Becoming a Chartered Accountant (CA) is one of the most respected and rewarding career paths in the financial world. It demands discipline, intellectual rigor, and a long-term commitment to learning and ethics. The designation is globally recognized and opens doors to leadership roles in audit, taxation, corporate finance, consulting, and even entrepreneurship. However, the journey is not for the faint-hearted. It requires navigating complex exams, gaining practical experience, and continuously adapting to evolving regulations and technologies.

This guide breaks down the real-world path to becoming a successful CA—beyond just passing exams. It covers strategic planning, skill development, mindset shifts, and professional habits that separate high-performing CAs from the rest.

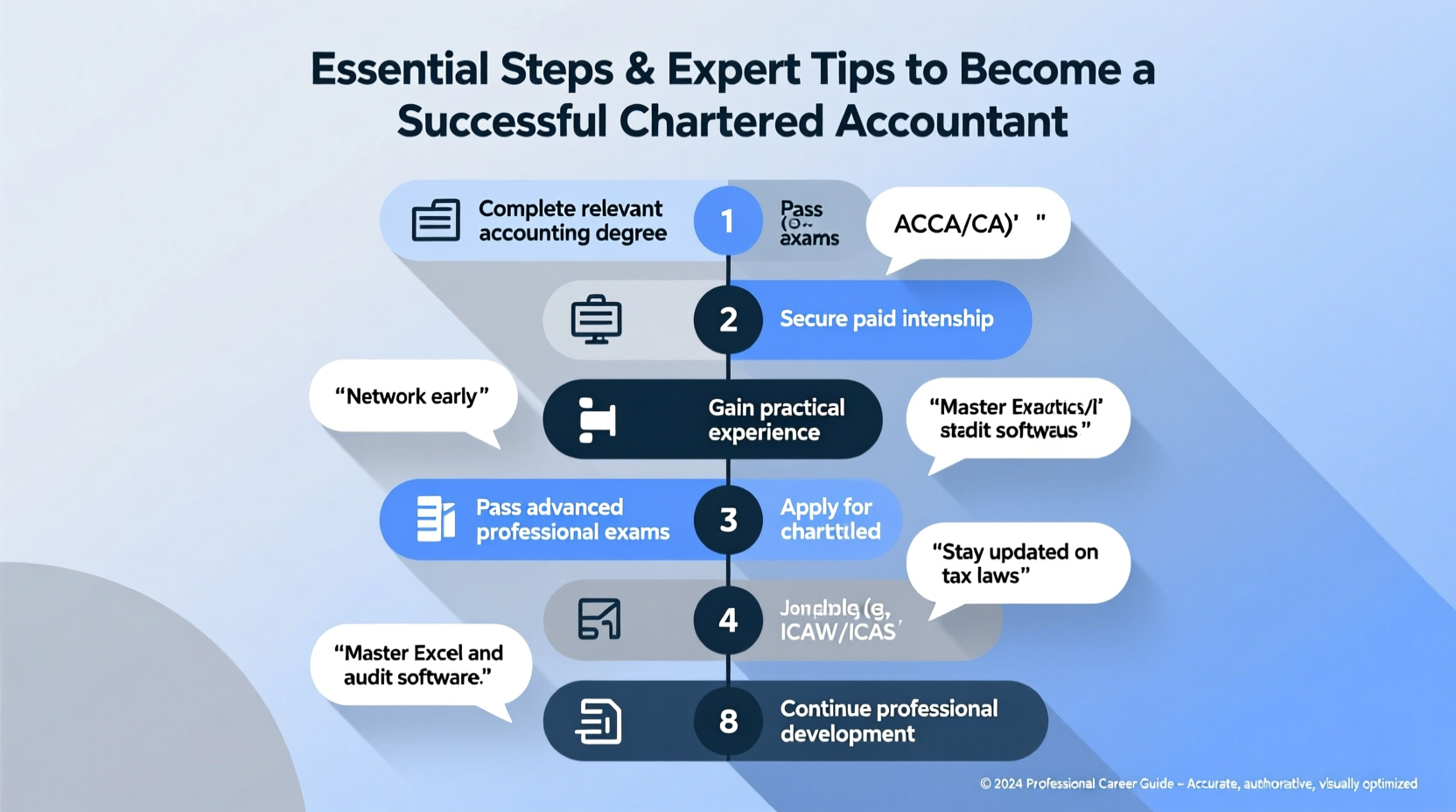

Step-by-Step Path to Becoming a Chartered Accountant

The route to becoming a CA varies slightly by country, but most systems—such as those governed by ICAEW, CPA Canada, or ICAI in India—follow a similar structure: education, examination, practical training, and certification. Below is a universal timeline applicable to most jurisdictions:

- Complete Eligible Education: Most CA programs require a high school diploma with strong performance in mathematics and accounting. A bachelor’s degree in commerce, finance, or business is highly recommended.

- Enroll in a Recognized CA Program: Register with a professional body such as ICAEW, ACCA, CPA Australia, or ICAI. Each has specific entry requirements and curricula.

