Giving gifts is a meaningful way to support loved ones, whether helping a child buy their first home, funding a grandchild’s education, or simply expressing appreciation. However, when the value of those gifts exceeds certain thresholds, federal tax implications come into play. The U.S. Internal Revenue Service (IRS) allows individuals to give money or property without triggering gift tax—up to a point. Understanding the gift tax-free limit, its exclusions, and how the system operates can help you plan wisely and avoid unnecessary filings or liabilities.

What Is the Gift Tax?

The federal gift tax applies to the transfer of property or money from one individual to another when nothing—or less than full value—is received in return. While the giver typically pays the tax, the rules are structured so that most people never owe anything due to generous annual and lifetime exemptions.

It's important to note that the gift tax exists partly to prevent individuals from avoiding estate taxes by giving away all their assets before death. As such, large gifts are tracked over a person’s lifetime and counted against a unified federal estate and gift tax exemption.

Annual Gift Tax Exclusion: The First Line of Protection

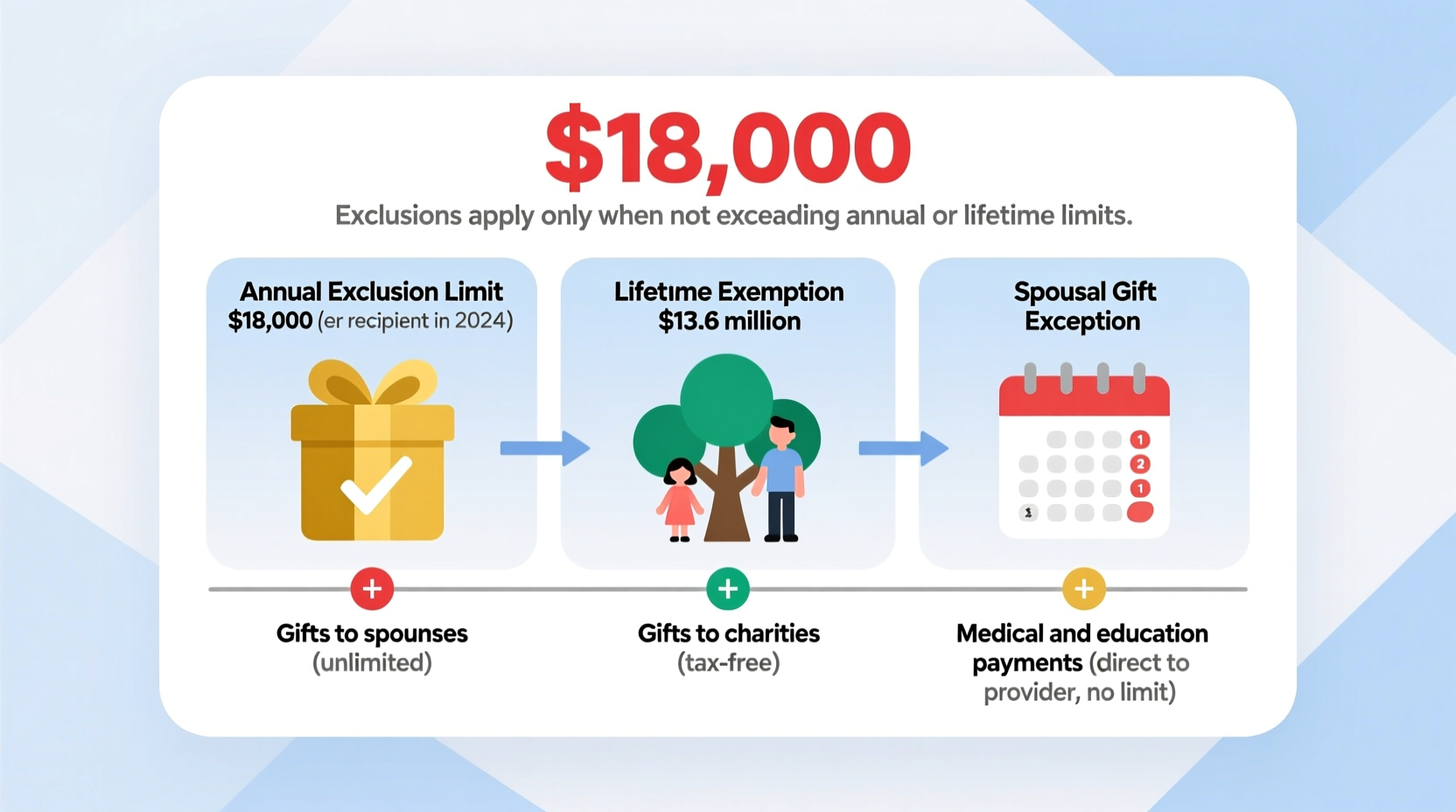

Each year, the IRS permits individuals to give up to a certain amount per recipient without any reporting or tax consequences. For 2024, this amount is $18,000 per recipient. This means you can give $18,000 to as many people as you’d like without filing a gift tax return or using any portion of your lifetime exemption.

If you're married, you and your spouse can together gift up to $36,000 to any one individual annually through gift splitting, provided both agree to treat the gift as made equally by each spouse.

