Determining the final price of a sale isn’t just about applying a discount. It involves understanding base prices, taxes, shipping, fees, and promotional adjustments. Whether you're a small business owner, an online seller, or a consumer comparing deals, miscalculations can lead to lost profits or overspending. This guide breaks down the entire process into clear, actionable steps so you can compute final sale prices with confidence and accuracy.

Step 1: Identify the Base Price

The base price is the starting point for any calculation. It’s the original selling price of the product before any discounts, taxes, or additional charges are applied. For businesses, this may be the listed retail price; for consumers, it's typically the price tag on a website or shelf.

Ensure the base price reflects only the cost of the item itself. Do not include:

- Tax

- Shipping

- Handling fees

- Promotional bundles (yet)

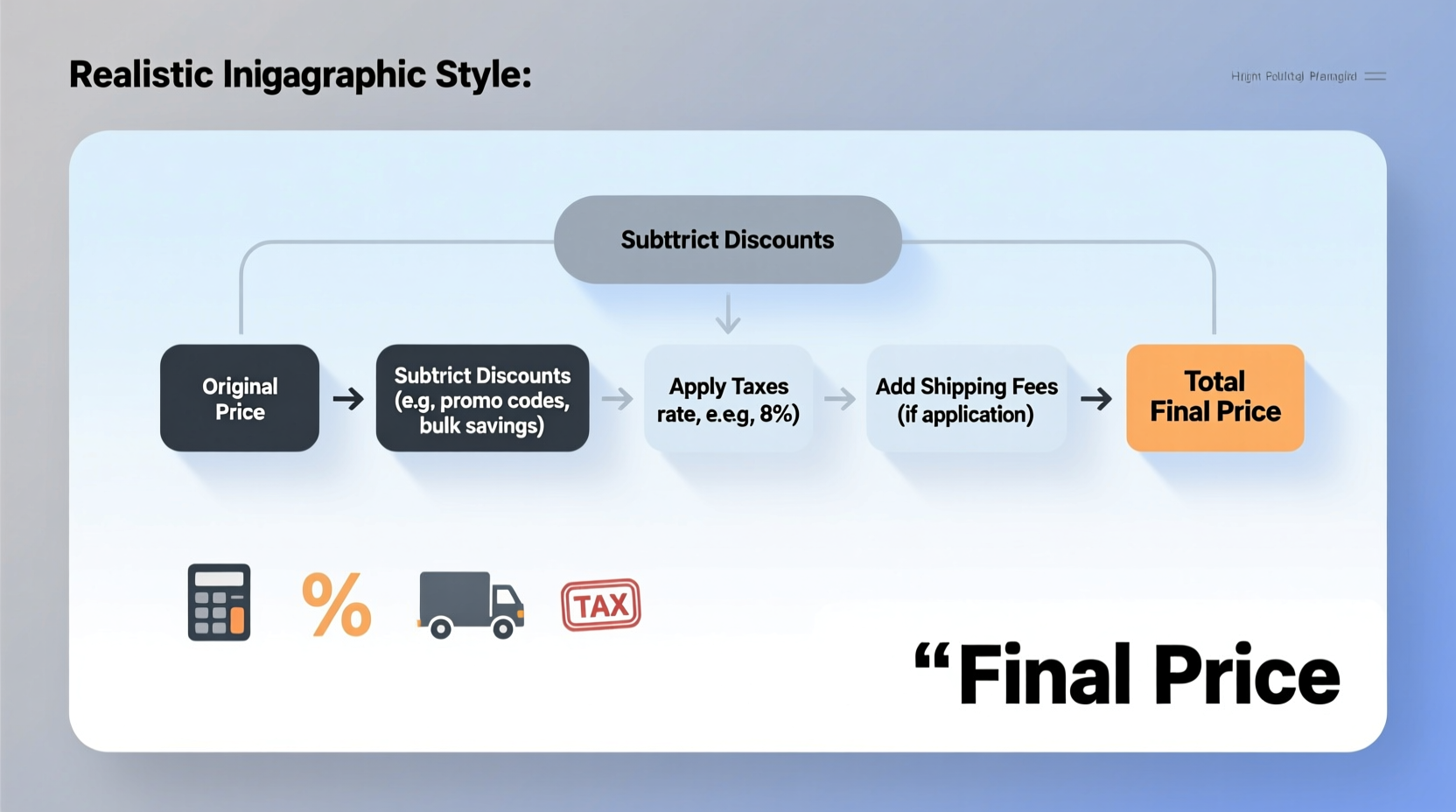

Step 2: Apply Discounts and Promotions

Once you have the correct base price, apply any applicable discounts. These could be percentage-based (e.g., 20% off), fixed reductions ($10 off), or buy-one-get-one offers. The method varies depending on the type of discount.

