Cash App has become one of the most widely used peer-to-peer payment platforms in the U.S. and beyond, offering quick money transfers, direct deposits, and even investing features. However, users occasionally encounter a frustrating roadblock: their payments are blocked or flagged without clear explanation. Whether you're trying to send $20 to a friend or receive a freelance payment, a blocked transaction can disrupt your plans. Understanding why Cash App blocks payments—and how to resolve these issues—is essential for maintaining seamless financial activity.

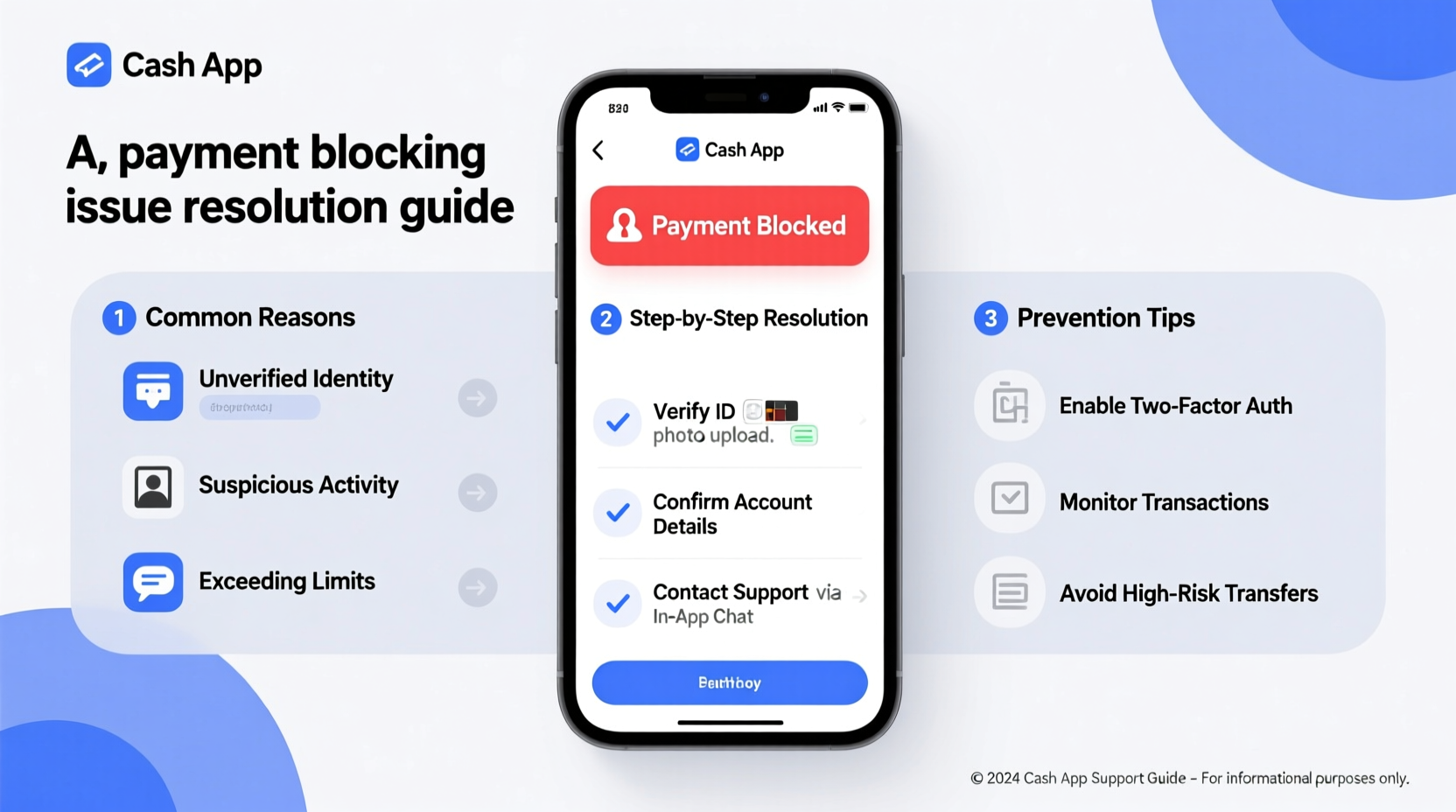

Why Cash App Blocks Payments: Common Triggers

Cash App employs automated security systems designed to detect suspicious behavior and prevent fraud. While these safeguards protect users, they can sometimes flag legitimate transactions. The platform may block a payment based on several risk indicators:

- Sudden changes in transaction patterns – Large or frequent transfers that deviate from your usual behavior.

- Unverified account information – Missing or outdated ID, address, or SSN details.

- Use of public Wi-Fi or new devices – Logging in from unfamiliar networks or locations raises red flags.

