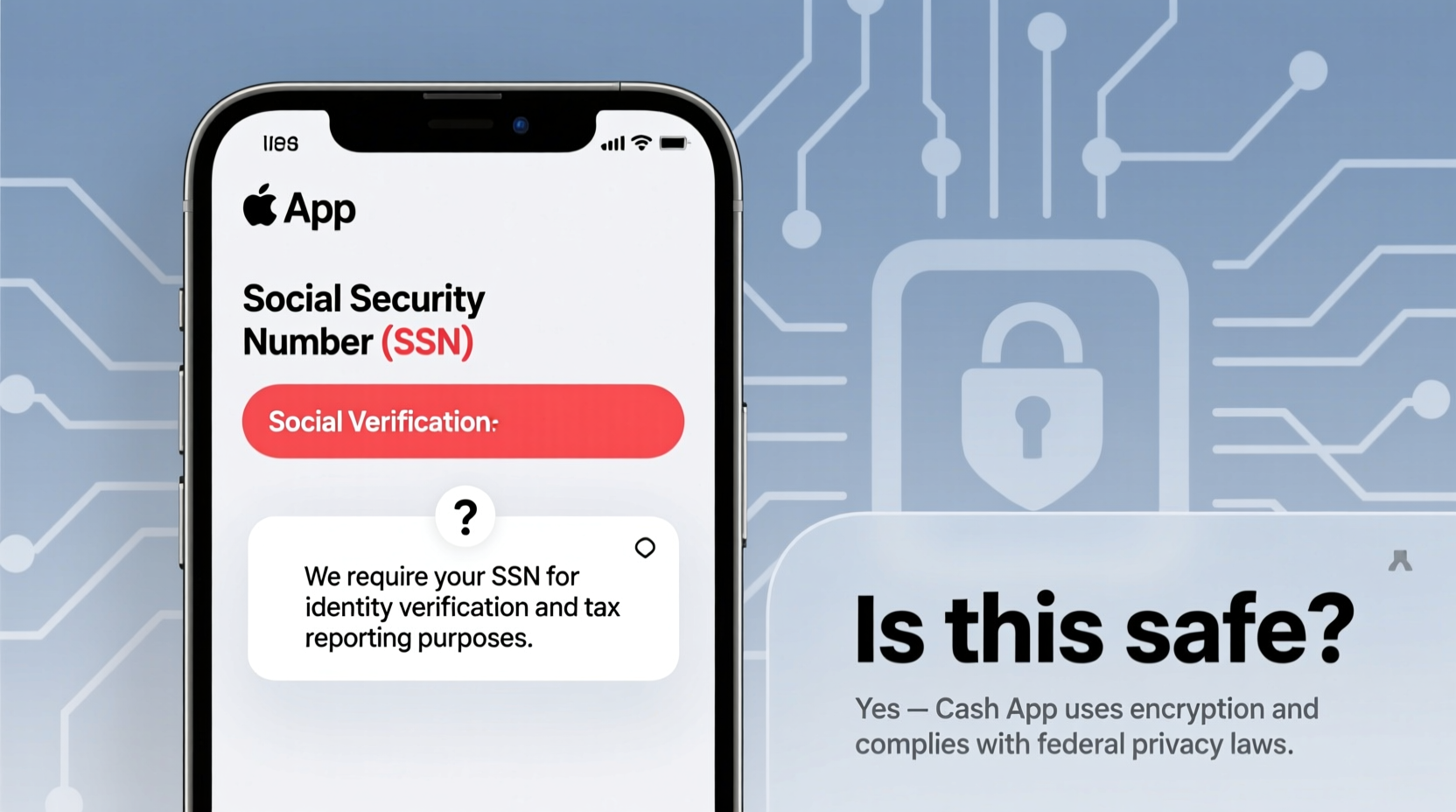

Cash App has become one of the most popular peer-to-peer payment platforms in the U.S., offering fast money transfers, direct deposit, investing, and even a free debit card. But at some point during setup or account upgrade, users are asked to provide their Social Security Number (SSN). This request raises understandable concerns: Why does a payments app need such sensitive personal information? And more importantly, is it safe to give it?

The short answer is yes—under normal circumstances, providing your SSN to Cash App is safe and necessary. But understanding the reasons behind the request, how the data is protected, and what risks—if any—exist is crucial for making an informed decision.

Why Cash App Needs Your SSN

Cash App isn’t asking for your SSN just to collect data. The request is tied directly to regulatory compliance and financial services expansion. When you sign up for certain features, federal laws require identity verification to prevent fraud, money laundering, and tax evasion.

Here’s when and why Cash App collects your SSN:

- Identity Verification: To confirm you are who you say you are, especially when moving beyond basic sending and receiving of funds.

- IRS Reporting Requirements: If you earn over $600 from third-party transactions (like selling goods), Cash App must report this to the IRS using your SSN.

- Financial Product Access: To enable features like direct deposit, Bitcoin trading, stock investing, and the Cash Card, your identity must be verified under anti-money laundering (AML) regulations.

