Starting a business often means navigating a maze of legal requirements, two of the most critical being licensing and bonding. While these steps protect both you and your clients, they come with costs that vary widely depending on industry, location, and business structure. Understanding these expenses upfront helps you budget accurately and avoid surprises during setup. This guide breaks down what you’ll pay, why, and how to manage those costs wisely.

What Does “Licensed and Bonded” Mean?

Being “licensed” means your business has met local, state, or federal regulatory standards to legally operate in a specific industry. A license grants permission but doesn’t guarantee quality or reliability. Being “bonded,” on the other hand, involves purchasing a surety bond—a financial guarantee that you’ll fulfill contractual obligations. If you fail to do so, the bond compensates affected parties up to its limit.

Licensing and bonding are especially common in trades like construction, plumbing, landscaping, and home inspection. They signal professionalism and build client trust. But more than reputation, they’re often mandatory: operating without them can result in fines, penalties, or even closure.

The Role of Surety Bonds in Business Protection

A surety bond is not insurance for your business. Instead, it protects the public or project owner. There are three main parties involved:

- Obligee: The entity requiring the bond (usually a government agency or client).

- Principal: You, the business owner purchasing the bond.

- Surety: The company backing the bond financially.

If a claim is made against your bond due to non-performance or unethical behavior, the surety pays the claimant—but you must repay the surety in full. This system incentivizes compliance and accountability.

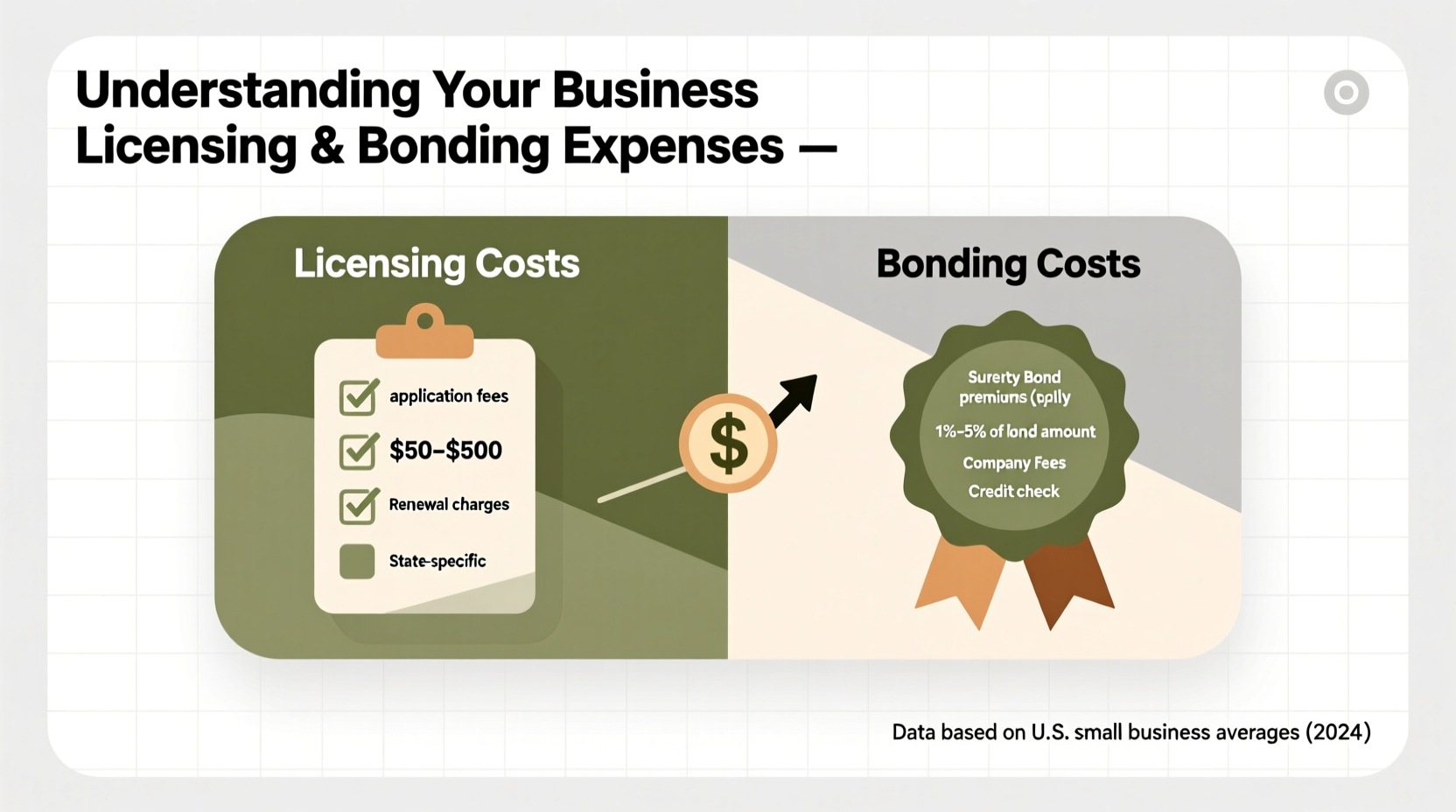

Breaking Down Licensing Costs

Licensing fees are typically one-time or recurring (annual renewal), and vary significantly by jurisdiction and industry. Here’s what influences the price:

- Business type: A mobile food vendor may pay $200 annually, while a liquor store license can exceed $12,000.

