Finding affordable, reliable car insurance doesn’t have to be a time-consuming chore. With so many providers offering different coverage levels, discounts, and customer service models, comparing options manually can quickly become overwhelming. That’s where specialized comparison websites come in—designed to streamline the process by aggregating quotes from top insurers, presenting them side-by-side, and helping drivers make informed decisions in minutes.

Among the various platforms available, one stands out for its accuracy, user experience, and depth of insight: Insurify. While other sites like The Zebra, NerdWallet, and Compare.com offer solid functionality, Insurify delivers a uniquely refined blend of real-time pricing, personalized recommendations, and AI-driven risk assessment that makes shopping for car insurance not just efficient—but genuinely intelligent.

Why Use a Car Insurance Comparison Website?

Shopping directly through an insurer's website may seem straightforward, but it limits your perspective. You’re only seeing one option at a time, which increases the risk of overpaying or missing out on better coverage terms elsewhere.

Comparison platforms eliminate this blind spot by pulling data from dozens of carriers—both national giants and regional specialists—and displaying them in a standardized format. This allows users to evaluate:

- Premium costs across multiple companies

- Coverage limits and deductibles

- Available discounts (safe driver, multi-policy, etc.)

- Customer satisfaction ratings

- Mobile app usability and claims support

According to a 2023 J.D. Power study, consumers who used digital comparison tools saved an average of $456 annually compared to those who renewed with their existing provider without exploring alternatives.

Top Features of the Best Car Insurance Shopping Platforms

Not all comparison websites are created equal. The most effective ones share several key characteristics that enhance transparency, trust, and decision-making speed.

Real-Time Quotes Based on Driving History

The best platforms integrate soft credit checks and driving record verification to generate accurate premiums—not ballpark estimates. Insurify, for example, uses AI-powered underwriting models that adjust quotes dynamically based on recent traffic violations, mileage patterns, and even parking habits.

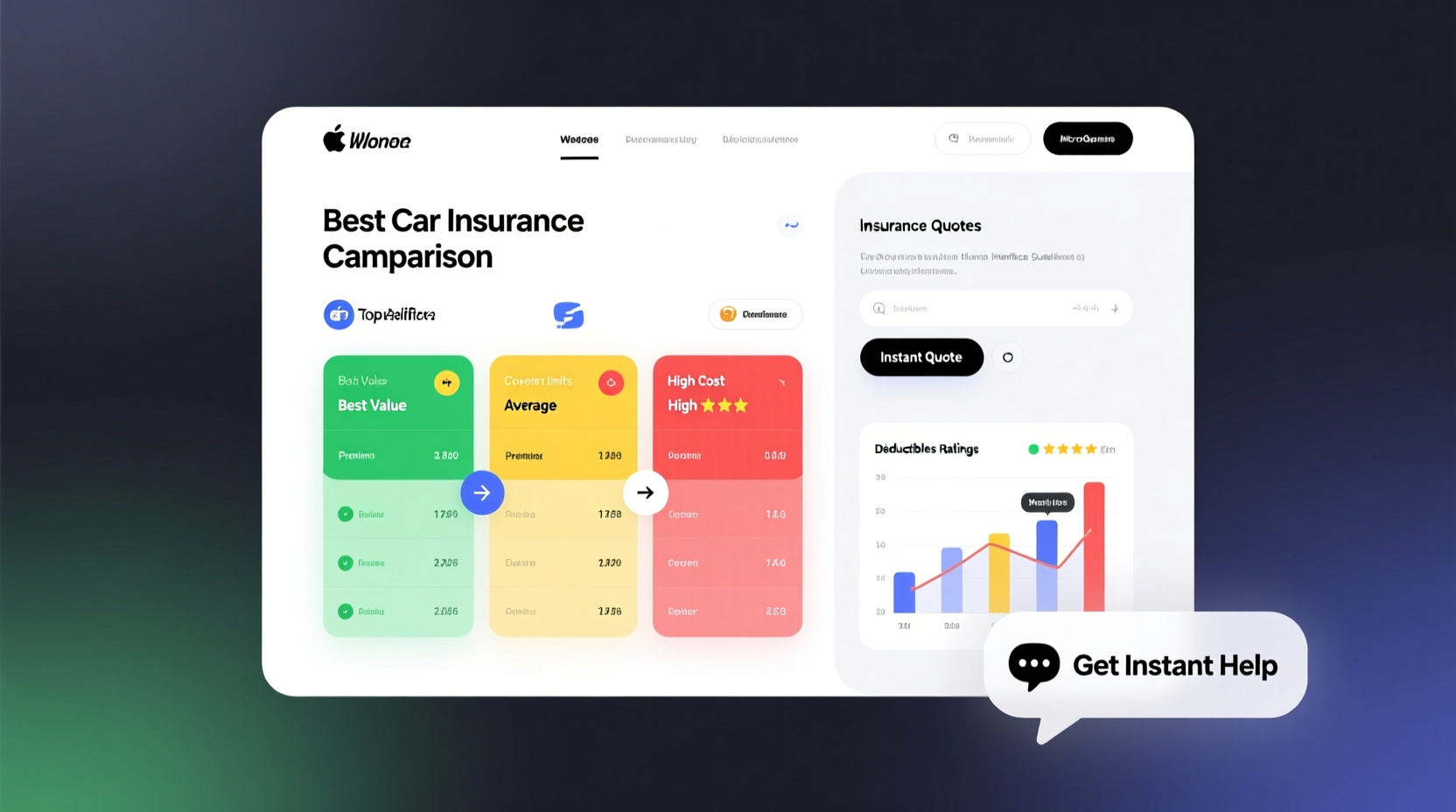

Side-by-Side Plan Comparisons

A clean interface that lets you toggle between policies is essential. Look for tables that clearly outline liability limits, collision/comprehensive coverage, roadside assistance availability, and rental reimbursement options.

