Short-term savers seeking a secure place to park cash while earning modest interest often turn to 30-day certificates of deposit (CDs). These time deposits offer predictable returns, FDIC insurance up to $250,000, and protection from impulsive withdrawals—ideal for emergency funds or upcoming expenses. While 30-day CDs typically come with lower annual percentage yields (APYs) compared to longer-term CDs, they provide flexibility and liquidity when rates are volatile or uncertain. With careful selection, even low-starting APYs can be optimized through strategic banking choices.

Understanding 30-Day CDs: How They Work

A 30-day CD is a fixed-term deposit account that locks in your money for exactly one month. During this period, the bank pays interest at a predetermined rate. At maturity, you receive your principal plus accrued interest. Unlike traditional savings accounts, early withdrawal usually incurs penalties, making these instruments best suited for funds you won’t need immediately.

These CDs are particularly useful during periods of rising interest rates. Instead of committing to a year-long term, investors use 30-day CDs to “ladder” their deposits—reinvesting every month into slightly higher-yielding terms as rates climb. This strategy balances yield potential with flexibility.

“Short-term CDs like the 30-day variety are excellent tools for disciplined savers who want safety without long-term commitment.” — Linda Ruiz, Senior Financial Analyst at SafeHarbor Wealth Advisors

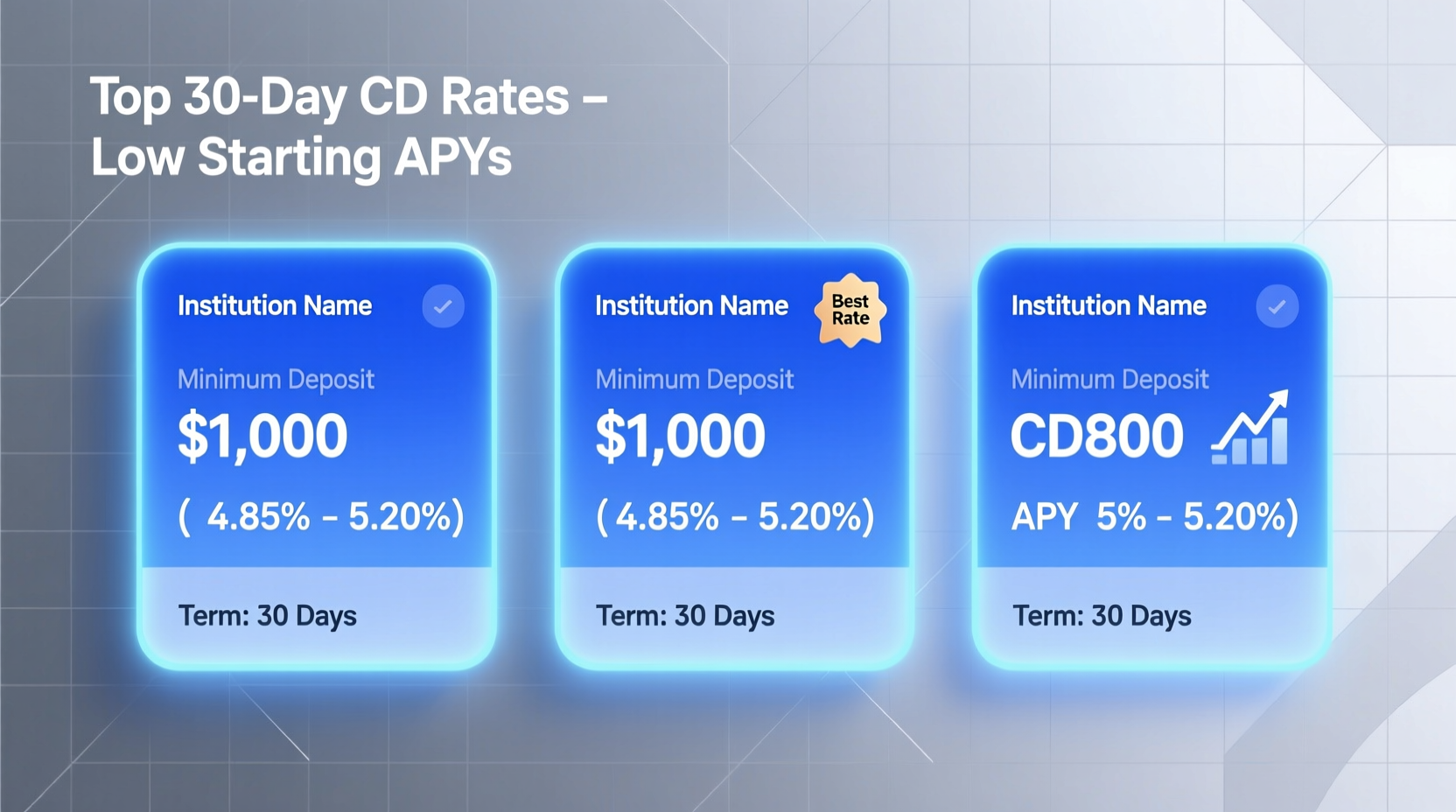

Top 5 Banks Offering Competitive 30-Day CD Rates

While many national banks no longer offer 30-day terms due to administrative overhead, several online banks and credit unions still provide them, especially as part of promotional campaigns. Below is a comparison of current offerings based on data from Q2 2024:

