Your Personal Identification Number (PIN) is a critical layer of security across financial, medical, and digital accounts. Whether tied to a debit card, smartphone, or government ID system, a compromised PIN can lead to identity theft, unauthorized transactions, or data breaches. Yet many people either forget their PINs, store them insecurely, or use weak combinations that are easy to guess. Managing your PIN properly isn’t just about convenience—it’s about safeguarding your personal and financial well-being.

Understanding What a PIN Is and Why It Matters

A PIN is typically a 4- to 6-digit code used to verify your identity when accessing secured services. Unlike passwords, which can be complex and stored digitally, PINs are often memorized and manually entered. This simplicity makes them vulnerable if not managed carefully.

PINs are commonly associated with:

- Banking cards (debit, credit, ATM)

- Mobile devices (SIM cards, lock screens)

- Government-issued IDs (e.g., national health systems)

- Online account recovery processes

The strength of a PIN lies in its confidentiality. Once exposed—whether through phishing, shoulder surfing, or poor storage practices—the protection it offers collapses.

“Your PIN is a key to your financial life. Treat it like you would a house key: never leave it lying around and always know where it is.” — James Reed, Cybersecurity Consultant at SecureEdge Solutions

How to Locate a Lost or Forgotten PIN

Forgetting your PIN is common, but how you recover it determines your security risk. Never attempt to guess repeatedly—many systems lock after three failed attempts.