- Location: Urban areas often charge more than rural ones. For example, a general business license in Austin, TX, costs $75; in San Francisco, it starts at $106 and scales with gross receipts.

- Regulatory complexity: Highly regulated industries (e.g., healthcare, childcare) require background checks, facility inspections, and training certifications—all adding cost.

In addition to base fees, consider ancillary expenses:

- Application processing time (potential lost income)

- Legal consultation for complex filings

- Zoning permits or signage approvals

- Occupational exams (e.g., contractor licensing tests)

“Many small business owners underestimate municipal-level requirements. A state contractor license might cost $200, but missing a $50 city permit could halt your first job.” — Marcus Tran, Small Business Compliance Advisor

Understanding Bond Pricing and Types

Bond costs are usually a percentage of the total bond amount required—typically between 1% and 3% for applicants with strong credit. Those with lower credit scores may pay 5–15%. Unlike insurance premiums, bond premiums are not recurring unless the bond itself needs annual renewal.

Common bond types include:

| Bond Type | Purpose | Average Cost Range | Renewal? |

|---|---|---|---|

| Contractor License Bond | Required for trade licensing; ensures code compliance | $100–$500 (1–3% of bond amount) | Yes, often annual |

| Surety Bid Bond | Guarantees bid submission in good faith | $0–$250 (often free for small bids) | No |

| Performance Bond | Covers project completion per contract terms | 1–3% of contract value | Project-based |

| Fidelity Bond | Protects against employee theft (optional) | $500–$1,500/year | Annual |

The required bond amount is usually set by law or client demand. For instance, California requires residential contractors to post a $25,000 surety bond. At 3%, that’s a $750 annual premium. However, if your credit score is below 650, expect rates closer to $1,875.

Mini Case Study: A Landscaping Startup’s Experience

Jamie Lopez launched a landscaping business in Phoenix, Arizona. She assumed her only cost would be a $150 city business license. But when bidding on municipal contracts, she learned she needed a state contractor license ($560), a $10,000 surety bond ($300), and proof of workers’ comp—even with no employees yet.

Total initial outlay: $1,200. After securing financing through a small business loan, Jamie completed the process in six weeks. Her first contract? A $15,000 park maintenance job that required bonding. Without it, she wouldn’t have been eligible.

Step-by-Step Guide to Getting Licensed and Bonded

Navigate the process efficiently with this timeline-based approach:

- Research Requirements (Week 1): Visit your state’s Secretary of State website, local city hall portal, and industry regulatory board. Identify all necessary licenses and bonds.

- Gather Documentation (Week 2): Prepare EIN, business formation documents, ID, tax records, and any required certifications or exam results.

- Apply for Licenses (Week 3): Submit applications and pay fees. Some may require in-person visits or fingerprinting.

- Secure a Surety Bond (Week 4): Apply through a licensed surety provider. Expect a credit check. Once approved, receive bond documentation.

- File and Verify (Week 5): Submit bond forms to the obligee (e.g., city licensing office). Confirm acceptance in writing.

- Maintain Compliance (Ongoing): Mark renewal dates. Update bonding if contract values increase or regulations change.

Checklist: Are You Ready to Get Licensed and Bonded?

- ✅ Identified all required licenses (local, state, federal)

- ✅ Confirmed bond type and amount needed

- ✅ Checked personal and business credit scores

- ✅ Gathered legal business documents (EIN, Articles of Organization, etc.)

- ✅ Budgeted for application fees, bond premiums, and exams

- ✅ Scheduled any required training or testing

- ✅ Selected a reputable surety bond provider

- ✅ Verified filing procedures with the issuing authority

Frequently Asked Questions

Do I need both a license and a bond?

Not always, but many industries require both. A license proves legal operation; a bond provides financial assurance. Some jurisdictions issue a license only after you prove bonding.

Can I get bonded with bad credit?

Yes, but it will cost more. Specialized surety companies offer high-risk bonding programs, though rates can reach 10–15% of the bond amount. Over time, improving your credit reduces future premiums.

How long does it take to get bonded?

For standard applicants, approval takes 24–72 hours. Expedited service is available for urgent bids. Complex cases involving financial review may take up to two weeks.

Conclusion: Plan Ahead, Protect Your Business

Getting licensed and bonded isn’t just a legal formality—it’s a strategic investment in your business’s credibility and longevity. Costs vary, but transparency and preparation minimize delays and overspending. By researching requirements early, comparing providers, and maintaining compliance, you position your business to win contracts, earn trust, and grow sustainably.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?