Selling a property can be one of the most financially significant transactions in a person’s life. While the proceeds may seem like pure profit, a portion is often subject to capital gains tax. Many homeowners are surprised by their tax bill after a sale, not realizing that even a primary residence might trigger taxable gains. Understanding how capital gains tax works—and how to calculate it accurately—is essential for maximizing your net return and avoiding unexpected liabilities.

What Is Capital Gains Tax?

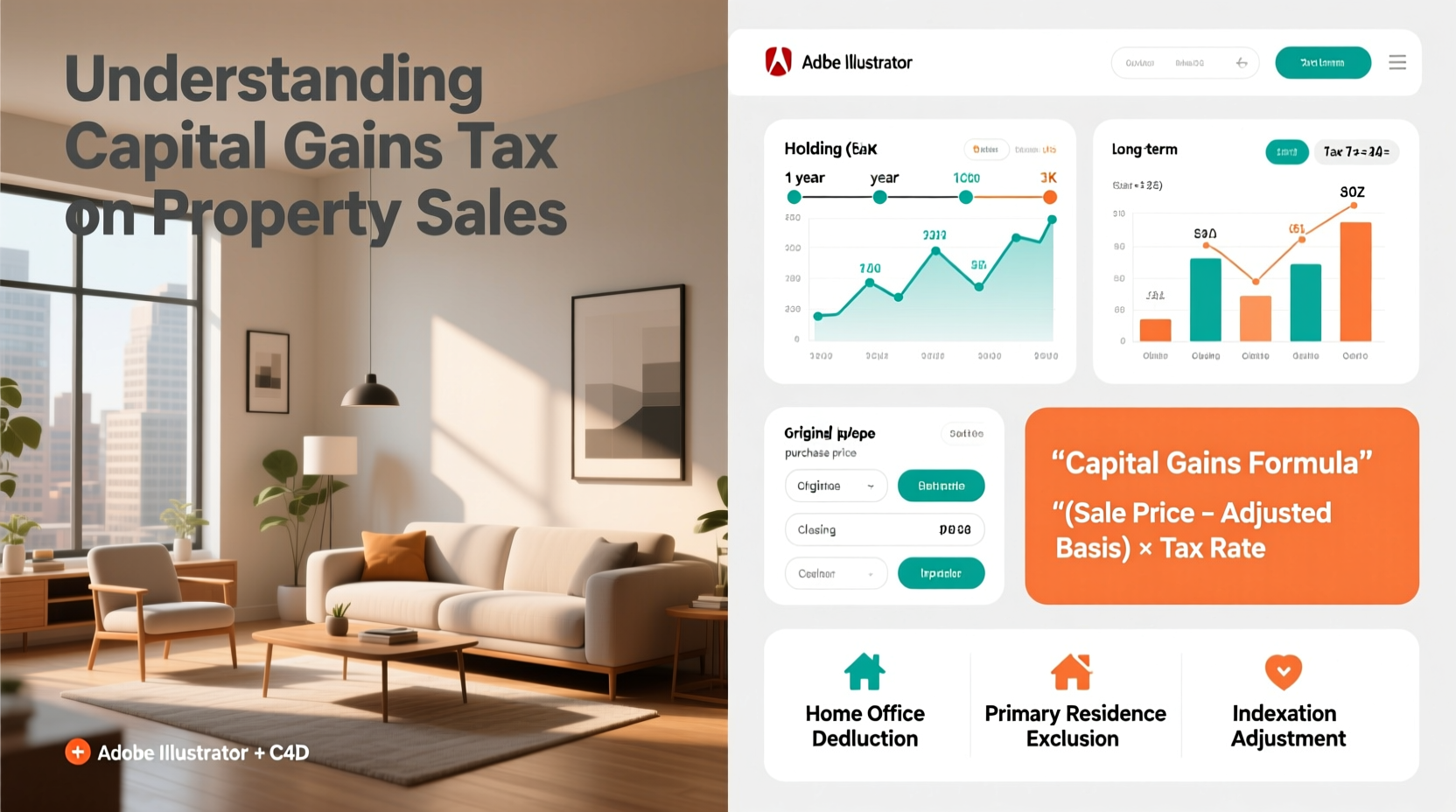

Capital gains tax (CGT) is a levy imposed on the profit earned from selling an asset that has increased in value. When applied to real estate, it’s calculated as the difference between the sale price and the original purchase cost, adjusted for certain expenses. The tax only applies to the gain, not the full sale amount.

In most countries, CGT is categorized into short-term and long-term gains. Short-term gains apply to properties held for less than a year and are typically taxed at ordinary income rates. Long-term gains, from assets held over a year, benefit from lower tax rates as an incentive for longer investment horizons.

“Capital gains tax isn’t about taxing wealth—it’s about taxing the increase in wealth. Knowing what counts as basis and what qualifies for exclusion can save thousands.” — James Rutherford, CPA and Tax Advisor

How to Calculate Your Capital Gain

The calculation may seem straightforward, but several factors influence the final taxable amount. Follow this formula:

- Determine the sale price of the property.

