Investing in tax lien certificates offers a unique path to high-yield returns with relatively low market volatility. When property owners fail to pay their taxes, local governments auction off the right to collect those unpaid amounts—plus interest—to investors. Done correctly, this strategy can generate annual returns of 8% to 36%, depending on the state and jurisdiction. However, success requires research, discipline, and a clear process. This guide walks through every stage of acquiring tax liens profitably, from initial research to redemption collection.

Understanding Tax Lien Certificates and How They Work

Tax lien certificates are legal claims placed against a property when the owner defaults on property taxes. The government sells these liens at public auctions to recover lost revenue. Investors who purchase the lien effectively lend money to the property owner, securing the right to be repaid with statutory interest if the debt is settled.

If the homeowner pays back the delinquent taxes within a set redemption period (typically 6 months to 3 years), the investor receives the principal plus accrued interest. If not, the investor may initiate foreclosure proceedings to take ownership of the property—though most profits come from redemption, not property acquisition.

Interest rates vary by state law. For example:

| State | Maximum Interest Rate | Redemption Period |

|---|---|---|

| Florida | 18% | 2 years |

| Arizona | 16% | 3 years |

| Illinois | 36% | 2.5 years |

| Texas | 25% | 2 years |

| Indiana | 8% + $10 fee | 1 year |

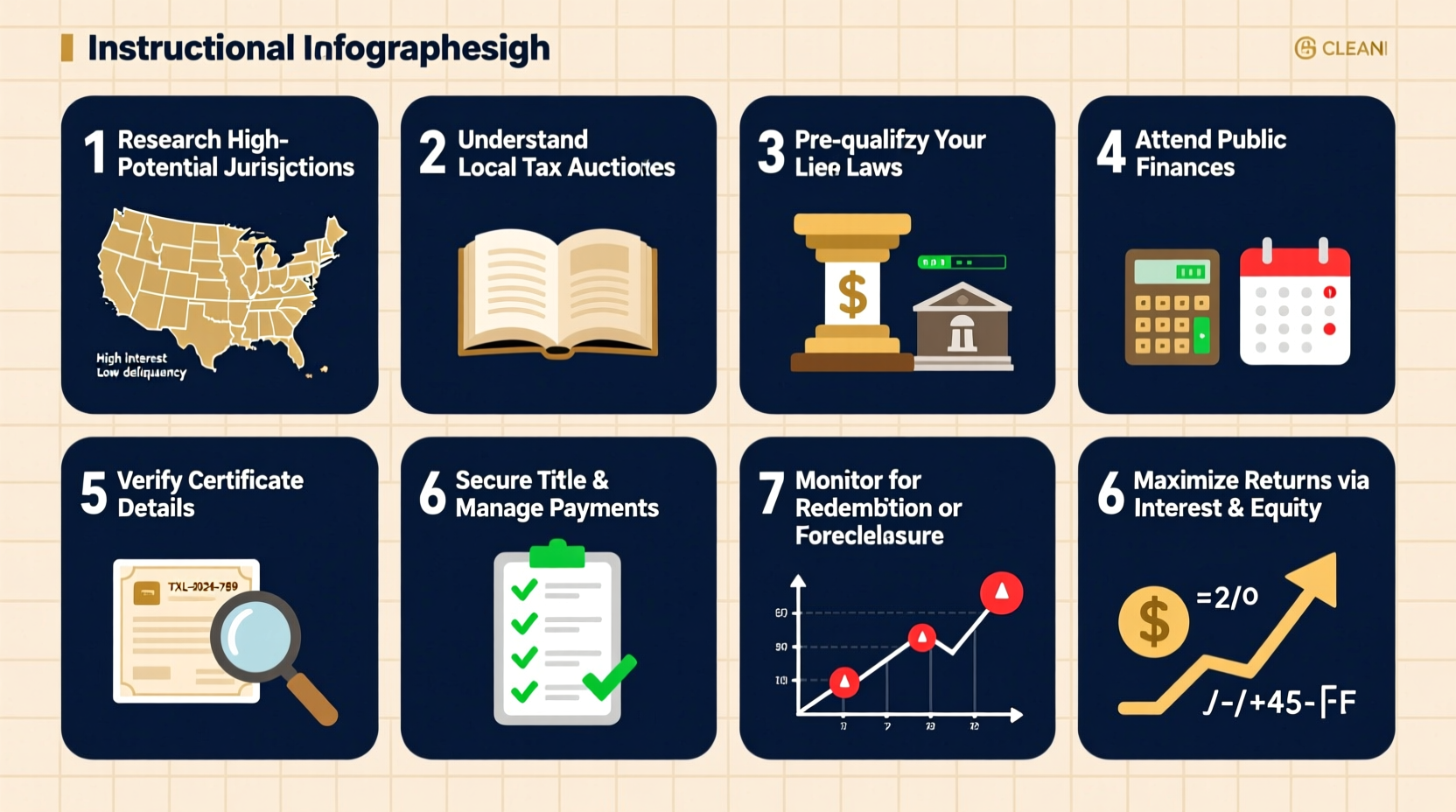

The 7-Step Process to Acquiring Profitable Tax Liens

- Research Jurisdictions: Not all counties offer favorable terms. Look for areas with strong property values, stable populations, and consistent redemption rates. Avoid jurisdictions with complex foreclosure processes or low transparency.

