Federal income tax withholding is a standard part of payroll processing for most U.S. workers. Employers deduct a portion of each paycheck based on the employee’s filing status, allowances, and income level. However, some individuals may be eligible to claim exemption from this withholding under specific circumstances defined by the Internal Revenue Service (IRS). Claiming exemption means no federal income tax is withheld from your paycheck—but it comes with strict eligibility rules. Misunderstanding or misapplying these rules can result in underpayment penalties or unexpected tax bills at filing time.

This guide breaks down the IRS criteria for claiming exemption, walks through the steps to assess your eligibility, and provides practical tools to help you make an informed decision.

Understanding Tax Withholding and Exemption Basics

Federal income tax withholding ensures that taxpayers pay their annual tax liability gradually throughout the year. The amount withheld depends on information provided on Form W-4, Employee’s Withholding Certificate. Most employees fill out this form when starting a new job, allowing employers to calculate appropriate deductions.

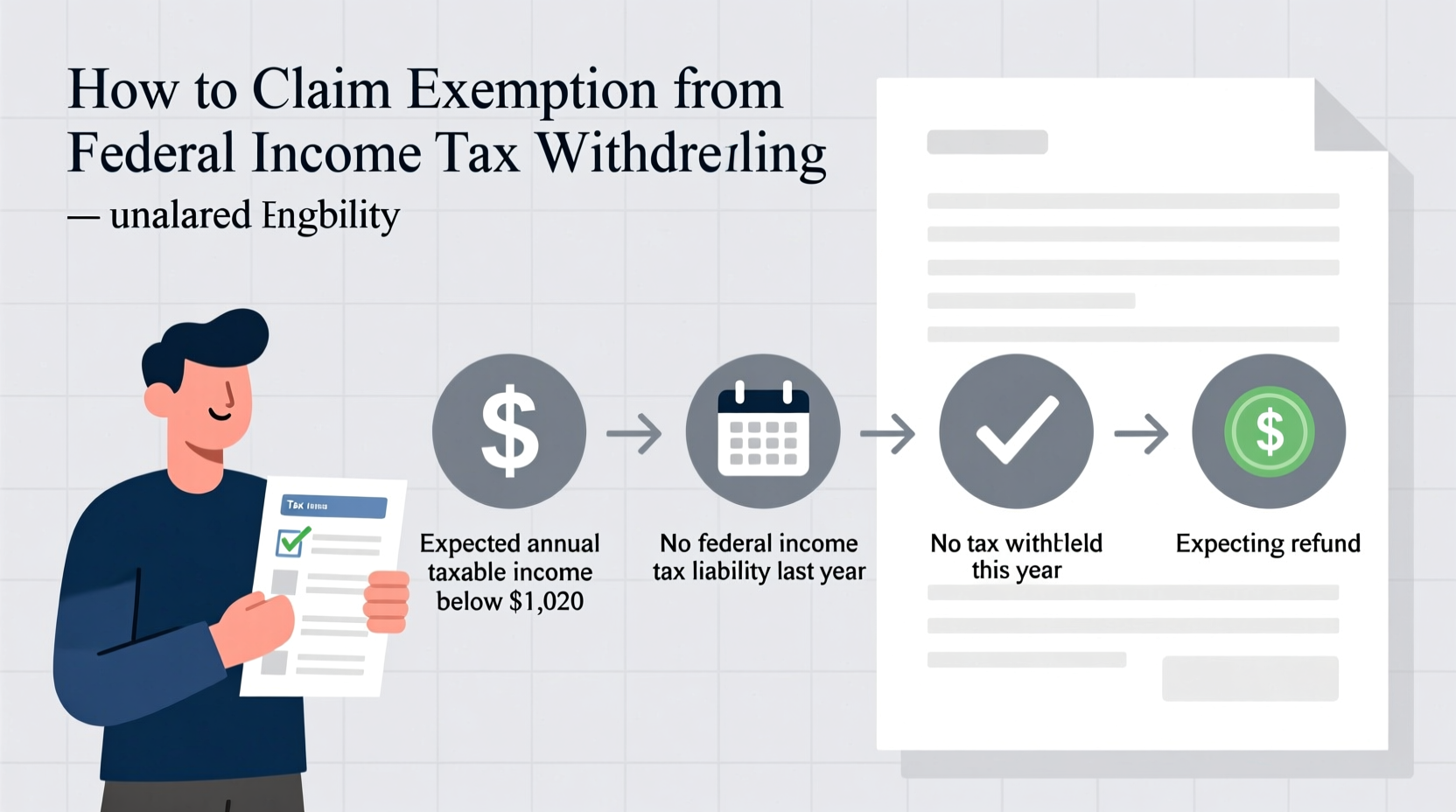

However, certain individuals may claim exemption from federal income tax withholding if they meet two key conditions established by the IRS:

- You had no federal income tax liability in the prior tax year.

- You expect to have no federal income tax liability in the current tax year.

It's critical to understand that “no tax liability” doesn’t mean low income—it means your total tax obligation after credits, deductions, and exemptions equals zero or less than zero (i.e., you would receive a refund even without any withholding).

