Investing in the stock market doesn’t have to be complex or risky. For most people seeking reliable wealth accumulation over decades, one of the most effective strategies is investing in S&P 500 index funds. These funds offer broad exposure to the U.S. economy, low fees, and historically strong returns. Unlike picking individual stocks, which requires time, research, and emotional discipline, index fund investing is straightforward and accessible. This guide walks through each essential step—from setting goals to monitoring progress—so you can confidently build long-term wealth.

Why the S&P 500 Is a Foundation for Long-Term Growth

The S&P 500 tracks the performance of 500 of the largest publicly traded companies in the United States, including Apple, Microsoft, Amazon, and Johnson & Johnson. Since its inception, the index has delivered an average annual return of about 10% before inflation and around 7% after adjusting for it. What makes it powerful is diversification: no single company’s failure can derail your entire investment, and the collective strength of American innovation and economic resilience drives steady growth over time.

Warren Buffett famously recommended that most investors put their money into a low-cost S&P 500 index fund. In his 2013 letter to shareholders, he wrote:

“By periodically investing in an index fund, the know-nothing investor is likely to outperform most professional money managers.” — Warren Buffett

This endorsement from one of history’s greatest investors underscores the effectiveness of passive, long-term indexing. It removes emotion, minimizes costs, and aligns with how markets naturally grow over decades.

Step-by-Step Plan to Begin Investing

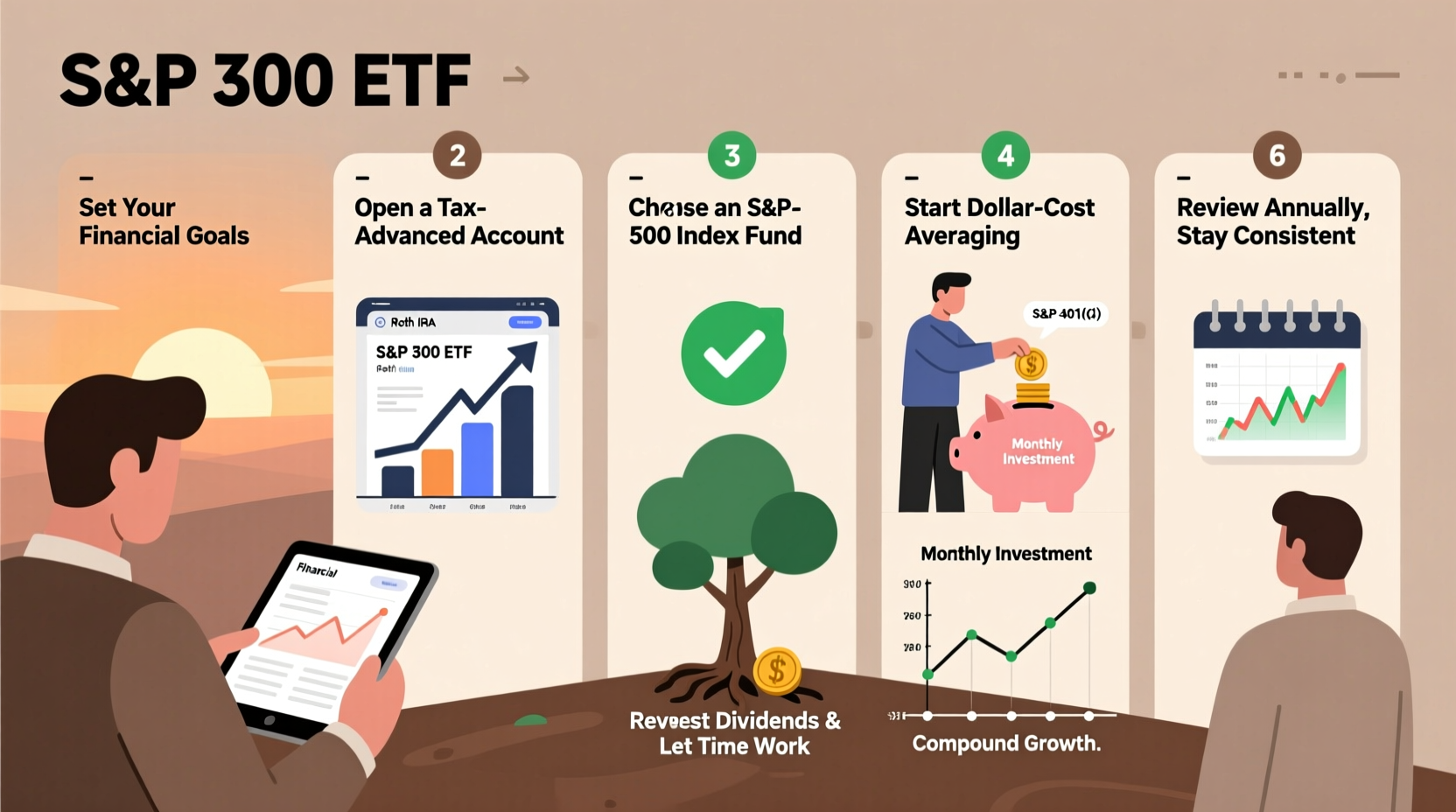

Building wealth through S&P 500 index funds isn’t about timing the market—it’s about consistency, patience, and following a clear process. Here’s how to get started:

- Define Your Financial Goals: Determine why you’re investing. Is it for retirement, a home purchase, or generational wealth? Knowing your timeline helps shape your strategy.

