The Social Security number (SSN) is one of the most critical identifiers in the United States, used for employment, taxation, banking, and government services. While the Social Security Administration (SSA) generally discourages changing an SSN, there are limited circumstances under which corrections or replacements are permitted. Whether you need to fix an error on your card or request a new number due to identity theft or safety concerns, understanding the official process is essential. This guide walks you through every phase—eligibility, documentation, application, and follow-up—with actionable steps and expert insights.

When Can You Change or Correct Your SSN?

The SSA does not allow SSN changes simply for personal preference or to avoid debt. However, exceptions exist under specific conditions:

- Error correction: The number was assigned in error or contains incorrect information (e.g., wrong name or birthdate).

- Identity theft: Persistent misuse of your number despite corrective actions.

- Safety concerns: Documented threats such as domestic abuse, stalking, or harassment.

- Religious or cultural objections: Rare cases where sequential numbers cause repeated confusion (e.g., father and child with same number).

- Duplicate assignment: Another person has been mistakenly issued your number.

“We only issue new SSNs when individuals face ongoing harm or systemic errors that cannot be resolved otherwise.” — Social Security Administration Field Office Supervisor

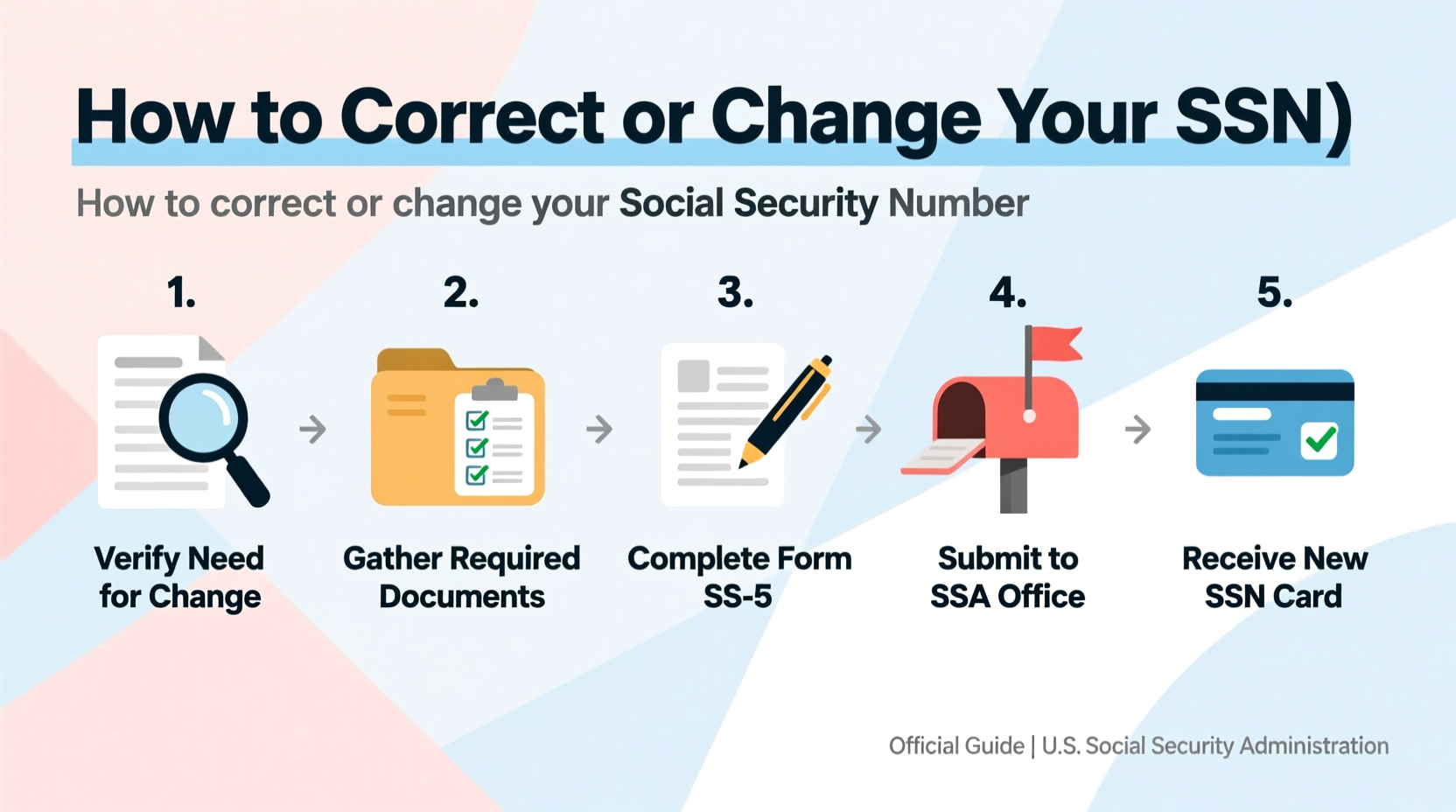

Step-by-Step Process to Correct or Change Your SSN

Follow this structured timeline to navigate the SSA’s requirements efficiently.

