Tax season may come once a year, but the responsibility of managing your financial documents extends far beyond April 15. Many taxpayers assume that once they’ve filed their return, the job is done. But what happens if the IRS comes knocking? Or if you need to prove income for a mortgage application? Keeping accurate and complete tax records isn’t just about compliance—it’s about protecting your financial future. Understanding how long to retain these documents can prevent costly mistakes, reduce stress during audits, and ensure you’re prepared for life’s major financial milestones.

General Guidelines: How Long Should You Keep Tax Records?

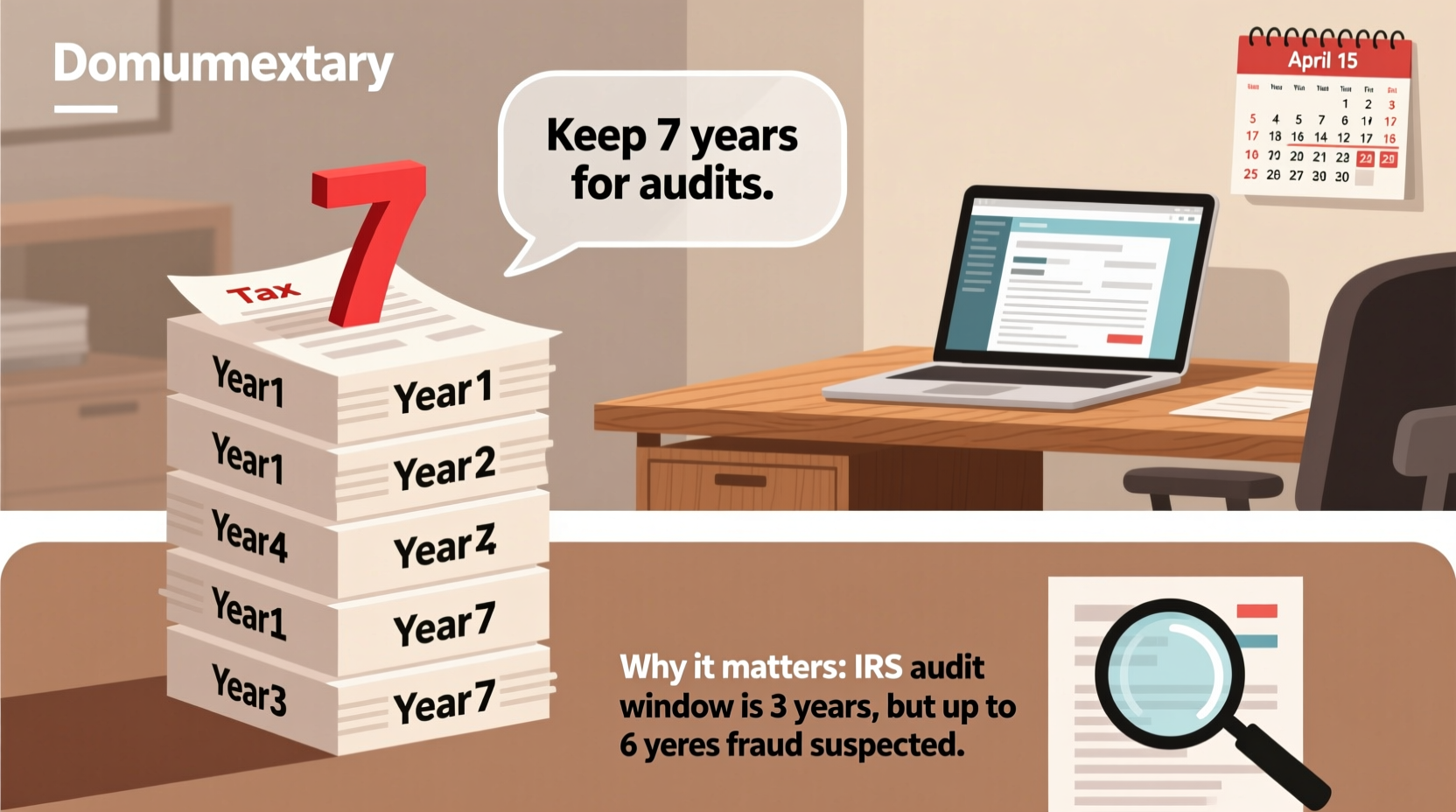

The Internal Revenue Service (IRS) doesn’t expect you to store decades of paperwork indefinitely. However, there are clear guidelines based on different types of filings and circumstances. The standard recommendation is to keep most tax records for at least **three years** from the date you filed your original return or two years from the date you paid the tax, whichever is later. This aligns with the IRS’s general statute of limitations for auditing returns.

But three years isn’t always enough. In certain cases, the IRS has up to six years to audit you—especially if you underreported your gross income by more than 25%. For example, if you failed to report 30% of your income, the IRS could legally challenge your return up to six years after filing. In rare cases involving fraud or failure to file, there is no time limit at all.

What Documents Should You Keep—and for How Long?

