Customer Acquisition Cost (CAC) is one of the most critical metrics for any business investing in marketing. It reveals how much you're spending to win each new customer—and whether that investment is paying off. Yet, many companies miscalculate CAC or fail to act on the insights it provides. Getting this number right isn’t just about spreadsheets; it’s about aligning marketing strategy with long-term profitability.

When CAC is too high relative to customer lifetime value (LTV), even rapid growth can mask financial instability. Conversely, a well-optimized CAC allows businesses to scale efficiently, reinvest in high-performing channels, and maintain competitive advantage. This guide breaks down how to calculate CAC with precision and leverage that data to refine your marketing strategy.

Understanding Customer Acquisition Cost: The Core Formula

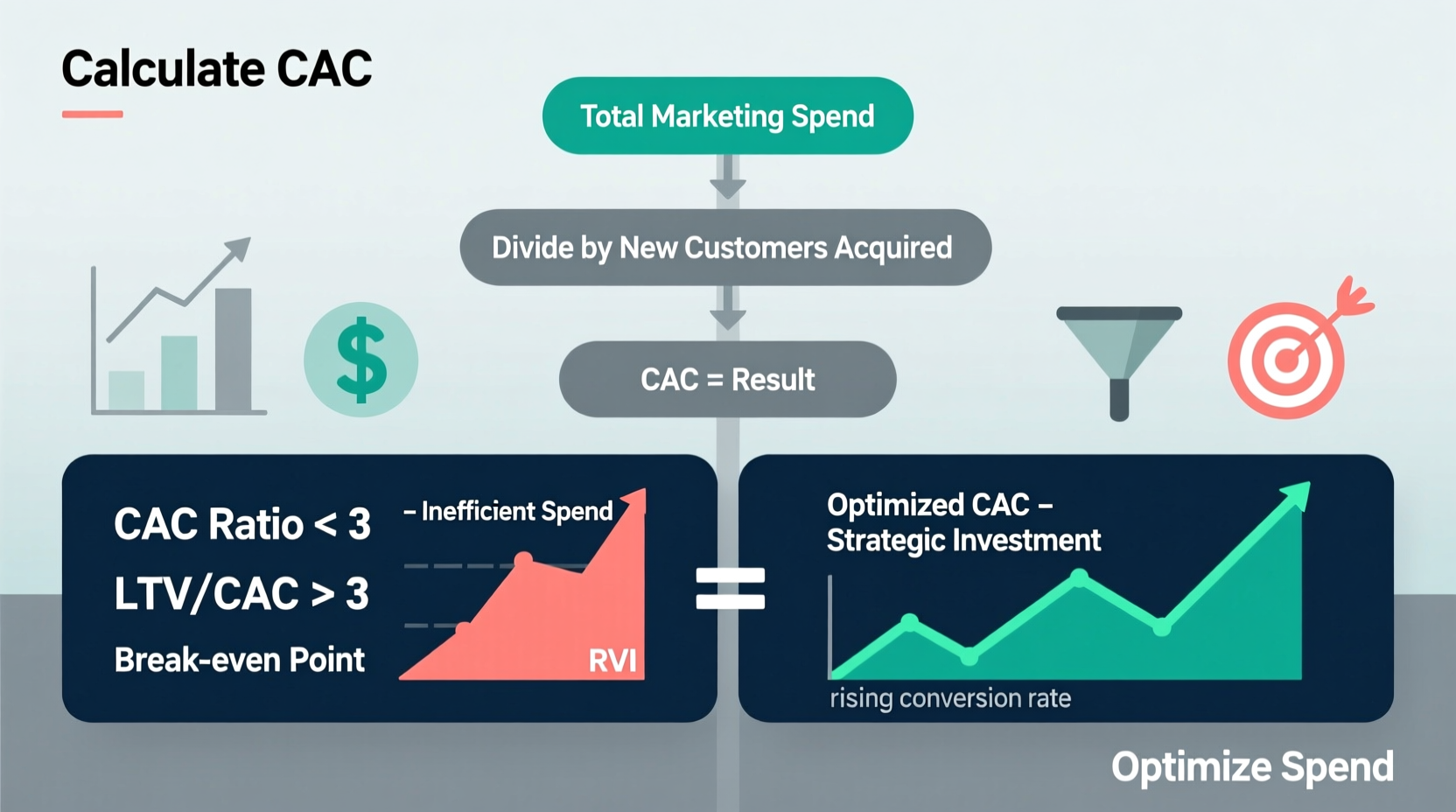

The basic formula for CAC is simple:

CAC = Total Marketing & Sales Expenses ÷ Number of New Customers Acquired

This includes all costs directly tied to acquiring customers over a specific period—salaries for marketing and sales teams, ad spend, tools (e.g., CRM, analytics platforms), agency fees, and overheads like software subscriptions used for campaigns.

