Purchasing abandoned properties can offer substantial financial rewards, from flipping for profit to converting into rental units or personal homes at a fraction of market cost. However, the process is fraught with legal complexities, hidden liabilities, and emotional traps that can turn a dream deal into a costly nightmare. Success requires meticulous research, strategic planning, and disciplined execution. This guide walks through every critical phase—from identification to closing—while highlighting how to sidestep frequent missteps.

1. Research and Identify Potential Properties

The first step in acquiring an abandoned property begins long before making an offer. Start by identifying areas where vacancy rates are high due to economic decline, foreclosure waves, or urban decay. Public records, tax delinquency lists, and municipal databases are goldmines for finding neglected buildings.

Local county assessor websites often publish lists of properties with unpaid taxes. These can lead to tax lien sales or eventual auctions. Additionally, drive through neighborhoods known for disrepair and take note of overgrown lawns, boarded windows, or accumulated mail—clear signs of abandonment.

Networking with local code enforcement officers, utility companies, or even mail carriers can also yield off-market leads. They often know which properties have been vacant for months or years.

2. Conduct Thorough Due Diligence

Once you've identified a target property, due diligence becomes non-negotiable. Many investors lose money because they skip this phase, assuming low price equals good value. In reality, structural damage, environmental hazards, or unresolved ownership claims can erase any potential gain.

- Title Search: Hire a title company or attorney to perform a full title search. Confirm who legally owns the property and whether there are liens, easements, or pending lawsuits.

- Property Condition Assessment: Hire a licensed inspector to evaluate structural integrity, plumbing, electrical systems, roof condition, and presence of mold, asbestos, or pests.

- Zoning and Land Use: Verify zoning regulations. An abandoned warehouse may seem perfect for conversion—but only if residential or mixed-use development is permitted.

- Back Taxes and Fees: Determine outstanding tax obligations. In some jurisdictions, back taxes must be paid in full upon purchase, even at auction.

“Due diligence isn’t just about protecting your investment—it’s about uncovering what others missed. The most profitable deals hide behind layers of complexity.” — Marcus Tran, Real Estate Attorney and Investor

3. Understand Acquisition Methods and Choose Wisely

Abandoned properties can be acquired through several channels, each with distinct risks and requirements. Understanding these options helps match strategy to goals.

| Method | Pros | Cons |

|---|---|---|

| Tax Lien Auctions | Low entry cost; potential for high returns via interest or foreclosure | Risk of non-redemption; lengthy legal process to claim title |

| Foreclosure Auctions (Trustee Sales) | Potential to buy below market value | No inspections allowed; purchased “as-is”; cash-only |

| County Surplus Sales | Transparent process; often includes title clarity | Limited inventory; competitive bidding |

| Direct Negotiation with Owner | Flexibility in terms; opportunity for off-market deals | Time-consuming; owner may not respond or act in bad faith |

For beginners, direct negotiation or county surplus sales are generally safer. Experienced investors may pursue tax liens or trustee auctions but should have contingency funds and legal support ready.

