Mounjaro (tirzepatide) has emerged as one of the most effective medications for managing type 2 diabetes—and increasingly, for weight loss. However, with a list price exceeding $1,000 per month, many patients find it financially out of reach. The good news: it is possible to access Mounjaro for as little as $25 a month through a combination of manufacturer discounts, pharmacy savings, insurance navigation, and patient assistance programs. This guide outlines practical, real-world strategies that thousands have used successfully to reduce their out-of-pocket costs.

Understanding Mounjaro’s Pricing Landscape

The sticker price of Mounjaro can be misleading. While the wholesale acquisition cost (WAC) sits around $974.60 per pen (depending on dosage), what you actually pay depends heavily on your insurance coverage, pharmacy choice, and eligibility for financial aid. Most people don’t pay full price—those who do are typically either uninsured or unaware of available support options.

Insurance plans vary widely in how they cover Mounjaro. Some require prior authorization, step therapy (trying cheaper alternatives first), or limit coverage to specific indications like type 2 diabetes, not weight management. Even with insurance, copays can range from $50 to over $300 monthly—unless you take proactive steps to lower them.

Lilly Savings Card: Your First Line of Defense

Eli Lilly, the manufacturer of Mounjaro, offers a Savings Card that reduces the cost to as low as $25 per month for eligible commercially insured patients. This is the most direct route to affordable access—but it comes with conditions.

- You must have commercial (private) health insurance.

- You cannot use the card if you are enrolled in Medicare, Medicaid, or other government-funded programs.

- The maximum benefit is $150 per prescription, up to 12 fills per year.

- Valid at over 60,000 pharmacies nationwide, including CVS, Walgreens, and Walmart.

To enroll, visit the official Mounjaro website, create an account, and download the card. Present it at the pharmacy alongside your prescription. Most patients see immediate savings at checkout.

“Over 70% of patients using our savings program pay $25 or less per fill.” — Eli Lilly Patient Support Team

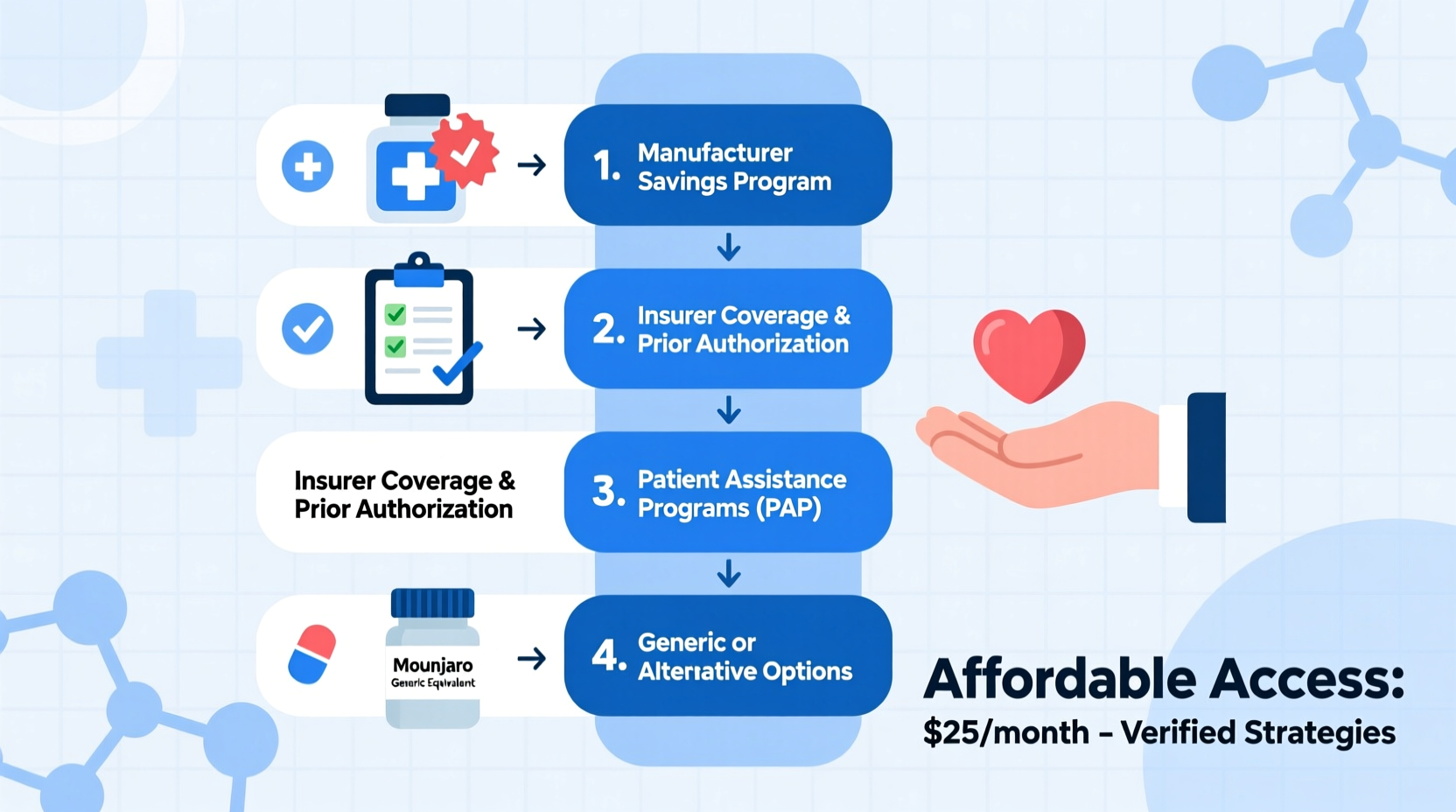

Step-by-Step: How to Get Mounjaro for $25/Month

Follow this timeline to maximize your chances of securing Mounjaro at the lowest possible cost:

- Confirm Diagnosis & Prescription: Ensure your doctor prescribes Mounjaro for an FDA-approved use (e.g., type 2 diabetes). Off-label use may complicate insurance approval.

