Importing goods from China to the United States is a common practice for businesses and individuals alike, but miscalculating duties can lead to unexpected costs and delays. U.S. Customs and Border Protection (CBP) enforces strict regulations on imported products, and understanding how to calculate import duty correctly ensures compliance and protects your bottom line. This guide walks through every essential step—from identifying your product’s classification to factoring in additional fees—so you can estimate total landed costs with confidence.

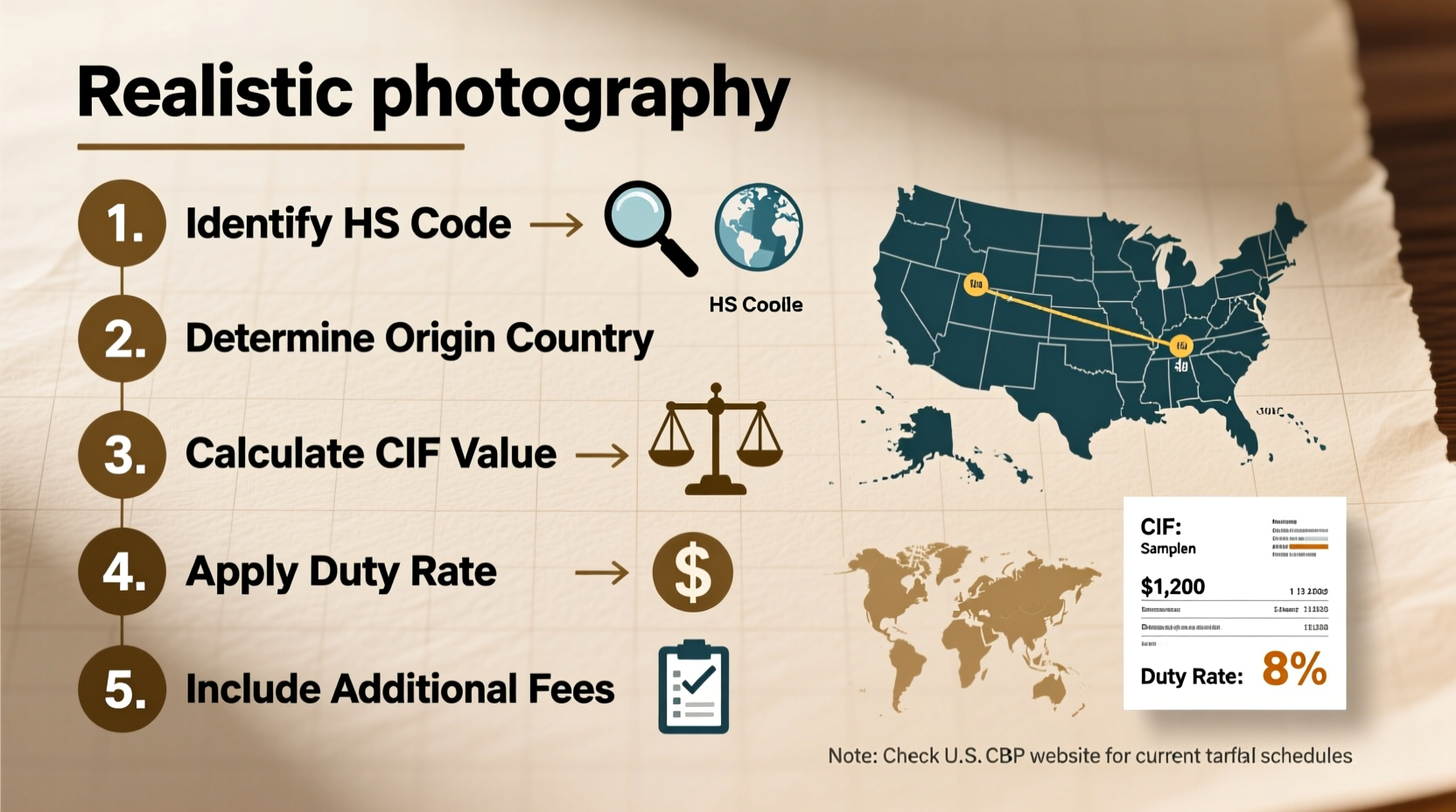

Step 1: Identify the Correct Harmonized System (HS) Code

The first and most critical step in calculating import duty is determining the correct Harmonized System (HS) code for your product. The HS system is an internationally standardized method of classifying traded products. In the U.S., this is extended into the Harmonized Tariff Schedule (HTS), which assigns specific duty rates based on product type.

To find the right HTS code:

- Visit the U.S. International Trade Commission’s HTS database.

- Search using keywords describing your product (e.g., “plastic kitchen utensils” or “LED light bulbs”).

- Review the results and select the code that best matches your item’s material, function, and design.

For example, ceramic coffee mugs fall under HTS code 6912.00.45, which carries a base duty rate of 17.5%. Misclassifying your product—even slightly—can result in incorrect duty assessments and potential penalties.