- Credit Checks (for Boosts or Loans): In limited cases, if Cash App offers credit-based features in the future, your SSN may be used for soft credit checks.

“Financial technology platforms like Cash App operate under the same legal obligations as traditional banks when it comes to customer identification and transaction reporting.” — Sarah Lin, Financial Compliance Analyst

Is It Safe to Provide Your SSN to Cash App?

Yes, Cash App employs industry-standard security measures to protect your personal information, including your SSN. However, “safe” doesn’t mean risk-free—it means that the platform follows best practices in data encryption, access control, and regulatory compliance.

Data Protection Measures

Cash App, developed by Block, Inc. (formerly Square, Inc.), uses multiple layers of protection:

- End-to-End Encryption: All sensitive data, including your SSN, is encrypted both in transit and at rest.

- Tokenization: Personal identifiers are replaced with secure tokens when processed or stored.

- Two-Factor Authentication (2FA): Adds an extra layer of login security to prevent unauthorized access.

- Biometric Lock: Available on mobile devices to restrict app access via fingerprint or face recognition.

- Regular Audits: Cash App undergoes routine security assessments and complies with financial regulations like KYC (Know Your Customer) and AML.

When You Must Provide Your SSN

You’re not required to enter your SSN immediately upon downloading Cash App. However, certain actions trigger the verification process. Here’s a timeline of common scenarios:

- Initial Setup: No SSN needed. You can send and receive money between friends using just your phone number or $Cashtag.

- First Deposit Over $300: Cash App may prompt identity verification, including SSN, to comply with transaction monitoring rules.

- Enabling Direct Deposit: Required to link your bank account and receive paychecks or government benefits.

- Investing in Stocks or Bitcoin: Federal regulations mandate identity verification for investment activities.

- Earning Over $600 Annually: If you use Cash App for business or freelance work, you’ll need to provide your SSN for IRS Form 1099-K reporting.

Real Example: Freelancer Receiving Payments

Maya is a freelance graphic designer who started using Cash App to receive client payments. Initially, she only used her $Cashtag and didn’t provide her SSN. But after six months, her earnings surpassed $5,000. When she tried to cash out, Cash App prompted her to verify her identity. She entered her full name, address, date of birth, and SSN. Within 24 hours, her account was verified, and she could continue using all features—including tax reporting at year-end.

This is a standard process for digital financial platforms. Without verification, Maya wouldn’t have been able to access higher-tier services or remain compliant with tax laws.

Do’s and Don’ts When Sharing Your SSN with Cash App

| Action | Do | Don't |

|---|---|---|

| Providing SSN | Enter it directly in the app through the official verification screen | Never share it via email, text, or third-party websites |

| Device Security | Use 2FA and biometric locks on your phone | Don’t leave your phone unlocked or logged into Cash App on shared devices |

| Data Confirmation | Double-check that you’re entering your own accurate SSN | Don’t guess or use someone else’s number—fraud penalties apply |

| Monitoring | Review transaction history monthly for suspicious activity | Ignore notifications about login attempts or changes to your account |

Frequently Asked Questions

Can I use Cash App without giving my SSN?

Yes, but with limitations. You can send and receive small amounts between individuals without verification. However, to unlock features like direct deposit, investing, or business transactions, you must verify your identity with your SSN.

Does Cash App sell my SSN to third parties?

No. Cash App’s privacy policy explicitly states they do not sell user data. Your SSN is used solely for identity verification, regulatory compliance, and service provision. It may be shared with trusted partners like banking institutions or credit bureaus—but only as legally required.

What happens if my Cash App account is hacked?

If your account is compromised, contact Cash App support immediately. While your SSN itself isn’t exposed through typical breaches (it’s not stored in plain text), unauthorized access to your account could lead to identity misuse. Enable two-factor authentication and monitor your credit reports regularly to mitigate risks.

How to Stay Protected After Submitting Your SSN

Once you’ve provided your SSN, staying vigilant is key. Identity theft often occurs not because of corporate breaches, but due to individual lapses in security. Follow this checklist to minimize exposure:

- ✅ Enable two-factor authentication in Cash App settings

- ✅ Use a strong, unique password for your Cash App account

- ✅ Regularly review your transaction history and linked devices

- ✅ Avoid public Wi-Fi when accessing financial apps; use a secure network or VPN

- ✅ Monitor your credit reports annually at AnnualCreditReport.com

- ✅ Set up alerts for any changes to your account or large transactions

Conclusion: Balancing Convenience and Security

Providing your SSN to Cash App is a necessary step for unlocking its full range of financial tools—and it’s generally safe when done correctly. The platform adheres to strict security protocols and legal standards designed to protect consumers. That said, safety also depends on your behavior: securing your device, recognizing scams, and monitoring your accounts.

Digital finance is evolving rapidly, and tools like Cash App offer unprecedented convenience. With smart habits and awareness, you can enjoy these benefits without compromising your personal security. If you’ve hesitated to verify your identity, now you know why it’s requested and how to do it safely.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?