When shopping for a loan or credit card, you’ll often see two numbers: the interest rate and the annual percentage rate (APR). While they may seem similar, they represent different aspects of borrowing costs. The APR is almost always higher than the interest rate—and understanding why can save you money and prevent surprises down the line. This article breaks down the key differences, explains what makes APR higher, and shows how to use this knowledge when comparing financial products.

Understanding the Basics: Interest Rate vs APR

The interest rate is the cost of borrowing money expressed as a percentage of the loan amount. It reflects only the interest charged by the lender over a year, without including any additional fees or charges. For example, if you take out a $10,000 personal loan with a 6% interest rate, you’ll pay $600 in interest annually—assuming no compounding or extra fees.

APR, on the other hand, stands for Annual Percentage Rate. It includes not just the interest rate but also certain fees and charges associated with the loan, such as origination fees, closing costs, mortgage insurance (in home loans), or annual credit card fees. Because it incorporates more costs, APR gives a fuller picture of what a loan truly costs per year.

“APR was designed to help consumers compare loans on an apples-to-apples basis. It’s not perfect, but it’s far more comprehensive than the interest rate alone.” — Michael Tran, Senior Financial Analyst at Consumer Lending Watch

Why Is APR Typically Higher Than the Interest Rate?

In most cases, APR exceeds the stated interest rate because it accounts for additional costs beyond simple interest. Here are the primary reasons:

- Origination Fees: Many loans charge an upfront fee to process the application. For instance, a 1% origination fee on a $20,000 loan adds $200 to the total cost, which gets factored into the APR.

- Closing Costs: Common in mortgages, these include appraisal fees, title searches, attorney fees, and more. Even if paid separately, they increase the effective APR.

- Discount Points: Optional fees paid to lower the interest rate. Since they’re part of the loan’s cost, they raise the APR even if the interest rate drops.

- Mortgage Insurance: Required for many home loans with less than 20% down payment. This recurring cost is included in the APR calculation.

- Compounding Frequency: While not directly added, how often interest compounds (monthly, daily) affects the effective APR, especially in credit cards.