For example, if your company spends $50,000 on marketing and sales in a quarter and acquires 500 new customers during that time, your CAC is $100.

Breaking Down the Components of Accurate CAC Calculation

To avoid misleading results, go beyond the surface-level formula. Consider these often-overlooked elements:

- Attribution windows: When did the customer convert? Was it due to an ad seen three weeks ago? Use multi-touch attribution models to assign credit across touchpoints.

- Channel-specific CAC: Calculate CAC separately for paid search, social media, email, and organic efforts. This helps identify underperformers.

- Sales cycle length: For B2B or high-consideration products, factor in delayed conversions. A lead generated today may not become a customer for months.

- Blended vs. marginal CAC: Blended CAC averages all costs, while marginal CAC measures the cost of acquiring the last few customers. Marginal CAC often rises as channels saturate.

Ignoring these nuances can make a campaign appear profitable when it’s actually eroding margins.

Step-by-Step Guide to Calculating and Validating Your CAC

- Define your time period (e.g., Q1 2024).

- Compile all relevant expenses: Include salaries, ad spend, creative production, tech stack costs, and contractor fees tied to acquisition.

- Isolate new customers only: Exclude renewals, referrals from existing customers (unless incentivized), or internal transfers.

- Attribute customers to the correct period: Use first-touch or UTM tracking to align signups with campaign timelines.

- Calculate total CAC and break it down by channel.

- Cross-check with LTV: Ensure CAC is no more than 30% of average customer lifetime value for healthy unit economics.

Optimizing Marketing Spend Based on CAC Insights

Once you have accurate CAC figures, the real work begins: optimization. Not all customers are equally valuable, and not all channels perform the same. Here’s how to use CAC data strategically:

- Pause or scale back channels where CAC exceeds acceptable thresholds.

- Double down on channels delivering below-average CAC and strong retention.

- A/B test creatives, landing pages, and offers to lower conversion costs within high-potential channels.

- Negotiate vendor pricing or explore self-service alternatives to reduce overhead.

Optimization isn’t a one-time task—it requires continuous monitoring and adjustment as market conditions change.

Real Example: SaaS Startup Reduces CAC by 38%

A mid-sized SaaS company noticed their overall CAC had risen to $220, making profitability unsustainable. Upon deeper analysis, they found that LinkedIn Ads were driving only 5% of new customers but consuming 35% of the budget. Meanwhile, SEO and referral traffic had a near-zero marginal cost but weren’t being prioritized.

The team reallocated 60% of the LinkedIn budget to content creation and technical SEO improvements. Within six months, organic signups increased by 72%, and blended CAC dropped to $136. Retention also improved because organically acquired users were more product-aligned.

“Many companies optimize for vanity metrics like clicks or impressions. The smart ones optimize for cost per *valuable* customer.” — Lisa Tran, Growth Strategist at ScaleMetrics

Do’s and Don’ts of CAC Management

| Do’s | Don’ts |

|---|---|

| Track CAC by channel and customer segment | Use total revenue instead of new customer count in the formula |

| Include fully loaded costs (salaries, tools, overhead) | Ignore sales team commissions or agency retainers |

| Compare CAC against LTV and payback period | Assume last-click attribution is always accurate |

| Review CAC monthly for fast-moving markets | Calculate CAC only once per year |

Actionable Checklist: Master Your CAC in 7 Steps

- Collect all marketing and sales expenses for the past quarter.

- Verify the number of new paying customers acquired in that period.

- Break down spend and acquisitions by channel (e.g., Facebook, Google, Email).

- Calculate both blended and channel-specific CAC.

- Compare each channel’s CAC to its customer retention and average order value.

- Identify the top two channels with the lowest CAC and highest quality customers.

- Reallocate 20–50% of underperforming channel budgets to top performers and test iterations.

Frequently Asked Questions

What if my CAC is higher than my product price?

This is a red flag. If your CAC exceeds the initial transaction value, you’re losing money on every sale unless customers make repeat purchases quickly. Focus on improving conversion rates, increasing average order value, or reducing acquisition costs through targeting or creative optimization.

Should I include referral program costs in CAC?

Yes—if you’re actively incentivizing referrals (e.g., offering discounts or cash rewards), those costs are part of acquisition and should be included. Organic word-of-mouth without incentives doesn’t count.

How often should I recalculate CAC?

Monthly for most businesses. High-growth startups or seasonal brands may need weekly tracking during peak periods. Regular recalibration ensures you catch inefficiencies early.

Conclusion: Turn CAC Into a Strategic Lever

Accurately calculating customer acquisition cost transforms marketing from a cost center into a strategic engine. It’s not just a number—it’s a diagnostic tool that reveals where your resources are working and where they’re leaking. By measuring CAC with precision and acting on the insights, you gain control over growth, profitability, and long-term sustainability.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?