Filing taxes as a self-employed professional doesn’t have to be overwhelming. While the process involves more responsibility than traditional W-2 employment, it also offers greater control over your financial outcomes—especially when you understand the rules, leverage deductions, and stay ahead of deadlines. Whether you're a freelancer, independent contractor, consultant, or gig worker, this guide walks you through every essential phase of tax preparation with clarity and precision.

Understand Your Tax Obligations

As a self-employed individual, you are responsible for both income tax and self-employment tax, which covers Social Security and Medicare contributions. Unlike employees who split these costs with their employers, self-employed professionals pay the full 15.3% (12.4% for Social Security and 2.9% for Medicare) on net earnings up to certain thresholds.

The IRS considers you self-employed if you operate a trade or business as a sole proprietor, independent contractor, or partner in a partnership—and you do so with the intention of making a profit. This classification means you must file an annual return and typically make quarterly estimated tax payments.

“Self-employment brings freedom, but also fiscal accountability. The earlier you adopt disciplined tax habits, the smoother your financial journey will be.” — Linda Torres, CPA and Small Business Tax Advisor

Track Income and Expenses Accurately

Precise recordkeeping is the foundation of accurate tax filing. Every dollar earned and spent must be documented to determine your taxable income and maximize allowable deductions.

Start by collecting all sources of income: client payments, platform payouts (like Upwork or Fiverr), royalties, or sales revenue. Use accounting software such as QuickBooks, FreshBooks, or Wave to automate tracking. Alternatively, maintain a detailed spreadsheet that logs:

- Date of transaction

- Client or payer name

- Amount received

- Payment method

- Description of service or product

On the expense side, categorize deductible costs. Common deductible expenses include:

- Home office (if used regularly and exclusively for business)

- Internet and phone services

- Software subscriptions (e.g., design tools, project management apps)

- Professional development (courses, certifications)

- Travel related to business meetings or conferences

- Health insurance premiums (if not covered by another plan)

- Office supplies and equipment

| Expense Type | Deductible? | Notes |

|---|---|---|

| Laptop for work | Yes | Can be depreciated or deducted fully under Section 179 |

| Personal cell phone | Partial | Only the business-use percentage is deductible |

| Gym membership | No | Considered personal, even if it improves productivity |

| Business meals with clients | Yes (50%) | Must be directly related to business discussion |

| Car mileage | Yes | Standard rate of 67 cents per mile in 2024 (must log trips) |

Calculate Net Profit and Self-Employment Tax

Your net profit is calculated by subtracting business expenses from total income. This figure flows into Schedule C (Form 1040), where you report profit or loss from your business.

Once net profit is determined, use Schedule SE (Form 1040) to calculate self-employment tax. Only 92.35% of your net earnings are subject to self-employment tax, due to the “employer-equivalent” portion deduction.

For example, if your business earned $60,000 and had $15,000 in deductible expenses:

- Net profit: $60,000 – $15,000 = $45,000

- Taxable amount for SE tax: $45,000 × 92.35% = $41,557.50

- SE tax: $41,557.50 × 15.3% = $6,358.29

You may deduct half of this self-employment tax when calculating your adjusted gross income (AGI), reducing your overall income tax burden.

Make Quarterly Estimated Tax Payments

Since no taxes are withheld from your income, the IRS expects you to pay taxes throughout the year via estimated payments. These are due four times annually:

- April 15 (for January 1 – March 31)

- June 17 (for April 1 – May 31)

- September 16 (for June 1 – August 31)

- January 15 next year (for September 1 – December 31)

To estimate your payments, review last year’s tax return or project current-year earnings. You can use Form 1040-ES to calculate amounts. A safe harbor rule allows you to avoid penalties if you pay either:

- 90% of your current year’s tax liability, or

- 100% of last year’s tax (110% if AGI exceeds $150,000)

“Missing a quarterly payment by even a few days triggers penalties. Set calendar reminders or automate payments through the EFTPS system.” — Marcus Lee, Enrolled Agent and Tax Compliance Specialist

