Financial clarity doesn’t come from income alone—it comes from understanding what you truly own and owe. Your net worth is the most accurate snapshot of your financial health, combining all your assets and liabilities into a single number. Whether you're building wealth, paying off debt, or preparing for retirement, knowing your net worth provides direction, motivation, and accountability. This guide walks you through the process of calculating your net worth with precision and using that insight to make smarter financial decisions.

Why Net Worth Matters More Than Income

Many people focus solely on their salary or monthly cash flow, but income tells only part of the story. A high earner can still be financially unstable if they carry significant debt or fail to save. Net worth cuts through the noise by measuring your actual financial progress over time.

It reflects not just how much money you make, but how well you manage it—how much you’ve accumulated, how efficiently you use credit, and whether your lifestyle aligns with long-term goals. According to financial planner Carl Richards, “Net worth is the ultimate scorecard of your financial life.” It allows you to track growth, identify red flags, and adjust course before small problems become crises.

“Your net worth isn't about bragging rights—it's about awareness. You can't improve what you don't measure.” — Jeanette Mack, Certified Financial Educator

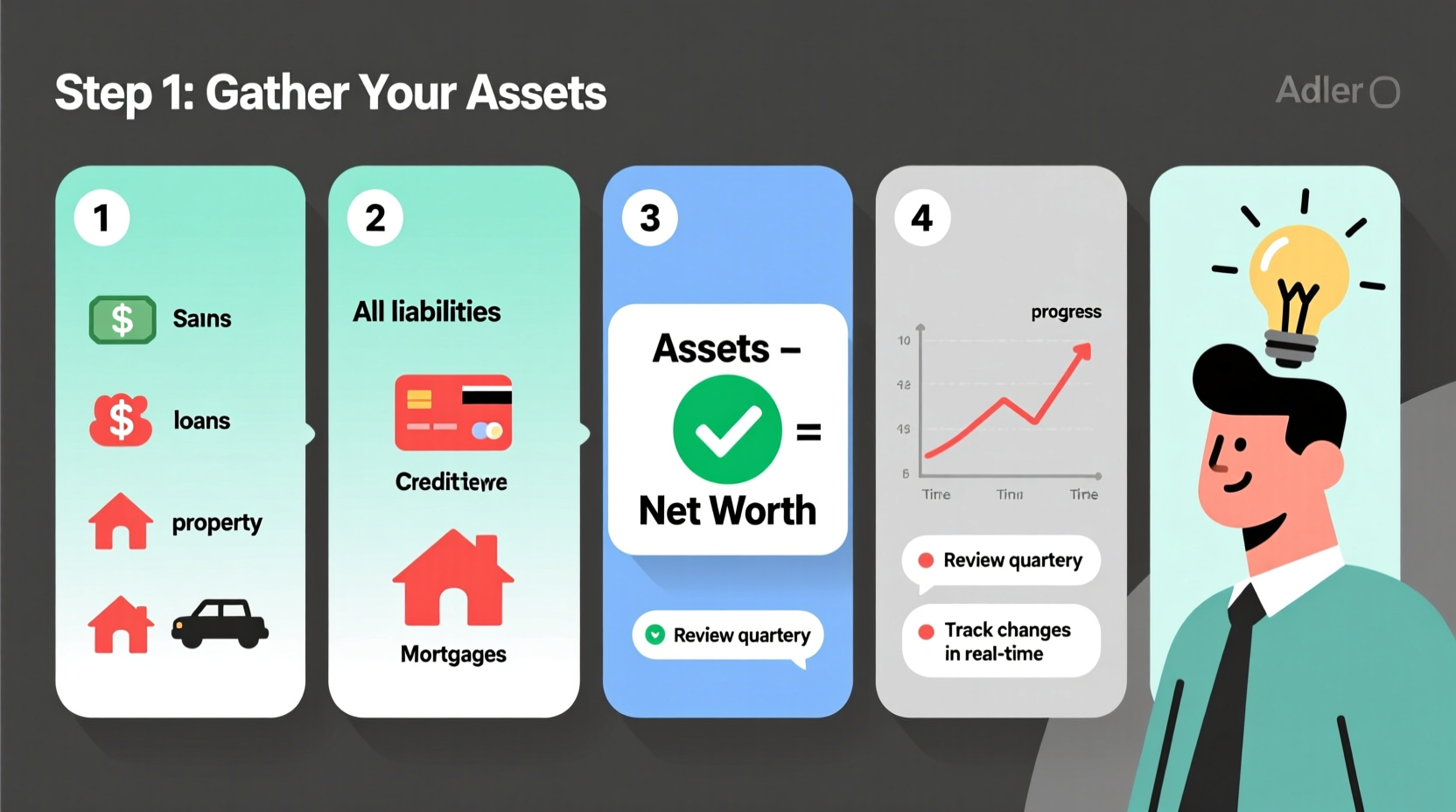

Step-by-Step: How to Calculate Your Net Worth

Calculating your net worth is simple in concept: subtract what you owe (liabilities) from what you own (assets). But accuracy depends on thoroughness and honest valuation. Follow these steps carefully to ensure an accurate result.

- Gather All Financial Statements: Collect bank statements, investment accounts, loan balances, mortgage documents, credit card bills, and any records of personal property with value.

