Having your credit card declined at a critical moment—whether online, in-store, or while booking travel—can be frustrating and embarrassing. But it’s more common than you think. Most declines aren’t due to major financial issues but rather preventable oversights or temporary glitches. Understanding the root causes empowers you to respond quickly and avoid repeat incidents. This guide breaks down the most frequent reasons for a declined credit card, offers immediate solutions, and provides long-term strategies to keep your credit access smooth.

Why Credit Cards Get Declined: The Top Causes

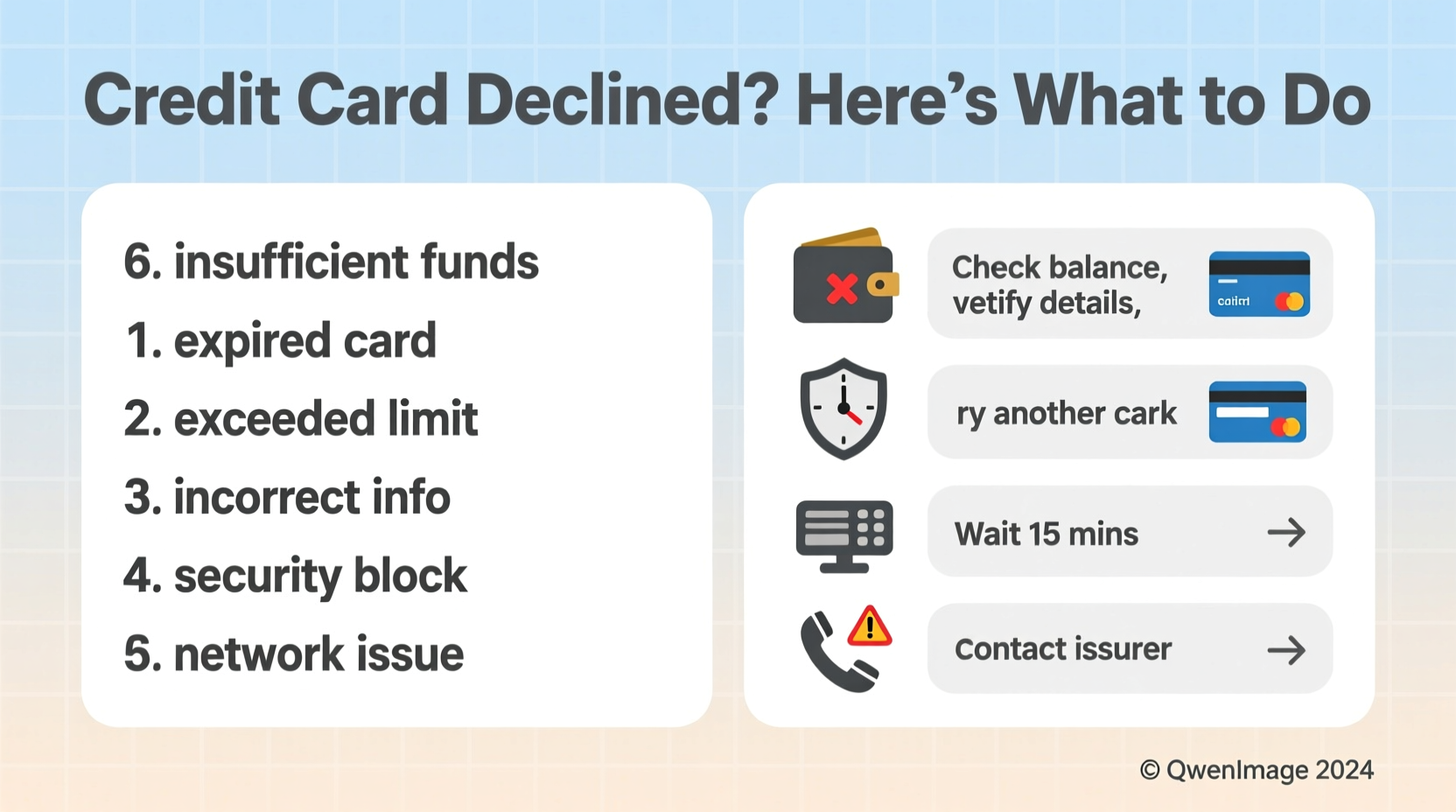

Credit card declines stem from issuer-side safeguards, account status issues, or user errors. While each transaction is evaluated in real time, several predictable factors trigger rejections:

- Exceeded credit limit: Spending beyond your available balance triggers an automatic block.

- Missed or late payment: Even one overdue payment can suspend card privileges temporarily.

- Suspected fraud: Unusual spending patterns (e.g., large purchase abroad) prompt security holds.

