When investors come across a stock offering a double-digit dividend yield, alarm bells should ring — not necessarily because the opportunity isn’t real, but because history shows that abnormally high yields often signal underlying risk. AGN Corporate Services (AGNCS) has recently attracted attention for its eye-catching dividend payout, currently hovering around 14–16%. While such returns are rare in today’s low-interest environment, they demand scrutiny. Is AGNCS delivering exceptional value to shareholders, or is this yield a red flag disguised as generosity?

This article dissects the sustainability of AGNCS’s dividend by analyzing financial health, cash flow dynamics, industry positioning, and historical precedent. By separating fact from speculation, we aim to answer whether AGNCS offers long-term income potential or presents a classic case of “too good to be true.”

Understanding Dividend Yield: What High Numbers Really Mean

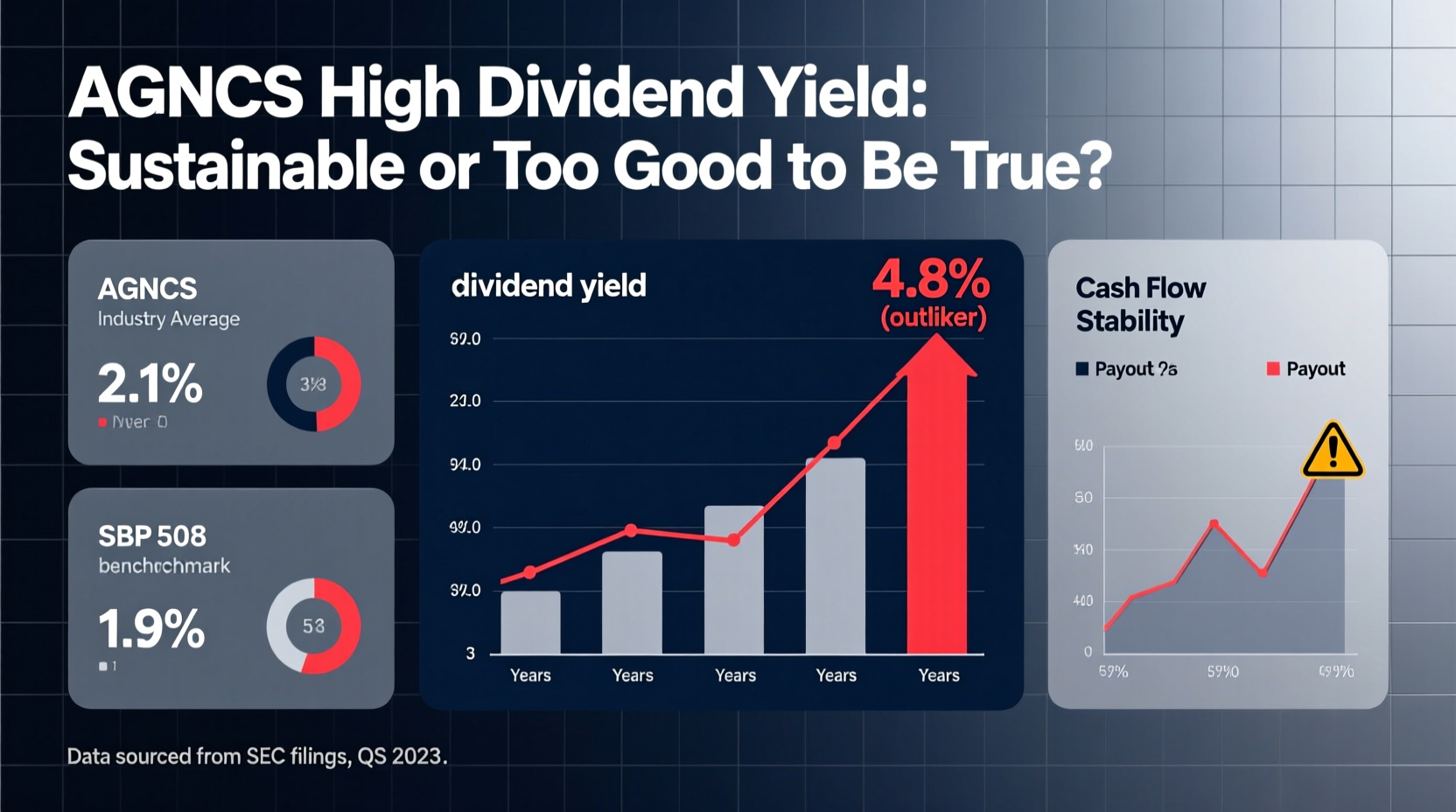

Dividend yield is calculated by dividing the annual dividend per share by the current stock price. A high yield can result from two scenarios: either the company pays out large dividends relative to its share price, or the stock price has fallen significantly while dividends remain unchanged.

In AGNCS’s case, both factors appear to play a role. The company maintains a fixed dividend policy, but its share price has declined over the past 18 months due to macroeconomic pressures and sector-specific challenges. This combination inflates the yield, making it appear more attractive than it may actually be on a fundamental basis.

“High yields aren’t inherently bad, but when they exceed 10%, you must ask: what’s the trade-off?” — Michael Tran, Senior Equity Analyst at Horizon Capital

The key question isn’t just how much is being paid, but whether the business generates enough earnings and free cash flow to support those payments without eroding capital or increasing leverage.

Financial Health Check: Can AGNCS Afford Its Dividend?

To assess sustainability, we examine three critical metrics: payout ratio, operating cash flow, and debt levels.

The payout ratio — the percentage of earnings paid out as dividends — is one of the most telling indicators. For most mature companies, a ratio above 80% raises concerns; for AGNCS, recent filings show a trailing twelve-month (TTM) payout ratio exceeding 95%. This means nearly all net income is being distributed, leaving minimal room for reinvestment, economic downturns, or unexpected expenses.

