Finding accurate and trustworthy information about a business is essential whether you're considering a partnership, making a purchase, investing, or simply verifying legitimacy. In an age of digital misinformation and increasingly sophisticated scams, knowing how to conduct thorough due diligence can protect your time, money, and reputation. This guide provides practical, step-by-step methods to locate businesses and confirm their credibility using reliable sources and proven techniques.

Start with a Strategic Online Search

The first step in identifying a business is conducting a precise online search. Use targeted keywords such as the company’s full legal name, location, industry, and key personnel. Avoid vague terms like “best” or “top-rated,” which return marketing-heavy results rather than factual data.

Use quotation marks around the business name (e.g., “Summit Financial Group”) to ensure exact matches. Include the state or country if known—this filters out unrelated entities with similar names. For example: \"Green Valley Organics\" California.

Review the top results carefully. Legitimate businesses typically appear on official directories, news articles, press releases, or professional networks like LinkedIn. Be cautious of websites that lack contact details, physical addresses, or clear service descriptions.

Verify Business Registration and Legal Status

Every legally operating business must register with a government authority. In the United States, this is typically done at the state level through the Secretary of State’s office. Other countries have equivalent agencies—such as Companies House in the UK or Corporations Canada.

Visit the relevant government website and use their business entity search tool. You can usually search by business name, registration number, or owner’s name. The results should include:

- Official business name and any DBAs (Doing Business As)

- Date of formation and registration status (active, inactive, dissolved)

- Registered agent and principal address

- Ownership or management information (in some jurisdictions)

- Annual report filing history

“Government filings are the gold standard for confirming a business exists legally. Always cross-reference these before engaging financially.” — Laura Mendez, Small Business Compliance Officer

If a business cannot be found in official registries, it may be unregistered, which raises serious red flags—especially for contracts, investments, or large purchases.

