Filing for unemployment is often a necessary step during job transitions, layoffs, or economic downturns. While the process is designed to be accessible, many applicants are uncertain about how long it takes to file—and more importantly—how long it takes to receive benefits. The timeline can vary significantly based on location, individual circumstances, and administrative workload. Understanding the key factors that influence processing time helps applicants prepare, reduce delays, and manage expectations.

Typical Timeline for Filing and Receiving Benefits

The time it takes to file an unemployment claim is generally short—most applications can be completed online in under an hour. However, the full process from application submission to receiving the first payment typically spans one to three weeks, depending on several variables.

In most U.S. states, applicants can expect:

- Application filing: 30–60 minutes (online)

- Initial processing: 7–14 days

- First benefit payment: 10–21 days after filing, if no issues arise

- Back pay issuance: Retroactive to the week of initial application, if approved

Some states, like Texas and Florida, report faster processing times (within 7–10 days), while others such as New York or California may take longer due to higher volume or verification requirements.

“The average applicant should not expect immediate payments. There’s always a lag between filing and disbursement due to identity checks, employer response periods, and system backlogs.” — Laura Simmons, State Workforce Development Analyst

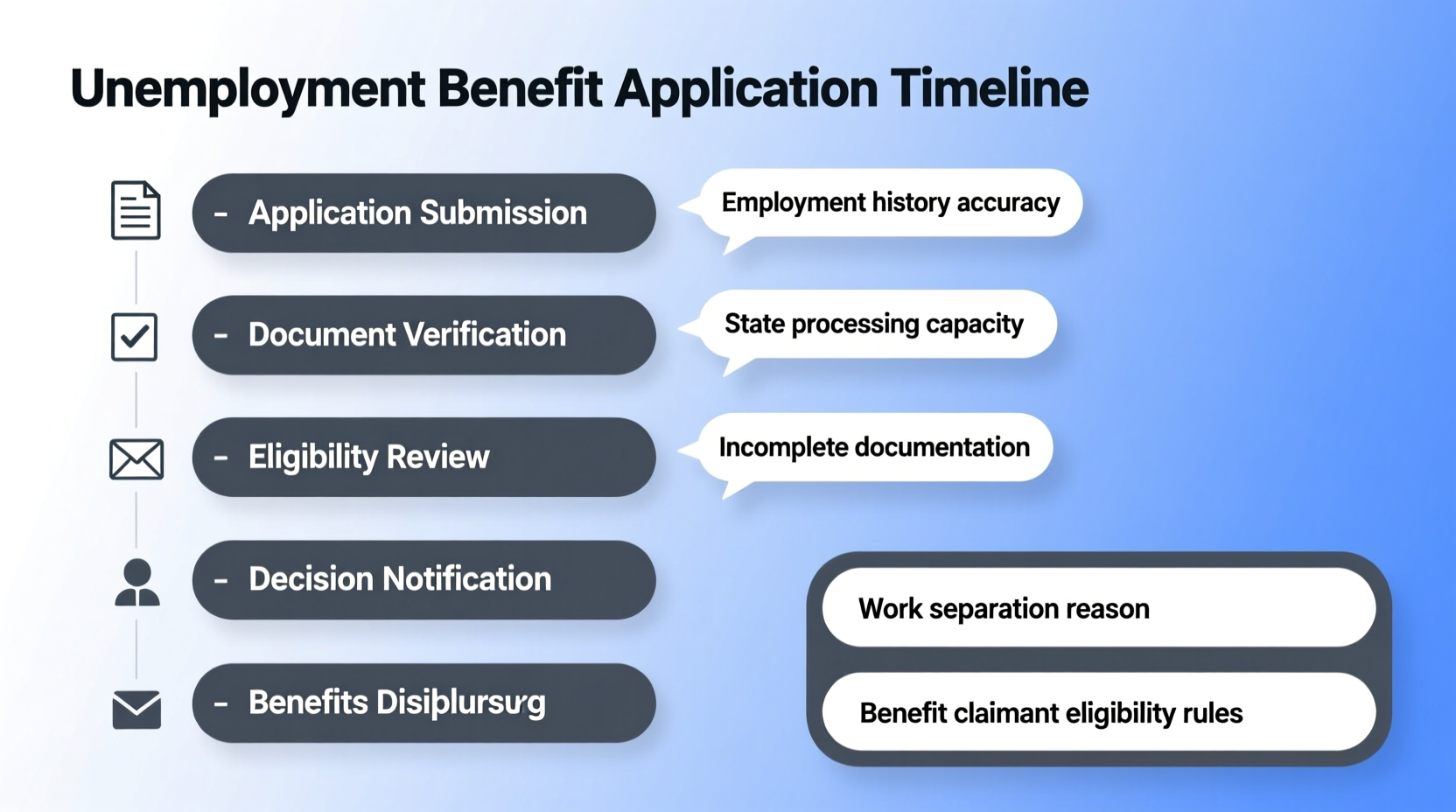

Key Factors That Influence Processing Time

While the basic structure of unemployment claims is similar nationwide, outcomes depend heavily on external and personal factors. Being aware of these can help applicants avoid preventable delays.

