Understanding your income structure is essential whether you're filing taxes, applying for a loan, or managing personal finances. While net income reflects what you take home after deductions, gross income represents your total earnings before any subtractions. For many individuals—especially freelancers, contractors, or those with variable pay—reconstructing gross income from net can be challenging but necessary. This guide walks you through the process with precision, using real-world logic and practical tools.

Why Gross Income Matters

Gross income is more than just a number on a tax form. Lenders use it to assess creditworthiness. Employers may reference it during salary negotiations. Tax authorities require accurate reporting of total earnings. Yet, when all you have is your net income—what actually lands in your bank account—determining the original gross figure requires reverse engineering.

The key lies in understanding the components that reduce gross income to net: taxes (federal, state, local), Social Security and Medicare contributions (FICA), retirement plan contributions, health insurance premiums, wage garnishments, and other pre-tax or post-tax deductions.

“Accurate gross income calculation ensures financial transparency, especially when self-employed or working under non-traditional employment arrangements.” — Lisa Tran, CPA and Financial Literacy Advocate

Step-by-Step: Reversing Net to Gross Income

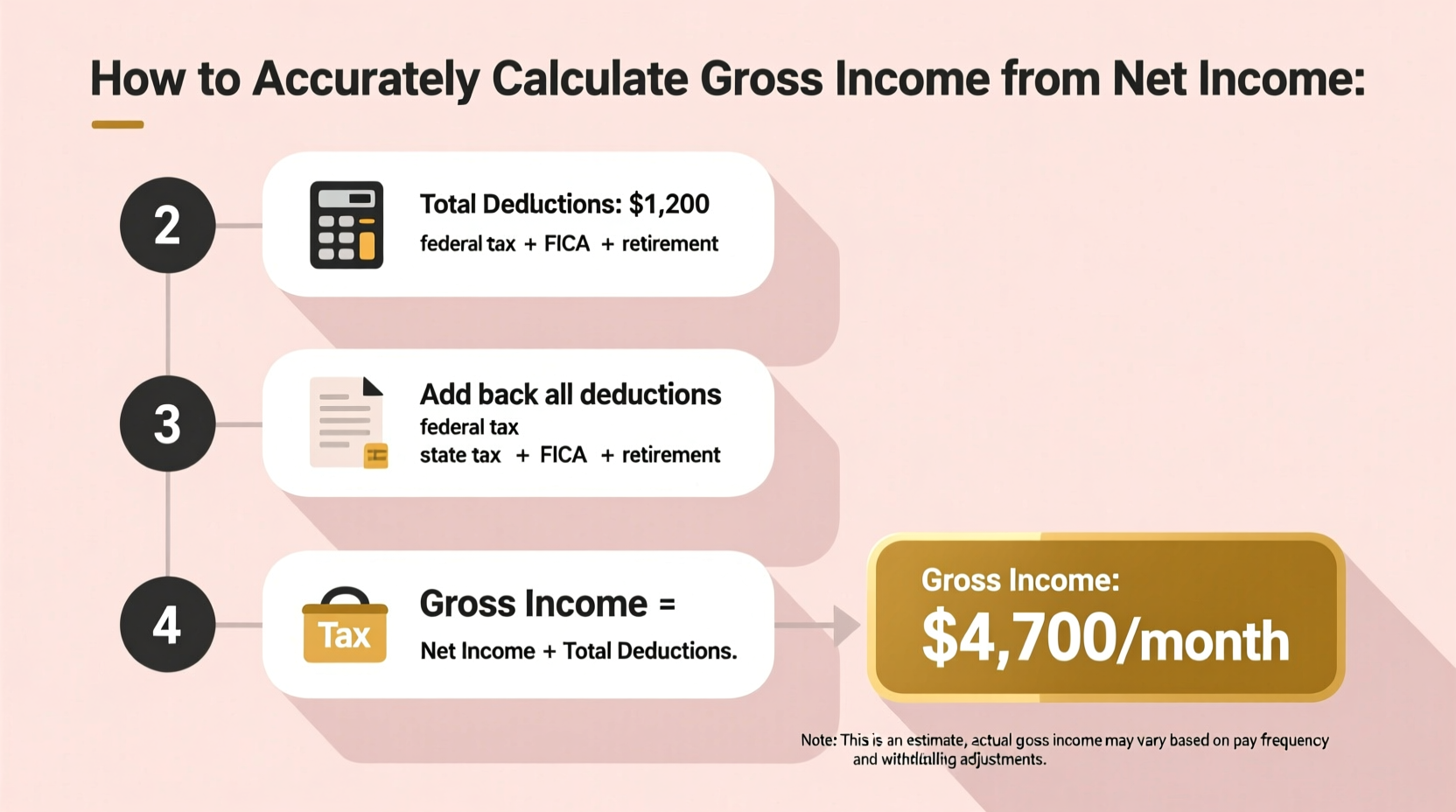

To reconstruct gross income from net, follow this structured approach. The method applies to salaried employees, hourly workers, and independent contractors alike.

