Moving money between bank accounts is a routine financial task, yet it carries risks if not handled with care. Whether you're shifting funds from checking to savings, paying a family member, or consolidating balances across institutions, the process must prioritize security, accuracy, and timeliness. A single mistake—like entering the wrong account number or falling for a phishing scam—can lead to delays, fees, or even irreversible loss. This guide walks through each phase of a secure fund transfer, offering practical steps, expert insights, and tools to ensure your transactions are smooth and protected.

Why Secure Fund Transfers Matter

Financial fraud continues to rise, with the Federal Trade Commission reporting over $10 billion in consumer losses in 2023 alone. Many incidents stem from simple errors during digital transfers—such as misdirected payments or compromised login credentials. Beyond fraud, incorrect transfers can trigger overdraft fees, missed bill payments, or strained personal relationships. Ensuring every transaction is deliberate, verified, and traceable reduces risk and builds confidence in managing your finances.

“Even small transfers deserve full attention. A $50 error can snowball into credit issues or relationship conflicts.” — Lisa Nguyen, Certified Financial Planner

Step-by-Step Process for Safe Fund Transfers

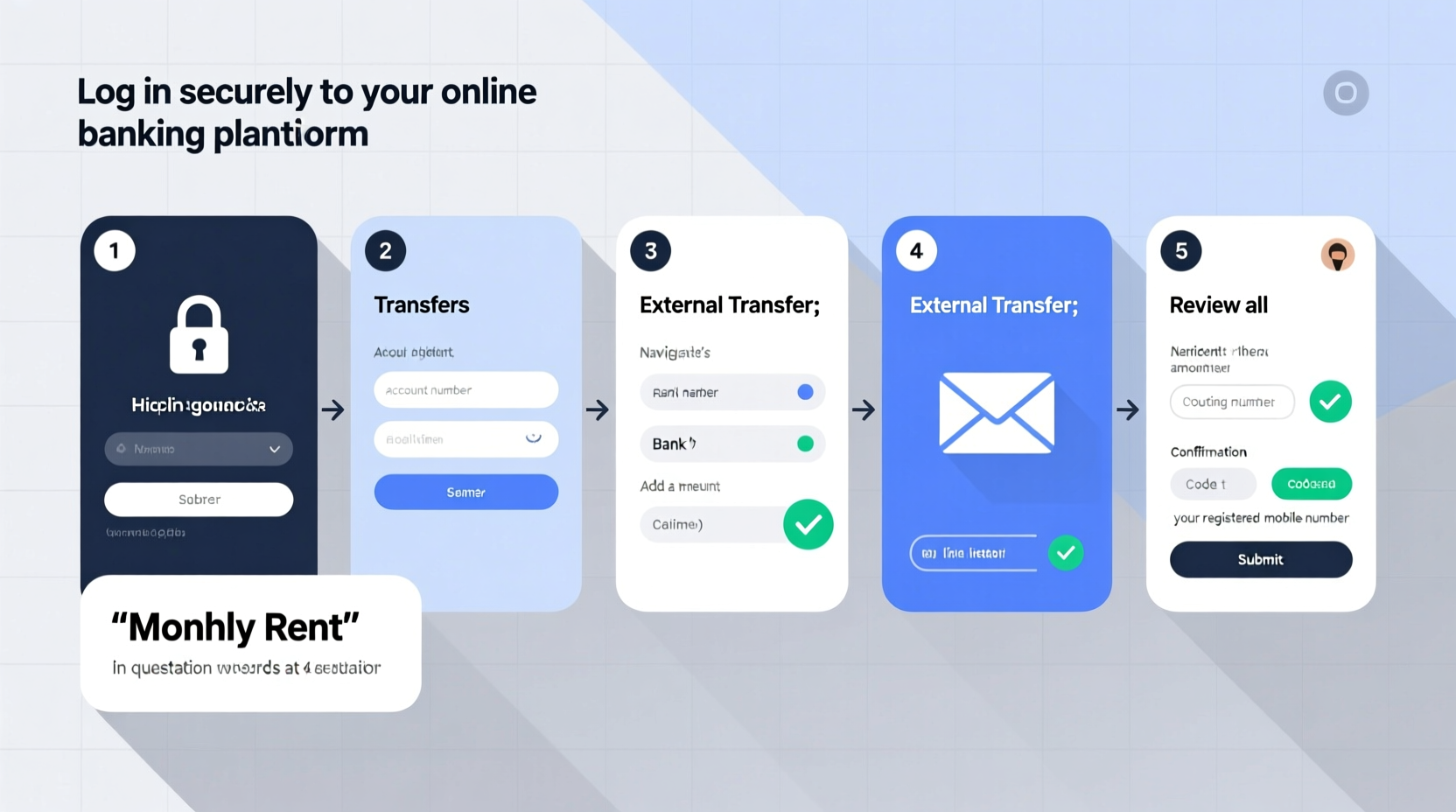

Follow this structured timeline to complete any inter-account transfer with minimal risk:

- Verify both accounts: Confirm ownership, routing numbers, and account types (checking, savings, etc.).