- Obtain the Tax Delinquent List: Most counties publish lists of properties in arrears before auction. These are often available online via county treasurer or tax collector websites. Review them carefully for property type, location, and amount owed.

- Analyze Property Values: Use public records, real estate platforms like Zillow or Redfin, and local assessor data to estimate fair market value. A general rule: avoid liens where the debt exceeds 5% of the property’s value—it signals higher risk of non-redemption.

- Determine Your Bid Strategy: Some auctions use interest rate bidding (lowest rate wins), while others accept premium bids (highest dollar amount). In competitive markets, aggressive bidding can erode profits. Conservative bidders often win better long-term deals.

- Register for the Auction: Requirements vary. You may need a deposit, ID, EIN, or proof of funds. Online auctions (e.g., Bid4Assets, TaxSaleFinder) require account creation and pre-approval.

- Participate in the Auction: Attend live events or bid online. Stick to your pre-approved list and budget. Emotional bidding leads to overpayment and reduced yields.

- Monitor and Manage Post-Purchase: After winning, file documentation with the county. Track redemption dates, send courtesy notices to owners, and prepare for possible foreclosure if needed.

“Smart tax lien investing isn’t about buying the most—it’s about buying the right ones.” — Robert Kiyosaki, author of *Rich Dad Poor Dad*

Risks and How to Mitigate Them

Tax lien investing is not without risks. Understanding them—and taking steps to reduce exposure—is critical.

- Non-redemption: The property owner never pays. While this could lead to ownership, foreclosure is time-consuming and costly. Always assess whether the underlying property is worth pursuing.

- Junior Liens: Other debts (mortgages, HOA liens) may take priority. A first-mortgage holder can foreclose and wipe out your lien. Always check title status before bidding.

- Property Condition: Abandoned or severely damaged homes may cost more to rehabilitate than they’re worth. Drive by the property or use satellite imagery to evaluate condition.

- Legal Complexity: Foreclosure laws differ widely. In some states, you must publish notices, serve documents, and appear in court. Partner with a local real estate attorney familiar with tax lien procedures.

Real Example: Turning a $5,000 Investment into $7,200 in 24 Months

In 2021, an investor in Maricopa County, Arizona reviewed the delinquent tax list and identified a single-family home with a $4,200 lien. The property was valued at approximately $280,000—just 1.5% of value in arrears. The neighborhood showed steady occupancy and recent renovations nearby.

The investor participated in the online auction via Auction.com, placing a conservative bid at 14% interest (the minimum acceptable). The lien was awarded because other bidders sought higher yields. Over the next 26 months, the homeowner refinanced and paid off the tax debt.

Final return: $4,200 × 14% × 2.17 years = $1,278 in interest. Total return: $5,478—a 30.4% total return on capital, or roughly 14% compounded annually.

No foreclosure was needed. The entire process required less than five hours of management time over two years.

Checklist: Pre-Auction Due Diligence

- ✅ Property type (residential, commercial, vacant land)

- ✅ Estimated market value vs. lien amount

- ✅ Physical condition (via Google Street View or site visit)

- ✅ Existence of senior liens (mortgage, HOA)

- ✅ Redemption period and interest cap in that jurisdiction

- ✅ Auction rules (bid type, deposit, registration deadline)

- ✅ Your maximum bid price or interest rate

Frequently Asked Questions

Can I lose money investing in tax lien certificates?

Yes, if the property has little equity, significant senior debt, or deteriorates during the redemption period. Additionally, legal costs in foreclosure can exceed gains. Proper due diligence minimizes this risk.

Are tax lien returns taxable?

Yes. Interest earned is considered ordinary income and must be reported on your federal tax return. You’ll typically receive a Form 1099-INT from the county after redemption.

Do I need a license or special qualification to buy tax liens?

No. Any individual or entity with funds can participate, though some counties require registration or a deposit. Non-residents can invest in most jurisdictions.

Conclusion: Building Wealth Through Disciplined Investing

Tax lien certificates are not a get-rich-quick scheme—but for disciplined investors, they offer a rare combination of high yields, low correlation to stock markets, and tangible asset backing. Success lies not in volume, but in selectivity. By following a structured approach, conducting thorough research, and managing risk proactively, you can build a reliable stream of passive income.

The auction won’t wait. Counties sell liens year-round, and the best opportunities go fast. Identify your target market, prepare your checklist, and take your first bid. The next certificate could be your highest-returning investment yet.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?