- Subtract the adjusted cost basis, which includes:

- Purchase price

- Acquisition costs (legal fees, title insurance, transfer taxes)

- Major improvements (kitchen remodels, additions, new roof)

- The result is your capital gain.

Example: You bought a house for $300,000 and spent $50,000 on qualifying improvements. Your adjusted basis is $350,000. If you sell for $700,000 and pay $30,000 in selling costs (agent commissions, closing fees), your net sale proceeds are $670,000. Your capital gain is $670,000 - $350,000 = $320,000.

Deductible Improvements vs. Repairs

Not all upgrades count toward your cost basis. The IRS and similar tax authorities distinguish between improvements and repairs:

| Improvements (Add to Basis) | Repairs (Do Not Add) |

|---|---|

| New HVAC system | Fixing a leaky faucet |

| Room addition | Painting walls for maintenance |

| Energy-efficient windows | Replacing broken tiles |

| Deck or patio construction | Regular lawn care |

Primary Residence Exclusion: When You Can Avoid Tax

One of the most valuable provisions in capital gains tax law is the primary residence exclusion. In the U.S., single filers can exclude up to $250,000 of gain; married couples filing jointly can exclude up to $500,000—provided they meet two key criteria:

- Ownership test: You must have owned the home for at least two of the last five years before the sale.

- Use test: You must have lived in the home as your primary residence for at least two of those same five years.

This exclusion can be used once every two years. It applies regardless of whether you reinvest the proceeds, making it a powerful tool for downsizing, relocating, or retiring.

Real-Life Example: Applying the Exclusion

Lena and Mark bought a suburban home for $400,000 in 2018. Over the years, they invested $80,000 in a basement renovation and a solar panel installation. In 2024, they sold the home for $950,000, with $40,000 in selling costs. Their adjusted basis: $400,000 + $80,000 = $480,000. Net proceeds: $950,000 - $40,000 = $910,000. Capital gain: $910,000 - $480,000 = $430,000.

Since they’re married and meet both ownership and use tests, they qualify for the $500,000 exclusion. Their taxable gain: $430,000 - $500,000 = $0. They owe no capital gains tax.

Step-by-Step: How to Compute and Report Your Tax

Follow this timeline to ensure accuracy and compliance:

- Before Selling: Gather purchase documents, improvement receipts, and loan statements.

- After Closing: Obtain the settlement statement (e.g., HUD-1 or closing disclosure) showing net proceeds.

- Calculate Adjusted Basis: Add purchase price and eligible improvements. Subtract depreciation if previously rented.

- Determine Gain: Subtract adjusted basis from net sale proceeds.

- Apply Exclusions: Deduct applicable primary residence exclusion.

- Report on Tax Return: Use Form 8949 and Schedule D (U.S.) or equivalent local forms. Even if no tax is due, report the sale if you receive Form 1099-S.

Strategies to Minimize Your Capital Gains Tax

You don’t have to pay more than necessary. Consider these legal methods to reduce your liability:

- Delay the sale until you meet the two-year residency requirement.

- Reinvest through a 1031 exchange (U.S.) for investment properties—defer taxes by buying a “like-kind” property.

- Track all eligible costs, including landscaping that adds value or energy-efficient upgrades.

- Sell during a low-income year to qualify for a 0% long-term capital gains rate (if income falls below threshold).

- Title transfers to a spouse or trust may help manage future gains, though rules vary by jurisdiction.

Checklist: Preparing for a Tax-Efficient Sale

- ✅ Confirm primary residence status and occupancy duration

- ✅ Collect all purchase and improvement documentation

- ✅ Estimate capital gain using net proceeds and adjusted basis

- ✅ Determine eligibility for exclusion or deferral options

- ✅ Consult a CPA or tax advisor, especially for rental or inherited property

- ✅ File required forms even if no tax is owed

Frequently Asked Questions

Do I pay capital gains tax if I downsize?

Not necessarily. As long as you meet the ownership and use tests and your gain is under $250,000 (single) or $500,000 (married), you can exclude the gain—even if you buy a smaller or less expensive home.

What if I rented out part of my home?

Mixed-use properties complicate taxation. The portion used as a rental may be subject to depreciation recapture at a 25% rate, separate from capital gains. Proper allocation based on square footage and usage time is critical.

How does inheritance affect capital gains tax?

Inherited property receives a “stepped-up basis,” meaning the cost basis is reset to the market value at the date of death. This often eliminates or reduces capital gains when the heir sells, even shortly after inheriting.

Final Thoughts and Next Steps

Understanding capital gains tax isn’t just about compliance—it’s about protecting your financial interests. Whether you’re selling your first home or managing an investment portfolio, accurate calculations and strategic planning can preserve tens of thousands of dollars. The key lies in preparation: document everything, know your exclusions, and seek expert advice when needed.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?