Personalized Discounts Highlighted

Advanced tools scan your profile for eligible savings—such as low-mileage, bundling home and auto, paperless billing, or usage-based tracking programs—and display how much each could reduce your premium.

Transparent Carrier Ratings

User reviews, BBB accreditation, AM Best financial strength scores, and NAIC complaint indexes should be easily accessible. These metrics help assess long-term reliability beyond just price.

“Digital insurance marketplaces have democratized access to competitive pricing. A few years ago, only agents had this level of cross-carrier visibility.” — Mark Reynolds, Senior Analyst at Insurance Insights Group

How Insurify Outperforms Other Comparison Sites

While several platforms exist, Insurify has emerged as the leader due to its proprietary technology and commitment to data accuracy.

| Feature | Insurify | The Zebra | NerdWallet |

|---|---|---|---|

| Number of Partner Insurers | 70+ | 50+ | 30+ |

| AI-Powered Risk Assessment | Yes | No | No |

| Instant Digital Bind (Buy Online) | Yes | Limited | No |

| Usage-Based Discount Matching | Yes | Partial | No |

| Free Claims Score Simulation | Yes | No | No |

What sets Insurify apart is its **Claims IQ** feature—a predictive tool that analyzes historical claims data to forecast how likely a company is to approve or delay future claims based on your location and vehicle type. This kind of forward-looking insight isn’t available anywhere else.

Mini Case Study: Sarah’s Savings Journey

Sarah, a 34-year-old teacher from Austin, Texas, had been paying $147/month with State Farm for six years. She assumed loyalty would protect her rate. After using Insurify during renewal season, she discovered that Progressive offered identical coverage for $98—with a $75 online signing bonus. By switching, she saved $588 in the first year alone. The entire process took 11 minutes, including document upload and e-signature.

Step-by-Step Guide to Using a Top Comparison Site

To get the most value from any car insurance shopping platform, follow this proven sequence:

- Gather Your Information: License number, VIN, current policy details, and proof of prior coverage.

- Answer Questions Honestly: Mileage, annual driving distance, past accidents, and credit tier affect pricing accuracy.

- Review All Quote Options: Don’t jump at the cheapest plan—check what’s included and excluded.

- Compare Add-Ons: Evaluate whether features like OEM parts coverage or gap insurance are worth the extra cost.

- Check Financial Strength Ratings: Use AM Best or Moody’s to verify insurer stability.

- Read Recent Customer Reviews: Focus on claims handling experiences, not just pricing.

- Purchase Directly Through the Platform (if available): Some sites allow instant binding with digital ID cards issued immediately.

Common Pitfalls to Avoid When Comparing Policies

Even experienced shoppers can fall into traps when evaluating insurance offers. Watch out for these red flags:

- Incomplete Coverage Match: One quote includes uninsured motorist protection; another doesn’t. Make sure apples-to-apples comparisons.

- Temporary Promotional Rates: Some insurers offer steep initial discounts that expire after six months.

- Hidden Fees: Check for administrative charges, policy issuance fees, or electronic payment surcharges.

- Outdated User Reviews: A carrier’s service quality can change rapidly—prioritize feedback from the last 12 months.

FAQ

Is it safe to enter personal information on a comparison site?

Yes—reputable platforms like Insurify use bank-level encryption (256-bit SSL) and do not sell your data to third parties. They act as brokers, sharing your info only with quoted insurers for underwriting purposes.

Will comparing quotes affect my credit score?

No. Most sites perform a “soft pull” that doesn’t impact your credit. Only when you apply directly with an insurer does a hard inquiry occur.

Can I switch car insurance providers mid-policy?

Absolutely. Most states allow policy changes at any time. Any remaining premium is typically refunded prorated. Just ensure there’s no lapse in coverage.

Final Checklist Before Buying

Before finalizing your purchase on any car insurance comparison site, run through this checklist:

- ✅ Confirmed all drivers in household are listed

- ✅ Verified liability limits meet or exceed state minimums

- ✅ Compared deductible amounts across plans

- ✅ Checked availability of emergency roadside assistance

- ✅ Reviewed customer service channels (phone, chat, app)

- ✅ Ensured digital ID card access via mobile app

- ✅ Confirmed ability to file claims online or by phone 24/7

Conclusion

Shopping for car insurance no longer requires hours of calling agents or filling out redundant forms. With advanced platforms like Insurify, you can compare dozens of verified quotes in under 15 minutes—all while gaining insights into claims performance, discount eligibility, and long-term affordability. The right tool doesn’t just show you cheaper options; it helps you understand which policy truly fits your lifestyle, budget, and risk profile.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?