Closing a business is rarely as straightforward as flipping a switch. Whether due to retirement, shifting priorities, or market challenges, ending operations requires careful planning, clear communication, and strict adherence to legal and financial responsibilities. Done incorrectly, it can result in tax penalties, lawsuits, damaged credit, or lingering liabilities. A well-executed closure protects your reputation, minimizes risk, and ensures compliance with state and federal regulations.

This guide outlines the critical actions every business owner should take when winding down operations—ensuring you leave on solid ground, without unexpected consequences.

Assess Your Decision and Plan Strategically

Before initiating any formal steps, confirm that closing is the right decision. Explore alternatives such as selling the business, restructuring debt, or pivoting services. If closure remains the best path, create a detailed exit plan. This includes timelines, key personnel responsibilities, asset distribution strategies, and communication protocols.

A strategic plan helps maintain control during an emotionally charged process. It also prevents hasty decisions that could trigger unnecessary costs or legal exposure.

Notify Stakeholders Transparently

Clear, timely communication builds trust and reduces the risk of disputes. Notify stakeholders in order of impact:

- Employees: Provide written notice explaining the closure timeline, final paychecks, benefits continuation (e.g., COBRA), and severance if applicable. Comply with the Worker Adjustment and Retraining Notification (WARN) Act if you have 100+ employees and are shutting down a plant or mass layoff is imminent.

- Customers: Inform them about service discontinuation, refund policies, and support availability. Offer prorated refunds or referrals where possible to preserve goodwill.

- Vendors and Creditors: Communicate your intent to settle outstanding debts or negotiate payment plans. Avoid ghosting suppliers—this damages future creditworthiness.

- Business Partners and Investors: Hold direct conversations outlining next steps, asset liquidation, and return of capital.

“Transparency during closure often defines how your professional legacy is remembered. Handle relationships with integrity.” — Laura Simmons, Small Business Advisor & Former SBA Consultant

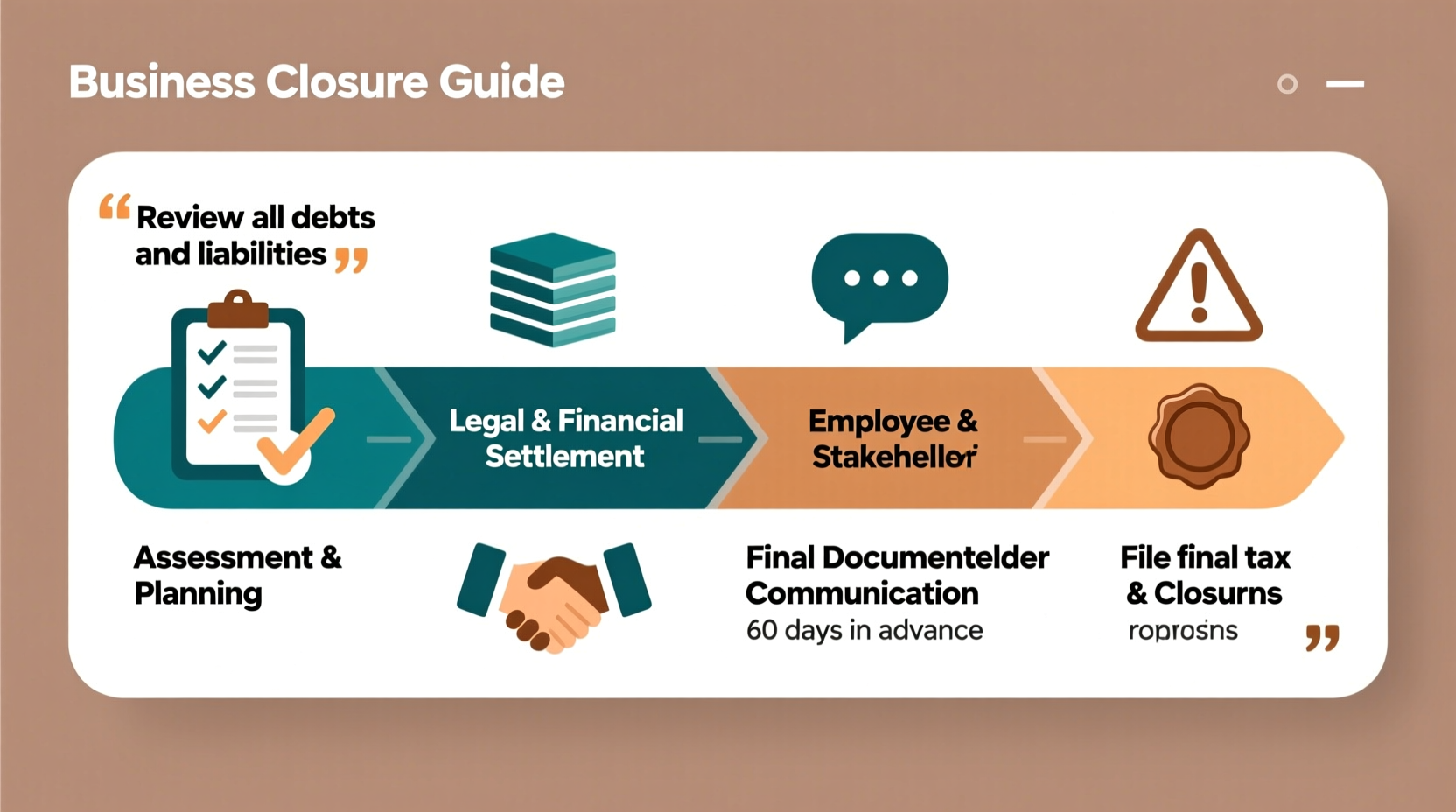

Step-by-Step Closure Timeline

Follow this structured sequence to ensure no critical step is overlooked:

