Transferring a vehicle as a gift—whether to a family member, friend, or loved one—can be a generous and meaningful gesture. However, without proper documentation, the process can lead to complications with registration, taxes, or even legal disputes. A gift affidavit for a car is a crucial document that formally declares the transfer of ownership without monetary exchange. This guide breaks down everything you need to know: what a gift affidavit is, when it’s required, how to write one, and where to find reliable resources to make the process smooth and legally sound.

What Is a Gift Affidavit for a Car?

A gift affidavit, sometimes referred to as a \"gift letter\" or \"affidavit of gift,\" is a legal document stating that a motor vehicle is being transferred from one party (the donor) to another (the recipient) as a gift, with no money exchanged. While not all states mandate this form, many require it to waive sales tax, verify the absence of fraud, or support title transfer applications.

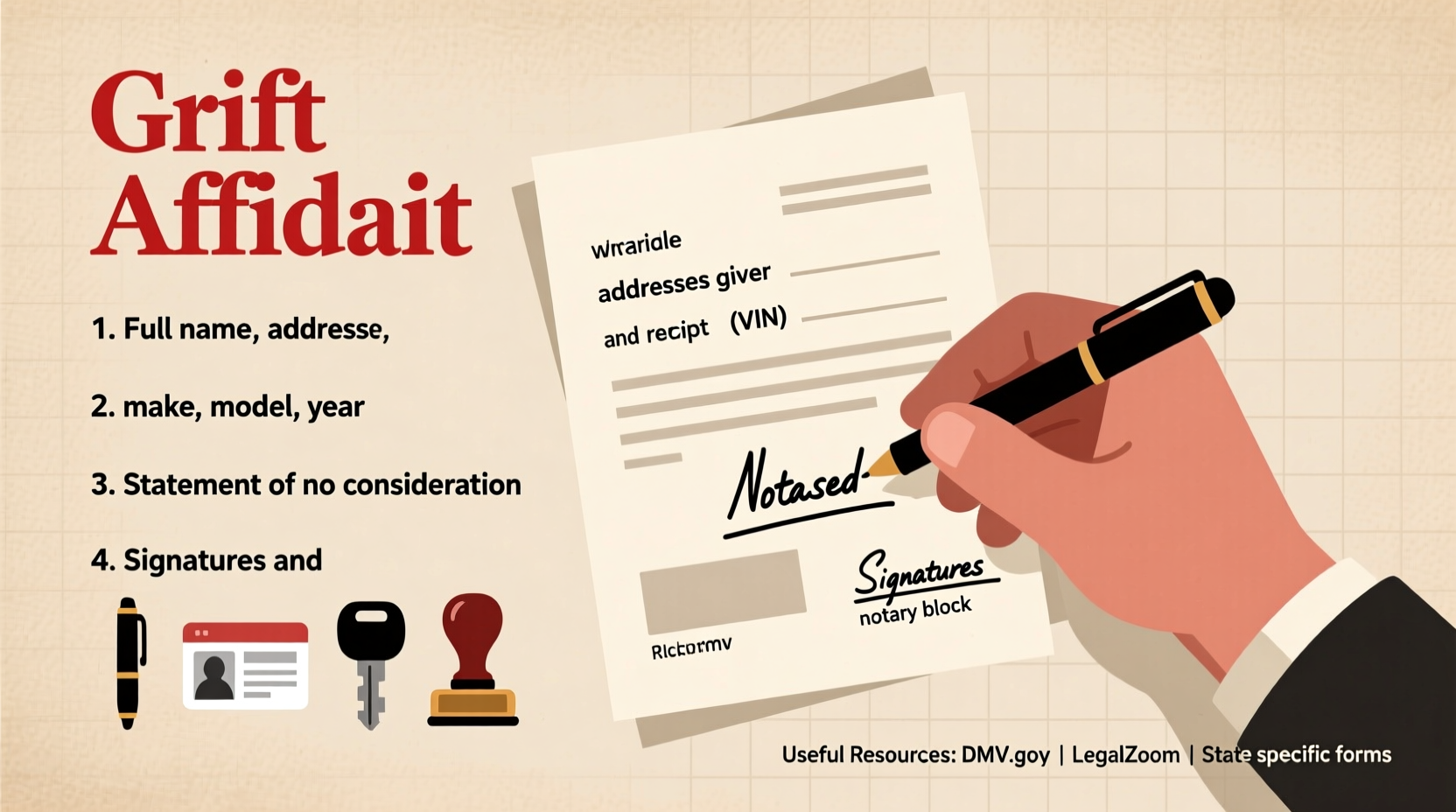

The affidavit typically includes:

- Names and addresses of both parties

- Vehicle identification number (VIN)

- Year, make, model, and color of the vehicle

- Date of transfer

- A sworn statement that no payment was made

- Signatures of both donor and recipient

- Notarization (required in most states)

It serves as proof to the Department of Motor Vehicles (DMV) that the transaction is legitimate and not an attempt to avoid taxes through undervalued sales.

