Finding the right savings strategy is essential to growing your money with minimal risk. One of the most reliable tools available is the certificate of deposit (CD). Unlike standard savings accounts, CDs offer fixed interest rates over a set term, helping you earn predictable returns. But not all CDs are created equal. Choosing the best CD for your financial objectives requires understanding key features like interest rates, term lengths, early withdrawal penalties, and institution safety. Whether you're saving for a vacation, building an emergency fund, or planning for a major purchase, selecting the right CD can make a meaningful difference in how quickly your money grows.

Understand How CDs Work

A certificate of deposit is a time-bound savings account offered by banks and credit unions. When you open a CD, you agree to keep your money deposited for a specific period—ranging from three months to five years or more. In return, the financial institution pays you a fixed interest rate, typically higher than what’s offered on regular savings accounts. At the end of the term, known as maturity, you receive your initial deposit plus accrued interest.

The trade-off for higher yields is reduced liquidity. Withdrawing funds before the maturity date usually triggers an early withdrawal penalty, which can erase some or all of your earned interest. Because of this structure, CDs are ideal for money you know you won’t need immediately. They’re also FDIC-insured up to $250,000 per depositor, per institution, making them one of the safest places to park cash.

Compare Key Features Before You Choose

Not every CD will serve your needs equally. To make an informed decision, evaluate these critical factors across multiple institutions:

- Annual Percentage Yield (APY): This reflects the total interest you’ll earn in a year, including compounding. Higher APYs mean faster growth.

- Term Length: Shorter terms (3–12 months) offer flexibility; longer terms (2+ years) typically pay higher rates but lock up your cash.

- Minimum Deposit: Some high-yield CDs require $1,000 or more to open, while others accept as little as $0.

- Early Withdrawal Penalties: These vary widely. Some charge 3–6 months of interest; others may take more depending on term length.

- Bump-Up and No-Penalty Options: Bump-up CDs let you request a rate increase if market rates rise. No-penalty CDs allow early access without fees, though they often have lower APYs.

CD Comparison Table: Sample Offers (as of 2024)

| Institution | Term | APY | Min. Deposit | Early Withdrawal Penalty |

|---|---|---|---|---|

| Ally Bank | 12 months | 4.50% | $0 | 30 days of interest |

| Capital One | 18 months | 4.75% | $1,000 | 90 days of interest |

| Discover Bank | 6 months | 4.30% | $2,500 | No penalty after 7 days |

| Pentagon Federal Credit Union | 3 years | 4.80% | $1,000 | Up to 365 days of interest |

Online banks often offer better rates than traditional brick-and-mortar institutions due to lower overhead costs. However, always verify customer service availability and ease of access when choosing where to open your account.

“Locking in a high-yield CD during periods of rising interest rates can be a smart move—but only if you’re certain you won’t need the funds early.” — Laura Simmons, Certified Financial Planner

