Your W-2 form is more than just a slip of paper—it’s a detailed record of your earnings and taxes for the year. Employers are required to issue this form by January 31st each year, and it plays a crucial role in preparing your federal and state income tax returns. Yet, many people glance at the total wages and move on, missing important details that could affect their refund or tax liability. Understanding each box on your W-2 empowers you to file accurately, spot errors early, and gain insight into your financial picture.

What Is a W-2 Form?

The W-2, officially known as the \"Wage and Tax Statement,\" is issued by your employer to report your annual wages and the amount of taxes withheld from your paycheck. The Internal Revenue Service (IRS) requires employers to send this form to both employees and the Social Security Administration. It includes federal, state, and local tax withholdings, retirement contributions, and other compensation data.

If you worked for multiple employers during the year, you’ll receive a separate W-2 from each. These forms are essential when completing your Form 1040 tax return. Errors on a W-2 can delay refunds or trigger audits, so reviewing it carefully is critical.

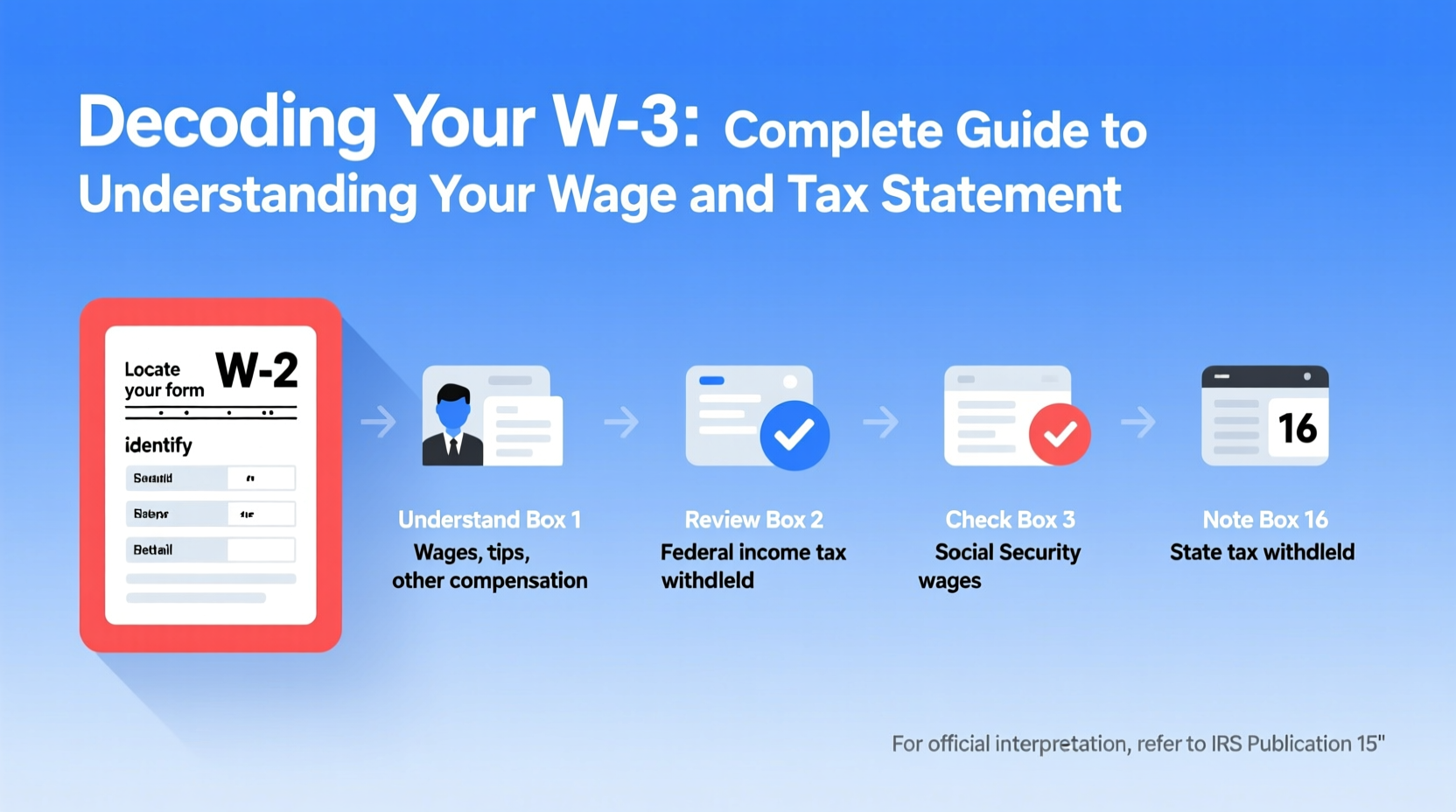

Step-by-Step Guide to Reading Your W-2

Each W-2 contains 20 labeled boxes, but only a handful are relevant to most taxpayers. Here's how to interpret them one by one:

- Box 1 – Wages, Tips, Other Compensation

This shows your total taxable income for federal tax purposes. It includes salary, bonuses, commissions, and taxable fringe benefits, minus pre-tax deductions like 401(k) contributions or health insurance premiums. - Box 2 – Federal Income Tax Withheld