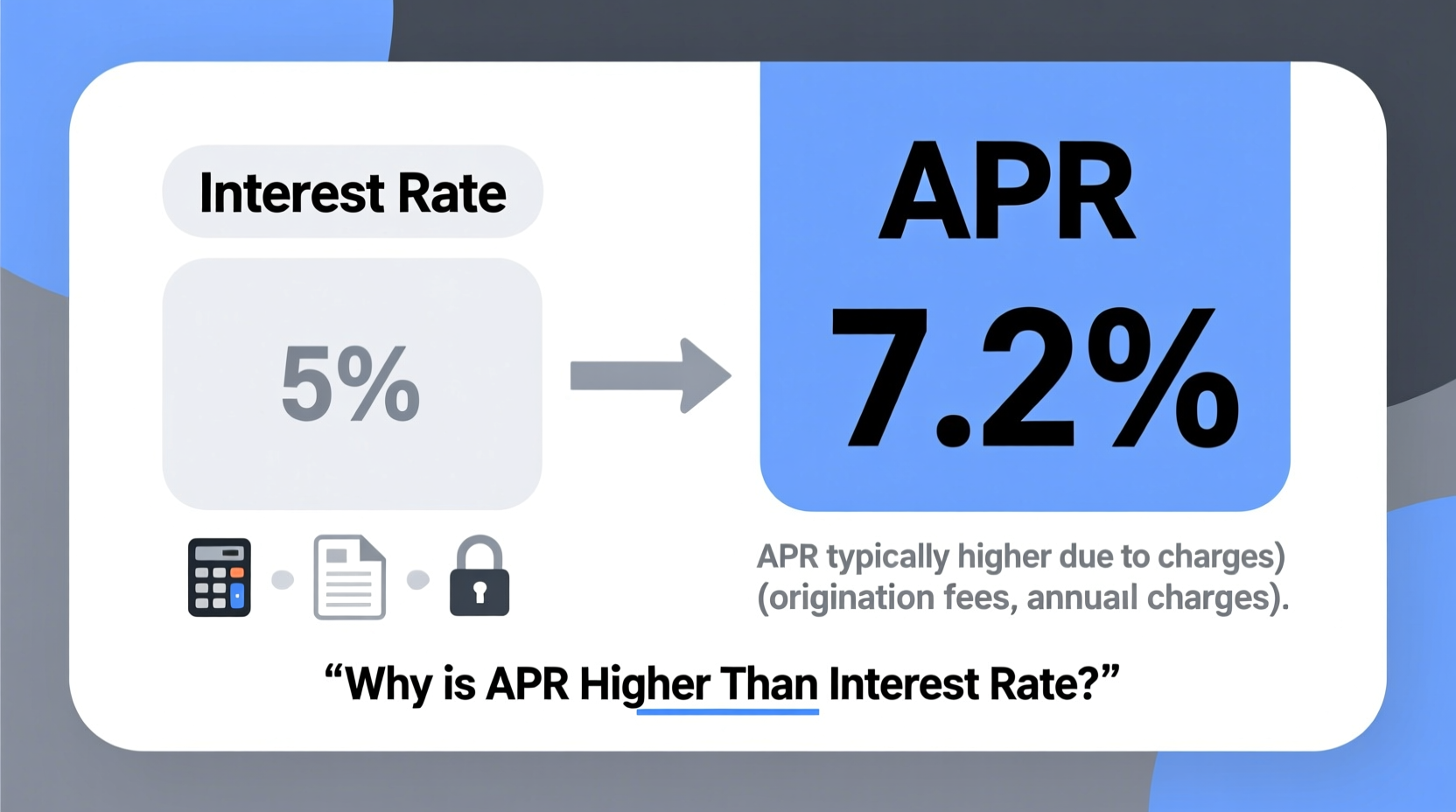

How APR Is Calculated: A Practical Example

To illustrate, let’s consider a 5-year auto loan for $25,000 with a 5% interest rate and a $500 origination fee.

First, the lender calculates the total finance charge over the life of the loan, including both interest and fees. Then, that total cost is converted into an annualized rate—this becomes the APR.

In this case:

- Total interest paid over 5 years ≈ $3,250

- Origination fee = $500

- Total cost = $3,750

- Effective APR ≈ 6.05%

Even though the interest rate is 5%, the APR jumps to over 6% due to the added fee. This difference helps borrowers understand the true cost of borrowing.

Comparing Loan Offers: What to Look For

When reviewing loan offers, focus on APR as your primary comparison tool. However, keep in mind that not all fees are included in APR. Some charges—like late fees, prepayment penalties, or administrative costs—may not be reflected.

| Loan Type | Interest Rate | Fees Included in APR | Fees Often Excluded |

|---|---|---|---|

| Personal Loan | 7% | Origination fee, processing fee | Late fees, check processing |

| Mortgage | 6.2% | Origination, underwriting, points | Appraisal (sometimes), attorney fees |

| Credit Card | 18% (variable) | Annual fee (if applicable) | Foreign transaction fees, cash advance fees |

This table highlights that while APR is more inclusive than interest rate, it still doesn’t capture every possible cost. Always read the fine print before committing.

Mini Case Study: Choosing Between Two Credit Cards

Sarah is comparing two credit cards:

- Card A: 16% interest rate, $0 annual fee → APR: 16%

- Card B: 14% interest rate, $95 annual fee → APR: 15.8%

At first glance, Card B seems better due to its lower APR and interest rate. But Sarah rarely uses her card and pays off balances immediately. In her case, the annual fee isn’t justified. She chooses Card A, avoiding unnecessary costs despite its slightly higher APR.

This scenario shows that APR is useful—but not always the final word. Your spending habits and repayment behavior matter too.

Step-by-Step Guide to Evaluating APR Effectively

- Gather all loan offers and identify both the interest rate and APR.

- Check what fees are included in the APR disclosure (usually found in the loan estimate or Schumer box).

- Estimate your borrowing timeline—short-term loans make upfront fees more impactful.

- Calculate total cost manually if needed: add interest + fees, then divide by loan term.

- Compare across lenders using APR as the baseline, but factor in flexibility, customer service, and repayment terms.

Frequently Asked Questions

Can APR ever be the same as the interest rate?

Yes, but only if there are no additional fees associated with the loan. This is rare with mortgages or personal loans but common with some no-fee credit cards or promotional financing offers.

Why do credit card ads show both interest rate and APR?

They are legally required to disclose APR under the Truth in Lending Act (TILA). The APR includes the interest rate and any mandatory fees (like annual fees), helping consumers make informed decisions.

Does APR include compound interest?

Yes, APR accounts for compounding in most cases, especially for credit cards. However, standard APR assumes simple interest unless specified otherwise. The “effective APR” reflects actual compounding and may be higher.

Final Thoughts and Action Steps

Understanding the distinction between interest rate and APR empowers you to make smarter financial choices. While the interest rate tells you how much interest you’ll pay, the APR reveals the full cost of borrowing—including hidden fees that can add up quickly.

Before signing any loan agreement or opening a new credit account, follow this checklist:

- ✅ Compare APRs across multiple lenders

- ✅ Read the fee breakdown in the loan estimate

- ✅ Ask whether the APR is fixed or variable

- ✅ Consider how long you plan to keep the loan

- ✅ Calculate total repayment amount, not just monthly payments

“The best borrowers don’t just look at the headline rate—they dig into the APR and ask, ‘What am I really paying?’ That question separates informed decisions from costly mistakes.” — Lisa Nguyen, Consumer Finance Educator

Take Control of Your Borrowing Costs

Now that you know why APR is typically higher than the interest rate, use this insight to your advantage. Don’t be swayed by low interest rates advertised without context. Demand transparency, compare APRs rigorously, and always assess the total cost of credit. Whether you're financing a car, buying a home, or managing credit card debt, a clear understanding of APR puts you in a stronger financial position. Start applying this knowledge today—your future self will thank you.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?