Gift cards have evolved from one-time-use tokens into flexible financial tools. While traditional gift cards are non-reloadable and expire once the balance is spent, a growing number of reloadable gift cards now offer ongoing usability. Whether you're budgeting, gifting, or managing expenses for teens or employees, understanding which cards allow additional funds can make a significant difference in convenience and control.

The short answer: Yes, you *can* add money to certain gift cards—but only if they are specifically designed as reloadable. Not all gift cards support this feature, and the ability to reload depends on the issuer, card type, and where it’s purchased. This article breaks down everything you need to know about reloadable gift cards, including how they work, where to find them, and practical strategies for maximizing their value.

Understanding Reloadable vs. Non-Reloadable Gift Cards

The key distinction lies in the card's design. Most store-specific gift cards—like those from coffee shops, clothing retailers, or movie theaters—are issued with a fixed amount and cannot be topped up once used. These are typically disposable after the balance runs out.

In contrast, reloadable gift cards function more like prepaid debit cards. They often carry network logos such as Visa, Mastercard, American Express, or Discover and can be reloaded multiple times through various methods. These cards usually require registration and may involve fees, but they offer greater flexibility for ongoing use.

“Reloadable prepaid cards bridge the gap between cash and credit, offering spending control without a bank account.” — Federal Trade Commission (FTC)

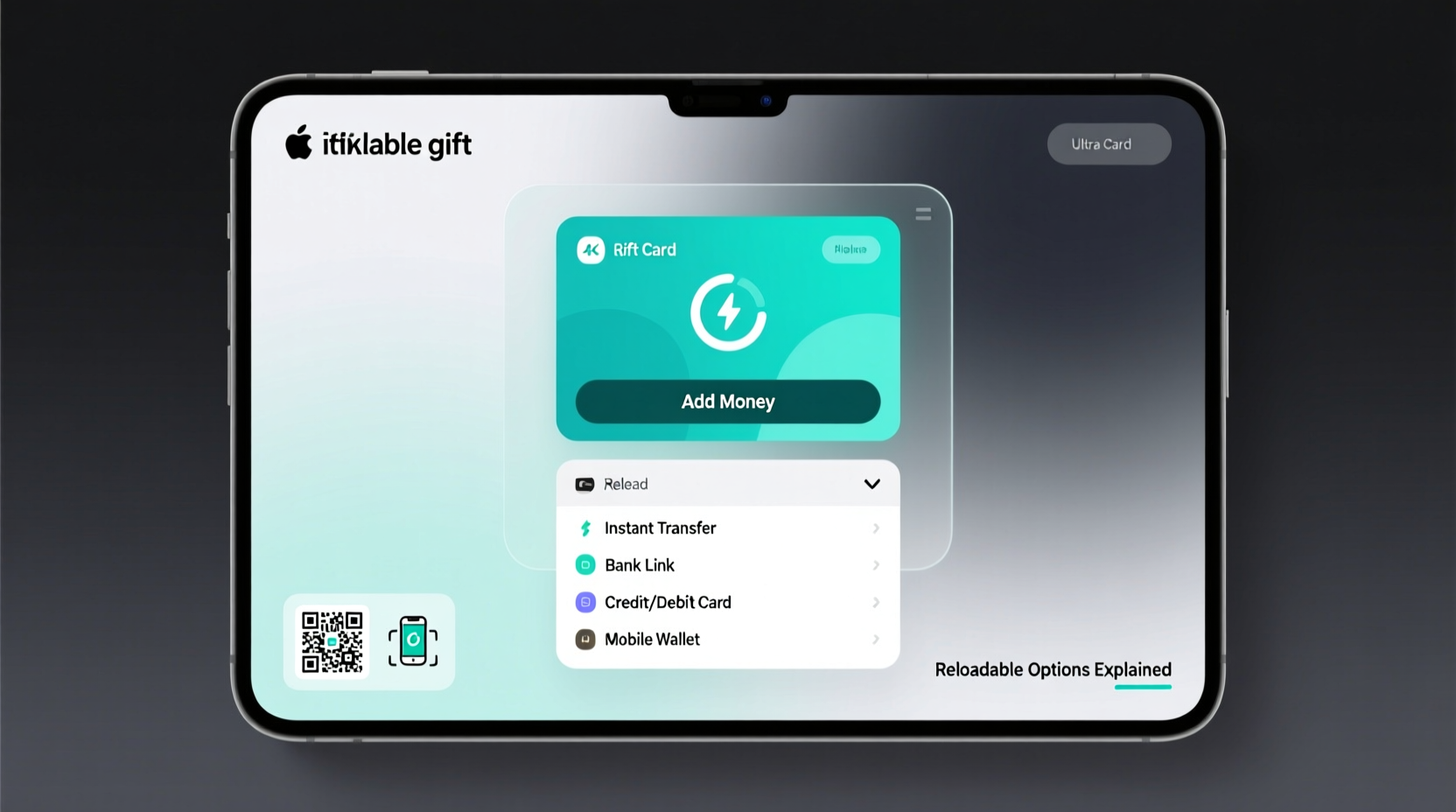

How Reloadable Gift Cards Work

Reloadable cards operate similarly to traditional debit cards but are not linked to a bank account. Instead, users load funds onto the card and spend up to the available balance. Each transaction deducts from the total, and when funds run low, additional money can be added—provided the card supports reloading.