| Institution | Minimum Deposit | Current APY (30-Day CD) | FDIC Insured? | Notes |

|---|---|---|---|---|

| Alliant Credit Union | $1,000 | 0.75% | Yes | Promotional rate; requires membership via partner organization |

| Ally Bank | $0 | 0.50% | Yes | No penalty for early withdrawal after first 7 days |

| Comenity Direct | $500 | 0.80% | Yes | Frequent limited-time offers; check website regularly |

| Synchrony Bank | $0 | 0.65% | Yes | High-yield savings alternative available simultaneously |

| Quontic Bank | $500 | 0.90% | Yes | Requires auto-renewal; highest base rate among listed |

Note: Rates fluctuate frequently and may require enrollment in e-statements or direct deposit to qualify. Always verify terms directly with the institution before opening an account.

How to Maximize Returns Despite Low Starting APYs

Even with modest initial yields, smart strategies can enhance your effective return and maintain access to competitive rates. Consider the following approaches:

- Laddering with monthly rollovers: Open a new 30-day CD each month. As rates change, newer deposits benefit from updated APYs, smoothing out volatility.

- Pair with high-yield checking bonuses: Combine your CD deposit with a bank offering sign-up bonuses for new customers, effectively boosting your net return.

- Monitor promotional windows: Many institutions introduce limited-time CD specials during quarter-end balance pushes or holiday seasons.

- Negotiate with relationship managers: Larger deposits (e.g., $25,000+) may qualify for tiered pricing or private offers not advertised publicly.

Step-by-Step Guide: Building a 30-Day CD Ladder

- Assess available funds: Determine how much you can allocate without needing immediate access.

- Divide capital into equal portions: For example, split $10,000 into ten $1,000 chunks.

- Open one 30-day CD per week: Stagger purchases weekly over 10 weeks to avoid rate lock-in risk.

- Reinvest at maturity: When each CD matures, reinvest into the best available 30-day rate at that time.

- Evaluate monthly: Track performance and adjust institutions if better rates emerge elsewhere.

Real Example: Using 30-Day CDs During Rate Volatility

In early 2023, Maria, a freelance graphic designer, received a $15,000 project payment she planned to use for a home renovation six months later. Rather than leave it in a 0.01% standard savings account, she created a rolling CD strategy:

- She opened five $3,000 30-day CDs with Quontic Bank at 0.90% APY.

- Each month, as a CD matured, she moved the funds to Comenity Direct, which had increased its promotional rate to 1.15%.

- By the fifth month, average earnings reached 1.02% APY across all maturities—significantly above what a single long-term CD would have offered at the start.

This approach protected her principal, provided predictable growth, and capitalized on shifting market conditions—all within a safe, insured framework.

Checklist: Choosing the Right 30-Day CD

Before opening any CD, run through this essential checklist:

- ✅ Confirm the APY is fixed for the full 30 days

- ✅ Verify there are no hidden fees or maintenance charges

- ✅ Check FDIC or NCUA insurance coverage status

- ✅ Review early withdrawal penalties (if applicable)

- ✅ Ensure automatic renewal settings match your intent (opt-out if unsure)

- ✅ Compare with high-yield savings accounts—sometimes they offer better flexibility and similar returns

- ✅ Read the fine print about bonus qualifications or relationship requirements

Frequently Asked Questions

Are 30-day CDs worth it with such low APYs?

Yes, for certain goals. If you're prioritizing safety and temporary placement of funds—such as saving for a near-term purchase or managing cash flow between investments—a 30-day CD offers more structure and slightly better returns than a standard savings account, with full federal protection.

Can I open multiple 30-day CDs at the same bank?

Most banks allow multiple CD accounts per customer, but some cap promotional rates to one per household. Spreading deposits across different institutions can help capture multiple intro offers while staying under FDIC limits per entity.

What happens when my 30-day CD matures?

You’ll typically have a grace period (often 7–10 days) to withdraw funds or roll them into a new term. If no action is taken, most banks automatically renew the CD for another 30 days at the current published rate, which may be lower or higher than the original.

Final Thoughts and Action Plan

Thirty-day CDs may not deliver headline-grabbing returns, but they serve a vital role in conservative financial planning. Their strength lies not in high yield, but in predictability, security, and strategic agility. In times of economic uncertainty or anticipated rate hikes, these instruments become powerful tools for preserving capital while positioning for future gains.

The key is active management. Don’t set and forget—even short-term CDs benefit from regular review. Monitor rate trends, stay alert for promotions, and consider laddering to smooth out fluctuations. By treating your cash reserves as dynamic assets rather than passive balances, you gain control over both risk and reward.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?