The total amount of federal income tax your employer withheld from your paychecks throughout the year. This will be applied as a credit against your federal tax liability. - Box 3 – Social Security Wages

This reflects the portion of your income subject to Social Security tax. Unlike Box 1, it may include some pre-tax deductions that aren’t excluded from Social Security taxation. - Box 4 – Social Security Tax Withheld

Shows the total Social Security tax withheld (6.2% of wages up to the annual wage base limit—$168,600 in 2024). - Box 5 – Medicare Wages and Tips

All wages subject to Medicare tax. There is no wage cap for Medicare tax, so high earners may see amounts here equal to or greater than Box 1. - Box 6 – Medicare Tax Withheld

Typically 1.45% of wages. High-income earners (above $200,000 if single or $250,000 if married filing jointly) may also owe an additional 0.9% Medicare surtax, which isn’t reflected here but must be calculated separately. - Box 7 – Social Security Tips

If you're a tipped employee (e.g., server, bartender), this shows reported tip income subject to Social Security tax. - Box 8 – Allocated Tips

Less common. Some large food and beverage employers allocate tips if reported tips fall below a certain percentage of sales. - Box 10 – Dependent Care Benefits

Shows any dependent care assistance provided by your employer (up to $5,000 tax-free). Amounts over this threshold are included in Box 1. - Box 12 – Codes for Various Compensation Types

This box uses letter codes to report different types of deferred compensation. Common codes include:- D – Elective deferrals to a 401(k) plan

- C – Elective deferrals to a Section 457(b) plan

- A – Excludable moving expenses (for military only)

- V – Designated Roth contributions

- Box 16 – State Wages, Tips, etc.

Your taxable income for state income tax purposes. This may differ from Box 1 due to state-specific rules on deductions and benefits. - Box 17 – State Income Tax Withheld

Total state income tax withheld during the year. You’ll need this when filing your state return. - Box 18 – Local Wages, Tips, etc. and Box 19 – Local Tax Withheld

Relevant if you live or work in a locality with its own income tax (e.g., New York City, Philadelphia).

Common Mistakes and How to Avoid Them

Errors on W-2s are more common than you might think. A mismatch between your records and the form can lead to processing delays or even an IRS notice.

| Mistake | Why It Matters | How to Fix |

|---|---|---|

| Name or SSN incorrect | Can cause rejection of e-filed returns | Contact HR immediately; request corrected W-2C |

| Box 1 higher than expected | Potential overstatement of income | Verify payroll records; check for double payments or bonuses |

| Federal tax withheld (Box 2) seems low | Risk of underpayment penalty | Review W-4 elections; adjust withholding for next year |

| Missing state/local info | Could delay state return processing | Request supplemental statement from employer or payroll provider |

“Taxpayers who take the time to verify their W-2 details reduce their chances of audit flags and refund delays by nearly 70%.” — Sarah Lin, Enrolled Agent and IRS Representation Specialist

Real Example: Spotting a Hidden Error

Consider Maria, a graphic designer in Austin, Texas. When she received her W-2, Box 1 showed $68,500 in wages. However, her final pay stub indicated total gross earnings of $65,000. After reviewing her last two paychecks, she noticed a $3,500 severance payment had been included—but it was coded incorrectly as regular wages instead of a non-recurring bonus.

She contacted her former employer’s payroll department, which confirmed the error and issued a corrected W-2 (Form W-2c). Without her vigilance, Maria might have faced questions from the IRS about unreported discrepancies or miscalculated credits like the Earned Income Tax Credit (EITC), which is sensitive to income thresholds.

Action Checklist Before Filing

- ✅ Compare your W-2 with your final pay stub of the year

- ✅ Verify personal information (name, SSN, address)

- ✅ Confirm total wages (Box 1) match your records

- ✅ Check federal, state, and local tax withholdings for accuracy

- ✅ Review Box 12 codes if you contribute to retirement plans

- ✅ Report discrepancies to your employer immediately

- ✅ Save a copy for your personal tax records

Frequently Asked Questions

What should I do if I haven’t received my W-2?

If you haven’t received your W-2 by February 15th, contact your employer first. If they fail to provide it and you’ve made reasonable efforts, call the IRS at 800-829-1040. They can help you obtain the necessary information to file on time using Form 4852, a substitute for the W-2.

Why is Box 1 less than my actual salary?

Box 1 reflects taxable wages after pre-tax deductions such as health insurance, 401(k) contributions, HSA, or commuter benefits. Your gross salary may be higher, but these reductions lower your taxable income for federal purposes.

Do I need to report tips if they’re not on my W-2?

Yes. If you earned tips not reported to your employer, you must report them on your tax return using Form 4137 (Social Security and Medicare Tax on Tips). Underreporting tips can result in penalties and interest.

Take Control of Your Tax Future

Understanding your W-2 isn’t just about filing taxes—it’s about financial literacy. Each number tells a story: how much you earned, how much was taken out, and what benefits you accessed. By decoding this form, you gain clarity, avoid costly mistakes, and lay the groundwork for smarter tax planning in the future. Whether you file yourself or use a professional, being informed ensures your return is accurate, complete, and optimized.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?