Step-by-Step Guide to Assessing Your Eligibility

Determining whether you qualify requires careful review of both past and projected financial situations. Follow this structured process to evaluate your eligibility accurately.

Step 1: Review Last Year’s Tax Return

Obtain a copy of your previous year’s Form 1040. Confirm that your total federal income tax liability was $0. This is not the same as having taxes withheld or receiving a refund. Look specifically at Line 24 (Total Tax) on the 2023 Form 1040—if it shows $0, you meet the first condition.

Step 2: Estimate Current-Year Income and Deductions

Project your income for the current year. Include wages, self-employment earnings, investment income, and any other taxable sources. Then estimate your deductions and credits. If you’re single, under age 65, and earning below the standard deduction threshold ($13,850 in 2023), you likely won’t owe federal income tax—provided no other complicating factors exist.

Step 3: Account for Changes in Circumstances

Consider life changes such as marriage, dependents, job loss, or additional income streams. For example, adding a second job could push you into a taxable range even if your first job alone wouldn’t.

Step 4: Complete the IRS Worksheet (Optional but Recommended)

The IRS provides a worksheet in Publication 505, Tax Withholding and Estimated Tax, to help determine exemption eligibility. It guides users through estimating taxable income, applying deductions, and calculating expected tax liability.

Step 5: Submit Updated W-4 (If Qualifying)

If you confirm eligibility, complete a new Form W-4 and write “Exempt” on line 4(c). Submit it to your employer. Note: Exemption status lasts only for one calendar year. You must requalify and potentially resubmit annually.

“Claiming exempt isn't about avoiding taxes—it's about aligning withholding with actual tax liability. When done correctly, it prevents over-withholding and gives taxpayers better control over their cash flow.” — Lisa Nguyen, Enrolled Agent and Tax Advisor

Common Scenarios: Who Typically Qualifies?

While anyone can claim exemption if they meet the criteria, certain groups are more likely to qualify due to lower income or high deductions. Below are realistic examples illustrating who might be eligible.

Mini Case Study: College Student Working Part-Time

Jamal is a full-time undergraduate student working 20 hours per week during the school year and full-time in summer. In 2023, he earned $11,200. He is claimed as a dependent by his parents, has no itemized deductions, and takes the standard deduction for a dependent. His total tax liability was $0. For 2024, he expects similar earnings and no major changes. Jamal qualifies to claim exemption from federal income tax withholding because he met both IRS conditions.

Mini Case Study: Retiree with Limited Income

Maria, age 67, receives $12,000 annually from a pension and $6,000 in Social Security benefits. Only a small portion of her Social Security is taxable, and her total gross income falls below the filing threshold for her age and filing status (Single). She owed no federal income tax in 2023 and expects the same in 2024. Maria may claim exempt status on her pension payments if she receives them via payroll-style checks.

Do’s and Don’ts When Claiming Exemption

| Do | Don’t |

|---|---|

| Verify both prior-year and current-year tax liability is $0 | Claim exemption just to increase take-home pay without qualifying |

| Update your W-4 annually if circumstances change | Forget that exemption expires every December 31 |

| Keep documentation of income and tax calculations | Assume being a dependent automatically qualifies you (it depends on total tax) |

| Consult a tax professional if unsure | Use exemption to evade taxes—this is illegal and subject to penalties |

Frequently Asked Questions

Can I claim exempt if I’m a dependent?

Yes, but only if you meet both IRS conditions: no tax liability last year and none expected this year. Being a dependent affects your standard deduction amount, so use IRS worksheets to verify eligibility.

How long does exempt status last?

Exemption from withholding is valid only for the calendar year in which you file the W-4. You must reevaluate and potentially resubmit each January if you wish to continue the status.

What happens if I claim exempt but actually owe taxes?

If you claim exempt without qualifying, you may face underpayment penalties when filing your return. The IRS may also initiate audits or impose fines for willful misrepresentation. Always base your claim on accurate projections and documentation.

Final Checklist Before Claiming Exemption

- ✅ Reviewed last year’s tax return and confirmed $0 federal tax liability

- ✅ Projected current-year income and verified it remains below taxable thresholds

- ✅ Considered all sources of income, including side gigs and investments

- ✅ Completed IRS Worksheet in Publication 505 (recommended)

- ✅ Prepared to submit a new Form W-4 with “Exempt” marked

- ✅ Understood that exemption must be renewed annually

- ✅ Consulted a tax advisor if uncertain or in a complex situation

Conclusion: Make an Informed Decision

Claiming exemption from federal income tax withholding can simplify your finances and improve cash flow—if you truly qualify. But it’s not a shortcut or loophole; it’s a privilege granted under narrow IRS guidelines. Taking the time to analyze your tax situation honestly protects you from surprises and ensures compliance.

Whether you're a student, retiree, or part-time worker, understanding your tax obligations empowers smarter financial decisions. Use the tools and insights in this guide to assess your eligibility with confidence—and keep your tax strategy aligned with the law.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?