Step-by-Step Guide to Completing a Car Gift Affidavit

- Determine if Your State Requires an Affidavit: Some states like California, Texas, and Florida require a formal gift affidavit; others accept a simple bill of sale marked “gift.”

- Gather Vehicle Information: Locate the VIN, title, registration, and current odometer reading.

- Download the Correct Form: Use your state’s official DMV template if available. If not, create your own using key elements outlined above.

- Fill Out the Affidavit: Include full names, addresses, vehicle details, and a clear declaration of gifting.

- Sign and Notarize: Both parties must sign in the presence of a notary public in most cases.

- Submit to the DMV: File the affidavit along with the title transfer application, original title, and any other required documents.

This process usually takes less than 30 minutes once paperwork is prepared, but processing times at the DMV may extend several weeks depending on location.

State-by-State Requirements: Do’s and Don’ts

| State | Gift Affidavit Required? | Sales Tax Exempt? | Notarization Needed? |

|---|---|---|---|

| California | Yes (REG 256 form) | Yes, if properly documented | Yes |

| Texas | Yes (Form VTR-130-S | Yes, with affidavit | Yes |

| Florida | Yes (HSMV 82050 form) | Yes, for immediate family | Yes |

| New York | No, but bill of sale recommended | Yes, with proof of gift | No |

| Illinois | No formal affidavit, but gift statement needed | Yes, if gifted to family | No |

Always confirm current rules directly with your local DMV. Policies change, and outdated advice can delay your transfer or trigger unnecessary fees.

Checklist: Transferring a Car as a Gift

- Verify eligibility for tax exemption based on relationship (e.g., parent to child)

- Obtain the vehicle’s clean title (no liens)

- Complete the gift affidavit or equivalent form

- Ensure both donor and recipient sign

- Get the document notarized (if required)

- Submit all forms to the DMV within the required timeframe (often 10–30 days)

- Update insurance under the new owner’s name

- Remove license plates if required by state law

Real Example: Gifting a Car to a College-Bound Child

Sarah, a resident of Texas, wanted to give her daughter Emma a used sedan before she started college. Sarah contacted the Texas DMV and learned she needed to complete Form VTR-130-S (Affidavit of Motor Vehicle Gift Transfer). She filled out the form with Emma’s information, included the VIN, and signed it in front of a notary at a local bank. Along with the signed title and completed form, Sarah mailed everything to the county tax office. Within two weeks, Emma received a new title in her name and registered the car at her campus address. Because the transfer was between parent and child, Emma avoided paying $800 in sales tax—proof that proper documentation pays off.

“Failing to file a gift affidavit can result in back taxes, penalties, or denial of registration.” — James Reed, Senior DMV Compliance Officer, California Department of Motor Vehicles

Where to Find Reliable Templates and Resources

While some states provide downloadable forms, others expect individuals to draft their own. Here are trusted sources:

- Official State DMV Websites: Search “[Your State] DMV gift affidavit form” (e.g., dmv.ca.gov, dps.texas.gov).

- Legal Aid Organizations: Nonprofits like LegalZoom or Rocket Lawyer offer free or low-cost templates reviewed by attorneys.

- County Clerk Offices: Often provide blank forms and notary services.

- PDF Template Libraries: Sites like PDFfiller or FormsPal host user-friendly, editable versions of common affidavits.

Be cautious with third-party sites. Always cross-check language against official DMV guidelines to ensure compliance.

Frequently Asked Questions

Do I need a notary for a car gift affidavit?

In most states—such as California, Texas, and Florida—a notary is required to validate signatures. Even if your state doesn’t mandate it, notarizing adds legal credibility and reduces the risk of future disputes.

Can I gift a car if there’s still a loan on it?

No. The vehicle must be free of liens before transferring ownership. You must pay off the loan first and obtain a lien release from the lender before completing the gift affidavit.

Is a gift affidavit the same as a bill of sale?

Not exactly. A bill of sale records a sale transaction, while a gift affidavit declares no money changed hands. Some states accept a bill of sale with a note stating “$0 consideration” instead of a formal affidavit, but always verify with your DMV.

Final Tips for a Smooth Transfer

Double-check spelling, dates, and VIN accuracy. One typo can cause rejection. Also, consider scheduling a DMV appointment online to reduce wait times. If the recipient lives in a different state, they may need to register the vehicle locally after transfer—research reciprocity rules beforehand.

Take Action Today

Gifting a car is more than a generous act—it’s a legal responsibility. With the right documentation, you protect both yourself and the recipient from future liabilities. Whether you're helping a teenager get their first car or supporting a family member in need, taking the time to complete a proper gift affidavit ensures the transfer is recognized, tax-exempt, and hassle-free. Use the resources in this guide to prepare your document correctly, and don’t hesitate to contact your local DMV for clarification. A few minutes of careful planning can save hours of frustration later.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?