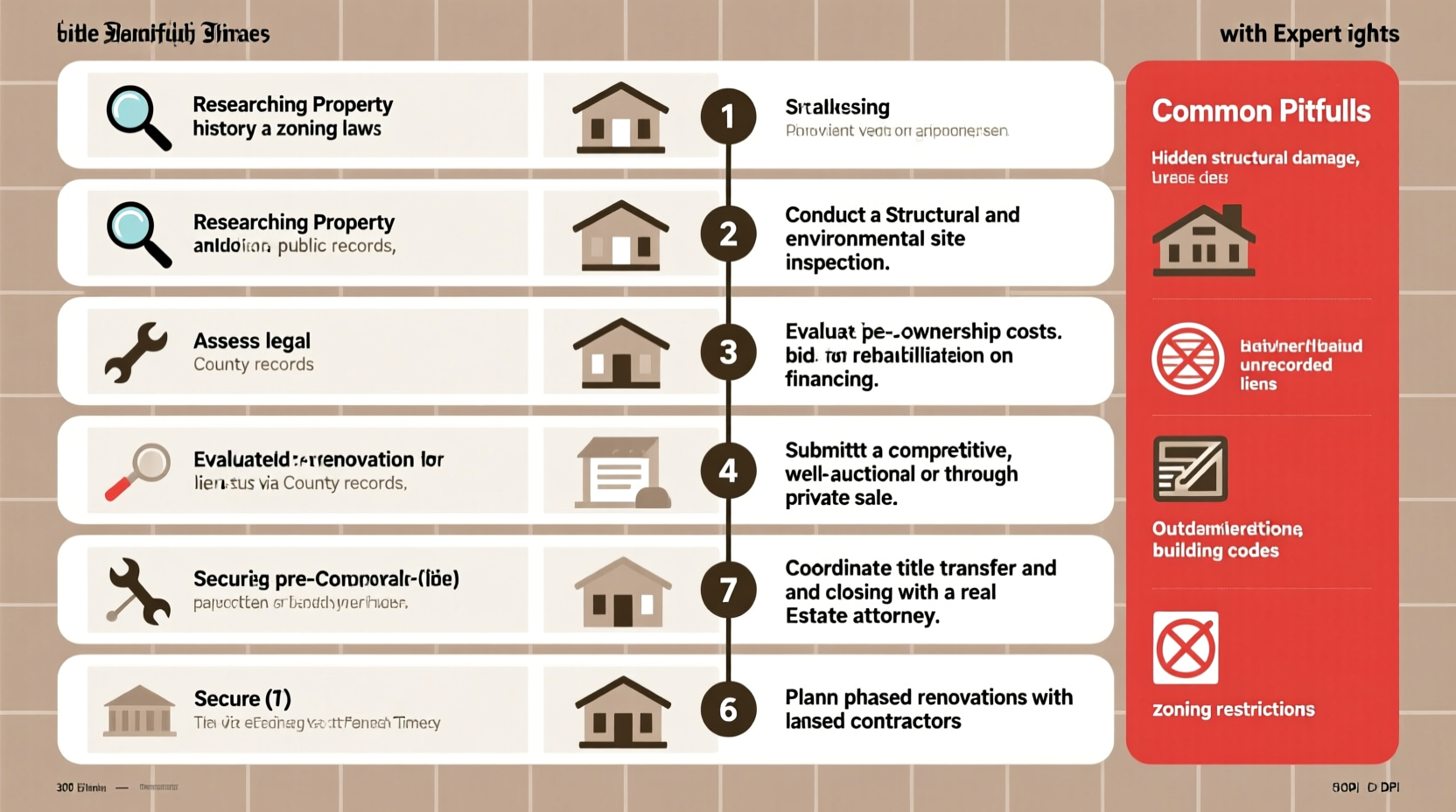

4. Avoid Common Pitfalls That Derail Investors

Even well-researched purchases can fail due to preventable errors. Awareness of recurring issues dramatically increases success odds.

- Underestimating Repair Costs: A $20,000 property may require $80,000 in renovations. Always get contractor estimates before committing.

- Ignoring Environmental Hazards: Old buildings may contain lead paint, asbestos insulation, or contaminated soil. Remediation costs can exceed structural repairs.

- Overlooking Squatters: Some abandoned homes are occupied illegally. Eviction laws vary by state and can delay possession for months.

- Failing to Secure Financing Early: Traditional lenders avoid distressed properties. Hard money loans or private financing may be necessary—arrange them in advance.

- Misjudging Neighborhood Trends: Just because a property is cheap doesn’t mean it will appreciate. Study crime rates, school quality, and development plans.

5. Execute the Purchase and Transition to Ownership

After selecting the right acquisition method and completing due diligence, move swiftly to close the deal. Timing matters—especially in auctions or competitive negotiations.

Step-by-Step Acquisition Timeline

- Week 1–2: Identify 3–5 candidate properties using public records and field observation.

- Week 3: Conduct preliminary title searches and schedule inspections.

- Week 4: Obtain contractor bids and environmental assessments.

- Week 5: Decide on acquisition method and prepare funding (cash, loan pre-approval, or investor pool).

- Week 6: Submit offer or register for auction; follow all procedural rules.

- Week 7–8: Close transaction, record deed, and initiate possession process (eviction if needed).

- Week 9+: Begin repairs, apply for permits, and plan next steps (sell, rent, or occupy).

Post-purchase, immediately file the deed with the county recorder and notify utilities. Change locks, secure the structure against vandalism, and begin remediation work promptly to prevent further deterioration.

Mini Case Study: From Vacant Warehouse to Profitable Lofts

In 2021, developer Lena Ruiz acquired a derelict textile warehouse in downtown Cleveland for $45,000 at a county surplus sale. Initial inspection revealed asbestos in insulation and foundation cracks. She budgeted $120,000 for abatement and repairs, secured a historic renovation grant, and converted the space into six artist lofts. By leasing units at $1,800/month, she achieved full ROI within 3.5 years. Her key insight? “The building looked dead, but the location was minutes from a new light rail station. I bet on infrastructure, not just bricks.”

FAQ

Can I live in an abandoned property immediately after buying it?

No. Most abandoned properties fail habitability standards. You must pass inspections, restore utilities, and obtain occupancy permits before moving in.

Are abandoned properties always sold at auction?

No. While many go to auction due to tax defaults or foreclosures, others are privately owned and may be negotiated directly—sometimes at better terms than public bidding.

What happens if someone is living in the abandoned property?

If occupants are squatters (not tenants), you’ll need to initiate a formal eviction through the courts. Never attempt self-eviction tactics like shutting off utilities or changing locks without legal authorization.

Final Checklist Before Buying

- ✅ Verified current ownership and lien status

- ✅ Completed physical inspection and environmental scan

- ✅ Researched zoning and future development plans

- ✅ Estimated repair costs with contractor quotes

- ✅ Secured financing or confirmed cash availability

- ✅ Understood local eviction and property maintenance laws

- ✅ Created a post-purchase action plan (repairs, permits, use)

Conclusion

Purchasing abandoned properties isn’t a shortcut to wealth—it’s a disciplined strategy that rewards preparation, patience, and persistence. When approached with caution and clarity, these overlooked assets can become powerful engines of equity growth and community revitalization. Whether you're aiming to flip, rent, or rebuild, the key lies in doing the unseen work upfront: researching, inspecting, and planning meticulously. Now that you understand the path and the pitfalls, take the next step. Find one property, run the numbers, and test your strategy on a small scale. The best investments often begin where others see only ruin.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?