- Percentage Discount: Multiply the base price by the discount rate, then subtract from the base.

- Fixed Amount Discount: Simply subtract the dollar amount from the base price.

- Bundled Offers: Calculate total value of items included, then apply the offer terms (e.g., pay for one, get second at 50%).

Example: A $150 jacket with a 30% discount.

Calculation: $150 × 0.30 = $45 discount → Final discounted price: $150 – $45 = $105.

Avoid Common Discount Errors

| Mistake | Correct Approach |

|---|---|

| Applying multiple percentages cumulatively instead of sequentially | Apply each discount one after another, not added together |

| Discounting after tax | Always apply discounts before adding tax |

| Ignoring minimum spend requirements | Verify eligibility before applying promo codes |

Step 3: Add Applicable Taxes

Taxes vary by location and product type. Sales tax is usually a percentage of the post-discount price, not the original base price. Using the previous example:

Post-discount price: $105

Sales tax rate: 8%

Tax amount: $105 × 0.08 = $8.40

Subtotal with tax: $105 + $8.40 = $113.40

Note: Some jurisdictions tax the full base price regardless of discounts. Confirm local regulations—especially important for e-commerce sellers operating across state lines.

“Tax compliance starts with accurate pricing. Misapplying tax rates can trigger audits and penalties.” — Linda Reyes, CPA and Small Business Tax Advisor

Step 4: Factor in Shipping and Handling Fees

Shipping costs can significantly alter the final price, especially for low-margin or heavy items. These fees may be flat-rate, weight-based, or free under certain conditions.

To calculate:

- Determine the shipping zone and package dimensions/weight.

- Use carrier rate calculators (USPS, FedEx, etc.) or preset internal rates.

- Add handling fees if applicable (e.g., packaging labor, insurance).

If offering “free shipping,” consider whether the cost is absorbed by the seller or built into the product price. In either case, account for it internally to maintain profitability.

Step 5: Include Additional Charges or Adjustments

Some transactions involve extra costs that must be included in the final price:

- Service fees (common on third-party platforms like eBay or Etsy)

- Payment processing fees (2–3% for credit cards)

- Customization or engraving charges

- Restocking fees (for returns or exchanges)

While some of these may be paid separately by the buyer, they should still be visible in the total transaction value for accurate recordkeeping and customer transparency.

Mini Case Study: Online Electronics Store Pricing Error

An online retailer advertised a tablet at $299 with 15% off and free shipping. However, their system applied the discount after tax, and the “free shipping” was actually a $12.95 fee waived only for orders over $300. The final checkout showed $274.89 instead of the expected $269.15—a difference caused by incorrect sequencing and hidden thresholds.

After customer complaints, the store revised its pricing logic: discounts now apply first, tax is calculated on the reduced amount, and shipping rules are clearly defined in the cart. As a result, conversion rates improved by 14%, and chargebacks dropped.

Complete Final Price Calculation Checklist

Your Step-by-Step Verification List

- Confirm the correct base price of the item.

- Apply all eligible discounts in the proper sequence.

- Calculate sales tax based on post-discount price and local rate.

- Add shipping, handling, and delivery fees.

- Include any platform, service, or processing charges.

- Round the final price appropriately (e.g., $9.99 vs. $10.00).

- Display the complete breakdown to the customer before purchase.

Frequently Asked Questions

Should I apply tax before or after the discount?

In most U.S. states, sales tax is applied to the price after discounts. However, a few states require tax to be calculated on the pre-discount amount. Always verify with your state’s Department of Revenue or consult a tax professional.

How do I handle tiered discounts?

Tiered discounts (e.g., 10% off one item, 15% off two or more) should be applied per qualifying unit. For example, buying two items at $100 each with a 15% bulk discount: ($100 × 2) × 0.15 = $30 off → Final subtotal: $170 before tax and shipping.

Can I round the final price for simplicity?

Yes, but consistently. Most businesses round to the nearest cent. Avoid rounding up every transaction—it may appear deceptive. If using psychological pricing (e.g., $9.99), ensure calculations support that model without inflating totals unfairly.

Mastering Accuracy for Better Business Outcomes

Accurate final price calculation protects both buyers and sellers. Customers gain trust when they see transparent, predictable pricing. Businesses avoid margin erosion, compliance risks, and reputational damage from billing errors. Automation tools like POS systems and e-commerce platforms can help, but human oversight remains essential—especially during promotions or seasonal sales.

Whether you’re setting up a new online store, managing retail operations, or simply trying to get the best deal as a shopper, mastering this process gives you control over financial outcomes. Precision in pricing isn’t just arithmetic—it’s a cornerstone of integrity and professionalism.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?