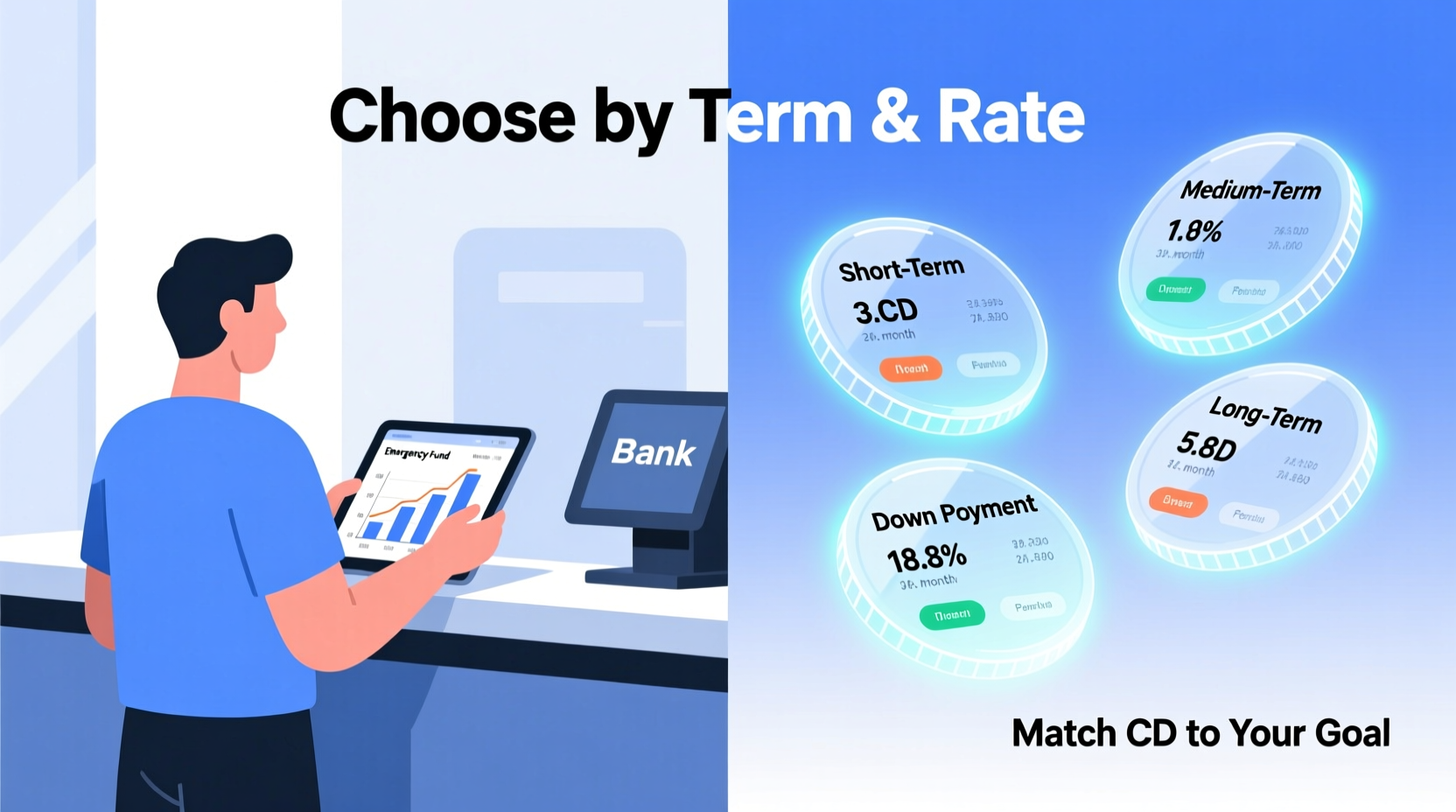

Match the CD Type to Your Savings Goal

Your timeline and purpose should guide your choice of CD. A short-term goal like holiday shopping calls for a different strategy than saving for a down payment on a house. Here’s how to align your CD selection with your objective:

Short-Term Goals (6–18 months)

For goals within a year or so, consider no-penalty or short-term CDs. These provide modest gains without sacrificing access to funds. Ally Bank and Marcus by Goldman Sachs offer competitive 6- to 12-month options with flexible withdrawal terms.

Medium-Term Goals (2–4 years)

If you're saving for a car, home renovation, or education expense, mid-length CDs (2–4 years) often deliver the best balance of yield and predictability. Look for bump-up features that protect against falling rates.

Long-Term Goals (5+ years)

While rare, long-term CDs can secure today’s high rates for future use. However, inflation risk increases over time. Consider laddering instead of locking all funds into a single long-term CD.

Create a CD Ladder for Flexibility and Growth

One of the most effective strategies for maximizing CD returns while maintaining access to cash is building a CD ladder. This approach involves spreading your savings across multiple CDs with staggered maturity dates.

Here’s how it works:

- Determine your total amount to invest—say, $10,000.

- Divide it into equal parts—e.g., $2,000 each.

- Open five CDs with terms of 1, 2, 3, 4, and 5 years.

- As each CD matures, reinvest it into a new 5-year term (or spend, if needed).

Over time, you benefit from higher yields on longer-term CDs while gaining annual access to a portion of your principal. If interest rates rise, you can capture those gains at renewal. If they fall, you’re still earning above-market rates on existing longer-term deposits.

Real Example: Building a Down Payment with CDs

Samantha wanted to buy a condo in three years and needed $15,000 for a down payment. Instead of leaving the money in a low-yield savings account earning 0.50%, she opened three $5,000 CDs: one at 12 months (4.40% APY), one at 24 months (4.60%), and one at 36 months (4.75%). Each year, as a CD matured, she used the funds for closing costs, inspections, and renovations. By locking in higher rates early, she earned nearly $2,100 in interest—over $1,800 more than she would have in a standard account.

This structured approach gave her peace of mind: her money was safe, growing steadily, and accessible when needed. She avoided market volatility and resisted the temptation to dip into her savings because early withdrawals would have cost her interest.

Checklist: Steps to Choose the Best CD

- Define your savings goal and timeline.

- Determine how much you can commit without needing early access.

- Research current CD rates from online banks, local institutions, and credit unions.

- Compare APYs, minimum deposits, and early withdrawal penalties.

- Decide between standard, bump-up, or no-penalty CD options.

- Consider building a CD ladder for larger amounts.

- Confirm the institution is FDIC or NCUA insured.

- Open the account and set maturity alerts.

Frequently Asked Questions

Can I lose money in a CD?

No, as long as your deposit is within insurance limits ($250,000 per institution), your principal is guaranteed. The only way to \"lose\" is by withdrawing early and paying penalties that exceed earned interest.

Are CD interest rates negotiable?

Rarely with retail banks, but some credit unions or private banks may offer relationship-based rate boosts for larger deposits or bundled services.

What happens when my CD matures?

You’ll enter a grace period (usually 7–10 days) during which you can withdraw funds, roll over into a new CD, or transfer the balance. If you do nothing, most institutions automatically renew the CD at the current rate.

Make Your Money Work for You

Choosing the best CD isn’t about chasing the highest advertised rate—it’s about matching the right product to your personal financial plan. Whether you prioritize safety, yield, or accessibility, there’s a CD strategy that fits. By understanding terms, comparing offers, and using tools like laddering, you can turn idle cash into a powerful component of your savings strategy. Start small, learn the landscape, and gradually refine your approach as your goals evolve. With discipline and smart choices, your CDs can become a cornerstone of financial progress.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?