Gift cards are everywhere—holiday gifts, employee bonuses, customer rewards. While convenient, they often go unused or sit with leftover balances that don’t cover full purchases. What if you could turn that idle value into usable cash? The good news is, it’s entirely possible to convert gift card balances into real money, provided you use the right approach. With rising demand for flexible spending options, several reliable platforms and strategies now allow users to unlock cash from gift cards safely and efficiently.

The key lies in knowing which methods are legitimate, fast, and cost-effective. This guide walks through proven pathways—from online marketplaces to bank-linked services—while highlighting risks to avoid and steps to maximize returns.

Understanding Gift Card Value and Liquidity

Not all gift cards are created equal when it comes to conversion potential. Major retailer cards (like Amazon, Walmart, or Target) and popular digital service cards (such as Visa, Mastercard, or Apple) typically have higher resale value due to broad acceptance and consumer trust. In contrast, niche or regional store cards may be harder to liquidate or fetch lower rates.

Most third-party buyers offer between 70% and 95% of the card’s face value, depending on brand demand, remaining balance, and platform policies. For example, a $100 Amazon gift card might sell for $85–$93, while a lesser-known restaurant chain card could only net $60.

Top 5 Safe Methods to Convert Gift Cards to Cash

1. Sell Through Reputable Online Marketplaces

Dedicated gift card exchange platforms like Pine Grove, Raise, and CardCash connect sellers with buyers looking for discounted cards. These sites verify card authenticity, handle transactions securely, and pay via direct deposit, PayPal, or check.

The process usually involves entering your card details, receiving an instant offer, and submitting the card upon acceptance. Funds are typically disbursed within 1–5 business days after verification.

2. Use Bank-Backed Gift Card Services

Some financial institutions and fintech apps now support limited gift card redemption. For instance, PayPal allows users to link eligible gift cards to their wallet and spend the balance directly. While not a direct cash payout, this provides near-cash flexibility.

Certain banks also partner with services like InComm Digital to enable partial conversions, especially for prepaid Visa or Mastercard gift cards. Check your bank’s digital tools or mobile app for available integrations.

3. Trade at In-Person Kiosks

Physical kiosks found in malls, grocery stores, and pharmacies (often labeled “Buy & Sell Gift Cards”) offer immediate cash in exchange for gift cards. Machines scan the balance and provide an instant offer, usually paying 70–85% of the value.

This method is ideal for those needing cash fast without waiting for online processing. However, rates are generally lower than online platforms, so compare options before proceeding.

4. Participate in Retailer Buyback Programs

A growing number of retailers run official trade-in programs. Target, for example, accepts competitor gift cards and gives you store credit at full value (up to $500). While not direct cash, this can be leveraged strategically by purchasing high-demand items and reselling them.

Likewise, GameStop buys gift cards from various gaming and entertainment brands, offering cash or store credit based on current market rates.

5. Donate for Tax Deductions (Indirect Cash Benefit)

If immediate liquidity isn’t critical, donating unwanted gift cards to qualified charities can yield tax benefits. Organizations like Charity Choice let donors choose where the card goes, and you may claim the full value as a deduction if properly documented.

This isn’t a cash payout per se, but for those itemizing deductions, it effectively reduces taxable income—a financial benefit equivalent to retaining more of your earnings.

“Selling gift cards through verified platforms has become a mainstream way to recover value from unused balances. The key is transparency—know the fees, understand the timeline, and never share codes with unverified buyers.” — Laura Simmons, Consumer Finance Analyst at NerdWallet