- Reports of scams or disputes – If someone reports your payment as unauthorized, Cash App may freeze related funds.

- Violation of Terms of Service – Engaging in prohibited activities like reselling gift cards or money laundering.

The system evaluates each transaction in real time using algorithms trained on historical fraud data. As a result, even well-intentioned users can be caught in false positives.

How to Resolve Blocked Payment Issues Step by Step

If your payment is blocked, don’t panic. Most issues can be resolved with prompt action. Follow this timeline to regain access and complete your transaction:

- Check the Notification – Open Cash App and review any alerts. Look for messages under \"Activity\" or in the Support section.

- Verify Your Identity – If prompted, upload a government-issued ID (driver’s license or passport) and confirm your address.

- Confirm Recent Activity – Respond to any verification emails or SMS codes sent by Cash App to confirm it was you initiating the transaction.

- Contact Support via In-App Chat – Tap the profile icon → \"Support\" → \"Something Else\" → \"Payments & Deposits\" → \"Payment is Blocked.\" You’ll be connected to a live agent or guided through resolution steps.

- Wait for Review (24–72 hours) – After submitting documents, allow up to three business days for review. Avoid repeating the transaction during this period.

- Resume Transactions – Once cleared, you should be able to send and receive normally.

In some cases, Cash App may require a selfie holding your ID to confirm authenticity. This process aligns with KYC (Know Your Customer) regulations enforced by financial institutions.

Preventive Measures: Do’s and Don’ts

To avoid future blocks, adopt habits that signal trustworthiness to Cash App’s monitoring systems. The following table outlines key behaviors:

| Do’s | Don’ts |

|---|---|

| Keep your personal info updated (name, address, phone number) | Don’t frequently switch devices or IP addresses |

| Enable two-factor authentication (2FA) | Don’t make rapid, high-volume transactions without prior history |

| Link a bank account and use it regularly to build transaction history | Don’t engage in transactions flagged as “for goods/services” when sending to strangers |

| Regularly log in from trusted devices | Don’t ignore verification requests or support messages |

Consistency in usage helps the system recognize you as a low-risk user. Over time, verified accounts experience fewer restrictions.

Real Example: How One User Regained Access

Mark, a freelance graphic designer from Austin, attempted to withdraw $850 in client payments after linking his bank account. The transfer was immediately blocked, and he received a message stating, “We’ve placed a temporary hold on your account.” Alarmed, he checked his email and found a request from Cash App to verify his identity.

He uploaded a photo of his driver’s license and submitted a short video confirming his identity as instructed. Within 18 hours, he received confirmation that his account was restored. Mark later shared that enabling 2FA and avoiding public Wi-Fi for financial tasks helped him avoid future issues.

This case highlights how proactive compliance with verification processes leads to faster resolutions—even during stressful situations.

“Automated fraud detection tools are necessary but imperfect. When users cooperate quickly with verification, 90% of holds are lifted within 48 hours.” — Lena Patel, Senior Fraud Analyst at a FinTech Compliance Group

Troubleshooting Checklist

Use this checklist whenever you encounter a blocked payment:

- ✅ Check Cash App notifications for specific reason codes

- ✅ Confirm your account is fully verified (ID, SSN, address)

- ✅ Ensure your device and internet connection are secure and familiar

- ✅ Avoid repeated attempts to resend the same amount

- ✅ Contact Cash App Support directly through the app

- ✅ Submit requested documents promptly and clearly

- ✅ Wait patiently for review—do not create a new account

Repeating a blocked transaction can trigger additional scrutiny. Instead, focus on resolving the root cause first.

Frequently Asked Questions

Why did Cash App block my payment without warning?

Cash App uses real-time risk assessment models that automatically flag transactions based on behavior patterns. You may not receive advance notice because the system acts instantly to prevent potential fraud. Review your recent activity and check the app for follow-up instructions.

How long does a payment block last?

Most blocks are resolved within 24 to 72 hours after submitting required information. Complex cases involving suspected fraud or third-party disputes may take longer, especially if manual review is needed.

Can I appeal a permanent restriction?

If your account is permanently limited, you can still contact Cash App Support to request a review. However, final decisions depend on compliance history and severity of policy violations. Providing accurate documentation improves your chances.

Final Thoughts and Next Steps

Being blocked from making a payment on Cash App is inconvenient, but rarely permanent. Most issues stem from security protocols designed to protect users—not punish them. By understanding the triggers, responding promptly to verification requests, and maintaining a consistent transaction profile, you can minimize disruptions and maintain reliable access to your funds.

Remember, financial technology platforms rely heavily on user cooperation to balance convenience and safety. Staying proactive about account health is just as important as managing your budget.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?