- Pass Rigorous Exams: CA exams are divided into foundation, intermediate, and final levels. Topics include financial reporting, auditing, taxation, law, and strategic management.

- Complete Articleship or Practical Training: Gain 2–3 years of supervised work experience under a practicing CA. This period is crucial for applying theoretical knowledge.

- Earn Certification: After passing all exams and fulfilling experience requirements, apply for full membership and use the “CA” designation.

- Commit to Continuing Professional Development (CPD): Stay updated with new standards, tax laws, and digital tools through ongoing learning.

Key Skills That Define Successful Chartered Accountants

Technical knowledge alone won’t ensure success. Top-tier CAs combine expertise with soft skills and emotional intelligence. The most impactful professionals master the following competencies:

- Analytical Thinking: Ability to interpret financial data, identify trends, and forecast outcomes.

- Attention to Detail: Precision in preparing tax returns, audits, and compliance reports prevents costly errors.

- Communication: Explaining complex financial concepts clearly to clients, executives, and non-finance teams.

- Time Management: Balancing multiple client deadlines, especially during peak seasons like tax filing or year-end audits.

- Integrity and Ethics: Upholding confidentiality and professional standards, even under pressure.

- Digital Fluency: Proficiency in ERP systems, data analytics tools, and AI-powered accounting software.

“Technical excellence gets you through the door, but communication and judgment are what make you indispensable.” — Rajiv Mehta, Partner at Deloitte India

Expert Tips for Excelling in the CA Journey

Surviving the CA process requires more than studying hard. Success comes from strategy, resilience, and smart habits. Here are actionable insights from seasoned professionals:

Many candidates underestimate the mental toll of the CA journey. Burnout is common due to long hours and high expectations. To maintain balance:

- Schedule weekly downtime for family, exercise, or hobbies.

- Join study groups for peer support and motivation.

- Use productivity tools like Pomodoro timers to stay focused without overworking.

Checklist: Are You on Track to Become a Successful CA?

Use this checklist to assess your progress and readiness at each stage:

- ✅ Completed prerequisite education with strong grades in math and accounting

- ✅ Enrolled in a recognized CA program and understand its structure

- ✅ Created a realistic study schedule aligned with exam dates

- ✅ Secured articleship or internship with a reputable firm

- ✅ Developed basic proficiency in Excel, Tally, or QuickBooks

- ✅ Practiced past exam papers under timed conditions

- ✅ Built a network of peers and mentors in the profession

- ✅ Committed to ethical standards and lifelong learning

Common Pitfalls and How to Avoid Them

Even talented candidates fail due to avoidable mistakes. The table below outlines frequent missteps and proven solutions:

| Pitfall | Consequence | How to Avoid |

|---|---|---|

| Starting preparation too late | Rushed studying, lower pass rates | Begin foundational topics during college; use summer breaks wisely |

| Neglecting practical application | Struggles during articleship or client interactions | Simulate real-world scenarios while studying (e.g., mock audits) |

| Ignoring soft skills | Limited career growth despite technical competence | Practice presentations, join Toastmasters, seek feedback |

| Overlooking digital tools | Reduced efficiency and competitiveness | Learn cloud accounting, data visualization, and automation basics |

Real Example: From Struggling Student to Audit Manager

Meera Patel failed her first CA intermediate exam. Overwhelmed by the volume of material and working part-time at a small firm, she considered quitting. Instead, she restructured her approach: she joined a study group, created a color-coded revision plan, and sought mentorship from a senior auditor. She began volunteering for extra tasks at work—preparing trial balances, assisting in tax filings—to reinforce learning.

Within two years, Meera passed all remaining exams on her first attempt. Her hands-on experience and proactive attitude earned her a promotion to audit associate. Today, she leads client engagements at a Big Four firm and mentors junior trainees. Her turning point wasn’t talent—it was persistence and a willingness to adapt.

Frequently Asked Questions

How long does it take to become a Chartered Accountant?

Typically 3 to 5 years, depending on the country and individual pace. This includes passing exams and completing required practical training (articleship). Some complete it faster through exemptions or accelerated tracks.

Is the CA designation worth the effort?

Yes, for those committed to finance and advisory careers. CAs enjoy higher earning potential, global mobility, and access to leadership roles. The ROI becomes evident within 5–7 years post-qualification.

Can I work abroad as a CA?

Absolutely. Many CA bodies have mutual recognition agreements (MRAs) with international organizations. For example, ICAI members can gain CPA or ACCA status with fewer exams. Fluency in English and local tax knowledge improve employability overseas.

Conclusion: Your Journey Starts Now

Becoming a successful Chartered Accountant isn’t just about clearing exams—it’s about building a mindset of precision, integrity, and continuous improvement. The path is demanding, but every challenge you overcome sharpens your expertise and credibility. Whether you aim to lead an audit team, start your own firm, or transition into CFO roles, the foundation you lay today determines your future impact.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?