A sudden drop of 100 points in your credit score can feel like a financial emergency. It affects your ability to secure loans, increases interest rates, and may even impact job prospects or rental applications. While alarming, such a drop is not irreversible. Understanding the root causes—and taking swift, informed action—can stabilize your score and begin the recovery process.

Credit scores fluctuate based on changes in your financial behavior and reporting. A 100-point decline typically signals a significant event or pattern in your credit history. The good news: with targeted corrections, many people see improvements within weeks or months.

Why Did My Credit Score Drop 100 Points?

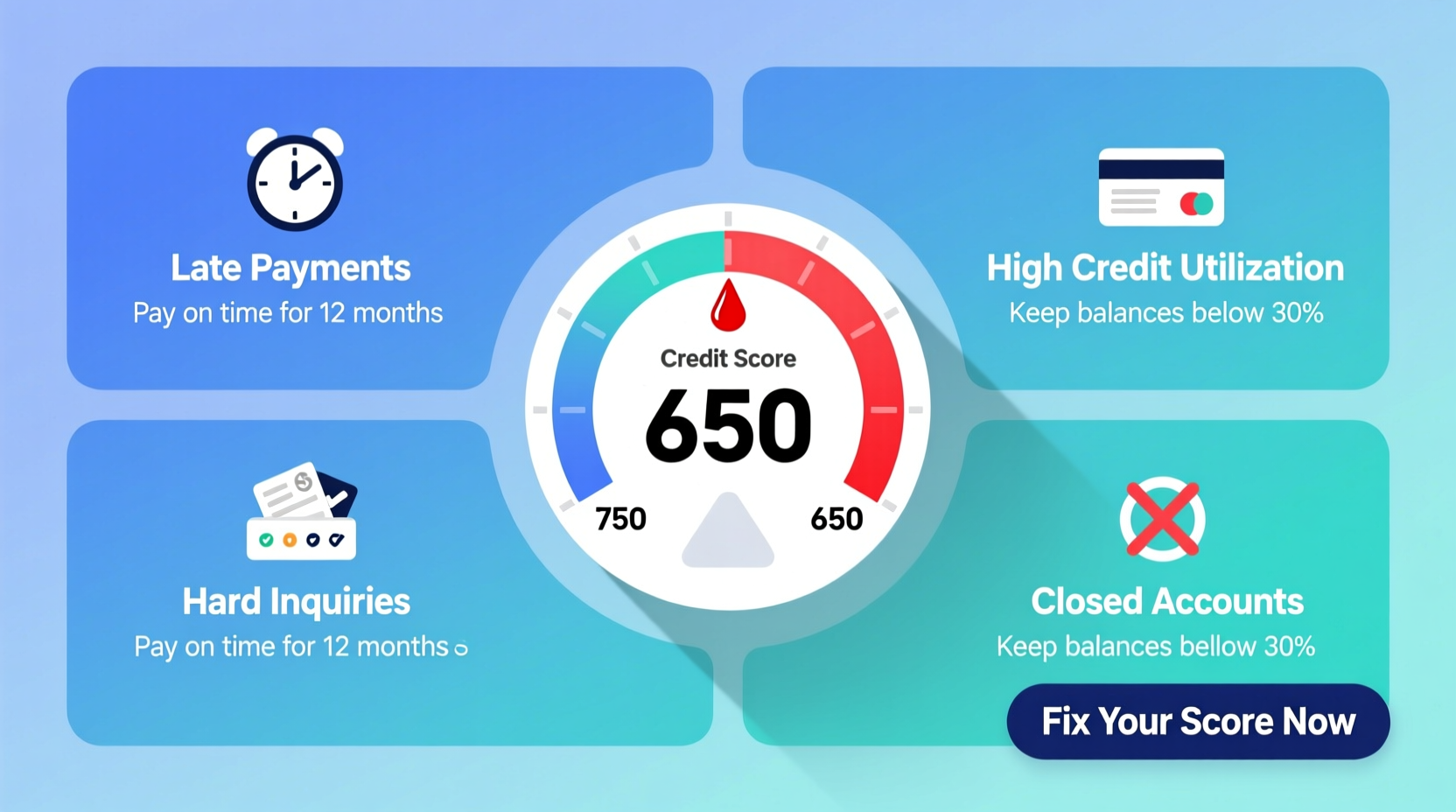

A credit score drop of this magnitude rarely happens without cause. Several key factors trigger steep declines. Identifying which applies to you is the first step toward recovery.

- Late or missed payments: Payment history accounts for 35% of your FICO score. A single late payment reported after 30 days can slash your score by 60–110 points, depending on your starting point.

- High credit utilization: Using more than 30% of your available credit signals risk. Jumping from 20% to over 90% utilization could cost you 100+ points overnight.