- Expired card: Transactions fail if the card’s validity date has passed.

- Incorrect card details: Typing errors in number, CVV, or ZIP code during checkout cause soft declines.

- Insufficient funds on secured cards: For secured credit cards, the charge exceeds the deposit amount.

- Issuer restrictions: Some cards block certain merchant types (e.g., gambling, adult sites).

Unlike debit cards, credit card declines don’t involve checking a bank balance—but they do rely on credit availability, payment history, and behavioral algorithms.

Immediate Steps to Take When Your Card Is Declined

A decline doesn’t mean permanent denial. Quick action can often resolve the issue within minutes. Follow this timeline when it happens:

- Stay calm and verify the reason. Ask the merchant or check your bank’s app—some systems display real-time alerts like “Transaction declined: suspected fraud.”

- Try a different payment method. Use another card, cash, or digital wallet to complete the purchase if possible.

- Call your credit card issuer. Use the number on the back of your card. Automated systems may offer instant solutions, but speaking with a representative resolves complex cases faster.

- Verify recent activity. Confirm whether a large or out-of-pattern transaction triggered a fraud alert.

- Check your credit limit and balance. Log into your online account to see if you’re near or over your limit.

- Update expired card information. If the card recently expired, ensure you’re using the new one with updated dates.

Most issuers can lift temporary holds within 5–10 minutes once identity is confirmed. Fraud-related blocks are typically resolved same-day.

Do’s and Don’ts After a Credit Card Decline

| Action | Do | Don’t |

|---|---|---|

| Responding to decline | Call issuer immediately; verify account status | Keep swiping the same card repeatedly |

| Online transactions | Double-check card number, CVV, and billing address | Use outdated saved cards in browser autofill |

| Fraud suspicion | Confirm legitimate transactions with issuer | Ignore alerts or delay reporting suspicious charges |

| Travel use | Notify issuer before international trips | Assume your card will work automatically abroad |

| Payment issues | Make at least minimum payment by due date | Wait weeks after missing a payment to contact support |

Real Example: How One Traveler Fixed a Mid-Trip Decline

Mark, a digital nomad based in Lisbon, tried to book a last-minute train ticket to Madrid. His card was declined despite having paid his bill the previous week. He couldn’t complete the transaction online and faced a sold-out departure.

He called his U.S.-based issuer and learned the issue: the $180 charge was flagged as high-risk due to the foreign merchant and location. The system auto-blocked it. After confirming his identity and travel dates, the agent lifted the restriction. Mark completed the purchase within 12 minutes.

The fix wasn’t complicated—but without knowing to call, he would have missed his trip. His takeaway? Always set a travel notice through the mobile app before crossing borders.

“Over 70% of international transaction declines are due to unreported travel. A two-minute notification saves hours of hassle.” — Lena Pruitt, Senior Customer Support Manager at Horizon Financial

Prevention Checklist: Avoid Future Declines

Proactive habits reduce the odds of a decline dramatically. Use this checklist monthly:

- ✅ Set up real-time transaction alerts via text or app

- ✅ Notify your issuer before traveling domestically or internationally

- ✅ Keep at least one backup credit card from a different network

- ✅ Monitor your credit utilization—stay under 30% of your limit

- ✅ Update recurring payments with new card info after expiration

- ✅ Review statements weekly for unauthorized charges

- ✅ Pay bills on time—set calendar reminders or autopay

- ✅ Store issuer’s customer service number in your phone

Frequently Asked Questions

Can a credit card be declined even with good credit?

Yes. A strong credit score doesn’t guarantee every transaction goes through. Declines are often tied to real-time risk assessment, not creditworthiness. For example, a sudden $2,000 jewelry purchase in a new city may trigger a fraud alert regardless of your payment history.

Does a declined transaction affect my credit score?

No. The decline itself does not impact your credit score. However, behaviors that lead to declines—like maxing out your card or missing payments—do affect your credit utilization and payment history, which together make up nearly half of your FICO score.

Why was my card declined online but works in stores?

This often points to mismatched billing information. Online systems verify the name, address, ZIP code, and CVV. If any detail doesn’t match your issuer’s records, the transaction fails. In-person EMV chip transactions rely less on address data and more on chip authentication.

Take Control of Your Credit Access

A declined credit card isn’t just an inconvenience—it’s a signal. Whether it’s a fraud alert, an expired card, or a simple typo, each incident reveals an opportunity to strengthen your financial habits. By understanding the triggers, responding swiftly, and adopting preventive routines, you regain control and confidence in every transaction.

Start today: review your current credit limits, update your travel settings, and test one online payment with corrected billing details. Small steps now prevent bigger disruptions later. Your credit should work for you—not hold you back.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?