Understanding your true take-home pay is essential for effective budgeting, tax planning, and long-term financial health. While your paycheck may reflect a certain amount, the figure on your W-2 form offers a more complete picture of your earnings and withholdings. The W-2, officially known as the \"Wage and Tax Statement,\" is issued annually by employers and reports your total wages, taxes withheld, and other key financial data. However, many individuals assume that the wages listed in Box 1 automatically represent their net income—this is a common misconception. Net income is not the same as gross wages or even taxable income; it’s what remains after all deductions are accounted for. Using your W-2 correctly allows you to calculate this number with precision.

Understanding Key Terms: Gross Income vs. Net Income

Before diving into the W-2 form, it's crucial to distinguish between gross income and net income. Gross income refers to all the money you earn from your job before any taxes or deductions are taken out. This includes salary, bonuses, commissions, and taxable benefits. On your W-2, gross income is typically reflected in Box 1 (Wages, Tips, Other Compensation), though some pre-tax deductions may already be excluded.

Net income, also referred to as \"take-home pay,\" is the amount you actually receive after federal, state, and local taxes, as well as payroll deductions like Social Security, Medicare, retirement contributions, and health insurance premiums, have been subtracted. Unlike gross income, net income isn’t directly stated on the W-2. You must calculate it using information from multiple boxes on the form combined with knowledge of your personal deductions.

“Many taxpayers confuse the wages in Box 1 with their actual take-home pay. That number is still subject to additional withholdings and doesn’t reflect post-tax deductions.” — Laura Simmons, CPA and Tax Advisor

Breaking Down the W-2 Form: What Each Box Tells You

The IRS W-2 form contains 20 boxes, each providing specific financial details. To determine net income accurately, focus on the following key fields:

| Box | Description | Relevance to Net Income |

|---|---|---|

| 1 | Wages, tips, other compensation | Basis for taxable income; does not include pre-tax deductions |

| 2 | Federal income tax withheld | Amount deducted for federal taxes |

| 4 | Social Security tax withheld | 6.2% of wages up to annual limit |

| 6 | Medicare tax withheld | 1.45% of wages (plus 0.9% if over threshold) |

| 10 | Dependent care benefits | May reduce taxable income; affects net available funds |

| 12 | Codes for pre-tax deductions (e.g., Code D = 401(k)) | Reduces taxable income but also reduces paycheck |

| 14 | Other deductions (union dues, after-tax retirement, etc.) | Post-tax deductions affect net income |

While Boxes 1 through 6 provide core tax withholding data, Box 12 (with its alphabetic codes) reveals critical pre-tax reductions such as health insurance premiums, flexible spending accounts (FSA), and retirement plan contributions. These lower your taxable income but also reduce the amount you receive in each paycheck. Box 14 may include additional employer-reported deductions not covered elsewhere.