- Collect Your Net Pay Stub or Bank Statement

Start with the clearest record of your take-home pay. If you’re an employee, use a recent pay stub. Freelancers should pull payment summaries from platforms like PayPal, Upwork, or direct client transfers. - Identify All Deductions

List every deduction shown on your pay statement:- Federal income tax

- State and local income taxes

- Social Security (6.2%)

- Medicare (1.45%)

- Pre-tax benefits (health, dental, vision, HSA, 401(k))

- Post-tax deductions (union dues, charitable giving)

- Wage garnishments

- Determine Pre-Tax vs. Post-Tax Deductions

Pre-tax deductions lower your taxable income and must be added back *before* tax calculations. Post-tax deductions are subtracted after taxes and are added directly to net income to reach gross. - Add Back Post-Tax Deductions to Net Income

If your net pay was $3,200 and you paid $100 in union dues (post-tax), your adjusted net becomes $3,300. - Reverse Engineer Taxes Using Known Rates

This is the core mathematical challenge. You need to isolate the portion of taxes withheld based on known percentages. Use the formula:Gross Income = (Net Income + Post-Tax Deductions) / (1 – Total Tax Rate – Pre-Tax Deduction Rate)For example, if combined tax rates (federal, state, FICA) equal 22% and pre-tax retirement contributions are 5%, then divide adjusted net by (1 – 0.27) = 0.73.

- Add Back Pre-Tax Contributions

Once you’ve calculated the base gross amount before taxes, add any pre-tax deductions such as 401(k) contributions or health insurance to arrive at total gross income.

Real Example: Freelancer Recalculating Annual Gross

Jamal works as a freelance graphic designer. Over the past year, he received $48,000 in net payments via various platforms. He knows he set aside approximately 25% for taxes but didn’t track exact withholdings because platforms don’t automatically deduct them.

To determine his gross income, Jamal considers that as a self-employed individual, he’s responsible for both the employer and employee portions of FICA (totaling 15.3%). He estimates effective federal and state tax rates at 10%, bringing his total tax burden to about 25.3%. Since no pre-tax deductions apply, he uses the simplified formula:

Gross = Net / (1 – Tax Rate)

Gross = $48,000 / (1 – 0.253) = $48,000 / 0.747 ≈ $64,257

Jamal concludes his gross income was approximately $64,257. This figure is critical when filing Schedule C and calculating self-employment tax.

Common Pitfalls and How to Avoid Them

- Mistaking net for gross on loan applications — Doing so can lead to denial or underqualification.

- Ignoring pre-tax contributions — Retirement or health plan amounts aren't part of net pay but are part of gross earnings.

- Using flat tax assumptions across states — State tax rates vary widely; always verify your specific rate.

- Overlooking local taxes — Cities like New York, Philadelphia, and Denver impose additional income taxes.

| Deduction Type | Included in Gross? | Added Back When Calculating Gross? |

|---|---|---|

| Federal Income Tax | Yes | No — already part of gross reduction |

| Social Security & Medicare | Yes | No — deducted from gross |

| 401(k) Contribution (pre-tax) | Yes | Yes — must be added to taxable wages |

| Health Insurance Premium (pre-tax) | Yes | Yes — included in gross earnings |

| Union Dues (post-tax) | No | Yes — added to net before reversing taxes |

| Roth 401(k) Contribution | No | Yes — post-tax, added to net first |

Checklist: Accurately Calculate Gross from Net

- ✅ Gather at least one full pay period’s documentation (pay stub, invoice, bank deposit record)

- ✅ Identify all deductions: taxes, insurance, retirement, garnishments

- ✅ Separate pre-tax from post-tax deductions

- ✅ Research applicable tax rates (federal, state, FICA)

- ✅ Apply the reverse calculation formula

- ✅ Add back pre-tax benefits to final gross figure

- ✅ Verify result against prior-year W-2 or 1099 forms if available

Frequently Asked Questions

Can I calculate gross income without a pay stub?

Yes, but accuracy depends on reliable records. Estimate deductions based on typical rates (e.g., 15.3% for self-employment tax, average federal bracket). Use accounting software or consult a tax professional for better precision.

Does gross income include bonuses and overtime?

Absolutely. Gross income encompasses all compensation before deductions: base salary, commissions, bonuses, tips, overtime, and taxable fringe benefits. Ensure these are reflected in your reconstruction.

What if my tax withholding varies each month?

Use an average across multiple pay periods. Fluctuations often occur due to changes in filing status, extra income, or seasonal work. Averaging smooths out anomalies and improves estimation accuracy.

Final Thoughts: Take Control of Your Financial Picture

Knowing how to reverse-engineer gross income from net isn’t just useful—it’s empowering. Whether you’re budgeting, negotiating a new job, or preparing tax returns, having a clear grasp of your total earnings strengthens your financial decision-making. The process demands attention to detail, but once mastered, it becomes a repeatable skill that pays dividends in accuracy and confidence.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?