- Recent hard inquiries: Multiple loan or credit card applications in a short span generate hard inquiries, each potentially dropping your score by 5–10 points.

- Closed credit accounts: Closing an old card reduces your total credit history length and available credit, increasing utilization and lowering average age of accounts.

- New account with limited history: Opening a new credit line dilutes your overall credit age, especially if you have few existing accounts.

- Errors or fraud: Identity theft, incorrect late payments, or duplicate collections can severely damage your score.

Common Scenarios That Cause Major Score Drops

Sometimes, multiple factors combine to create a perfect storm. Consider these real-world examples:

Case Study: Medical Bill Surprise

Sarah paid her medical bill promptly but discovered six months later that the provider had sent it to collections due to an insurance processing error. The collection account was reported to all three bureaus. Her score fell from 762 to 658—over 100 points—in one month. After disputing the error with documentation, the collection was removed, and her score rebounded within two billing cycles.

Case Study: Credit Card Closure Chain Reaction

Mark closed his oldest credit card to avoid temptation. Unbeknownst to him, this reduced his total available credit by $8,000 and increased his utilization from 28% to 76%. His score dropped from 720 to 615. He reopened the account (after negotiation) and paid down balances, restoring his score to 700+ in four months.

“Sudden credit score drops are often tied to utilization spikes or unverified negative entries. Consumers who act quickly can often reverse damage within 90 days.” — Lisa Thompson, Certified Financial Counselor

Step-by-Step Guide to Fix Your Credit Score

Recovery is possible—but it requires a strategic approach. Follow this timeline to regain control.

- Obtain your credit reports (Day 1–3): Visit AnnualCreditReport.com and download reports from Equifax, Experian, and TransUnion. Review every account, inquiry, and public record.

- Identify errors (Day 4–5): Look for incorrect late payments, unfamiliar accounts, duplicate entries, or outdated information. Highlight discrepancies.

- Dispute inaccuracies (Day 6–10): File disputes online with each bureau. Include copies of supporting documents (payment receipts, ID, etc.). Most investigations conclude in 30 days.

- Reduce credit utilization (Ongoing): Pay down balances aggressively. Aim to keep utilization below 10% for optimal scoring. Make multiple payments per month to lower statement balances.

- Avoid new credit applications (Next 3–6 months): Each hard inquiry adds risk. Pause new credit searches unless absolutely necessary.

- Monitor progress weekly: Use free tools like Credit Karma, Experian Free, or your bank’s credit dashboard to track changes.

Do’s and Don’ts When Recovering From a Score Drop

| Action | Do | Don’t |

|---|---|---|

| Checking your credit | Review all three reports monthly | Ignore notifications from credit monitoring services |

| Handling high balances | Pay twice monthly to reduce reported balance | Max out cards even if paid in full |

| Addressing errors | Submit disputes with evidence | Assume the error will fix itself |

| Managing old accounts | Keep them open and use lightly | Close long-standing credit cards |

| Building positive history | Set up autopay for minimums | Miss even one small payment |

Checklist: Immediate Actions to Take After a 100-Point Drop

- ✅ Pull all three credit reports

- ✅ Identify any new negative entries

- ✅ Confirm accuracy of payment history

- ✅ Calculate current credit utilization

- ✅ Dispute all verified errors

- ✅ Contact creditors to request goodwill adjustments for isolated late payments

- ✅ Set up alerts for future changes

- ✅ Avoid closing any credit accounts

- ✅ Begin paying down high-utilization cards first

- ✅ Schedule follow-up review in 30 days

Frequently Asked Questions

How long does it take to recover from a 100-point credit score drop?

Recovery time depends on the cause. Errors corrected through disputes can boost your score in 30–45 days. Late payments remain for seven years but lose impact over time. With disciplined habits, most people regain 50–100 points within 3–6 months.

Can a single late payment drop my score by 100 points?

Yes, especially if you had a high score (750+) and no prior delinquencies. A single 30-day late payment can reduce scores by up to 110 points. The higher your initial score, the harder the fall.

Will paying off collections raise my score immediately?

Not always. Paid collections still appear on your report and may continue to hurt your score under older models. However, newer FICO 9 and VantageScore 4 ignore paid collections. Some lenders use these updated models, so paying off debts improves your chances.

Conclusion: Regain Control and Protect Your Future

A 100-point credit score drop is serious—but not permanent. The key lies in prompt investigation, correction of errors, and consistent financial discipline. Whether the cause was a missed payment, high utilization, or fraudulent activity, you have the power to respond effectively.

Start today: pull your reports, dispute inaccuracies, and adjust your spending and repayment habits. Small actions compound into major improvements. Your credit history reflects your financial journey—not just one setback. By taking ownership now, you lay the foundation for stronger borrowing power, lower interest costs, and greater peace of mind.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?