Many Americans use Flexible Spending Accounts (FSAs) to pay for qualified medical expenses with pre-tax dollars. While most people think of prescriptions or doctor visits, dental care products—including certain toothbrushes—can also be eligible for reimbursement. However, not every toothbrush qualifies. Understanding the rules can help you make smarter purchases and save money on essential oral hygiene tools.

What Is an FSA and How Does It Work?

An FSA, or Flexible Spending Account, is a tax-advantaged account offered by employers that allows employees to set aside pre-tax income for qualified medical expenses. These funds must typically be used within the plan year, although some plans offer a grace period or carryover option. Common FSA-eligible items include prescription medications, contact lenses, first-aid supplies, and select dental products.

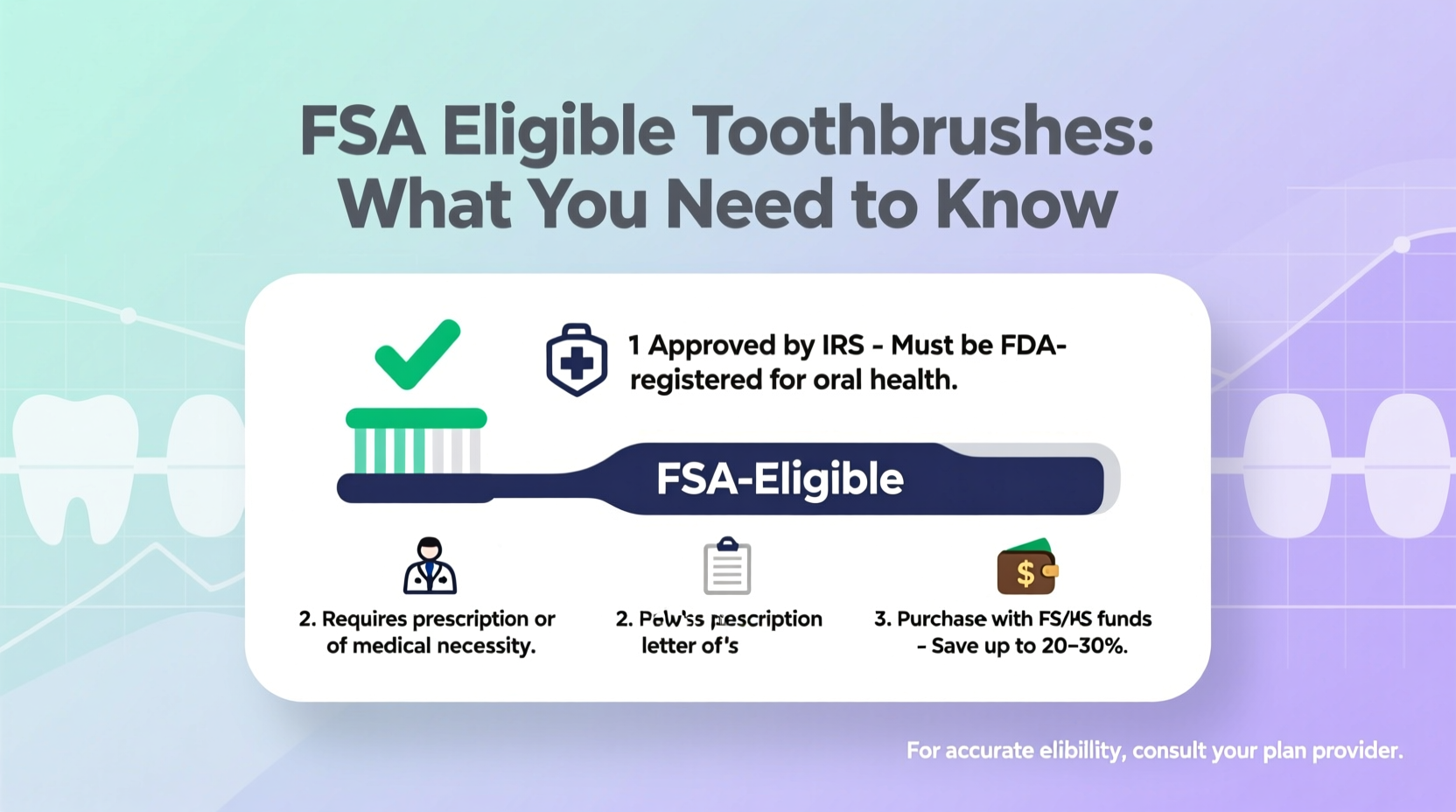

The Internal Revenue Service (IRS) determines what qualifies as a medical expense under Section 213(d) of the tax code. According to IRS guidelines, a product must be primarily intended for the \"prevention or alleviation of a physical or mental defect or illness\" to be eligible. This standard is key when evaluating whether a toothbrush meets FSA requirements.

Are Toothbrushes FSA Eligible?

Yes—but only if they meet specific criteria. A regular manual toothbrush from the drugstore generally does not qualify because it’s considered a general health item rather than a medical necessity. However, electric toothbrushes, especially those marketed for therapeutic purposes such as improving gum health or treating gingivitis, are more likely to be eligible.

