Closing a business is rarely a simple decision. Whether driven by retirement, shifting priorities, or market conditions, the process demands careful planning and emotional resilience. Done haphazardly, it can lead to legal exposure, financial penalties, and lingering stress. But with a structured approach, you can dissolve your company efficiently, protect your reputation, and move forward with confidence. This guide outlines the key actions required to close your business thoughtfully and completely—without unnecessary strain.

Assess Your Decision and Notify Key Parties

Before any formal steps are taken, ensure that closing is truly the right choice. Revisit your business plan, consult trusted advisors, and evaluate alternatives such as selling the business or transitioning ownership. Once the decision is final, transparency becomes critical.

Begin by informing those who depend on your business:

- Employees: Provide advance notice where possible, explain severance (if applicable), and assist with transition documents like reference letters.

- Customers: Send a clear message explaining the closure, refund policies, and how ongoing services will be handled.

- Vendors and creditors: Notify suppliers of your intent to close and settle outstanding invoices or negotiate payment plans.

- Partners and investors: Hold a meeting to discuss the dissolution, financial implications, and next steps.

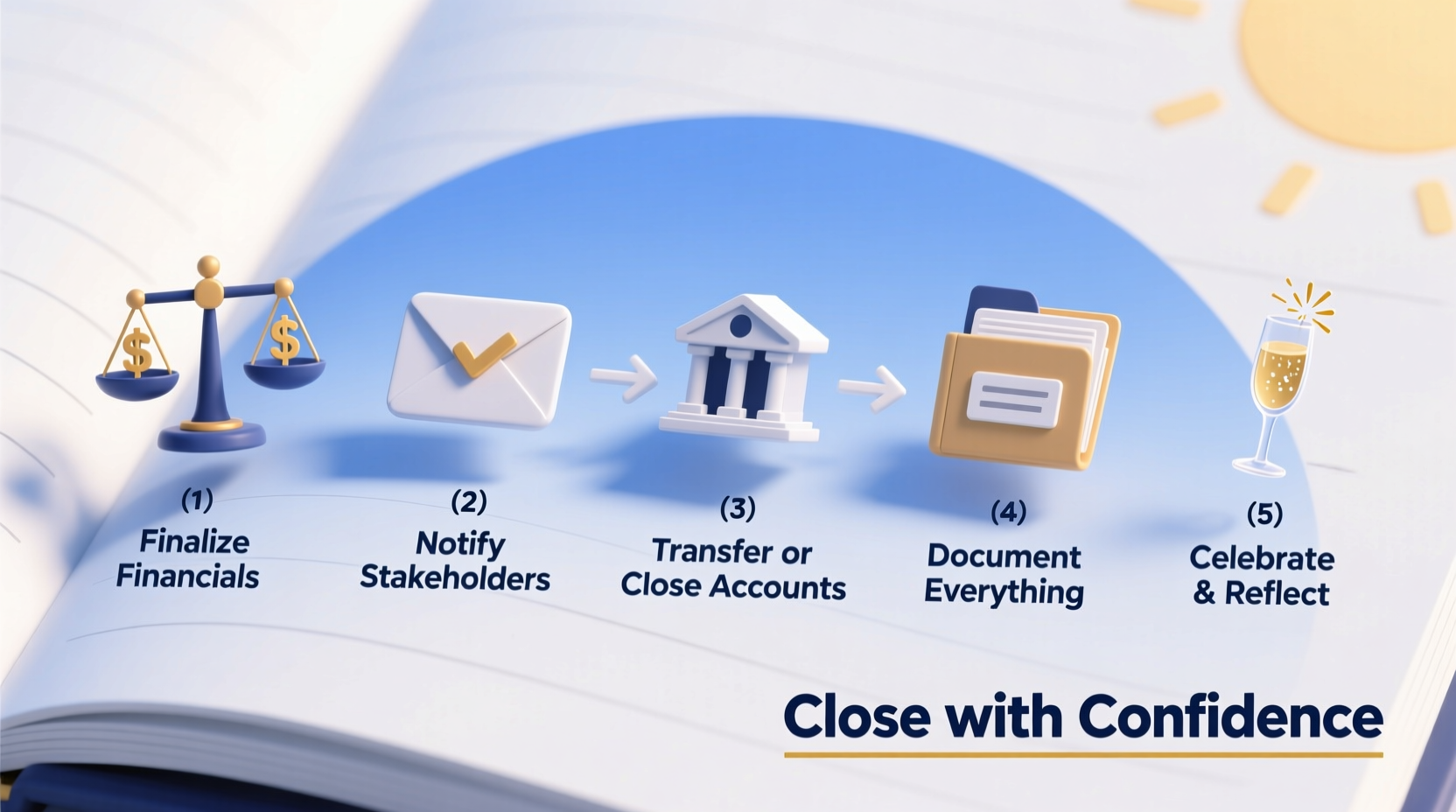

Step-by-Step Timeline for Business Closure

A well-structured timeline prevents last-minute scrambles and ensures no detail is overlooked. The following sequence spans approximately 3–6 months, depending on complexity:

- Month 1: Finalize the decision, notify stakeholders, and appoint a dissolution officer if needed.