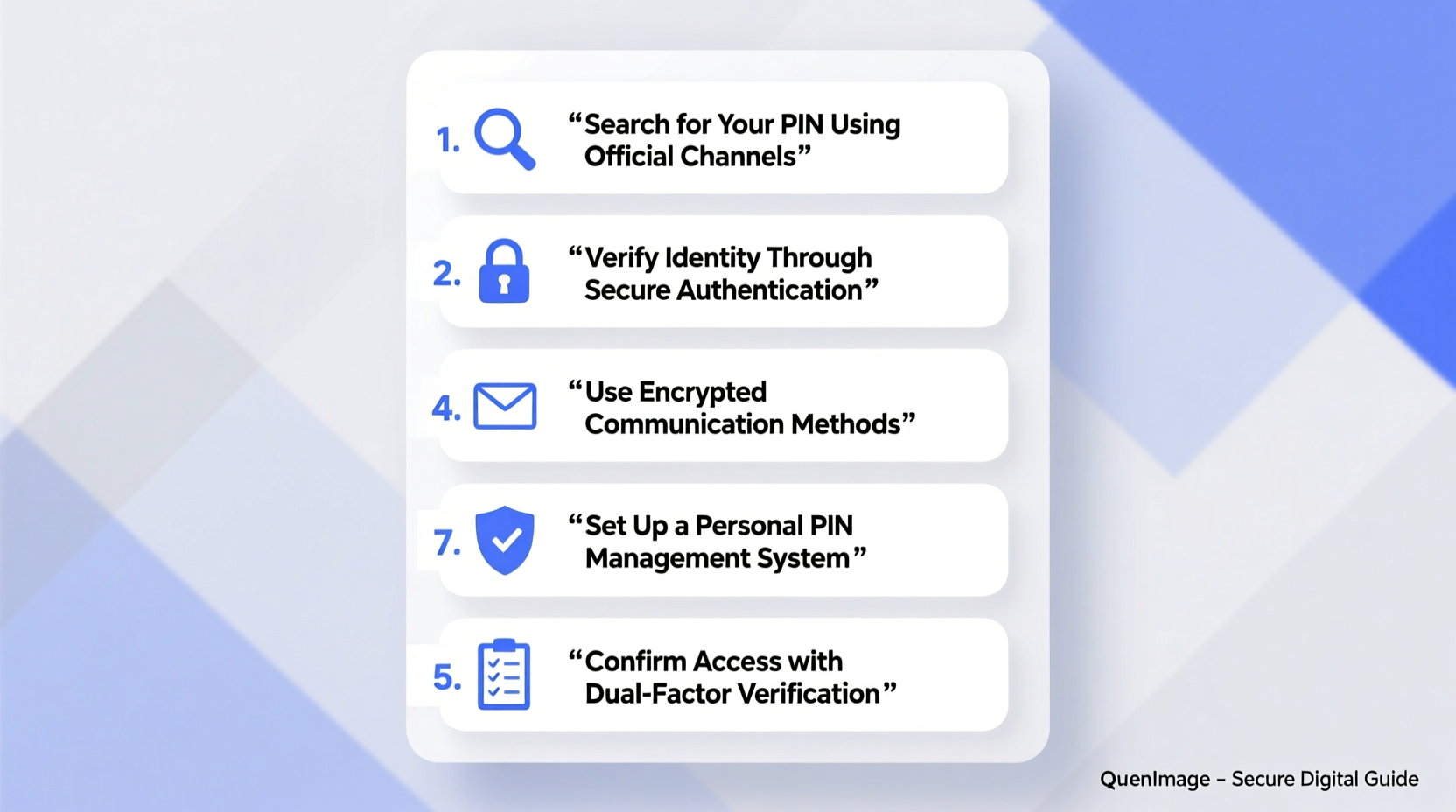

Step-by-Step Guide to Recover Your PIN

- Contact the issuing institution: For bank cards, call customer service or visit a branch. You’ll need to verify your identity with documents like a government ID or recent statements.

- Use official online portals: Many banks allow PIN resets via secure login on their website or app. Look for “Manage PIN” under account settings.

- Check original documentation: Some institutions mail your initial PIN in a separate sealed envelope. If you still have paperwork from account setup, review it carefully.

- Request a new card if necessary: If recovery fails, most providers will issue a replacement card with a new PIN.

Best Practices for Creating a Secure PIN

Not all PINs are created equal. Avoid predictable patterns such as \"1234\", \"0000\", or birth years. A strong PIN balances memorability with unpredictability.

Do’s and Don’ts of PIN Creation

| Do’s | Don’ts |

|---|---|

| Use random digits unrelated to personal dates | Use birthdays, anniversaries, or phone numbers |

| Choose different PINs for different services | Reuse the same PIN across multiple accounts |

| Consider slight variations based on a pattern only you know (e.g., add 1 to the second digit each year) | Write down obvious clues like “Mom’s birthday +1” |

| Change your PIN periodically, especially after suspected exposure | Keep the default PIN sent by the provider |

One effective method is using a mnemonic device. For example, associate each digit with a word or event that only makes sense to you—but avoid writing the logic down verbatim.

Secure Methods for Storing and Managing Multiple PINs

If you have several PINs—for a bank card, SIM, medical portal, etc.—memorizing all may be challenging. The goal is to avoid insecure habits while maintaining accessibility.

Storage Options Compared

- Mental memorization: Most secure, especially when combined with memory techniques.

- Encrypted password manager: Tools like Bitwarden or 1Password can store PINs securely behind one master password. Enable two-factor authentication.

- Physical notebook (with caveats): If written, disguise the PIN among other numbers. Example: List it as part of a fake phone number or price list.

- Never store in unencrypted digital files: Avoid plain text notes, spreadsheets, or cloud documents without encryption.

Real-World Scenario: How One User Regained Control After Losing a Wallet

Sophia, a small business owner, lost her wallet containing two bank cards and her driver’s license. She immediately contacted both banks and froze the cards. While she remembered one PIN, she had forgotten the second—one she hadn’t used in over a year.

She logged into her bank’s mobile app, verified her identity using biometrics and a security question, and accessed the “Reset PIN” feature. Within minutes, she set a new PIN and scheduled a replacement card. She also reviewed her password manager, where she had securely stored hints (not the full PIN) for future reference.

This experience prompted her to create a checklist for emergency preparedness, including immediate contact numbers and account details—all stored offline in an encrypted USB drive at home.

Essential PIN Management Checklist

To stay proactive, follow this actionable checklist:

- ✅ Memorize your primary PINs or use a trusted memory aid

- ✅ Change default PINs immediately after receiving new cards or devices

- ✅ Never share your PIN, even with family or customer service reps

- ✅ Cover the keypad when entering your PIN in public

- ✅ Regularly monitor account activity for unauthorized access

- ✅ Store backup information securely—never on sticky notes or smartphones

- ✅ Update PINs every 6–12 months or after high-risk situations (e.g., lost wallet)

Frequently Asked Questions

Can I change my PIN online?

Yes, most banks and service providers allow PIN changes through their secure websites or mobile apps. You’ll need to authenticate your identity first using multi-factor verification.

Is it safe to keep PINs in a password manager?

Yes, provided the manager uses end-to-end encryption and you protect it with a strong master password and two-factor authentication. Avoid managers that store data in the cloud without local encryption.

What should I do if someone sees me enter my PIN?

Treat it as potentially compromised. Change the PIN as soon as possible and monitor your account for suspicious activity. If it was a banking PIN, consider temporarily freezing the card.

Protecting Your Digital Identity Starts with Small Habits

Managing your PIN effectively doesn't require advanced technology—just awareness and discipline. From choosing non-obvious digits to storing them wisely, every decision shapes your overall security posture. In an era where financial fraud is increasingly sophisticated, treating your PIN with respect is not optional; it's essential.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?