- Choose the right transfer method: Decide between internal bank transfers, external ACH, wire transfers, or peer-to-peer apps.

- Log in securely: Use official banking apps or websites with two-factor authentication enabled.

- Enter transfer details carefully: Double-check recipient information, especially account and routing numbers.

- Set amount and date: Specify exact dollar amounts and select immediate or scheduled execution.

- Review and confirm: Scrutinize all fields before final submission.

- Save confirmation: Record transaction IDs, timestamps, and expected arrival times.

- Monitor both accounts: Verify deduction and deposit within the expected window.

Choosing the Right Transfer Method

Different situations call for different tools. Understanding the strengths and limitations of each option helps prevent delays and unnecessary costs.

| Method | Speed | Fees | Best For |

|---|---|---|---|

| Internal Bank Transfer | Instant – 1 business day | Free | Same bank accounts |

| ACH Transfer (External) | 1–3 business days | Free or $3–$5 | Recurring transfers, payroll deposits |

| Wire Transfer | Same day – 1 business day | $15–$50 (outgoing) | Large, urgent payments |

| Peer-to-Peer Apps (Venmo, Zelle, Cash App) | Minutes – 1 day | Free (standard), fee for instant | Personal payments to friends/family |

For example, Zelle is ideal for splitting rent with a roommate but should never be used for purchases from strangers due to limited fraud protection. Wire transfers are fast and irrevocable—perfect for closing on a home, but dangerous if sent to a fraudulent account.

Security Best Practices and Common Pitfalls

Most transfer issues stem from avoidable oversights. These do’s and don’ts help maintain control and clarity:

- Do use only official bank apps or websites—never click links in emails claiming to be from your bank.

- Do enable multi-factor authentication (MFA) on all financial accounts.

- Don’t save login credentials in browsers or unsecured password managers.

- Don’t rush transfers under pressure—scammers often create false urgency (“Send now or lose your refund!”).

- Do set up transaction alerts to monitor unusual activity instantly.

Mini Case Study: Recovering from a Misdirected Payment

Sarah needed to transfer $2,000 to her landlord using her bank’s mobile app. In a hurry, she selected an old saved payee—her cousin’s account—instead of her landlord’s. The transfer processed within minutes. Panicked, Sarah contacted her bank immediately. Because the transfer was internal, the bank was able to reverse the transaction after verifying her identity and intent. Her cousin, alerted by a text notification, cooperated fully. Had this been an external ACH or wire transfer, recovery might have taken weeks—or been impossible.

The lesson? Always review payee names and account endings before confirming. Even trusted contacts should be re-verified periodically.

Essential Pre-Transfer Checklist

Before initiating any fund movement, run through this checklist to minimize risk:

- Confirmed I’m logged into the official bank website or app

- Enabled two-factor authentication for this session

- Verified recipient name matches official records

- Double-checked routing and account numbers (no typos)

- Reviewed past successful transfers for comparison

- Ensured sufficient funds to avoid overdraft

- Set up email/SMS alert for transaction confirmation

- Planned to monitor both accounts post-transfer

Frequently Asked Questions

How long does a typical bank transfer take?

Transfers within the same bank are usually instant or completed within one business day. External ACH transfers typically take 1–3 business days. Wire transfers settle the same day or next business day but come with higher fees and fewer consumer protections.

Can I cancel a transfer after sending it?

It depends on the method. Internal transfers may be cancellable within a short window. ACH transfers can sometimes be reversed within 24 hours if unauthorized. Wire transfers are nearly always final once processed. Always act quickly and contact your bank directly if you need to dispute a transaction.

Are peer-to-peer apps safe for large transfers?

They’re convenient but carry risks. Most P2P services lack robust fraud protection for authorized payments. Never use them for transactions over $1,000 unless you fully trust the recipient. For larger sums, opt for formal wire or ACH transfers with written agreements.

Final Recommendations for Ongoing Safety

Secure fund transfers aren’t just about one-time actions—they reflect ongoing habits. Regularly audit your saved payees, update passwords every 90 days, and review account statements weekly. Consider setting transfer limits on high-risk accounts, especially those linked to third-party apps. Banks like Chase and Wells Fargo allow customers to cap daily external transfer amounts—a useful safeguard against unauthorized withdrawals.

Technology evolves, but human vigilance remains the strongest defense. As fintech expands with instant payments and open banking, staying informed becomes more critical than ever.

“The safest transfer is the one you verify twice and question once.” — Marcus Reed, Cybersecurity Advisor at FinTrust Group

Take Action Today

Start by reviewing your most recent outgoing transfers. Are all recipients accurate? Are there unfamiliar names or amounts? Then, apply the checklist above to your next planned transaction. Small habits—like pausing before hitting “confirm” or testing with $1—build long-term financial resilience. Share this guide with family members who may not be as familiar with digital banking risks. In a world where money moves faster than ever, safety lies not in speed, but in intention.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?