- Evaluate eligibility: Determine whether your situation qualifies under SSA guidelines. Most requests are denied if based solely on credit issues or personal dislike of the number.

- Gather supporting evidence: Collect legal documents proving your identity, citizenship, and the reason for the request (e.g., police reports, court orders, affidavits).

- Complete Form SS-5: Download and fill out the Application for a Social Security Card, available at ssa.gov.

- Submit in person: Visit your local SSA office with original documents; mail submissions are not accepted for SSN changes.

- Attend interview: An SSA representative will review your case and may ask follow-up questions about your request.

- Wait for decision: Processing takes 2–4 weeks. If approved, you’ll receive a new card with updated information.

- Update records: Notify financial institutions, employers, credit bureaus, and government agencies of the change.

Required Documentation

You must provide original or certified copies of the following:

| Document Type | Purpose | Examples |

|---|---|---|

| Proof of Identity | Verify who you are | U.S. driver’s license, state ID, passport |

| Proof of Citizenship | Confirm U.S. status | Birth certificate, naturalization certificate |

| Proof of Reason | Justify the change | Police report, restraining order, IRS notice of identity theft |

| Form SS-5 | Official application | Completed and signed form (downloadable online) |

Real Example: Escaping Identity Theft with a New SSN

Linda M., a resident of Austin, Texas, discovered her SSN had been used to open multiple fraudulent credit accounts after her wallet was stolen. Despite placing fraud alerts and working with credit bureaus, new accounts continued to appear. She filed a report with the FTC and local police, then visited her SSA office with evidence of the theft and a letter from a credit counselor detailing the unresolved damage.

After a 10-day review, the SSA approved her request for a new SSN based on “continued misuse causing substantial harm.” Linda received a new card and spent the next three months updating her bank accounts, employer records, and loan providers. Her credit history did not automatically transfer, so she worked closely with lenders to re-establish her credit profile under the new number.

Common Mistakes to Avoid

Many applications are rejected due to preventable errors. Be mindful of the following:

- Submitting photocopies instead of originals: The SSA requires original documents or certified copies.

- Failing to explain the reason clearly: Vague statements like “I don’t want people to find me” are insufficient without legal backing.

- Not updating third parties: After receiving a new number, delay in notifying banks or employers can lead to payroll and tax issues.

- Expecting automatic credit transfer: A new SSN does not carry over your credit history. You must rebuild it gradually.

Do’s and Don’ts Summary

| Do’s | Don’ts |

|---|---|

| Provide detailed, documented proof of harm or error | Apply just to escape bad credit history |

| Visit a local SSA office in person | Mail sensitive documents without confirmation |

| Keep records of all interactions | Assume your credit report will follow the new number |

| Notify key institutions promptly | Use both old and new numbers interchangeably |

Frequently Asked Questions

Can I get a new SSN if I’m in debt or have bad credit?

No. The SSA does not permit SSN changes to evade financial obligations. Doing so could be considered fraudulent. Instead, consider credit counseling or identity protection services to address underlying issues.

Will my credit history transfer to the new SSN?

No. A new SSN creates a fresh start with no credit history. You will need to begin building credit again by opening secured accounts, becoming an authorized user, or applying for credit builder loans.

How often can I change my SSN?

Extremely rarely. The SSA limits changes to one in a lifetime under exceptional circumstances. Repeated requests are typically denied unless new, compelling evidence emerges.

Final Checklist Before Applying

- ✅ Confirm your reason meets SSA criteria

- ✅ Collect original proof of identity and citizenship

- ✅ Gather evidence supporting your request (e.g., police reports, court orders)

- ✅ Complete Form SS-5 accurately

- ✅ Schedule an in-person appointment at your nearest SSA office

- ✅ Prepare to update all financial and government records post-approval

Conclusion

Changing or correcting a Social Security number is a serious, complex process reserved for exceptional situations. It’s not a solution for financial trouble, but it can offer relief when your current number puts your safety or identity at risk. By understanding the rules, preparing thorough documentation, and following up diligently, you can navigate the system effectively. If you qualify, take action with confidence—your long-term security may depend on it.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?