To reload, users typically need to:

- Register the card online or via an app

- Link a funding source (bank account, credit card, or cash)

- Select a reload method (direct deposit, retail top-up, mobile transfer)

Major Reloadable Gift Card Options

Several widely available reloadable cards stand out due to their accessibility, low fees, and broad acceptance. Here’s a comparison of popular choices:

| Card Name | Network | Reload Methods | Fees | Where Accepted |

|---|---|---|---|---|

| Green Dot Prepaid Visa | Visa | Bank transfer, cash at retail, direct deposit, mobile check deposit | $7.95 monthly fee (waivable), $3.00 ATM withdrawal | Anywhere Visa is accepted |

| Netspend Visa Prepaid | Visa | Direct deposit, bank transfer, Western Union, retail reload | $9.95 monthly fee (waivable), $2.50 reload fee at stores | Global Visa network |

| Bluebird by American Express | No network (limited Amex partners) | Bank transfer, Walmart MoneyCard reload, direct deposit | No monthly fee, $5.95 ATM fee | Walmart, select merchants, online |

| Vanilla Visa Gift Card (Reloadable Version) | Visa | Online reload only after registration | $4.95 purchase fee, no monthly fee | Any merchant accepting Visa |

Note: Some cards marketed as \"gift cards\" are actually reloadable prepaid products. Always verify reload functionality before purchasing.

Step-by-Step Guide to Adding Money to a Reloadable Card

If you already own a reloadable gift card, follow these steps to add funds:

- Register Your Card: Visit the issuer’s website or app and enter the card number, security code, and expiration date. Provide personal details as required.

- Choose a Reload Method: Common options include:

- Direct deposit (use routing and account numbers provided by the card)

- Bank transfer (link a checking account for electronic transfers)

- Retail reload (add cash at Walmart, CVS, or Walgreens using the Reload @ the Register service)

- Mobile check deposit (if supported)

- Add Funds: Enter the amount you wish to load. Confirm the transaction and wait for processing (usually instant for cash reloads, 1–3 days for bank transfers).

- Verify Balance: Check your updated balance online, via app, or by calling customer service.

Real Example: Managing a Teen’s Spending with a Reloadable Card

Sarah, a parent of two teenagers, wanted to teach responsible spending without handing over cash or a credit card. She purchased a reloadable Netspend Visa card for her daughter Emma, who was starting part-time work. Sarah set up direct deposit of Emma’s paycheck to the card and enabled text alerts for every transaction.

Each week, Emma received a small allowance loaded automatically when her balance dipped below $20. Over time, she learned to track spending, avoid overdrafts (since the card declines transactions exceeding the balance), and save for larger purchases. The reloadable feature allowed continuous use without needing new cards, making it both economical and educational.

Common Mistakes to Avoid

While reloadable gift cards offer benefits, misuse can lead to frustration or unnecessary costs. Watch out for these pitfalls:

- Ignoring Fees: Monthly maintenance, reload, ATM, and inactivity fees can erode value quickly. Choose fee-free or waivable plans.

- Not Registering the Card: Unregistered cards often can’t be reloaded and aren’t protected against loss or theft.

- Using Outdated Retail Services: Some stores discontinued cash reload services post-pandemic. Verify availability before heading out.

- Assuming All Visa Cards Are Equal: A generic Visa gift card bought at a grocery store is likely non-reloadable. Only specific prepaid versions support top-ups.

Checklist: How to Choose the Right Reloadable Gift Card

- ✅ Confirmed reloadability before purchase

- ✅ Low or waivable monthly fees

- ✅ Multiple reload options (cash, bank, direct deposit)

- ✅ Fraud protection and lost card replacement

- ✅ Mobile app with balance alerts and spending tracking

- ✅ Wide acceptance (preferably major payment network)

Frequently Asked Questions

Can I reload a store-specific gift card like Starbucks or Amazon?

Yes, but only within that ecosystem. For example, you can add money to a registered Starbucks card online or via their app, and Amazon allows reloading of its gift card balance through their website. However, these funds can only be used at the respective retailer.

Are there reloadable gift cards with no fees?

A few options exist. The Bluebird by American Express has no monthly or reload fees, though ATM withdrawals cost extra. Some credit unions also offer low-fee reloadable prepaid cards to members.

Can I use a reloadable gift card for subscriptions?

Yes, most reloadable Visa or Mastercard-based prepaid cards work with recurring payments like Netflix or Spotify. However, ensure the card has sufficient balance and auto-reload is enabled to prevent service interruption.

Final Thoughts and Action Steps

Reloadable gift cards are more than just gifts—they’re practical tools for financial management, gifting with longevity, and teaching spending discipline. By selecting the right card and understanding how to maintain and fund it, users gain flexibility without the risks of credit debt.

Start by identifying your goal: Is it for personal budgeting, teen allowances, employee incentives, or travel spending? Then compare card features, prioritize low fees, and confirm reload access. Register your card immediately and consider setting up automatic top-ups to keep funds flowing seamlessly.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?