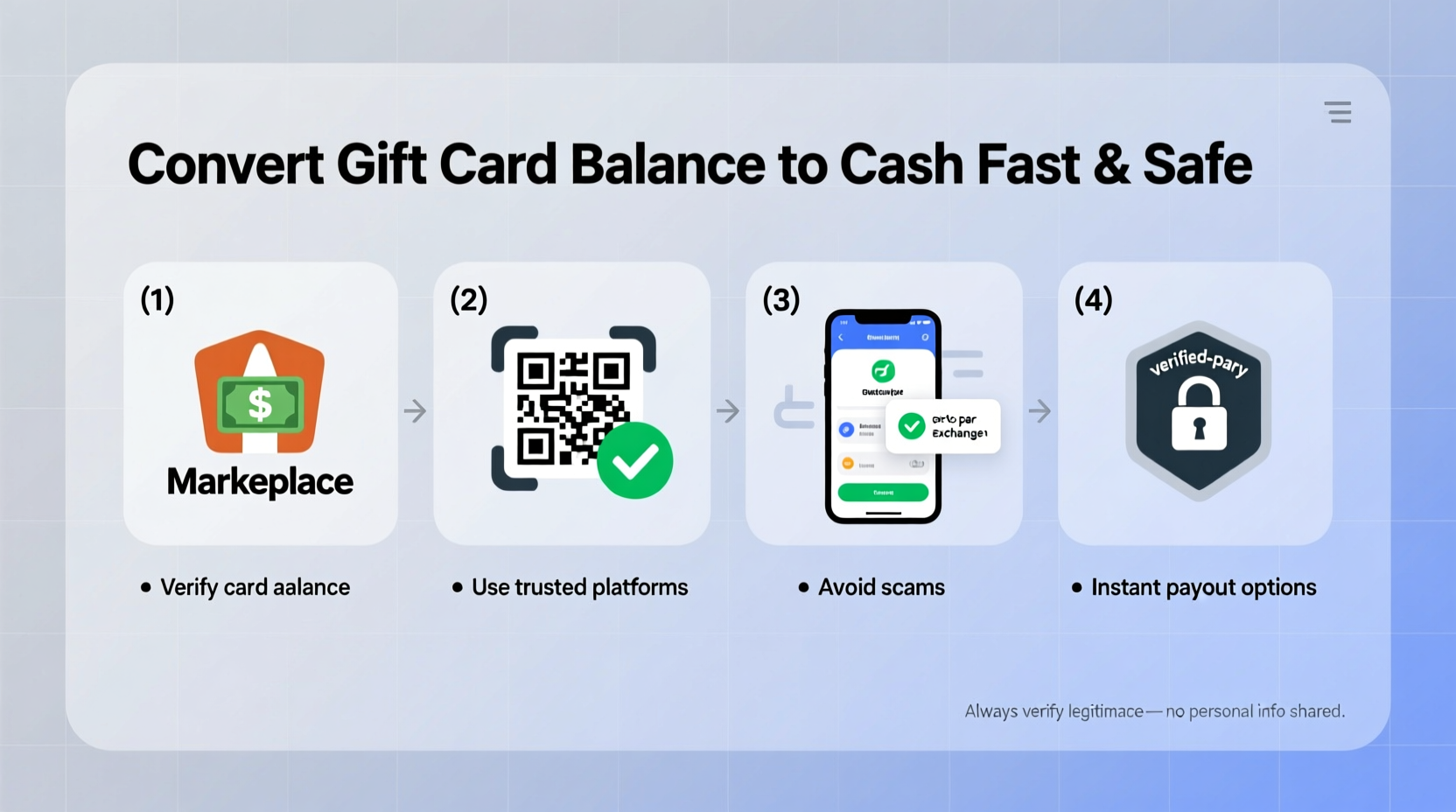

Step-by-Step Guide: How to Sell Your Gift Card Safely Online

Follow this sequence to ensure a secure and efficient transaction:

- Evaluate the card: Confirm the brand, remaining balance, and PIN/code access.

- Research platforms: Compare offers across Pine Grove, Raise, and CardCash using their quote tools.

- Select the best offer: Consider payout speed, payment method, and user reviews.

- Create an account: Register with the chosen site using a secure email and strong password.

- Enter card details: Input the gift card number, PIN, and any required security codes.

- Accept the offer: Review terms and lock in the sale.

- Submit the card: Follow instructions—some sites require you to scratch off and upload the back; others only need digital info.

- Wait for verification: Most platforms verify within 24–72 hours.

- Receive payment: Funds are sent via your preferred method, typically within five business days.

Do’s and Don’ts When Converting Gift Cards

| Do’s | Don’ts |

|---|---|

| Check card balance before listing | Share card codes on public forums |

| Use encrypted, reputable resale sites | Sell to individuals via social media unless using escrow |

| Keep records of transactions | Respond to unsolicited “buyers” messaging you |

| Opt for PayPal or direct deposit payouts | Use gift cards with stolen or fraudulent origins |

| Act fast—offers fluctuate weekly | Ignore platform fees and processing times |

Real Example: Turning Unused Holiday Cards into Emergency Cash

Sarah, a freelance graphic designer from Austin, received over $600 in assorted gift cards during the holidays—mostly from clients and family. With a sudden car repair bill, she needed quick funds but didn’t want to dip into her savings.

She checked her cards: $200 Amazon, $150 Target, $100 Sephora, and $150 Visa. Using CardCash’s online estimator, she discovered the Visa card would fetch 92%, Amazon 88%, Target 85%, and Sephora just 70%. She decided to sell all except the Sephora card, which she kept for future use.

Within two days, Sarah submitted the cards online, received confirmation emails, and had $512 deposited into her PayPal account. After covering her repair, she still had money left over for groceries.

Her takeaway? “I didn’t think those random cards were worth much, but together they saved me from taking out a short-term loan.”

Frequently Asked Questions

Can I convert any gift card to cash?

Most major retailer and prepaid cards can be converted, but availability depends on platform policies and demand. Store-specific cards (e.g., local boutiques) may not be accepted. Always verify eligibility before starting the process.

Are there fees involved in selling gift cards?

Yes. Buyers typically deduct a margin (10–30%) to cover risk and service costs. Some platforms also charge small processing or withdrawal fees. Review each site’s fee structure before accepting an offer.

Is it legal to sell my gift card for cash?

Yes, in most cases. Federal law does not prohibit reselling gift cards, though some issuers’ terms may discourage it. As long as the card was obtained legally and isn’t reported lost or stolen, selling it is permitted.

Maximize Your Returns: Final Checklist

- ✔️ Verify the current balance on your gift card

- ✔️ Research at least three resale platforms for competitive offers

- ✔️ Choose a payment method with low fees and fast processing

- ✔️ Avoid sharing card details outside secure portals

- ✔️ Keep transaction records for tax or dispute purposes

- ✔️ Act promptly—market rates for certain cards drop seasonally

Take Control of Your Unused Balances

Unused gift cards represent billions in stranded value each year. But with the right tools and knowledge, you can reclaim that money and put it toward what matters—bills, emergencies, or personal goals. Whether you choose online exchanges, in-person kiosks, or strategic trade-ins, safety and speed should guide your decisions.

Start today: gather your unused cards, check their balances, and explore reputable resale options. Every dollar recovered is a step toward greater financial flexibility.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?