Determining senior status is more than just a number—it’s about eligibility for a wide range of benefits that can improve quality of life, reduce expenses, and support long-term well-being. While many assume turning 65 automatically makes someone a senior, the truth is that age thresholds vary significantly depending on context, organization, and country. Understanding these differences is essential for accessing discounts, healthcare programs, retirement accounts, and social services.

This guide breaks down how senior status is defined across different sectors, what benefits are tied to each milestone, and how individuals can proactively plan around these criteria to maximize advantages.

Defining Senior Status: It Depends on the Context

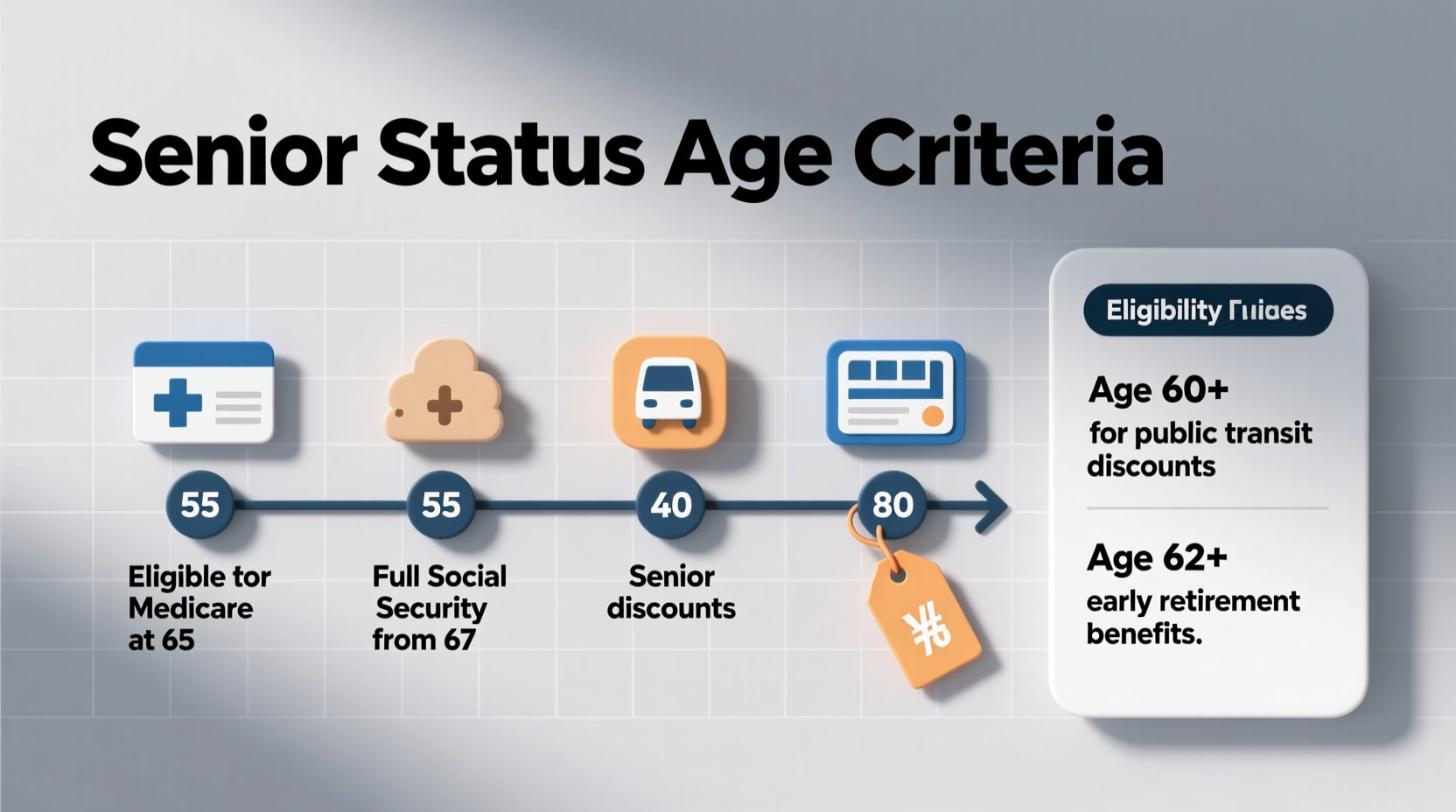

There is no universal standard for when someone becomes a “senior.” The definition shifts based on purpose—whether it's for government programs, private business discounts, or healthcare eligibility. Recognizing this variability helps avoid confusion and ensures you don’t miss out on opportunities simply because you assumed you weren’t eligible yet.

- Age 50: Often marks the beginning of early senior identity in the U.S., especially with AARP membership eligibility.

- Age 55: Common threshold for senior housing communities and some financial product offerings.