- List Every Asset: Include cash, savings, retirement accounts, real estate, vehicles, investments, and valuable personal items like jewelry or art.

- Assign Current Market Values: Use up-to-date valuations—not purchase prices—for homes, cars, and investments. For retirement accounts, use the latest statement balance.

- List All Liabilities: Record every debt: mortgages, student loans, car loans, credit card balances, personal loans, and any other amounts owed.

- Subtract Liabilities from Assets: Total all assets, total all debts, then subtract the latter from the former. The result is your net worth.

What Counts as an Asset? A Comprehensive Breakdown

Not everything you own contributes positively to your net worth. Only include items with measurable monetary value that could be converted to cash. Here’s a detailed list:

- Liquid Assets: Cash, checking and savings accounts, money market funds.

- Investment Accounts: Stocks, bonds, mutual funds, ETFs, brokerage accounts.

- Retirement Savings: 401(k), IRA, Roth IRA, pension plans (use current balances).

- Real Estate: Primary home, rental properties, vacation homes (use fair market value).

- Vehicles: Cars, motorcycles, boats (use Kelley Blue Book or similar appraisal tools).

- Personal Property: Jewelry, collectibles, fine art (only include if appraised and liquidatable).

- Business Ownership: Equity in private companies or side businesses (estimate conservatively).

Be realistic when valuing non-liquid assets. A vintage watch might have sentimental value, but unless it’s been professionally appraised and sold, its contribution to net worth should be minimal or excluded.

Common Liabilities That Reduce Your Net Worth

Liabilities are obligations that reduce your financial equity. They must be recorded at their current outstanding balance—not minimum payments or future interest. Common types include:

| Liability Type | Where to Find Balance | Valuation Method |

|---|---|---|

| Mortgage | Mortgage statement or lender portal | Outstanding principal balance |

| Student Loans | Federal or private loan servicer | Current principal owed |

| Auto Loans | Loan agreement or auto financing company | Remaining payoff amount |

| Credit Card Debt | Monthly statement | Total balance due (not limit) |

| Personal Loans | Lender account dashboard | Current unpaid balance |

| Taxes Owed | IRS notices or tax software | Unpaid assessed taxes |

Do not include routine expenses like rent, utilities, or groceries—they are not liabilities in the net worth context because they aren’t debts carried over time.

Mini Case Study: Tracking Progress Over Time

Samantha, 34, decided to calculate her net worth for the first time after reading about financial independence. Initially overwhelmed, she gathered her documents and followed the steps outlined here. Her results:

- Assets: $185,000 (home equity: $120k, 401(k): $48k, savings: $12k, car: $5k)

- Liabilities: $110,000 (mortgage: $98k, student loans: $10k, credit cards: $2k)

- Net Worth: $75,000

Though pleased with the positive number, Samantha realized her credit card debt was growing. She committed to tracking her net worth quarterly and paid off $1,500 in credit card debt within six months. By her next calculation, her net worth had increased to $76,500—even without major income changes—simply by reducing liabilities.

Checklist: Building Financial Clarity Through Net Worth Tracking

Action Plan: Use this checklist to establish a reliable net worth tracking system:

- ☐ Gather all financial account statements

- ☐ List every asset with current market value

- ☐ List every liability with current balance

- ☐ Calculate total assets minus total liabilities

- ☐ Record the date and final net worth figure

- ☐ Repeat every 3–6 months

- ☐ Analyze trends: Is your net worth growing?

- ☐ Adjust spending, saving, or debt repayment based on insights

Frequently Asked Questions

Should I include my primary residence in my net worth?

Yes. Your home is an asset with market value. Subtract the remaining mortgage balance to determine your equity, which counts toward net worth. However, remember it’s illiquid—you can’t access the value without selling or borrowing against it.

How often should I recalculate my net worth?

At minimum, do it annually. For better financial control, update it quarterly. If you're actively paying down debt or building investments, monthly tracking can provide powerful motivation.

What if my net worth is negative?

A negative net worth means your debts exceed your assets—this is common early in adulthood, especially with student loans. The key is recognizing it as a starting point, not a failure. Focus on increasing savings and reducing high-interest debt to shift the number upward over time.

Turning Insight Into Action

Knowing your net worth is not an end in itself—it’s the beginning of informed financial decision-making. When you see how lifestyle choices affect your bottom line, you gain leverage to change them. That impulse purchase might seem minor, but seeing how it stalls your net worth growth can be a powerful deterrent.

Use your net worth as a compass. Set targets—such as reaching a net worth of $100,000 or eliminating consumer debt—and revisit your numbers regularly to gauge progress. Pair this metric with budgeting and goal setting, and you create a complete framework for financial clarity.

“The most important number in your financial life isn’t your salary—it’s your net worth. That’s the true measure of financial freedom.” — David Mendels, CFP®

Conclusion: Take Control of Your Financial Narrative

Calculating your net worth transforms abstract money concerns into concrete data. It empowers you to see where you stand, celebrate progress, and correct course when needed. No special tools or degrees are required—just honesty, attention to detail, and consistency.

Start today. Pull out your latest statements, open a spreadsheet, and do the math. Then commit to revisiting it regularly. Over time, you’ll not only watch your net worth grow—you’ll understand exactly how and why it’s happening. That’s the foundation of lasting financial clarity.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?