchase, depending on verification timelines.

Top Companies Offering Direct Stock Plans

Several well-known corporations still support direct investing. The following table highlights reputable options available to U.S. residents as of 2024.

| Company | Sector | Minimum Initial Investment | Fees | Transfer Agent |

|---|---|---|---|---|

| Coca-Cola (KO) | Beverages | $50 | $1.50 per purchase (waived for auto-invest) | Computershare |

| Johnson & Johnson (JNJ) | Healthcare | $250 | No fee for auto-purchases; $3.50 otherwise | Broadridge |

| Walmart (WMT) | Retail | $100 | $2.50 per transaction | Computershare |

| IBM (IBM) | Technology | $50 | No purchase fee; $15 annual service fee | Computershare |

| 3M Company (MMM) | Industrial | $100 | $2.00 per purchase | Computershare |

These companies are known for stable operations and consistent dividend payouts, making them strong candidates for long-term direct ownership.

“Direct stock plans reward patience. They’re designed for investors who think in decades, not days.” — Laura Simmons, CFP and Behavioral Finance Advisor

Advantages and Limitations of Going Broker-Free

Buying stocks without a broker offers distinct benefits—but it’s not suited for every investor. Understanding trade-offs ensures realistic expectations.

Pros:

- No commissions: Avoid per-trade fees common with brokers.

- Automatic investing: Set up recurring purchases to build wealth systematically.

- Share discounts: Some DRIPs offer shares at 1–5% below market price.

- Ownership clarity: Shares are held in your name, not under street name via a broker.

- Dividend compounding: Reinvest dividends automatically, often without fees.

Cons:

- Limited selection: Only available for select companies, mostly large-cap.

- Slower execution: Purchases may settle over several business days.

- No real-time trading: Cannot place market or limit orders during market hours.

- Manual diversification: Building a balanced portfolio takes time and multiple enrollments.

Real Example: Building Wealth Through Consistency

Meet Sarah, a 34-year-old teacher in Ohio. She wanted to start investing but was wary of complex platforms and hidden fees. After researching low-cost entry points, she enrolled in Coca-Cola’s DSPP through Computershare with an initial $100 investment. She set up automatic monthly purchases of $75 and enabled full dividend reinvestment.

Over five years, Sarah invested $4,500 in total. Due to reinvested dividends and modest share price appreciation, her holdings grew to over 180 shares, valued at approximately $11,200. She didn’t time the market or monitor daily fluctuations. Her success came from consistency—not complexity.

Sarah now plans to open accounts in Walmart and IBM, gradually constructing a dividend-focused portfolio without ever paying a brokerage fee.

Checklist: Getting Started with Direct Stock Investing

Use this checklist to ensure a smooth start:

- ☐ Research companies offering DSPPs or DRIPs

- ☐ Confirm plan availability to new investors

- ☐ Compare fees, minimums, and auto-invest options

- ☐ Choose 1–2 starter stocks aligned with your goals

- ☐ Enroll through the official transfer agent website

- ☐ Link your bank account and set up recurring purchases

- ☐ Enable dividend reinvestment if applicable

- ☐ Save confirmation emails and account numbers securely

Frequently Asked Questions

Can I sell my shares if I buy them directly?

Yes. Most direct stock plans allow you to sell shares through the transfer agent’s platform. Sales may take longer than brokerage trades and could incur small fees, typically $10–$15 per transaction.

Are direct stock plans safe?

Absolutely. Your shares are registered in your name with the company’s transfer agent—a regulated financial entity. This is often safer than holding shares under a broker’s umbrella account.

Do I still get shareholder rights?

Yes. Direct owners receive voting rights, annual reports, and invitations to shareholder meetings, just like any other equity holder.

Take Control of Your Investing Journey

Buying stocks without a broker isn’t about rejecting modern finance—it’s about reclaiming simplicity. In an era of algorithmic trading and subscription-based investment apps, direct stock plans remind us that thoughtful, low-cost investing still works. You don’t need flashy tools or hourly updates to grow wealth. What you do need is consistency, patience, and the willingness to take ownership—literally.

Start small. Pick one company you believe in. Set up an automatic investment. Let dividends compound. Repeat. Over time, these deliberate choices accumulate into something far more valuable than short-term gains: financial independence built on ownership, not intermediaries.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?