Having your Chase overdraft request declined can be frustrating—especially when you're counting on that small cushion to cover an essential expense. You might assume that enrolling in overdraft protection means transactions will go through even if your balance is low. But that's not always the case. Several factors influence whether Chase approves or declines an overdraft, and understanding them is key to avoiding future surprises.

This guide breaks down the most common reasons for a declined overdraft at Chase, outlines actionable solutions, and provides practical steps to improve your banking experience. Whether it’s a one-time hiccup or a recurring issue, clarity starts here.

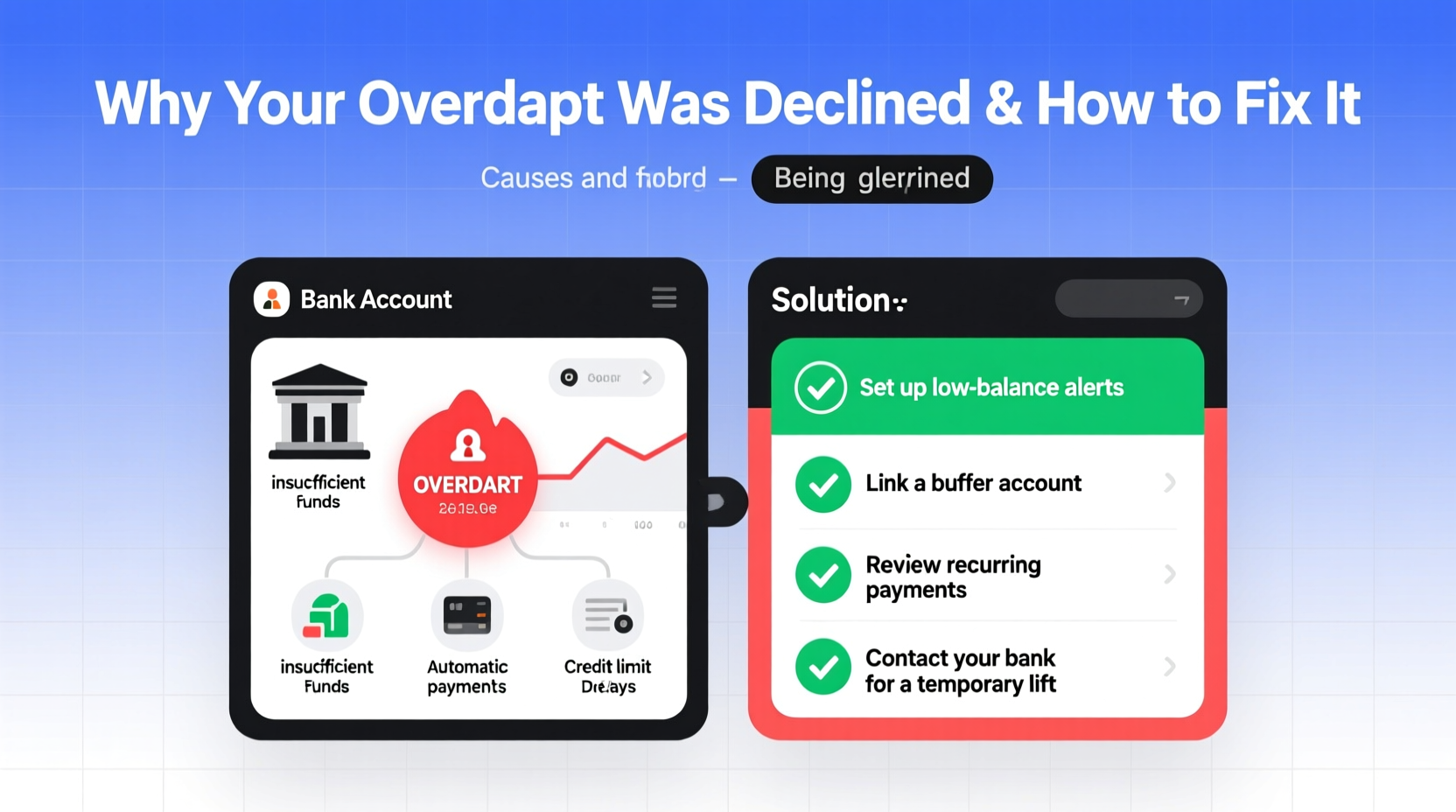

Why Chase Declines Overdraft Requests

Even with overdraft protection enabled, Chase doesn’t guarantee every transaction will be covered. The bank uses a combination of risk assessment, account history, and internal policies to determine whether to approve an overdraft. Here are the primary reasons your request may have been declined:

- Insufficient linked backup funds: If you rely on a savings account or credit line for overdraft coverage, but those funds are unavailable or maxed out, the transfer fails.

- Poor account standing: Accounts with frequent negative balances, excessive overdrafts, or unresolved fees may lose eligibility for coverage.

- New account status: Chase often limits overdraft privileges during the first 30–90 days after opening an account.

- Transaction type: Certain transactions like ATM withdrawals and debit card purchases are more likely to be declined than checks or recurring bills, which may be covered under \"standard\" overdraft practices.

