In an era marked by inflation, rising living costs, and economic uncertainty, mastering personal finance is no longer optional—it’s essential. The best ways to save money in 2024 go beyond cutting out daily lattes. They involve strategic planning, behavioral shifts, and leveraging modern tools to create sustainable habits. Whether you're building an emergency fund, saving for a major purchase, or aiming for financial independence, the following methods offer real, measurable results.

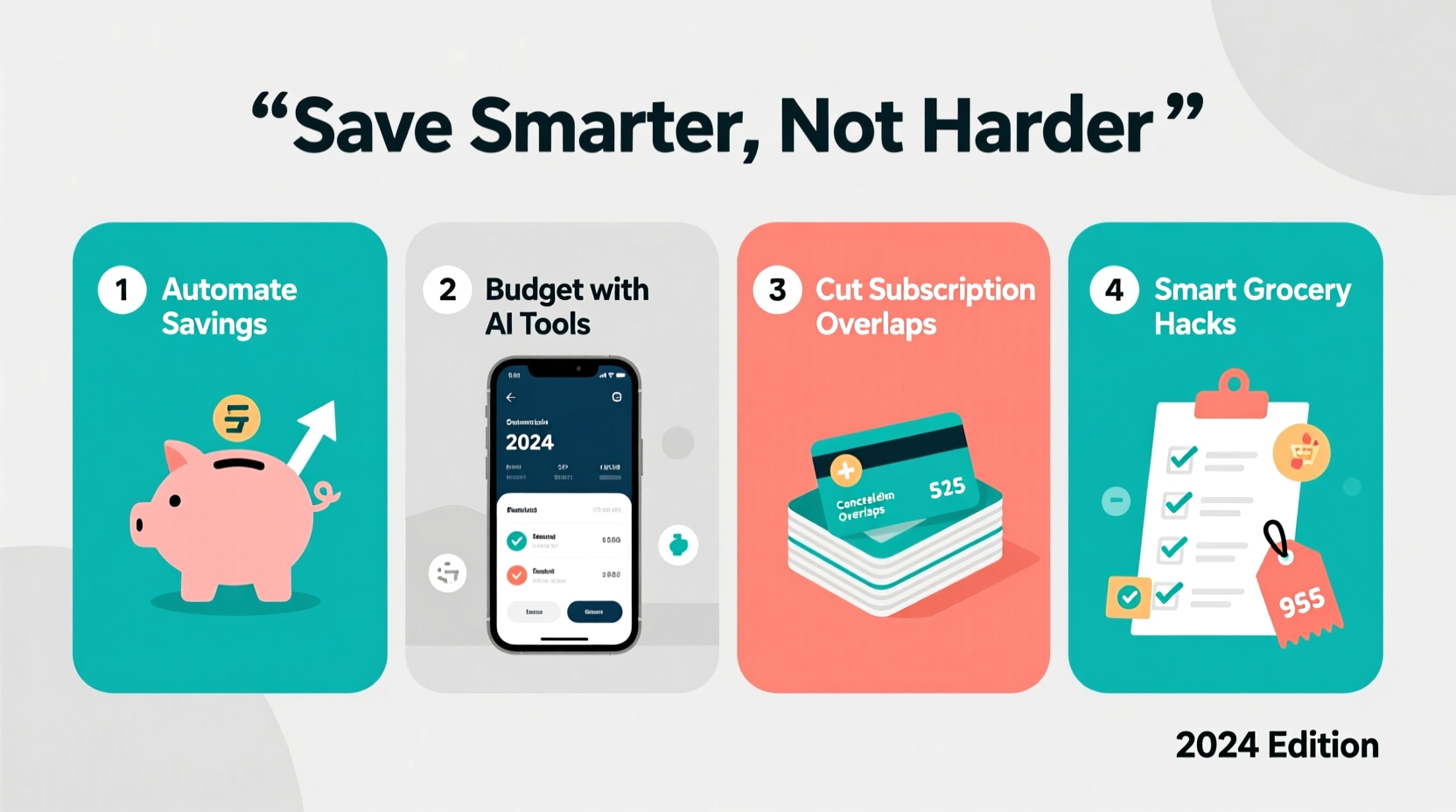

Automate Your Savings Strategy

One of the most effective—and underutilized—ways to save consistently is automation. When savings are automatic, they bypass willpower and decision fatigue. Set up recurring transfers from your checking account to a dedicated savings account immediately after each paycheck. This “pay yourself first” approach ensures that saving happens before spending.

Many banks now allow micro-saving features, such as rounding up debit card purchases and depositing the difference into savings. While individual amounts seem small, they accumulate quickly over time. For example, rounding up $3.50 spent on coffee to $4.00 adds $0.50 to savings. Do this 10 times a week, and you’ve saved $20 monthly—over $240 annually—without noticing.

Create a Realistic Budget Using the 50/30/20 Rule

Budgeting remains the cornerstone of effective saving. A clear understanding of where your money goes allows you to identify leaks and redirect funds toward priorities. The 50/30/20 rule offers a balanced framework:

- 50% for needs (rent, utilities, groceries, insurance)

- 30% for wants (dining out, entertainment, subscriptions)

- 20% for savings and debt repayment

This model provides flexibility while ensuring consistent progress toward financial goals. Adjust percentages slightly based on your income level and cost of living, but aim to keep savings at or above 20%.