- Age 60–62: Minimum age for certain federal assistance programs and early retirement options.

- Age 65: Most widely recognized benchmark, particularly for Medicare and full Social Security retirement benefits.

- Age 70: Relevant for delayed retirement credits and required minimum distributions (RMDs) from retirement accounts.

Key Benefits Linked to Senior Age Milestones

Each age bracket opens access to specific resources. Below is a breakdown of major benefits by age group.

| Age | Benefit Type | Description |

|---|---|---|

| 50+ | AARP Membership | Discounts on travel, insurance, prescriptions, and more; advocacy for older Americans. |

| 55+ | Senior Housing | Eligibility for age-restricted communities with amenities tailored to retirees. |

| 60+ | Nutrition Programs | Access to Meals on Wheels and congregate meal sites funded by the Older Americans Act. |

| 62+ | Social Security (Early) | Can claim reduced retirement benefits, though waiting increases monthly payments. |

| 65+ | Medicare | Federal health insurance covering hospital care, medical services, and prescription drugs. |

| 65+ | Retail & Transit Discounts | Widely offered at pharmacies, restaurants, museums, and public transportation systems. |

| 70½+ | Retirement Account Rules | Mandatory withdrawals begin from traditional IRAs and 401(k)s (as of current IRS rules). |

Understanding Government vs. Private Sector Definitions

Government agencies typically use stricter definitions rooted in policy and funding structures. For example, the U.S. Administration on Aging defines older adults as those aged 60 and above for program eligibility. In contrast, private businesses set their own rules to attract customers. Grocery stores may offer senior discounts at 55, while airlines might require passengers to be 65 or older.

“Age-based eligibility isn't one-size-fits-all. Knowing where flexibility exists allows people to benefit earlier and more fully.” — Dr. Linda Chen, Gerontology Researcher, University of Michigan

How to Determine If You Qualify as a Senior

Follow this step-by-step process to assess your status and unlock relevant benefits:

- Identify your goal: Are you seeking healthcare, discounts, housing, or retirement income? Each has different age requirements.

- Research official guidelines: Check federal, state, and local agency websites like SSA.gov, Medicare.gov, or Eldercare Locator.

- Contact organizations directly: Call retailers, transit authorities, or community centers to confirm their senior policies.

- Gather documentation: Keep a copy of your ID ready to verify age when applying for benefits or requesting discounts.

- Track upcoming milestones: Mark key birthdays (e.g., 62, 65, 70) on your calendar to prepare applications in advance.

Real-Life Example: Planning Around Senior Eligibility

Consider Maria, a 63-year-old widow living in Florida. She planned her transition into retirement by mapping out key age-related benefits:

- At 50, she joined AARP and began using its pharmacy discount card, saving over $400 annually on prescriptions.

- At 58, she moved into a 55+ community with lower property taxes and included maintenance services.

- At 62, she applied for early Social Security but limited work hours to minimize benefit reduction.

- Three months before turning 65, she enrolled in Medicare Part B during her Initial Enrollment Period to avoid late penalties.

By understanding staggered eligibility, Maria optimized her financial stability and healthcare coverage without gaps or surprises.

Essential Checklist for Approaching Senior Status

Use this checklist to stay prepared as you approach critical age thresholds:

- ✅ Review your credit report and ensure all employment records are accurate (important for Social Security calculations).

- ✅ Compare Medicare plans annually during Open Enrollment (October 15–December 7).

- ✅ Evaluate whether to delay Social Security claims beyond age 62 to increase lifetime payouts.

- ✅ Explore senior-focused tax deductions, such as higher standard deduction amounts for ages 65+.

- ✅ Update estate planning documents, including wills, powers of attorney, and healthcare directives.

- ✅ Investigate local senior centers for wellness programs, legal aid, and volunteer opportunities.

Frequently Asked Questions

Does turning 65 automatically make me a senior citizen?

Legally, no single law declares someone a “senior citizen” at 65. However, this age is widely used as a benchmark due to Medicare eligibility and full Social Security retirement age for those born before 1960. Many institutions accept 65 as proof of senior status for discounts and services.

Can I get Medicare before age 65?

Yes, under certain conditions. Individuals with qualifying disabilities who have received Social Security Disability Insurance (SSDI) for 24 months are eligible. Those diagnosed with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) may also qualify earlier.

Are senior discounts taxable?

No, discounts are not considered taxable income. They are price reductions offered voluntarily by businesses and do not affect your tax liability.

Conclusion: Take Control of Your Senior Journey

Senior status isn’t an event—it’s a phase shaped by informed decisions. From healthcare enrollment to everyday savings, the benefits available after 50 can significantly enhance financial security and personal well-being. Rather than waiting for a birthday to trigger action, proactive planning empowers individuals to navigate transitions smoothly and confidently.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?