Lifetime Gift and Estate Tax Exemption

Beyond the annual exclusion, the IRS provides a substantial lifetime exemption that combines both gift and estate taxes. For 2024, this exemption is $13.61 million per individual ($27.22 million for married couples). This means you can give away up to $13.61 million over your lifetime in addition to the annual excluded gifts without owing any gift tax.

Any taxable gifts—those exceeding the annual exclusion—that you make during life reduce this lifetime exemption dollar for dollar. For example, if you give someone $25,000 in 2024, $7,000 of that exceeds the $18,000 annual limit. That $7,000 counts against your $13.61 million lifetime exemption.

“The gift tax system isn’t designed to burden average families. It’s a tool to ensure ultra-high-net-worth individuals can’t completely bypass estate taxation.” — Laura Simmons, CPA and Estate Planning Advisor

How the Lifetime Exemption Works with Estate Taxes

The lifetime exemption is “unified,” meaning it covers both lifetime gifts and what passes at death. If you use $2 million of your exemption on taxable gifts while alive, only $11.61 million remains to shield your estate from federal estate tax upon death.

It’s also inflation-adjusted annually. However, the current high exemption levels are set to sunset after 2025, reverting to approximately $6 million (adjusted for inflation) unless Congress acts to extend them.

Key Exclusions from Gift Tax

Not all transfers count as taxable gifts. The IRS excludes several types of gifts entirely, regardless of amount. These exclusions are essential tools in financial and estate planning.

| Exclusion Type | Description | Tax Implication |

|---|---|---|

| Spousal Gifts | Unlimited gifts to a U.S. citizen spouse | Fully exempt |

| Charitable Donations | Gifts to qualified nonprofits | No gift tax; may qualify for income tax deduction |

| Medical Expenses | Payments made directly to healthcare providers | Excluded from gift tax |

| Educational Expenses | Tuition paid directly to accredited institutions | Excluded (room and board not included) |

| Political Organizations | Contributions to political parties or campaigns | Not subject to gift tax |

These exclusions can be powerful. For instance, grandparents can pay a grandchild’s college tuition directly to the university without using any of their annual exclusion or lifetime exemption.

When Must You File a Gift Tax Return?

You must file IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, if you give more than the annual exclusion amount to any one person in a year—even if no tax is actually due.

Filing doesn’t mean paying. Most filers report a taxable gift that simply reduces their remaining lifetime exemption. The return documents the transaction for IRS records.

Step-by-Step Guide to Handling Large Gifts

- Determine the fair market value of the gift—cash is straightforward, but property or stocks require valuation.

- Check if the gift qualifies for an exclusion (e.g., medical, educational, spousal).

- Apply the annual exclusion per recipient. Up to $18,000 per person in 2024 is automatically exempt.

- Calculate any excess over the annual limit. This amount will count against your lifetime exemption.

- File Form 709 by April 15 of the following year if the gift exceeds the annual exclusion.

- Maintain detailed records of the gift, including appraisals and proof of payment, for future reference.

Real-Life Example: Helping a Child Buy a Home

Sarah wants to help her daughter purchase her first home. In 2024, she gives her $50,000 toward the down payment. Since the annual exclusion is $18,000, $32,000 of the gift is considered \"taxable.\"

Sarah doesn’t owe any gift tax because she has plenty of lifetime exemption remaining. However, she must file Form 709 to report the $32,000 taxable gift. This amount reduces her available lifetime exemption from $13.61 million to $13.578 million.

By documenting this now, Sarah ensures clarity for her estate later and avoids potential disputes or misunderstandings among heirs.

Common Misconceptions About Gift Tax

- Myth: All large gifts are taxed immediately.

Truth: Only gifts exceeding the lifetime exemption are subject to tax—and even then, only after death via the estate tax system. - Myth: Receiving a gift is taxable income for the recipient.

Truth: Recipients never pay income tax on gifts. The responsibility lies with the giver, if any tax applies. - Myth: Parents can give unlimited amounts to children tax-free.

Truth: Only gifts to spouses (U.S. citizens) and payments made directly for medical/education expenses are unlimited.

Frequently Asked Questions

Do I have to report a $20,000 gift to my nephew?

Yes. Since $20,000 exceeds the $18,000 annual exclusion for 2024, you must file Form 709 to report the $2,000 excess. No tax is due unless you’ve already used up your $13.61 million lifetime exemption.

Can I give $18,000 to multiple family members each year?

Absolutely. The $18,000 annual exclusion applies per recipient. You could give $18,000 to your three children, four grandchildren, and two siblings—all totaling $180,000—without filing a gift tax return.

What happens if I exceed both the annual and lifetime limits?

If your cumulative taxable gifts go beyond $13.61 million (in 2024), the excess is taxed at rates up to 40%. This is rare and typically affects only very high-net-worth individuals.

Conclusion: Plan Smart, Give Freely

The gift tax system is designed to allow individuals to share wealth during their lifetime with minimal friction. With smart use of the $18,000 annual exclusion, strategic application of exclusions for education and medical costs, and awareness of the $13.61 million lifetime exemption, most people can give generously without ever owing a dollar in gift tax.

Proper planning today can preserve wealth, strengthen family security, and simplify estate administration tomorrow. Whether you're helping a loved one through a financial milestone or laying the groundwork for intergenerational wealth, understanding the rules empowers you to act with confidence.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?