- Assess Your Risk Tolerance: While the S&P 500 is relatively stable over the long term, short-term volatility is normal. If you plan to withdraw funds within five years, this may not be the best vehicle.

- Choose a Low-Cost Brokerage Account: Open an account with firms like Fidelity, Vanguard, or Charles Schwab. Look for no-fee trades, no minimum deposits, and access to commission-free index funds.

- Select the Right Fund: Opt for an S&P 500 index fund with the lowest expense ratio. Examples include Vanguard’s VOO (0.03%), iShares’ IVV (0.03%), and SPDR’s SPY (0.094%). Lower fees mean more of your returns stay in your pocket.

- Set Up Automatic Investments: Automate monthly contributions. Even $100 per month compounds significantly over 20+ years. Consistency beats timing.

- Reinvest Dividends: Enable dividend reinvestment so your payouts automatically buy more shares, accelerating compounding.

- Review Annually: Check your portfolio once a year to ensure alignment with your goals. Avoid frequent adjustments based on market noise.

Choosing the Right Fund: Key Comparisons

Not all S&P 500 index funds are identical. While they track the same index, differences in expense ratios, tax efficiency, and structure matter over time. Below is a comparison of top options:

| Fund Name | Ticker | Expense Ratio | Minimum Investment | Dividend Frequency |

|---|---|---|---|---|

| Vanguard S&P 500 ETF | VOO | 0.03% | $1 (via fractional shares) | Quarterly |

| iShares Core S&P 500 ETF | IVV | 0.03% | $1 | Quarterly |

| SPDR S&P 500 ETF Trust | SPY | 0.094% | $1 | Quarterly |

| Fidelity 500 Index Fund | FXAIX | 0.015% | $0 | Quarterly |

For most investors, FXAIX offers the lowest cost and no minimum, making it ideal for beginners. VOO and IVV are excellent choices for those using other brokerages. SPY, while popular, carries a higher fee and is better suited for traders than long-term holders.

Real Example: How Sarah Built Wealth Over 20 Years

Sarah, a 30-year-old graphic designer, began investing $500 per month in FXAIX through her Fidelity account. She automated contributions on payday and enabled dividend reinvestment. Over the next two decades, the market experienced recessions in 2008, 2020, and 2022, but she stayed the course without selling.

By age 50, despite periods of negative returns, her total investment of $120,000 grew to approximately $268,000, assuming a conservative 7% average annual return. Her discipline and consistency allowed compounding to work in her favor. More importantly, she avoided emotional decisions during downturns—a common pitfall that derails many investors.

Her story isn’t exceptional. It’s replicable. The math of compound growth rewards those who invest regularly and hold for the long term.

Avoiding Common Mistakes

Even simple strategies can go wrong if basic errors are made. Here are key pitfalls to avoid:

- Trying to Time the Market: No one consistently predicts highs and lows. Staying invested matters more than entering at the “perfect” time.

- Picking High-Fee Funds: A 1% fee versus 0.03% can cost tens of thousands over decades. Always prioritize low expense ratios.

- Overreacting to News: Headlines amplify fear. Remember, short-term drops are part of long-term gains.

- Neglecting Emergency Savings: Don’t invest money you might need in the next 3–5 years. Keep a cash buffer to avoid selling during downturns.

- Ignoring Tax Advantages: Use retirement accounts like IRAs or 401(k)s to defer or eliminate taxes on investment growth.

Checklist: Launch Your S&P 500 Investment Plan

Use this checklist to ensure you cover every critical step before and after investing:

- ✅ Define your investment goal and time horizon

- ✅ Build a 3–6 month emergency fund

- ✅ Choose a brokerage with low-cost S&P 500 index fund options

- ✅ Open a taxable account or retirement account (IRA/401k)

- ✅ Select a fund with the lowest expense ratio (e.g., FXAIX, VOO)

- ✅ Set up automatic monthly transfers

- ✅ Enable dividend reinvestment

- ✅ Review portfolio annually, but don’t obsess daily

- ✅ Stay informed but avoid reactionary decisions

Frequently Asked Questions

Can I lose money investing in the S&P 500?

Yes, in the short term. The market declines during recessions, geopolitical events, or financial crises. However, over 10+ year periods, the S&P 500 has always recovered and posted positive returns. Losses only become permanent if you sell during a downturn.

How much should I invest each month?

There’s no fixed amount. Start with what you can afford—$50, $200, or $1,000. The key is consistency. Increasing contributions as your income grows accelerates results.

Is the S&P 500 the same as the stock market?

No. The S&P 500 represents large-cap U.S. companies. It’s a major barometer of market health but doesn’t include small businesses, international stocks, or bonds. For broader diversification, some investors add total market or international index funds later.

Final Thoughts: Start Now, Stay Consistent

The path to long-term wealth doesn’t require genius-level analysis or insider knowledge. It requires one decision: to begin. By investing regularly in a low-cost S&P 500 index fund, you align yourself with the growth of the American economy. You benefit from innovation, productivity, and resilience—all without needing to pick winners or predict trends.

Time is your greatest ally. Every year you delay reduces the power of compounding. Whether you're 25 or 55, the best time to start was yesterday. The second-best time is today.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?