Not all tax-related documents have the same retention period. Some forms carry long-term importance due to their connection with property, investments, or business ownership. Below is a detailed breakdown of key documents and recommended retention periods:

| Document Type | Retention Period | Reason |

|---|---|---|

| Federal Income Tax Returns (Form 1040) | 7 years | Supports audits, claims for credits, and proof of income |

| W-2s, 1099s, and other income statements | 7 years | Verify reported income; needed for loan applications |

| Receipts for deductible expenses (charitable donations, medical costs) | 3–7 years | Justify itemized deductions if questioned |

| Records of home purchase, improvements, and sale | Indefinitely (or until 3 years after sale) | Determine capital gains and basis adjustments |

| Investment statements and cost basis records | Until sold + 3 years | Calculate taxable gains or losses accurately |

| Business expense logs and mileage records | 7 years | Required for self-employed individuals and small businesses |

| Proof of charitable contributions over $250 | 7 years | IRS requires written acknowledgment |

When You Need to Keep Records Longer Than Seven Years

In some situations, even seven years isn’t sufficient. Consider these exceptions where extended—or permanent—recordkeeping is wise:

- Homeownership: Keep records related to the purchase, major renovations, and sale of your home indefinitely. These documents help establish your cost basis, which directly affects capital gains taxes when you sell.

- Stocks, Real Estate, and Investments: Maintain transaction histories and brokerage statements until you’ve disposed of the asset and retained the final sale records for at least three additional years.

- Self-Employment and Business Ownership: If you operate a business, especially one with inventory or depreciation claims, retain all supporting documentation for at least seven years. The IRS scrutinizes business returns more closely due to higher risk of errors or omissions.

- Estate and Inheritance Planning: Documents tied to inherited assets, trusts, or estate tax filings should be preserved permanently by beneficiaries to support future tax calculations.

“Many people don’t realize that selling a home without proper records can trigger unnecessary tax bills. Keeping those early purchase agreements and renovation receipts can save thousands.” — David Lin, CPA and Tax Advisor

Real-Life Example: A Missed Receipt, A Costly Mistake

Sarah, a freelance graphic designer, claimed a $4,200 deduction for a new laptop and design software as a business expense. Three years later, she received an IRS notice questioning the deduction. She had discarded her receipt after filing, assuming the audit window had closed. Because she couldn’t substantiate the expense, the IRS disallowed the deduction, added interest, and assessed a small penalty. The oversight cost her over $1,500 in back taxes and fees. Had she kept the receipt and invoice for seven years, she could have easily proven the claim and avoided the entire issue.

This scenario is more common than many realize. The IRS doesn’t need to prove you lied—just that you can’t prove you were right. Documentation is your defense.

Best Practices for Organizing and Storing Tax Records

Knowing how long to keep records is only half the battle. The way you store them matters just as much. Here’s a step-by-step guide to effective record management:

- Digitize whenever possible: Scan receipts, W-2s, and bank statements. Use secure cloud storage with encryption (e.g., Google Drive, Dropbox, or dedicated financial apps).

- Organize by year and category: Create folders labeled “2023 – Taxes,” then subfolders like “Income,” “Deductions,” “Home,” and “Investments.”

- Back up your data: Store digital copies in two separate locations—one local (external hard drive), one offsite (cloud).

- Label physical files clearly: If keeping paper, use labeled binders or envelopes. Avoid basements or attics where moisture and heat can damage documents.

- Shred responsibly: Once records are past their retention period, use a cross-cut shredder to destroy sensitive information and prevent identity theft.

Frequently Asked Questions

Can I throw away old tax returns after seven years?

In most cases, yes. After seven years, the likelihood of an IRS audit drops significantly. However, never discard records related to property, investments, or business assets until you’ve fully accounted for their impact on current or future tax returns.

Do I need to keep state tax records as long as federal ones?

Generally, yes. Most states follow similar audit timelines as the federal government, though some have longer statutes of limitations. Check your state’s department of revenue guidelines to be sure.

What if I’m audited and don’t have the records?

The burden of proof is on you. Without documentation, the IRS will likely disallow deductions or adjust your return, potentially leading to additional taxes, penalties, and interest. Even estimates are not accepted without some form of substantiation.

Action Plan: Your Tax Record Retention Checklist

- ✅ Keep all federal tax returns for at least 7 years

- ✅ Save W-2s, 1099s, and income statements for 7 years

- ✅ Store receipts for deductions (medical, charity, business) with corresponding returns

- ✅ Maintain home purchase and improvement records indefinitely

- ✅ Keep investment transaction history until asset is sold + 3 years

- ✅ Digitize and back up important documents annually

- ✅ Shred expired records securely to protect personal data

Final Thoughts: Why This Matters More Than You Think

Tax records aren’t just for the IRS. Lenders, landlords, universities, and even employers may request proof of income or financial history. A well-maintained archive gives you control over your financial narrative. It protects you from audits, supports legitimate claims, and ensures you’re not overpaying on capital gains or missing out on eligible credits.

Think of tax recordkeeping not as a chore, but as part of your long-term financial hygiene. Just as you wouldn’t skip routine car maintenance, don’t neglect the upkeep of your financial documents. The few hours you spend organizing today could save you thousands—and untold stress—tomorrow.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?