Step 2: Determine the Customs Value of Your Shipment

Duty is not calculated on the retail price of goods but on their “customs value,” also known as the transaction value. According to CBP, this includes:

- The price paid for the goods

- Any royalties or licensing fees tied to the sale

- Packing costs incurred before shipment

- Transportation and insurance up to the point of entry into the U.S.

For instance, if you purchase 500 Bluetooth speakers at $10 each ($5,000 total), pay $300 for export packaging, and $700 for shipping and insurance to Los Angeles, the customs value is $6,000.

“Accurate valuation is foundational. Understating value—even unintentionally—can lead to fines or seizure.” — James Reed, Former CBP Compliance Officer

Step 3: Apply the Applicable Duty Rate

Once you have the HTS code and customs value, apply the corresponding duty rate. Most products are subject to one of three types of tariffs:

| Duty Type | Description | Example |

|---|---|---|

| Ad Valorem | A percentage of the customs value | 10% on wooden furniture (HTS 9403.60) |

| Specific | A fixed amount per unit (e.g., per kilogram or item) | $0.50 per square meter of fabric |

| Compound | A combination of ad valorem and specific rates | 5% + $0.20 per liter on certain beverages |

Let’s say your shipment of 500 Bluetooth speakers has an HTS code of 8518.29.00, with a duty rate of 2.5% ad valorem. With a customs value of $6,000, the basic import duty would be:

$6,000 × 0.025 = $150

Step 4: Account for Additional Fees and Taxes

Import duty is only part of the total cost. Other mandatory charges often apply:

- Merchandise Processing Fee (MPF): A CBP fee calculated as 0.3464% of the entered value, with a minimum of $27.23 and maximum of $538.10 per formal entry.

- Harbor Maintenance Fee (HMF): 0.125% of the cargo value, applied to ocean shipments.

- Additional Tariffs (e.g., Section 301): Products from China may be subject to extra duties due to trade policies. As of 2024, many electronics, machinery, and consumer goods face an additional 7.5%–25% tariff.

Using our speaker example:

- MPF: $6,000 × 0.003464 = $20.78 → But since this is below the $27.23 minimum, you’ll pay $27.23

- HMF: $6,000 × 0.00125 = $7.50

- If the product falls under List 3 of Section 301 tariffs: $6,000 × 0.25 = $1,500 additional duty

Total additional fees: $27.23 + $7.50 + $1,500 = $1,534.73

Combined with the base duty of $150, total import costs reach $1,684.73—more than 28% of the shipment’s value.

Step 5: Real-World Example – Importing Smartwatches

Consider a small business owner importing 200 smartwatches from Shenzhen. Each watch costs $45, shipping is $500, and insurance is $100.

Customs Value: (200 × $45) + $500 + $100 = $9,600

The watches are classified under HTS 8517.12.00 (wireless communication devices), with a base duty of 0%, but they fall under Section 301 with an additional 7.5% tariff.

Section 301 Duty: $9,600 × 0.075 = $720

MPF: $9,600 × 0.003464 = $33.25 (above minimum, so valid)

HMF: $9,600 × 0.00125 = $12.00

Total Import Costs: $720 + $33.25 + $12.00 = $765.25

In this case, despite a 0% base duty, the total landed cost increases by nearly 8%. Without proper calculation, the importer might have budgeted incorrectly and reduced profit margins unexpectedly.

Essential Import Checklist

Before filing your entry, verify the following:

- ✅ HTS code confirmed via official USITC database or CBP ruling

- ✅ Customs value includes all required components (product cost, packing, freight, insurance)

- ✅ Checked for Section 301, 232, or other special tariffs

- ✅ MPF and HMF calculated correctly

- ✅ Commercial invoice, bill of lading, and packing list prepared

- ✅ ISF (Importer Security Filing) submitted 24 hours before ocean departure (for sea freight)

Frequently Asked Questions

Do I need to pay duty on gifts shipped from China?

Yes, if the gift exceeds $800 in value. The U.S. allows one personal exemption per person per day up to $800 under Section 321. Amounts above this threshold are subject to full duty and fees.

Can I reduce my duty by undervaluing the invoice?

No. CBP cross-checks declared values with market data and past entries. Undervaluation is considered fraud and can result in penalties, shipment holds, or loss of import privileges.

Are there any products exempt from import duty?

Some goods qualify for duty-free treatment under free trade agreements or specific HTS provisions. For example, certain medical devices or educational materials may enter duty-free. Always verify eligibility through the HTS notes.

Conclusion: Take Control of Your Import Costs

Calculating import duty from China to the USA doesn’t have to be overwhelming. By systematically identifying the correct HTS code, accurately declaring customs value, and accounting for all applicable fees—including often-overlooked tariffs like Section 301—you gain full visibility into your landed costs. This knowledge empowers smarter sourcing decisions, better pricing strategies, and smoother customs clearance.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?