- Month 2: Inventory all assets, debts, contracts, and licenses. Begin customer and vendor notifications.

- Month 3: Settle accounts payable, collect receivables, and liquidate inventory or equipment.

- Month 4: File final tax returns, cancel registrations, and notify government agencies.

- Month 5: Distribute remaining funds to owners or shareholders after all obligations are met.

- Month 6: Archive records, close bank accounts, and formally dissolve the entity with the state.

This phased approach allows time to resolve complications—such as disputed invoices or contract terminations—without rushing critical decisions.

Settle Financial and Tax Obligations

One of the most common pitfalls in business closure is underestimating tax responsibilities. Failing to file final returns or pay payroll taxes can result in penalties long after operations cease.

Key financial actions include:

- Filing final federal, state, and local tax returns (including income, sales, and employment taxes).

- Notifying the IRS and relevant state departments of closure using Form 966 (for corporations) or equivalent documentation.

- Canceling your Employer Identification Number (EIN) or marking it inactive.

- Reconciling all business accounts and ensuring no automatic payments remain active.

| Obligation | Action Required | Agency/Party |

|---|---|---|

| Sales Tax | File final return and remit collected tax | State Revenue Department |

| Payroll Tax | Submit final Form 941 and W-2s | IRS & State Labor Office |

| Business License | Submit cancellation form | Local Clerk’s Office |

| Trademark | Decide to abandon or transfer | USPTO |

“Many entrepreneurs forget that dissolving a corporation doesn’t automatically erase tax liability. You must proactively close every financial door.” — Laura Simmons, CPA and Small Business Advisor

Handle Assets, Contracts, and Legal Requirements

Physical and intellectual assets must be managed responsibly. Selling equipment, transferring domain names, or licensing software requires attention to contractual terms.

Review all active agreements—including leases, service contracts, and partnership arrangements—for early termination clauses or exit procedures. Breaching a contract during closure can lead to litigation.

For example, if you’re leasing office space, contact the landlord to discuss mutual release options. Many are willing to re-lease the space and may waive penalties to avoid vacancy.

Mini Case Study: Closing a Small Marketing Agency

Sarah ran a boutique digital marketing firm for eight years. When she decided to retire, she began preparing six months in advance. She notified clients three months prior, offering referrals to vetted同行 firms. She sold her design software licenses and laptops, settled all vendor invoices, and filed final tax forms with her accountant’s help. By keeping communication open and honoring every commitment, Sarah closed her business with zero debt and strong client goodwill. Former customers later hired her for consulting, thanks to her professional exit.

Essential Closure Checklist

To ensure nothing slips through the cracks, follow this comprehensive checklist:

- ☑ Confirm decision to close with all owners/partners

- ☑ Notify employees, customers, vendors, and partners

- ☑ Inventory all physical and digital assets

- ☑ Cancel business licenses, permits, and registrations

- ☑ Pay off all debts or arrange settlements

- ☑ Collect outstanding receivables

- ☑ File final federal, state, and local tax returns

- ☑ Close business bank accounts and credit lines

- ☑ Distribute remaining assets to owners

- ☑ Archive financial and legal records for 7+ years

- ☑ File Articles of Dissolution with your state

Frequently Asked Questions

Can I reopen my business after dissolving it?

It’s possible but complicated. Once an entity is dissolved, you’d need to register a new business, obtain fresh licenses, and restart tax accounts. Some states allow revival within a few years, but it requires filing petitions and paying reinstatement fees. It’s better to keep the entity active if reopening is likely.

How long should I keep business records after closing?

Maintain financial records, tax returns, and legal documents for at least seven years. This covers the IRS audit window and potential liability claims. Store them securely, either physically or in encrypted digital storage.

Do I need a lawyer to close my business?

While not always mandatory, legal counsel is highly recommended for corporations, LLCs with multiple members, or businesses with complex contracts or liabilities. A lawyer can ensure compliance, minimize risk, and handle dissolution filings correctly.

Final Steps and Emotional Closure

Closing a business isn’t just a logistical process—it’s an emotional milestone. Years of effort, relationships, and identity are tied to your company. Allow yourself time to reflect. Host a small farewell with your team, write a personal note about what you’ve learned, or donate leftover supplies to a startup incubator.

Professional closure supports personal renewal. When every obligation is met and every relationship honored, you gain peace of mind—the most valuable outcome of a well-managed shutdown.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?