- Exceeding aggregate limits: Chase may cap the total amount it will cover per day (typically $100–$500 depending on account type and history).

- Suspicious activity: Unusual spending patterns can trigger fraud prevention systems, leading to declined transactions—even if funds are available via overdraft.

Overdraft Coverage Options at Chase: What You Need to Know

Chase offers multiple ways to manage overdrafts, but each comes with different rules and limitations. Understanding these options helps explain why some transactions go through while others don’t.

| Overdraft Option | Coverage Provided | Limitations |

|---|---|---|

| Everyday Overdraft Protection | Links to savings, credit card, or line of credit | Transfer fees apply; requires sufficient funds in linked account |

| Standard Overdraft Practice | Covers checks, ACH payments, and recurring debits | Does NOT cover ATM/debit card transactions unless opted in |

| Debit Card Overdraft Service | Allows overdrafts on point-of-sale and ATM transactions | Must be explicitly opted in; subject to daily limits and eligibility |

| No Overdraft Coverage | Transactions decline when funds are insufficient | No fees, but potential inconvenience |

If you haven’t actively opted into debit card overdraft coverage, Chase will decline ATM and everyday debit purchases when your balance is too low—even if other forms of payment (like checks) would be covered under standard policy.

Step-by-Step Guide to Resolving a Declined Overdraft

A declined overdraft isn't the end of the story. Follow this timeline to diagnose the cause and restore reliable coverage:

- Review your account activity immediately: Log in to your Chase account online or via the app. Check recent transactions, current balance, and any notifications about declined items or service changes.

- Check your overdraft settings: Navigate to “Account Services” > “Overdraft Protection.” Confirm whether you’re enrolled in Debit Card Overdraft Service and if a backup account is properly linked.

- Contact Chase customer service: Call the number on the back of your card or use secure messaging. Ask specifically: “Why was my overdraft request declined?” Request a review of your eligibility and daily limit.

- Deposit funds promptly: Even if you expect overdraft coverage, depositing money quickly prevents additional declines and reduces time spent in the negative.

- Request a reevaluation: If you’ve had a strong history but were recently declined due to temporary issues (e.g., a late paycheck), ask if Chase can manually approve a past item or increase your limit.

- Monitor for 30 days: Maintain positive balances, avoid repeated overdrafts, and build stability. This improves your chances of consistent future coverage.

Real Example: Why Maria’s Overdraft Was Declined

Maria, a freelance graphic designer, opened a Chase Total Checking® account three weeks ago. She assumed her overdraft protection was active because she linked her Chase Savings account. One morning, she tried to buy groceries using her debit card—the transaction was declined despite having overdraft protection enabled.

After calling Chase, she learned two things: First, new accounts aren’t eligible for debit card overdraft coverage until day 31. Second, her linked savings account didn’t have enough funds to cover the $78 purchase. Although her savings had $60, the full amount couldn’t be transferred.

Solution: Maria deposited $100 into her savings account and waited until her account matured past the 30-day mark. On day 32, she successfully opted into Debit Card Overdraft Service and tested with a small purchase. It went through without issue.

“We see many customers confused about why their ‘protected’ account still declines transactions. The reality is overdraft isn’t a promise—it’s a privilege based on eligibility and available resources.” — James R. Holloway, Banking Consultant and Former Regional Manager, JPMorgan Chase

Checklist: Prevent Future Overdraft Declines

- ✅ Opt in to Debit Card Overdraft Service if you want ATM and POS coverage

- ✅ Link a well-funded savings account or line of credit for backup transfers

- ✅ Maintain a positive balance regularly to show responsible usage

- ✅ Avoid frequent overdrafts—more than 2–3 per month may reduce eligibility

- ✅ Set up low-balance alerts and use mobile check deposits to stay ahead

- ✅ Review monthly statements for fees and declined items

- ✅ Consider switching to an account with higher overdraft limits if needed

Frequently Asked Questions

Can Chase deny an overdraft even if I have protection?

Yes. Having overdraft protection doesn’t guarantee approval. Chase evaluates each transaction based on your account history, risk profile, and available backup funds. New accounts, repeated overdrawn balances, or lack of linked resources can result in denials.

How much does Chase allow for overdrafts?

There’s no fixed dollar amount. Chase determines eligibility and limits on a case-by-case basis. Most customers face daily caps between $100 and $500. You won’t know your exact limit unless you contact customer service or experience a decline.

Is there a way to increase my overdraft limit?

While Chase doesn’t advertise formal overdraft limit increases, maintaining a healthy account for several months—avoiding chronic negative balances, paying fees promptly, and keeping linked accounts funded—can lead to improved treatment. Some customers report higher coverage after upgrading to a Plus or Premier checking account.

Final Thoughts and Next Steps

A declined overdraft from Chase is rarely arbitrary—it’s usually the result of policy, timing, or funding gaps. By reviewing your settings, understanding your account’s limitations, and building a stronger financial track record, you can significantly reduce the chances of future disruptions.

Don’t wait for another declined transaction to act. Take five minutes today to log in, confirm your overdraft preferences, and ensure your backup accounts are ready. Small proactive steps now can prevent stress later.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?