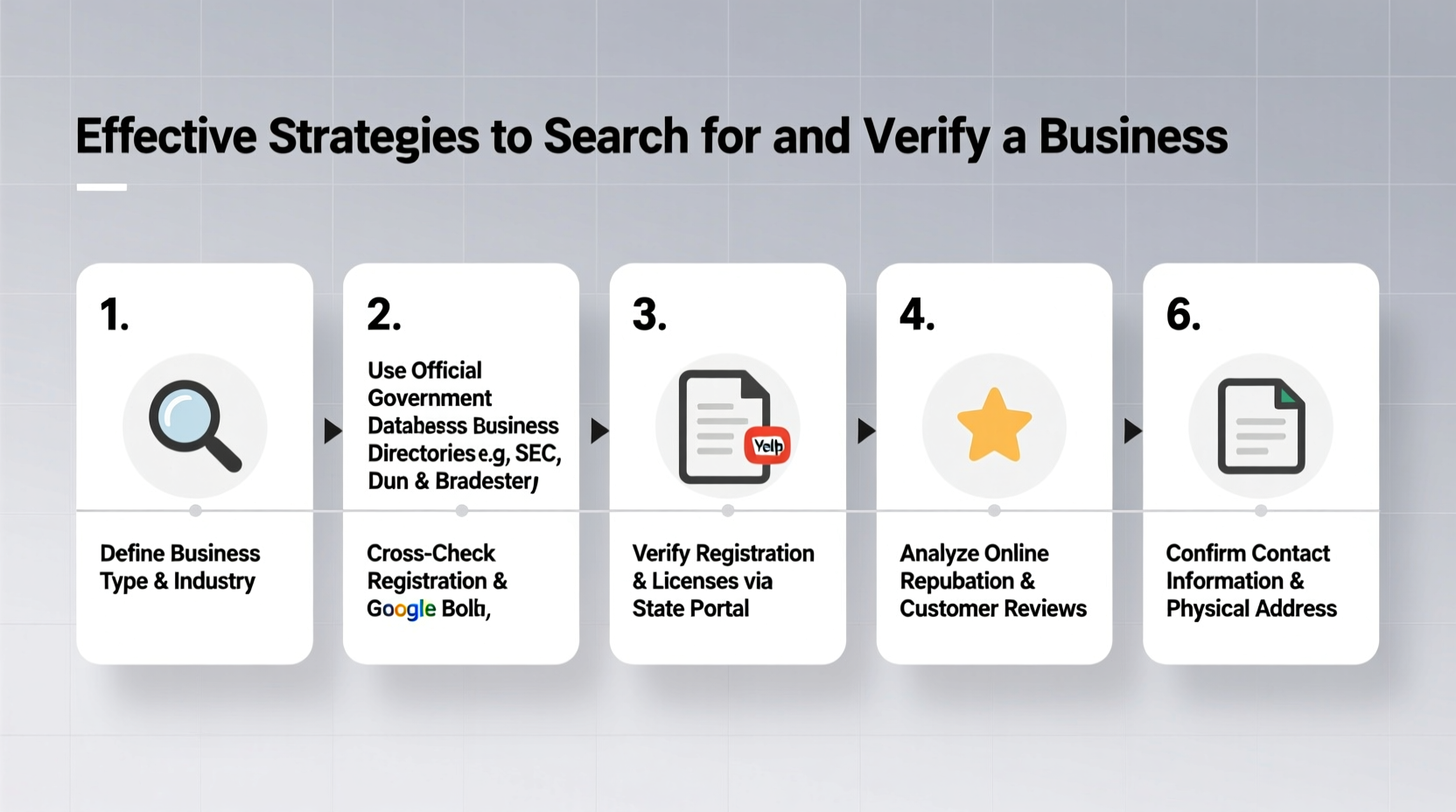

Conduct a Step-by-Step Verification Process

To ensure comprehensive verification, follow this structured timeline:

- Day 1: Perform initial search using search engines and social media platforms.

- Day 2: Check official business registry (state or national).

- Day 3: Review tax status via IRS (U.S.) or equivalent agency (e.g., EIN lookup).

- Day 4: Search for litigation history using court databases or PACER (U.S. federal cases).

- Day 5: Analyze customer reviews and complaints on BBB, Trustpilot, or Google Reviews.

- Day 6: Contact the business directly with specific questions to assess responsiveness and professionalism.

- Day 7: Compile findings and make a decision based on verified data.

Use Reliable Tools and Databases

Several authoritative platforms provide detailed business intelligence. Knowing which ones to trust is crucial.

| Tool | Purpose | Cost | Best For |

|---|---|---|---|

| Secretary of State Website | Legal registration & status | Free – $15 | Confirming legitimacy |

| IRS Tax Exempt Organization Search | Verify nonprofit status | Free | Charities and nonprofits |

| Leadership team & activity | Free – Premium | Assessing team presence | |

| OpenCorporates.com | Global business database | Free – Paid tiers | International research |

| Better Business Bureau (BBB) | Complaints & ratings | Free | Customer trust evaluation |

Cross-referencing multiple sources increases accuracy. For instance, if a company claims to be a registered nonprofit, verify its 501(c)(3) status via the IRS website—not just the organization’s own statement.

Real-World Example: Uncovering a Shell Company

In 2022, a small investor in Texas was approached by a company called “Horizon Energy Partners” offering high-return solar investments. The website looked professional, and representatives were responsive. However, when the investor searched the business name on the Texas Secretary of State website, no record appeared.

Suspicious, they dug deeper. A reverse image search revealed the “executive team” photos were stock images. The phone number was unlisted, and the address led to a virtual mailbox service. Further investigation showed two identical companies under different names had been flagged by the Federal Trade Commission for fraud.

By following verification steps—checking registration, analyzing digital footprints, and reviewing third-party reports—the investor avoided losing over $50,000. This case underscores why independent verification is non-negotiable.

Common Red Flags and How to Respond

While researching, watch for warning signs that suggest a business may not be legitimate:

- No physical address or only a P.O. box

- Lack of verifiable contact information

- Negative or absent customer reviews

- Recent formation date paired with aggressive marketing

- Unwillingness to provide documentation (e.g., license, tax ID)

- Mismatched details across platforms (e.g., different addresses on Google vs. state records)

Essential Verification Checklist

Before finalizing any business interaction, complete this checklist:

- ✅ Confirmed business name in official state/national registry

- ✅ Verified physical address and contact information

- ✅ Checked active status and formation date

- ✅ Reviewed leadership or ownership details

- ✅ Validated tax ID or EIN (if applicable)

- ✅ Searched for lawsuits or regulatory actions

- ✅ Analyzed customer feedback and BBB rating

- ✅ Conducted direct communication test (email/phone)

- ✅ Cross-referenced information across at least three reliable sources

FAQ: Common Questions About Business Verification

Can I verify a business without paying for services?

Yes. Most government business registries offer free search tools. Additionally, platforms like OpenCorporates, LinkedIn, and the IRS Tax Exempt Organization Search are free to use. While premium services exist, core verification can be done at no cost.

What should I do if a business isn’t listed in official records?

Treat this as a major red flag. An unregistered business may be operating illegally. Do not enter contracts, make payments, or share sensitive information. Report suspicious entities to local consumer protection agencies if necessary.

How often should I re-verify a business I already work with?

Re-verify annually or before major transactions. Businesses can change status, dissolve, or face legal issues over time. Staying updated ensures ongoing safety and compliance.

Conclusion: Take Control of Your Business Decisions

Searching for a business and verifying its details is not just a precaution—it's a necessity in today’s complex commercial landscape. With the right tools and disciplined approach, anyone can uncover the truth behind a company’s facade. Whether you’re a consumer, entrepreneur, or investor, taking the time to validate legitimacy protects your interests and builds smarter, more confident decision-making.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?