- Check Insurance Coverage: Call your insurer or log into your member portal to verify if Mounjaro is on your plan’s formulary and what tier it’s on.

- Apply for the Lilly Savings Card: Enroll online at mounjaro.com. Approval is usually instant.

- Choose a Participating Pharmacy: Use the pharmacy locator tool on the Lilly site to find nearby options.

- Fulfill Your Prescription: Bring your card and insurance information to the pharmacy. Pay only the $25 copay (or less).

- Renew Annually: The card expires after 12 months. Re-enroll online before it lapses.

What If You’re on Medicare or Uninsured?

The Lilly Savings Card excludes government-insured patients. But alternatives exist:

Patient Assistance Programs (PAPs)

Lilly also operates a Patient Assistance Program for low-income, uninsured, or underinsured individuals. Eligibility is based on income (must fall within 400% of the federal poverty level) and lack of third-party coverage.

- Provides Mounjaro free of charge.

- Covers both branded and future generic versions.

- Requires annual reapplication.

Applications can be submitted online via the Lilly Cares Foundation website. Physicians often need to complete part of the form, so inform your provider early.

Discount Pharmacy Networks

For cash-paying patients, platforms like GoodRx, SingleCare, or RX Savings Solutions offer discounted prices at retail pharmacies. As of 2024, some users report paying between $800–$900 per pen using these tools—still high, but potentially lower than full retail.

However, combining GoodRx with manufacturer coupons is not allowed. Use one or the other.

Comparison Table: Cost-Saving Options at a Glance

| Program | Eligibility | Max Savings | Out-of-Pocket Cost | Best For |

|---|---|---|---|---|

| Lilly Savings Card | Commercial insurance, not government plans | $150 per fill | $25/month | Privately insured patients |

| Lilly Cares PAP | Uninsured, low income, no third-party coverage | Full coverage | $0 | Medicare/Medicaid patients, unemployed |

| GoodRx / SingleCare | All patients (cash payers) | Up to 20% off WAC | $750–$900/month | Those excluded from Lilly programs |

| Insurance Copay Accumulators | Depends on plan design | Varies | $50–$300/month | Patients with high-deductible plans |

Real Example: Sarah’s Success Story

Sarah, a 52-year-old teacher from Ohio, was prescribed Mounjaro for type 2 diabetes. Her insurance initially denied coverage, citing “lack of prior therapy failure.” She paid $1,020 out of pocket for her first month—a devastating blow to her budget.

Determined to find a solution, Sarah contacted her endocrinologist, who helped submit a prior authorization appeal with clinical notes. Simultaneously, she applied for the Lilly Savings Card. Within two weeks, her appeal was approved, and her copay dropped to $75. Using the Lilly card, that was further reduced to $25.

Today, Sarah pays $25 every month and receives automatic refills. “I wish I’d known about the savings card sooner,” she says. “It saved me nearly $1,000 in the first year alone.”

Avoiding Common Pitfalls

Many patients miss out on savings due to avoidable mistakes. Here’s what to watch for:

- Assuming Medicare covers it fully: Many Part D plans restrict Mounjaro or impose high copays. Always check your plan’s formulary.

- Not appealing denials: Over 40% of initial denials are overturned upon appeal. Work with your doctor to submit medical necessity letters.

- Using discount cards with insurance: Combining GoodRx with insurance violates pharmacy rules and may result in claim rejection.

- Missing renewal dates: The Lilly card expires annually. Set a calendar reminder to re-enroll.

Checklist: Steps to Afford Mounjaro for $25/Month

- Get a prescription from your doctor for an approved condition.

- Verify Mounjaro coverage with your insurance provider.

- Enroll in the Lilly Savings Card (if commercially insured).

- If denied insurance coverage, file an appeal with clinical documentation.

- For Medicare/uninsured: Apply to Lilly Cares Foundation.

- Use a participating pharmacy and present your savings card.

- Set a yearly reminder to renew your savings program enrollment.

Frequently Asked Questions

Can I use the Lilly Savings Card with Medicare?

No. Federal law prohibits manufacturers from offering copay assistance to patients enrolled in government healthcare programs like Medicare or Medicaid. However, you may still qualify for free medication through the Lilly Cares Foundation if you meet income requirements.

What if my pharmacy doesn’t accept the savings card?

Call Lilly’s customer service at 1-833-808-1234. They can help resolve issues or direct you to a nearby participating pharmacy. Most major chains accept the card, but some independent pharmacies may not be enrolled.

Is there a generic version of Mounjaro available?

Not yet. Mounjaro is patent-protected, and no generics are expected before 2030. Biosimilars may emerge later, but until then, cost-saving programs are the best way to reduce expenses.

Take Control of Your Treatment Costs

Accessing Mounjaro for $25 a month isn’t luck—it’s strategy. By leveraging manufacturer programs, navigating insurance hurdles, and avoiding common errors, thousands of patients are staying on treatment without financial strain. The key is persistence: apply, appeal, and follow up. Your health shouldn’t be limited by price tags. Start today—your wallet and well-being will thank you.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?