For value-oriented investors, the enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) ratio is a powerful tool for assessing a company’s true operational performance and market valuation. Unlike price-to-earnings (P/E), which focuses only on equity, EV/EBITDA accounts for both debt and cash, offering a more holistic view of a firm’s worth. But what makes an EV/EBITDA ratio “good” or “bad”? The answer isn’t universal—it depends on sector, growth trajectory, and macroeconomic context. Understanding this metric deeply can help investors avoid overpaying for assets and identify undervalued opportunities with strong fundamentals.

What Is EV/EBITDA and Why It Matters

Enterprise Value (EV) represents the total value of a company, including its market capitalization, debt, minority interests, and preferred shares, minus cash and cash equivalents. EBITDA measures operating profitability before non-operating expenses and accounting adjustments. When combined, the EV/EBITDA ratio reveals how much you're paying for each dollar of core operating earnings.

This ratio is particularly useful when comparing companies across industries or those with different capital structures. For example, two firms may have similar earnings, but one carries significantly more debt. The P/E ratio might not reflect this imbalance, but EV/EBITDA does—making it a favorite among private equity professionals and seasoned analysts.

“EV/EBITDA cuts through the noise of financing decisions and accounting policies to show what a business truly earns.” — Michael Green, Portfolio Manager at Horizon Capital

What Is Considered the 'Best' EV/EBITDA Ratio?

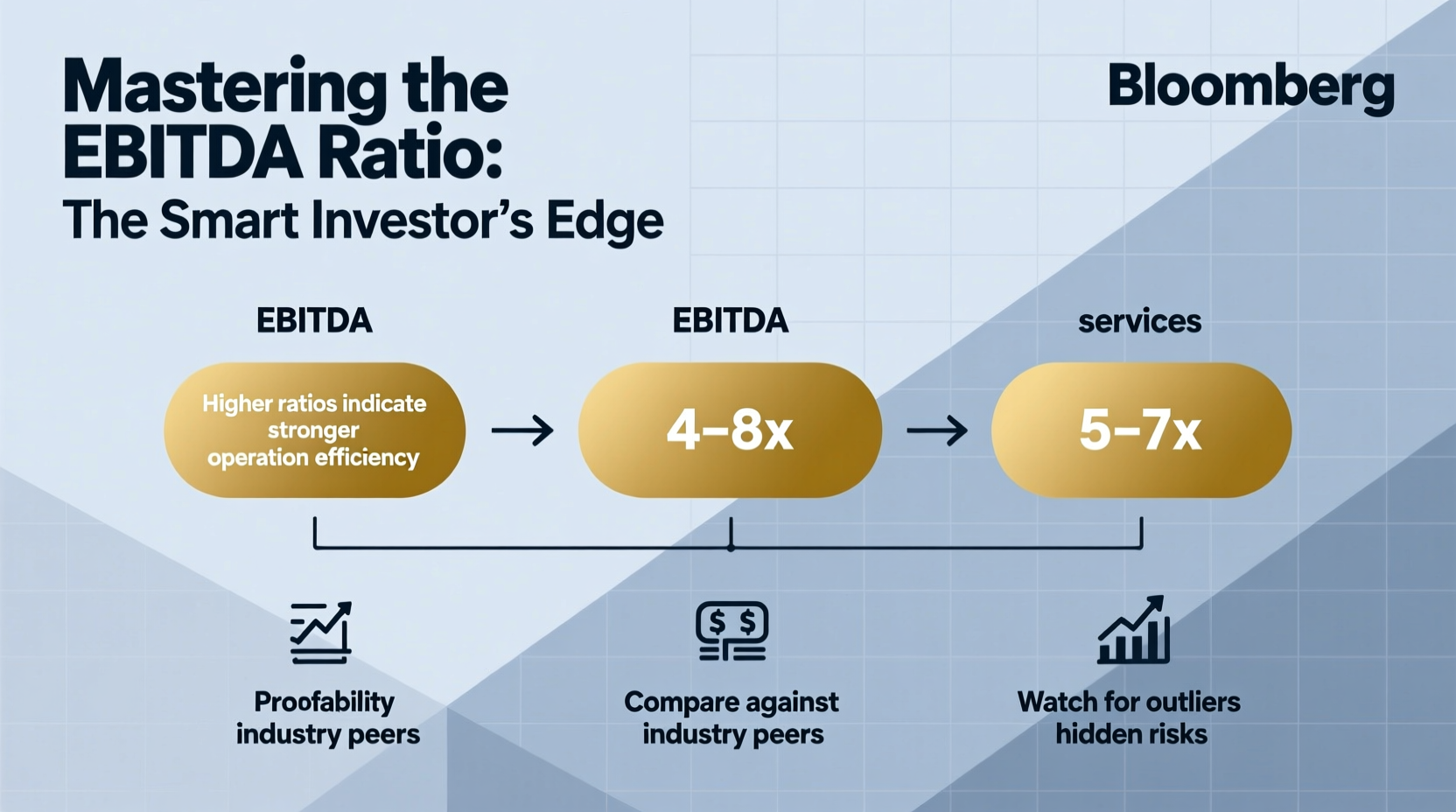

There is no single “best” EV/EBITDA number that applies to all companies. However, general benchmarks can guide initial analysis:

- Below 8x: Often considered undervalued, especially if the company has stable cash flows and manageable debt.

