Staking has become one of the most accessible ways for crypto holders to generate passive income. Unlike traditional mining, staking allows users to earn rewards by simply holding and locking their digital assets in a proof-of-stake (PoS) blockchain network. Among major exchanges, Coinbase stands out for its user-friendly interface, regulatory compliance, and robust security—making it an ideal platform for both beginners and experienced investors to stake their coins.

This guide walks through every stage of staking on Coinbase, from account setup to reward optimization, ensuring you maximize returns while minimizing risk.

Understanding Staking and Why It Works

Staking involves participating in the validation of transactions on a PoS blockchain. Instead of solving complex mathematical problems like in proof-of-work systems, validators are chosen based on the amount of cryptocurrency they \"stake\" as collateral. In return, they receive rewards—typically paid in the same coin.

Coinbase simplifies this process by acting as a node operator. When you stake through Coinbase, the platform handles all technical requirements: running nodes, maintaining uptime, and validating blocks. You benefit from consistent payouts without needing specialized hardware or deep technical knowledge.

“Staking democratizes participation in blockchain networks. Retail investors can now earn yield comparable to institutional players with minimal effort.” — Dr. Lena Torres, Blockchain Economist at ChainPolicy Labs

Rewards vary by asset but typically range between 3% and 8% annually. Some tokens may offer higher yields during promotional periods or early adoption phases.

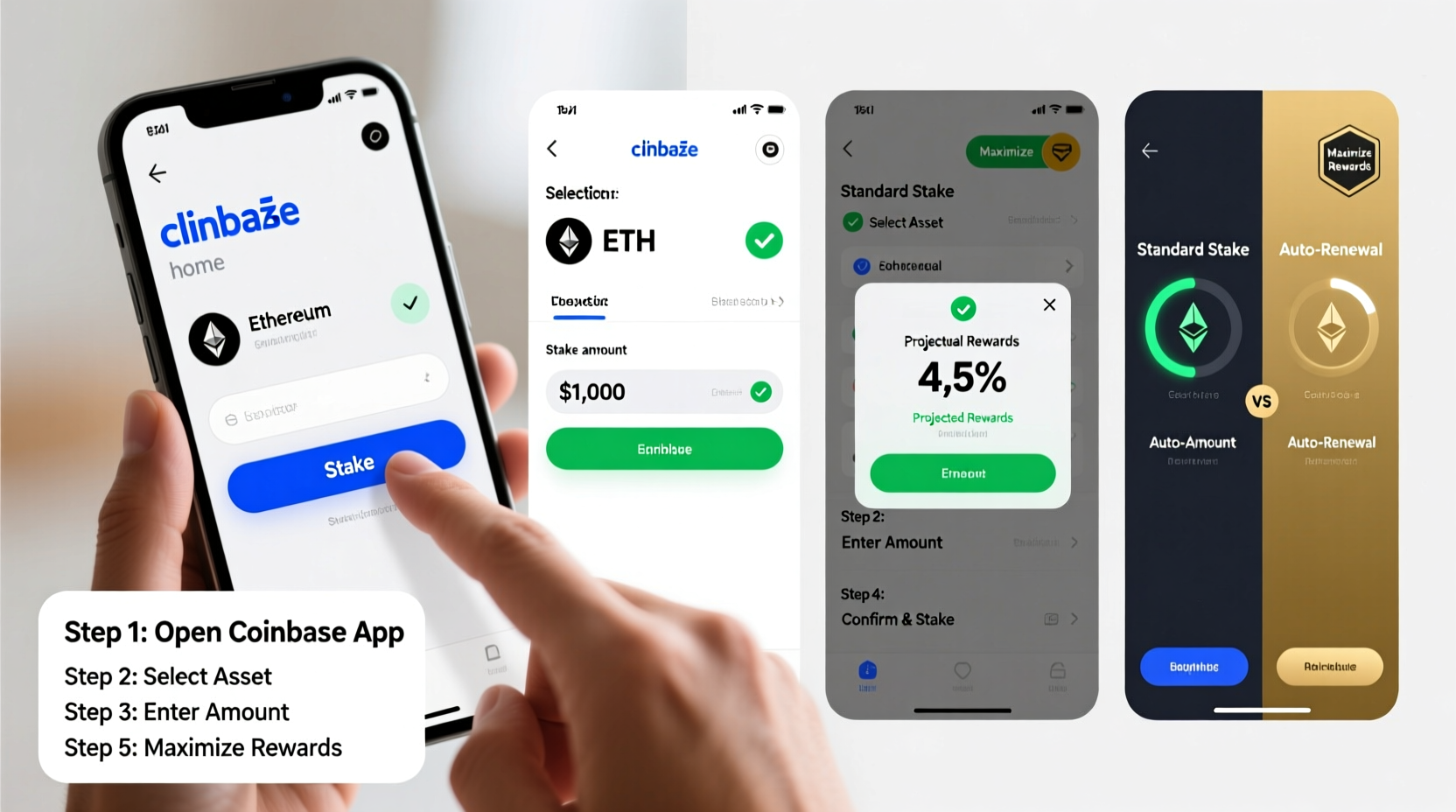

Step-by-Step Guide to Staking on Coinbase

Follow these steps to begin earning rewards through staking on Coinbase:

- Create and Verify Your Coinbase Account

If you don’t already have an account, sign up at coinbase.com. Complete identity verification (KYC), which includes uploading government-issued ID and confirming your address. Verification is required to access staking features. - Secure Your Account with Two-Factor Authentication (2FA)

Go to Settings > Security and enable 2FA using an authenticator app (e.g., Google Authenticator or Authy). Avoid SMS-based 2FA due to SIM-swapping risks. - Fund Your Account with Eligible Cryptocurrencies

Purchase or transfer supported staking assets such as Ethereum (ETH), Cardano (ADA), Solana (SOL), or Polygon (MATIC). These can be bought directly within Coinbase using USD or transferred from another wallet. - Navigate to the “Earn” Section

From the dashboard, click on “Earn” in the top menu. This page displays all available staking opportunities, including estimated annual percentage yield (APY), minimum stake amounts, and lock-up periods. - Select a Staking Option and Confirm Participation

Choose a cryptocurrency you wish to stake. Click “Start Earning,” enter the amount, and confirm the transaction. Once confirmed, your funds will be committed to the staking pool. - Monitor Your Rewards

Rewards are distributed daily and credited automatically to your account balance. You can view earnings under the “Rewards History” tab. Compounding occurs naturally if you reinvest rather than withdraw. - Unstake When Ready (If Applicable)

Note that some assets require an unstaking period (e.g., ETH has a multi-day cooldown). Initiate unstaking via the Earn section, then wait for processing before transferring or selling.

Top Coins Available for Staking on Coinbase

Not all cryptocurrencies support staking on Coinbase. The following table outlines key details about current staking options:

| Cryptocurrency | Estimated APY | Lock-Up Period | Payout Frequency | Minimum Stake |

|---|---|---|---|---|

| Ethereum (ETH) | 3.5% – 5.2% | Variable (unstaking delay) | Daily | No minimum |

| Solana (SOL) | 6.8% – 7.5% | None | Daily | No minimum |

| Cardano (ADA) | 3.0% – 4.0% | None | Weekly | No minimum |

| Polygon (MATIC) | 4.5% – 6.0% | None | Daily | No minimum |

| Avalanche (AVAX) | 9.0% – 11.0% | ~7 days unstaking | Daily | No minimum |

APYs fluctuate based on network conditions and validator performance. Higher yields often correlate with longer commitment periods or newer integrations.

Maximizing Your Staking Returns: Best Practices

To get the most out of your staking strategy, consider these proven tactics:

- Choose High-Yield Assets Strategically: While high APYs are attractive, assess long-term fundamentals. A project with strong development activity and real-world use cases is more likely to maintain value than one offering unsustainable yields.

- Diversify Across Multiple Chains: Don’t put all your capital into a single staking pool. Spread investments across different networks (e.g., ETH + SOL + MATIC) to reduce exposure to any one protocol’s risks.

- Reinvest Rewards Automatically: Manually withdrawing rewards breaks compounding. Keep them staked to grow your position exponentially over time.

- Watch for Network Upgrades: Events like hard forks or governance votes can temporarily pause staking. Stay updated via Coinbase announcements or official project channels.

- Factor in Tax Implications: In many jurisdictions, staking rewards are considered taxable income upon receipt. Track each payout for accurate reporting.

Mini Case Study: Sarah’s Passive Income Strategy

Sarah, a software engineer in Austin, began staking $2,000 worth of ETH and $1,000 of SOL on Coinbase in early 2023. She enabled auto-compound by leaving rewards in her staking accounts. Over 18 months, she earned approximately $280 in combined rewards, effectively turning her portfolio into a self-growing asset.

When Ethereum completed its Shanghai upgrade in April 2023—allowing withdrawals—she tested partial unstaking to verify the process worked smoothly. Confident in the system, she left the majority staked. Today, her holdings generate nearly $20 per month without active management.

Her approach highlights how disciplined, low-effort staking can create meaningful supplemental income over time.

Frequently Asked Questions

Is staking on Coinbase safe?

Yes. Coinbase is a regulated U.S.-based exchange with strong security protocols, including cold storage for most assets and regular third-party audits. However, always enable 2FA and never share login credentials.

Can I lose money staking?

While staking itself doesn’t lead to direct loss of principal under normal conditions, two risks exist: price volatility (if the coin’s value drops) and slashing penalties (in rare cases of network violations by validators). Coinbase absorbs slashing costs, protecting users from financial penalty.

Are staking rewards guaranteed?

No. Rewards depend on network uptime, validator performance, and overall participation rates. While Coinbase maintains high reliability, occasional downtime or maintenance may slightly affect payouts.

Conclusion: Start Building Your Crypto Income Stream Today

Staking on Coinbase offers a secure, straightforward path to earning passive income from your cryptocurrency holdings. With no technical barriers, daily payouts, and reliable infrastructure, it’s one of the most practical entry points for modern investors seeking yield in the digital economy.

The key to maximizing rewards lies not just in starting, but in staying consistent—reinvesting earnings, diversifying across chains, and staying informed. Whether you're staking $100 or $10,000, the principles remain the same: patience, discipline, and smart allocation compound over time.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?