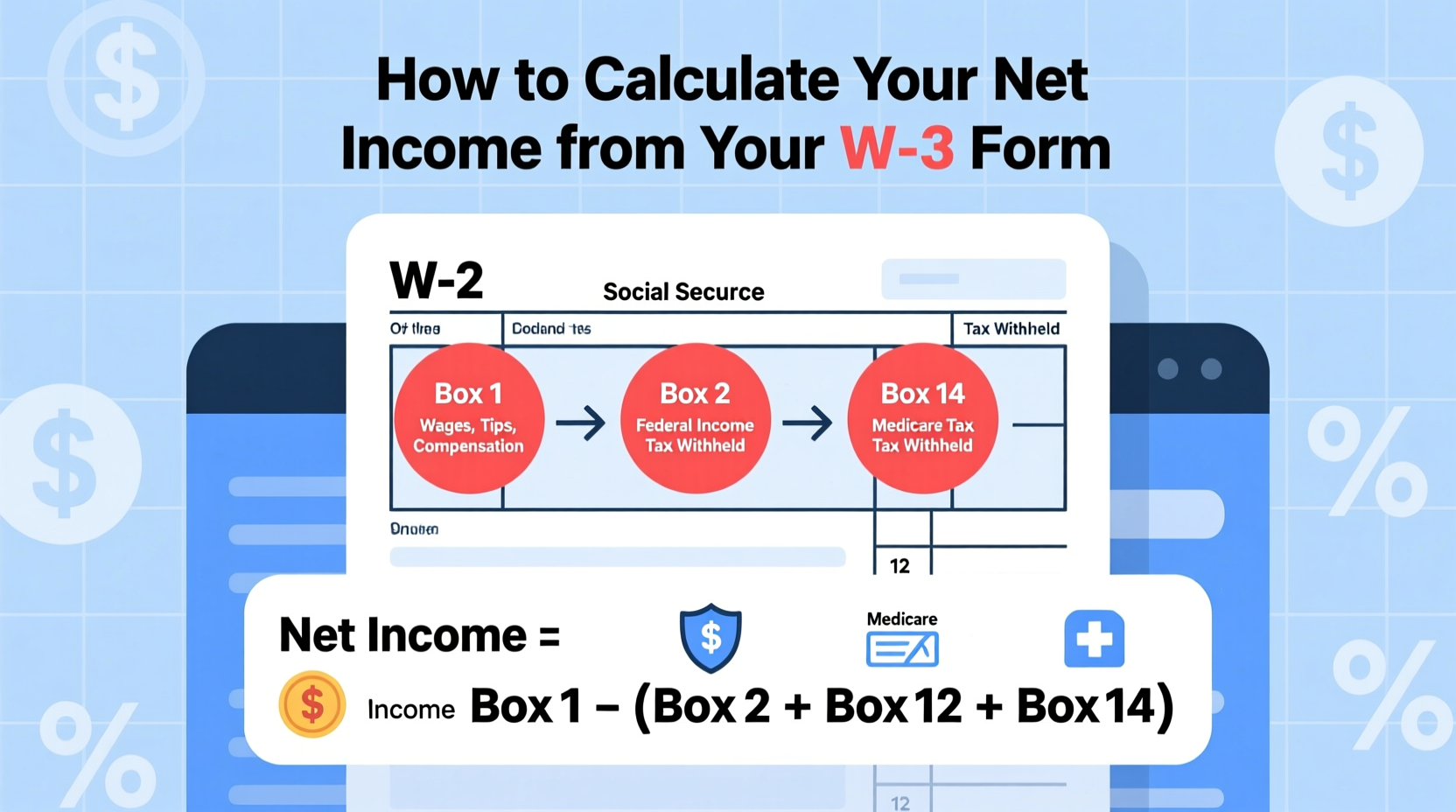

Step-by-Step Guide to Calculating Your Net Income from a W-2

Since net income isn’t listed outright on the W-2, follow this structured process to derive it:

- Start with Box 1 (Wages): This is your taxable wage base after pre-tax deductions like 401(k) and health insurance have been removed.

- Add back pre-tax deductions: Review Box 12 codes (e.g., D for 401(k), C for cafeteria plan) and sum these amounts. Adding them to Box 1 gives you your true gross pay.

- Subtract all withholdings: Deduct amounts from:

- Box 2 (Federal income tax)

- Box 4 (Social Security tax)

- Box 6 (Medicare tax)

- State/local taxes (Boxes 17 and 19, if applicable)

- Account for post-tax deductions: Check Box 14 for items like union dues, Roth 401(k) contributions, or wage garnishments. These come out after taxes and further reduce net income.

- Calculate final net income: Subtract all withholdings and deductions from your true gross pay (from Step 2).

Real Example: Calculating Net Income for Maria Lopez

Maria receives a W-2 with the following entries:

- Box 1: $65,000

- Box 2: $7,800 (federal tax)

- Box 4: $4,030 (Social Security)

- Box 6: $942.50 (Medicare)

- Box 12: Code D – $7,000 (401(k)), Code DD – $3,500 (employer-sponsored health insurance)

- Box 14: Union dues – $480

- Box 17: State tax – $2,600

Her calculation proceeds as follows:

- True gross pay = $65,000 + $7,000 + $3,500 = $75,500

- Total deductions = $7,800 + $4,030 + $942.50 + $2,600 + $480 = $16,852.50

- Net income = $75,500 – $16,852.50 = $58,647.50

This means Maria took home approximately $58,647.50 during the year, despite earning $75,500 in total compensation. Her W-2 alone didn’t reveal this full story—only careful analysis did.

Avoiding Common Mistakes When Interpreting Your W-2

Even financially savvy individuals can misinterpret W-2 data. Here are frequent pitfalls and how to avoid them:

- Mistaking Box 1 for gross income: Box 1 excludes pre-tax deductions. True gross income requires adding those back.

- Ignoring Box 12 codes: Failing to account for retirement or health deductions leads to underestimating total compensation and miscalculating net pay.

- Overlooking post-tax deductions in Box 14: These reduce take-home pay even though they don’t affect taxable income.

- Assuming W-2 reflects monthly net income: The W-2 shows annual totals. Divide by 12 only after calculating total net income for accurate monthly averages.

“Your W-2 is a tax document, not a paycheck summary. It reports what you’ve paid in taxes, not what you’ve actually received.” — James Reed, Enrolled Agent and Financial Educator

Checklist: How to Accurately Determine Net Income from Your W-2

- ✅ Obtain your most recent W-2 form from your employer or payroll portal

- ✅ Identify all amounts in Box 12 with deduction codes (D, E, F, G, H, C, DD, etc.)

- ✅ Add pre-tax deductions (e.g., 401(k), health insurance) back to Box 1 to find true gross income

- ✅ Sum all tax withholdings (federal, Social Security, Medicare, state/local)

- ✅ Include post-tax deductions from Box 14 (e.g., union dues, charitable giving)

- ✅ Subtract total withholdings and deductions from true gross income

- ✅ Verify results against your final annual pay stub for consistency

FAQ: Common Questions About Net Income and the W-2

Is Box 1 on the W-2 my net income?

No. Box 1 shows your taxable wages after pre-tax deductions but before payroll taxes and post-tax deductions. It is not your net income.

Why is my W-2 amount less than my total paychecks?

Your W-2 reflects taxable income, which excludes pre-tax benefits like retirement and health insurance. Additionally, your take-home pay is further reduced by taxes and other deductions not fully captured in one box.

Can I use my W-2 to create a household budget?

Yes, but only after calculating your actual net income. Use the annual net figure you derive, then divide by 12 for a monthly baseline. Include irregular income separately for accuracy.

Take Control of Your Financial Picture

Your W-2 form is more than just a tax filing requirement—it’s a powerful tool for understanding your real income and financial trajectory. By learning how to interpret its data beyond surface-level numbers, you gain clarity on how much you truly earn and where your money goes. Whether you're planning a budget, applying for a loan, or evaluating a job offer, knowing your accurate net income empowers smarter decisions. Don’t rely on assumptions or paycheck estimates. Take the time to analyze your W-2 thoroughly, reconcile it with your pay history, and build your financial plans on solid ground.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?