More concerning is the disconnect between net income and actual cash generation. Operating cash flow has declined by 12% year-over-year, while capital expenditures have remained steady. Free cash flow (FCF), which reflects cash available after maintaining operations, has turned negative in two of the last four quarters. When a company pays dividends despite negative FCF, it risks funding distributions through debt or asset sales — neither of which is sustainable long-term.

Business Model and Industry Risks

AGN Corporate Services operates primarily in the business process outsourcing (BPO) and corporate advisory space, serving mid-sized firms across North America and Europe. While the sector benefits from ongoing demand for cost-efficient back-office solutions, it faces rising competition from automation platforms and offshore providers with lower labor costs.

AGNCS differentiates itself through niche expertise in regulatory compliance and restructuring services. However, these areas are cyclical — demand spikes during economic downturns but slows in stable or growing markets. With interest rates stabilizing and credit conditions improving, client demand for restructuring services has softened, directly impacting top-line growth.

Revenue has stagnated over the past two years, growing just 1.3% annually. Meanwhile, employee-related costs — the largest expense for service firms — have risen 7% per year due to wage inflation and retention efforts. These margin pressures make consistent dividend funding increasingly difficult without operational improvements.

Debt Levels and Liquidity Position

As of the latest quarterly report, AGNCS carries $420 million in long-term debt against $110 million in cash and equivalents. While not immediately alarming, the debt-to-equity ratio stands at 1.8, above the industry average of 1.3. Interest coverage — earnings before interest and taxes (EBIT) divided by interest expense — sits at 2.6x, which is below the safe threshold of 3.0x preferred by credit analysts.

Management has stated its commitment to maintaining the dividend, but also acknowledged plans to refinance maturing debt in the next 12 months. If refinancing occurs at higher rates, interest costs could rise further, tightening cash flow even more.

Historical Precedent: Lessons from Other High-Yield Stocks

History is littered with examples of companies offering high yields that later cut dividends or collapsed entirely. Consider the case of Omega Healthcare Investors (OHI) in 2022, which maintained a 10%+ yield before slashing payouts after tenant defaults surged. Or General Electric, once a dividend darling, which cut its payout by 90% after years of unsustainable distributions masked declining industrial performance.

These cases share common traits with AGNCS: prolonged high yields, declining cash flow, and reliance on debt to maintain shareholder returns. In each instance, investors who focused solely on yield were caught off guard when the music stopped.

“Yield is what you’re promised. Sustainability is what you should evaluate.” — Linda Chen, Portfolio Manager at Apex Income Strategies

Mini Case Study: The Fall of Dividend Darling VYMIX

In 2019, VYMIX Trust offered a 13.5% yield and was widely held by retail income investors. Analysts praised its diversified portfolio and consistent payouts. But behind the scenes, the trust was selling core assets to fund dividends. When asset sales slowed in 2021, cash reserves dwindled. By Q2 2022, VYMIX announced a 60% dividend cut. The stock plunged 44% in three weeks.

Like AGNCS, VYMIX had strong branding, loyal shareholders, and transparent reporting — yet still failed to sustain its payout. The lesson? Transparency doesn’t guarantee solvency. Cash flow does.

Do’s and Don’ts When Evaluating High-Yield Stocks

| Action | Do | Don't |

|---|---|---|

| Evaluate Payout Ratio | Use free cash flow, not EPS, to calculate payout ratio | Rely solely on net income or GAAP metrics |

| Assess Debt Levels | Check interest coverage and upcoming maturities | Ignore off-balance-sheet liabilities |

| Analyze Revenue Trends | Look for consistent organic growth | Accept one-time gains as recurring revenue |

| Review Management Guidance | Compare past promises to actual results | Take forward-looking statements at face value |

Step-by-Step Guide to Assessing Dividend Sustainability

- Gather Financial Statements: Obtain the last three years of 10-K and 10-Q reports.

- Calculate Free Cash Flow: Subtract capital expenditures from operating cash flow.

- Determine Payout Ratio: Divide total dividends paid by free cash flow (ideal: under 80%).

- Analyze Revenue Trends: Look for consistent growth or stability, not volatility.

- Review Debt Metrics: Calculate debt-to-equity and interest coverage ratios.

- Monitor Management Actions: Are insiders buying or selling shares?

- Compare to Peers: Benchmark yield and financials against similar companies.

Frequently Asked Questions

Has AGNCS ever cut its dividend before?

Yes. In Q1 2020, amid the early pandemic uncertainty, AGNCS reduced its quarterly payout by 25% before restoring it nine months later. This precedent shows management is willing to adjust distributions under pressure.

What would trigger another dividend cut?

A sustained decline in free cash flow, failure to refinance debt on favorable terms, or a major client loss could force a reassessment. A drop in interest coverage below 2.0x would be a significant warning sign.

Are there any positive catalysts for AGNCS?

Potential upside exists if AGNCS successfully expands into ESG compliance consulting — a growing niche. Additionally, cost optimization initiatives announced in the last earnings call could improve margins if executed effectively.

Conclusion: Proceed with Caution, Not Conviction

AGNCS’s high dividend yield is undeniably tempting, especially in an era of modest bond returns. However, the numbers suggest the payout is stretched thin across shaky fundamentals. While the company has navigated past challenges, current trends in cash flow, revenue, and leverage indicate growing strain.

Investors seeking reliable income would be wise to view AGNCS not as a core holding, but as a speculative position — one requiring active monitoring and strict exit criteria. Sustainable dividends grow over time; unsustainable ones collapse silently.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?