- Month 1: Finalize the decision to close; consult legal and tax advisors.

- Month 2: Develop a closure checklist; begin internal communications.

- Month 3: Notify employees and customers; initiate asset sale or transfer.

- Month 4: Settle debts, cancel leases, and terminate contracts.

- Month 5: File final tax returns and dissolve business entities.

- Month 6: Archive records and formally close accounts.

Settle Financial Obligations and Cancel Licenses

One of the most common pitfalls in business closure is failing to resolve financial commitments. Prioritize the following:

- Pay all employee wages, accrued vacation time, and payroll taxes.

- File final federal and state tax returns—including income, sales, and employment taxes.

- Cancel your Employer Identification Number (EIN) with the IRS after filing final returns.

- Close business bank accounts only after all checks have cleared and obligations are met.

- Repay or restructure business loans. Defaulting harms personal and business credit.

- Cancel business licenses, permits, and registrations with local, state, and federal agencies.

| Action | Agency/Entity | Deadline Consideration |

|---|---|---|

| File final IRS tax return | Internal Revenue Service | By due date (including extensions) |

| Dissolve LLC or Corporation | Secretary of State | After settling debts and filing final reports |

| Cancel DBA (\"Doing Business As\") | County Clerk or State Office | Varies by jurisdiction |

| Terminate business phone, utilities, insurance | Service Providers | After last day of operation |

Real Example: The Restaurant That Closed Gracefully

Jamie Rivera operated a popular farm-to-table bistro for eight years. When rising rent and declining foot traffic made profitability unsustainable, she decided to close. Rather than shuttering abruptly, Jamie followed a six-month wind-down plan.

She informed staff two months in advance, offered severance to long-term employees, and hosted a “farewell dinner” for loyal customers. She sold kitchen equipment through an auction house, settled all vendor invoices, and filed her final tax returns with the help of her CPA. Within seven months, she had dissolved her LLC and preserved strong relationships across the community.

Two years later, she launched a catering side-hustle—and former vendors were eager to work with her again because of how professionally she handled the closure.

Common Pitfalls to Avoid

Even experienced entrepreneurs make mistakes when closing a business. Watch out for these frequent errors:

- Ignoring tax obligations: Failing to file final returns or pay sales tax can trigger audits and penalties years later.

- Keeping business accounts open: Inactive accounts may incur fees or be flagged for suspicious activity.

- Not canceling recurring subscriptions: Software, domain names, and cloud storage can continue billing indefinitely.

- Disposing of records too soon: Tax authorities recommend keeping financial documents for at least 7 years.

- Underestimating emotional toll: Business closure can feel like personal failure. Seek support from mentors or counselors.

Checklist: Essential Actions Before Closing

Use this comprehensive list to stay organized throughout the closure process:

- Consult with legal and tax professionals

- Decide whether to sell assets or transfer ownership

- Notify employees and comply with labor laws

- Inform customers and fulfill pending orders

- Pay off or renegotiate debts

- Sell or transfer intellectual property, if valuable

- File final federal, state, and local tax returns

- Cancel EIN, business licenses, and permits

- Close business bank and credit accounts

- Dissolve the legal entity with the Secretary of State

- Securely archive all business records for at least 7 years

Frequently Asked Questions

Can I reopen my business after dissolving it?

Yes, but not automatically. You would need to register a new business entity, obtain new licenses, and apply for a new EIN. Previous debts and filings remain separate, but rebuilding trust with vendors and customers may take time.

What happens if I don’t formally dissolve my business?

You may still be liable for annual report fees, franchise taxes, and penalties. Some states impose ongoing obligations even if inactive. Additionally, your business could be administratively dissolved, which complicates asset transfers and leaves a negative record.

Do I need to pay contractors or freelancers after closing?

Yes. Any work completed prior to closure must be paid per contract terms. Failure to do so can result in legal action or damage to your personal credit if you signed personally.

Final Steps and Moving Forward

Closing a business doesn’t mark the end—it marks a transition. By following a disciplined process, you protect your financial health, maintain professional credibility, and create space for future opportunities. Every signature, notification, and form filed correctly today prevents headaches tomorrow.

Take pride in how you finish. The way you handle closure reflects your values as a leader and entrepreneur. Whether you’re stepping away from business entirely or preparing for your next venture, doing it right sets the foundation for long-term success.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?