File Your Annual Return: Step-by-Step Timeline

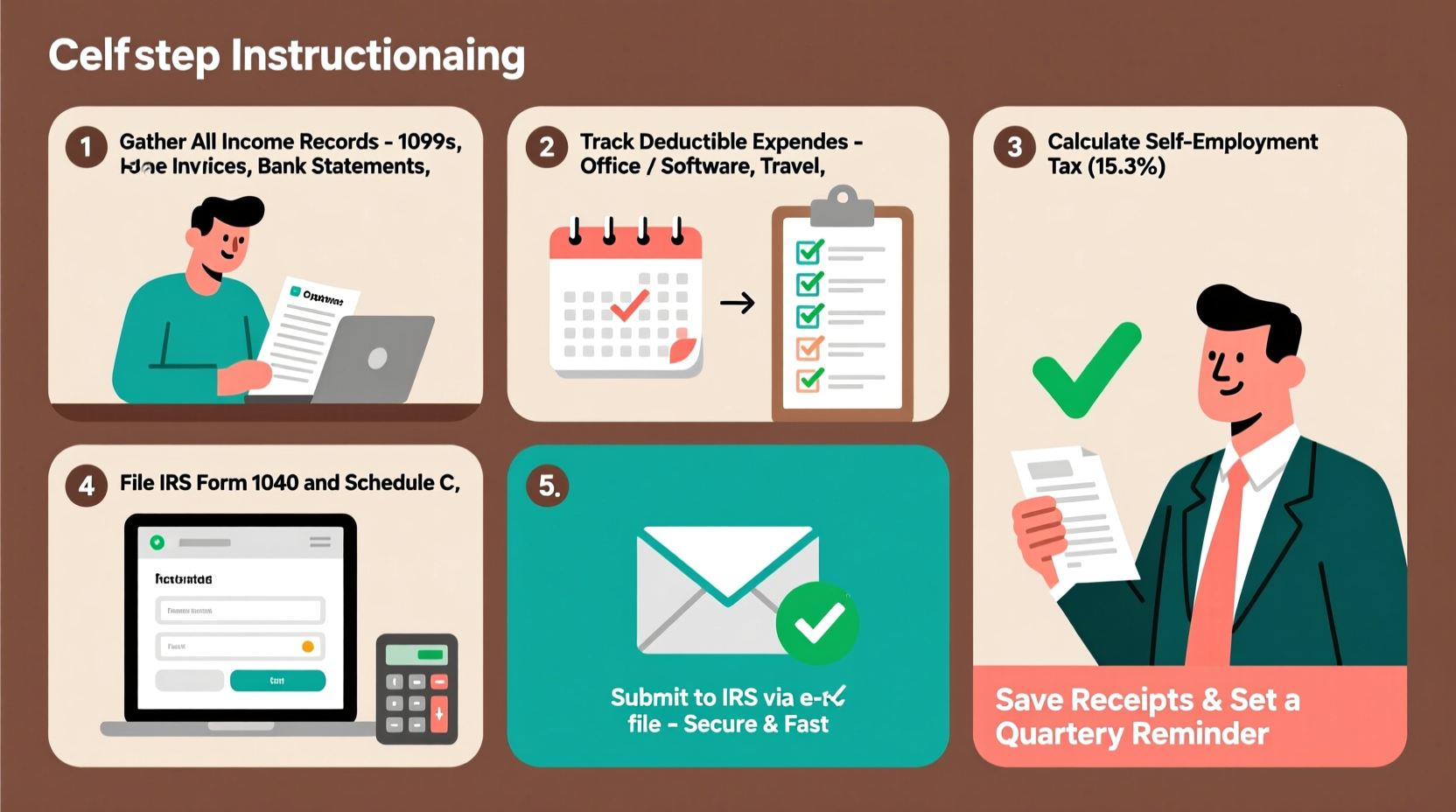

Follow this timeline to stay organized and avoid last-minute stress:

- January – February: Gather all 1099-NEC forms from clients who paid you $600 or more. Collect bank and credit card statements for business transactions.

- March: Reconcile your records. Confirm income matches deposits and expenses are properly categorized.

- Early April: Prepare and file your tax return. Submit Form 1040 with Schedule C and Schedule SE. Include other relevant schedules (e.g., SE for home office, Form 8829).

- April 15: Deadline to file and pay any remaining balance. Request an extension using Form 4868 if needed—but remember, this extends only the filing deadline, not the payment obligation.

- Throughout the Year: Continue tracking income and expenses. Make your next estimated tax payments on time.

Common Mistakes to Avoid

Many self-employed filers make preventable errors that trigger audits or lost savings. Steer clear of these pitfalls:

- Mixing personal and business finances: Use separate bank accounts and credit cards to simplify tracking.

- Underreporting income: All income, including cash and digital payments, must be reported—even without a 1099.

- Overstating deductions: Claim only legitimate, documented expenses. The IRS scrutinizes high home office or vehicle deductions.

- Missing deadlines: Late filings or payments incur penalties. Mark key dates on your calendar.

- Ignoring state tax obligations: Many states require separate filings and estimated payments for self-employed income.

Mini Case Study: Freelance Graphic Designer

Sophie runs a freelance graphic design business from her apartment in Denver. In 2023, she earned $72,000 from client projects and incurred $12,000 in expenses—including software ($1,200), a new monitor ($800), home office utilities ($2,500), travel to a design conference ($1,000), and health insurance ($6,500).

She used QuickBooks to track everything and set aside 25% of each payment for taxes. She made quarterly estimated payments totaling $13,200. When filing in April 2024, her Schedule C showed a net profit of $60,000. Her Schedule SE calculated $8,585 in self-employment tax, half of which ($4,292) reduced her taxable income.

By planning ahead and keeping meticulous records, Sophie avoided penalties, maximized deductions, and kept her tax season stress-free.

FAQ

Do I need to incorporate to be self-employed?

No. Most self-employed individuals operate as sole proprietors by default. Incorporation (LLC, S-Corp) offers liability protection and potential tax benefits but isn't required.

Can I deduct my home office if I rent?

Yes. Renters can deduct a portion of rent, utilities, and internet based on the percentage of space used exclusively for business. Use the simplified method ($5 per square foot, up to 300 sq ft) or actual expenses.

What happens if I miss a quarterly tax payment?

You may face an underpayment penalty. However, if you pay at least 90% of your total tax by year-end or use the prior-year safe harbor, you can avoid it. File Form 2210 to calculate any penalty due.

Final Checklist Before Filing

- ✅ Collected all 1099-NEC forms and recorded all non-1099 income

- ✅ Verified accuracy of income and expense records

- ✅ Calculated net profit using Schedule C

- ✅ Completed Schedule SE for self-employment tax

- ✅ Made all required quarterly estimated payments

- ✅ Reserved funds for any remaining tax balance

- ✅ Reviewed deductions for compliance and maximum benefit

- ✅ Prepared to file by April 15 (or submitted extension)

Take Control of Your Financial Future

Filing taxes as a self-employed professional is a skill that improves with practice. By building systems now—tracking every transaction, paying taxes proactively, and understanding your deductions—you lay the groundwork for long-term success. Don’t wait for tax season to begin organizing. Start today: open a business bank account, download an expense tracker, and schedule your next estimated payment. Your future self will thank you when April arrives without panic or surprises.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?