- 8x to 12x: A common range for mature, low-growth businesses in stable industries like utilities or consumer staples.

- 12x to 16x: Typical for growing companies in competitive sectors such as healthcare or industrials.

- Above 16x: Usually seen in high-growth or technology-driven firms, though caution is warranted if growth doesn't justify the premium.

That said, interpreting these numbers without context leads to poor decisions. A tech startup trading at 20x EV/EBITDA may be fairly valued if it's scaling rapidly, while a utility at 9x could be distressed if regulatory risks loom.

Industry Variations in EV/EBITDA Benchmarks

Different industries operate under distinct economic models, affecting their typical valuation multiples. The table below outlines average EV/EBITDA ratios across key sectors based on recent market data:

| Industry | Average EV/EBITDA (2023–2024) | Key Influencing Factors |

|---|---|---|

| Technology (SaaS & Cloud) | 14–18x | Recurring revenue, scalability, R&D intensity |

| Healthcare Providers | 9–12x | Regulatory exposure, reimbursement rates |

| Oil & Gas (Exploration) | 5–8x | Commodity price volatility, capex demands |

| Retail (Brick-and-Mortar) | 6–10x | E-commerce competition, margin pressure |

| Telecommunications | 7–11x | High fixed costs, slow growth, dividend appeal |

| Industrial Manufacturing | 9–13x | Cyclical demand, supply chain efficiency |

These ranges are starting points—not rules. A steel producer at 6x may seem cheap, but if input costs are soaring and margins shrinking, that multiple could still be excessive. Conversely, a biotech firm at 20x might appear expensive, yet a pending FDA approval could justify the premium.

How to Use EV/EBITDA in a Step-by-Step Investment Analysis

Smart investors don’t rely on any single metric. EV/EBITDA should be part of a layered analytical process. Follow this sequence to apply it effectively:

- Calculate EV: Market cap + total debt – cash and equivalents.

- Find trailing twelve-month (TTM) EBITDA: From the income statement, sum operating income plus D&A.

- Compute the ratio: Divide EV by EBITDA.

- Compare to peers: Select 3–5 direct competitors in the same sector.

- Analyze trends: Review the company’s EV/EBITDA over the past 3–5 years. Is it rising due to growth or falling because of declining earnings?

- Adjust for anomalies: Exclude one-time gains, restructuring charges, or unusual D&A spikes.

- Combine with other metrics: Pair with free cash flow yield, ROIC, and net debt/EBITDA to assess sustainability.

Red Flags Even a Good Ratio Can Hide

A low EV/EBITDA ratio often signals value, but it can also indicate fundamental problems. Known as “value traps,” these companies appear cheap for a reason—declining sales, excessive leverage, or obsolete business models.

Consider the case of LegacySteel Inc., a mid-sized manufacturer trading at just 5x EV/EBITDA in 2022. On the surface, it looked like a bargain. But deeper analysis revealed aging plants, $1.2 billion in long-term debt, and a 15% year-over-year drop in EBITDA due to cheaper foreign imports. Within 18 months, the company filed for Chapter 11. Investors who focused solely on the multiple lost over 70% of their capital.

“Low multiples attract attention, but they don’t guarantee returns. Always ask: Why is this company cheap?” — Sarah Lin, Chief Investment Officer at Apex Equity Partners

Actionable Checklist for Applying EV/EBITDA Wisely

Before making an investment decision based on EV/EBITDA, run through this checklist:

- ✅ Verified that EBITDA excludes non-recurring items (e.g., asset sales, legal settlements).

- ✅ Compared the ratio to at least three peer companies in the same industry.

- ✅ Reviewed the trend of EV/EBITDA over time—upward? Downward? Volatile?

- ✅ Assessed net debt levels—high leverage can distort the apparent value.

- ✅ Cross-checked with free cash flow—does EBITDA translate into real cash generation?

- ✅ Considered growth prospects—is the company expanding, stagnant, or contracting?

Frequently Asked Questions

Is a lower EV/EBITDA always better?

No. While a lower ratio can suggest undervaluation, it may also signal underlying risks such as declining earnings, poor management, or structural industry challenges. Always investigate the cause behind a low multiple.

Can EV/EBITDA be negative?

Yes—if a company has negative EBITDA (operating losses) or negative enterprise value (more cash than total valuation), the ratio becomes meaningless. In such cases, alternative metrics like price-to-sales or EV/Sales are more appropriate.

Why use EV/EBITDA instead of P/E?

EV/EBITDA includes debt and cash, making it capital-structure neutral. It’s also less affected by tax strategies and depreciation policies. P/E relies on net income, which can be distorted by interest expenses and one-time charges.

Conclusion: Think Beyond the Number

The EV/EBITDA ratio is a valuable lens for evaluating business value, but it’s not a standalone verdict. The “best” ratio depends on context—industry norms, financial health, and future potential. Smart investors use it not as a trigger for action, but as a gateway to deeper inquiry. By combining this metric with qualitative insights and complementary financial indicators, you position yourself to spot genuine value where others see only a number.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?