1. State Workload and System Capacity

States with outdated technology or high unemployment rates often experience slower processing. During the 2020 pandemic, some states took over eight weeks to issue first payments due to unprecedented demand and overwhelmed systems.

2. Completeness and Accuracy of Application

Mistakes such as incorrect employment dates, mismatched wages, or missing employer details trigger manual reviews. These can add days or even weeks to processing time. Always double-check entries before submitting.

3. Employer Response Time

After you file, your last employer is notified and given a window (usually 7–10 days) to respond. If they dispute your claim—citing reasons like voluntary resignation or misconduct—the state must investigate, delaying approval.

4. Identity Verification Requirements

To prevent fraud, many states require additional verification steps, such as uploading documents or completing a video interview. Failure to complete these promptly halts the process.

5. Weekly Certification Delays

Even after approval, you must certify weekly (or biweekly) that you’re still unemployed and meeting work search requirements. Missing a certification delays that week’s payment.

Step-by-Step Guide to Filing Unemployment Efficiently

Following a structured approach minimizes errors and speeds up processing. Use this timeline to stay on track:

- Day 1: Gather Required Information

Collect Social Security number, driver’s license, employment history for the past 18 months, employer contact details, and reason for job separation. - Day 1: Visit Your State’s Unemployment Website

Search “[Your State] + unemployment insurance” to find the official portal. Avoid third-party sites. - Day 1–2: Complete the Initial Claim

Fill out all fields accurately. Save progress if allowed. Review thoroughly before submission. - Day 3–5: Confirm Submission and Set Up UI Account

Check email and mail (physical or digital) for confirmation notices or requests for additional information. - Week 1–2: Respond Promptly to Requests

If the state asks for wage transcripts, ID proof, or work search logs, submit them within 48 hours. - Week 2–3: Begin Weekly Certifications

Once eligible, log in weekly to certify availability for work and continue receiving payments.

Do’s and Don’ts When Applying for Unemployment

| Do’s | Don’ts |

|---|---|

| File immediately after job loss | Wait weeks to apply “just in case” |

| Keep records of all communications | Ignore letters or emails from the unemployment office |

| Search for jobs as required by your state | Claim you’re actively searching without documentation |

| Use direct deposit for faster payments | Rely on paper checks if avoidable |

| Report any part-time income truthfully | Withhold earnings information to get full benefits |

Real Example: Maria’s Experience in Illinois

Maria, a customer service representative from Chicago, was laid off in March 2023 due to company downsizing. She waited four days before applying, thinking she might get rehired. When she finally filed, she missed the first week of eligibility because Illinois has a “waiting week” that isn’t paid.

Her application triggered a review because her employer reported her separation as “job abandonment,” which Maria disputed. She submitted a written explanation and copies of her termination letter. It took 18 days to resolve the dispute and begin payments. Once approved, she received back pay for five weeks but lost the waiting week.

Had Maria applied immediately and provided documentation upfront, she could have reduced the delay by nearly a week.

Checklist: Prepare for a Smooth Unemployment Claim

- ✅ Know your state’s unemployment website and login system

- ✅ Collect all employment details (dates, addresses, supervisors)

- ✅ Have your Social Security card and government-issued ID ready

- ✅ Write a clear, factual reason for job separation

- ✅ Set up direct deposit through your state’s portal

- ✅ Schedule time each week for certification

- ✅ Track job applications and save correspondence as proof of active search

Frequently Asked Questions

Can I file for unemployment if I quit my job?

Generally, quitting disqualifies you unless you left for “good cause” recognized by your state—such as unsafe working conditions, health issues, or relocating due to a spouse’s military transfer. You’ll need to provide evidence, and approval is not guaranteed.

What happens if my claim is delayed?

Delays don’t necessarily mean denial. Most are due to verification needs or incomplete info. Respond quickly to any requests. If no communication comes after 14 days, call your state’s unemployment office to check status.

Will I get back pay if my claim takes weeks to process?

Yes, if approved, benefits are retroactive to the week you first filed (minus any unpaid waiting week). For example, if you apply on a Monday and are approved three weeks later, you’ll receive payments for all three weeks, assuming weekly certifications were completed.

Conclusion: Take Action Now to Secure Your Benefits

Filing for unemployment doesn’t have to be overwhelming, but timing and accuracy are critical. While the average processing window is 10–21 days, proactive preparation can shorten that timeline and reduce stress. Every day you delay increases the risk of gaps in coverage, especially in states with non-paid waiting weeks.

Start today: gather your documents, visit your state’s official unemployment site, and submit your claim. Stay responsive, document everything, and meet all weekly requirements. By treating the process with urgency and precision, you protect your financial stability during uncertain times.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?