“Budgeting isn’t about restriction—it’s about intentionality. When you assign every dollar a job, you gain control.” — Carl Richards, Behavioral Finance Expert

Reduce High-Cost Debt Strategically

Carrying high-interest debt—especially credit card balances—can sabotage even the most disciplined savers. Interest charges erode disposable income and delay financial milestones. Prioritize paying off debt using one of two proven methods:

- Debt Snowball: Pay off debts from smallest to largest balance. Each paid-off account builds momentum and motivation.

- Debt Avalanche: Focus on debts with the highest interest rates first. This method saves more money long-term.

Consider transferring high-interest balances to a 0% intro APR credit card if you have good credit. Just ensure you repay the balance before the promotional period ends.

| Method | Best For | Key Benefit |

|---|---|---|

| Debt Snowball | Motivation-driven individuals | Quick wins build confidence |

| Debt Avalanche | Mathematically focused savers | Minimizes total interest paid |

Leverage Technology and Apps

In 2024, technology makes saving easier than ever. Financial apps can track spending, set goals, and even invest spare change. Some top tools include:

- Mint or YNAB (You Need A Budget): Comprehensive budgeting platforms that sync with bank accounts.

- Digit or Qapital: AI-powered apps that analyze cash flow and automatically save when safe to do so.

- Raise or Honey: Cashback and coupon platforms that reduce everyday spending.

These tools eliminate guesswork and provide real-time feedback, helping users stay accountable. Many also send alerts for unusual spending or upcoming bills, reducing late fees and overdrafts.

Adopt a Mindful Spending Philosophy

Saving isn’t just about earning more—it’s about spending wisely. Mindful spending means evaluating purchases based on value, necessity, and long-term impact. Before buying, ask:

- Do I need this, or do I want it?

- Will this add lasting value to my life?

- Can I afford it without going into debt?

This mindset shift reduces impulse buys and encourages delayed gratification. For instance, implementing a 24- to 72-hour waiting period before non-essential purchases often leads to canceled transactions and preserved savings.

Mini Case Study: How Sarah Saved $7,200 in One Year

Sarah, a 34-year-old graphic designer, wanted to build her emergency fund after facing unexpected medical expenses. She earned $65,000 annually and was spending nearly all of it. By applying several of these methods, she transformed her finances:

- She automated $400/month into savings, starting with payday deductions.

- Switched to a cheaper phone plan, saving $35/month ($420/year).

- Canceled three unused subscriptions ($20/month → $240/year).

- Used grocery cashback apps and meal planning to cut food costs by 20% ($75/month → $900/year).

- Negotiated her internet bill, saving $25/month ($300/year).

By combining automation, conscious cuts, and smart tools, Sarah saved $7,200 in 12 months—more than 11% of her gross income—without a salary increase.

Step-by-Step Guide to Launch Your 2024 Savings Plan

Follow this six-week timeline to establish a powerful savings habit:

- Week 1: Review last 3 months of bank statements. Categorize all expenses and identify top 3 spending leaks.

- Week 2: Set 1–3 specific savings goals (e.g., $1,000 emergency fund, $2,000 vacation). Assign timelines and amounts.

- Week 3: Open separate savings accounts for each goal. Enable automatic transfers.

- Week 4: Negotiate at least one recurring bill (internet, insurance, subscription).

- Week 5: Download and connect a budgeting app. Sync accounts and set spending limits.

- Week 6: Conduct a “spending fast”—no non-essential purchases for 7 days. Reflect on behavior and triggers.

By the end of six weeks, you’ll have systems in place that make saving effortless and insightful.

Frequently Asked Questions

How much should I realistically aim to save each month?

Aim for at least 20% of your income. If that’s not feasible, start with 5–10% and increase gradually. Even saving $100/month adds up to $1,200 in a year—a strong foundation for emergencies.

Is it better to save or pay off debt first?

Strike a balance. Build a small starter emergency fund ($500–$1,000) first to avoid new debt from surprises. Then aggressively tackle high-interest debt while maintaining minimal ongoing savings.

What’s the best type of savings account to use?

High-yield savings accounts (HYSAs) offer significantly higher interest rates than traditional banks—often 4–5% APY in 2024. They’re liquid, FDIC-insured, and ideal for short- to medium-term goals.

Essential Savings Checklist

Use this checklist to stay on track:

- ✅ Track all expenses for one full month

- ✅ Define 1–3 clear savings goals with target amounts

- ✅ Open a high-yield savings account

- ✅ Set up automatic transfers on payday

- ✅ Cancel at least two unused subscriptions

- ✅ Negotiate one recurring bill

- ✅ Use a budgeting app for 30 consecutive days

- ✅ Review progress monthly and adjust as needed

Conclusion: Start Small, Think Big

Saving money in 2024 doesn’t require drastic lifestyle changes or a six-figure income. It requires consistency, clarity, and the right systems. The methods outlined here—from automation to mindful spending—are proven to work across income levels and life stages. What matters most is starting, staying committed, and adjusting as your situation evolves.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?