To be FSA-approved, a toothbrush must be classified as a \"dental device\" designed to treat or prevent a medical condition. Many electric models come with features like pressure sensors, timers, and specialized brush heads that support better plaque removal and gum care—features that align with medical benefit standards.

FSA-Eligible vs. Non-Eligible Toothbrushes

| Feature | FSA-Eligible | Not Eligible |

|---|---|---|

| Type | Electric or battery-powered with medical claims | Standard manual toothbrush |

| Purpose | Prevents/treats gum disease, improves oral hygiene clinically | General cleaning or cosmetic use |

| Marketing Claims | Dentist-recommended, ADA-approved, reduces plaque by X% | Cleaner smile, fresher breath (cosmetic focus) |

| Examples | Oral-B iO Series, Philips Sonicare ProtectiveClean, Waterpik Sonic-Fusion | Colgate SlimSoft, Crest Pro-Health Manual |

How to Verify If Your Toothbrush Qualifies

Just because a toothbrush is electric doesn’t automatically make it FSA-eligible. The burden of proof often falls on the consumer when submitting claims. Here’s how to ensure your purchase qualifies:

- Check the Product Label or Website: Look for language indicating the toothbrush is designed to treat or prevent a dental condition. Terms like “for gum health” or “clinically proven to reduce gingivitis” are strong indicators.

- Review FSA Store Listings: Retailers like FSAStore.com or Well.ca maintain updated lists of eligible products. Searching for your model there can confirm its status.

- Save Receipts with Descriptions: When purchasing, keep a detailed receipt that includes the product name and description. Vague entries like “electric toothbrush” may be rejected.

- Contact Your FSA Administrator: If in doubt, reach out to your plan provider. Some require prior authorization or documentation from a dentist.

“Dental devices that serve a therapeutic purpose—like reducing inflammation or controlling plaque buildup—are clearly within IRS guidelines for FSA eligibility.” — Dr. Linda Chen, DDS, American Dental Association (ADA) Public Health Advisor

Real-World Example: Using FSA Funds for Better Oral Care

Sarah, a 34-year-old teacher from Ohio, suffered from mild periodontitis and was advised by her hygienist to upgrade her brushing routine. Her dentist specifically recommended a Philips Sonicare DiamondClean due to its built-in timer and pressure sensor, both designed to protect gums during brushing. She purchased the toothbrush using her FSA card at a participating online retailer. Because the product was listed as eligible and included clinical claims about plaque reduction, her claim was approved without issue. Over time, her gum bleeding decreased, and her follow-up appointments showed measurable improvement.

This case illustrates how FSA funds can bridge the gap between basic hygiene and preventive care—especially when guided by professional advice.

Step-by-Step Guide to Buying an FSA-Eligible Toothbrush

- Consult Your Dentist: Ask if a high-performance toothbrush could benefit your oral health, especially if you have gum disease, braces, or sensitivity.

- Research Models with Medical Claims: Focus on brands like Oral-B, Philips Sonicare, or Waterpik that publish clinical studies or partner with dental professionals.

- Verify Eligibility Before Purchase: Use FSA-approved marketplaces or check with your administrator to confirm coverage.

- Purchase Through FSA-Eligible Channels: Buy directly from FSAStore.com, Amazon (with FSA filter), or pharmacies that accept FSA cards.

- Keep Documentation: Save receipts, product pages, and any correspondence with your provider in case of audit or denial.

- Submit Claim (if needed): If your transaction isn’t auto-verified, submit the required documents through your FSA portal.

Common Mistakes to Avoid

- Assuming all electric toothbrushes qualify: Some are marketed purely for convenience or aesthetics and lack therapeutic claims.

- Using FSA funds without verification: An ineligible purchase can result in penalties or repayment obligations.

- Discarding receipts: Without proper documentation, even eligible items may be denied during review.

- Waiting until year-end: FSAs often have “use-it-or-lose-it” rules. Plan purchases early to avoid forfeiting funds.

FAQ

Can I use my FSA card for replacement brush heads?

Yes, in most cases. Replacement heads for eligible electric toothbrushes are considered medically necessary consumables and are typically covered. Check with your provider or retailer for confirmation.

Do I need a prescription for an FSA-eligible toothbrush?

Not usually. Most electric toothbrushes with clear medical intent qualify without a Letter of Medical Necessity (LOMN). However, if your plan requires one—or if you're claiming for a non-standard device—a note from your dentist can help secure approval.

Are smart toothbrushes eligible?

If they include features aimed at improving oral health outcomes—such as real-time feedback, app-guided brushing, or dentist-mode settings—they are more likely to qualify. As long as the primary function is therapeutic, smart capabilities don’t disqualify the product.

Conclusion: Make Informed Choices That Benefit Your Health and Budget

Your FSA is more than just a way to pay for prescriptions—it’s a tool for investing in preventive care. By choosing an FSA-eligible toothbrush backed by clinical research and therapeutic design, you’re not only saving money but also taking proactive steps toward better oral health. With rising dental costs and increasing awareness of the mouth-body connection, these small decisions add up to meaningful long-term benefits.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?