As tax season approaches, one of the most critical documents you’ll need is your W-2 form. For UPS employees, this form details your annual wages, taxes withheld, and other essential information required to file your federal and state returns accurately. Fortunately, UPS provides a secure and user-friendly platform for accessing your W-2 online—eliminating the wait for paper copies in the mail.

This guide walks you through every step of retrieving your W-2 from UPS, including troubleshooting tips, deadlines, and best practices for safeguarding your personal data. Whether you're a seasonal worker or a long-term employee, you'll be able to locate your form quickly and confidently.

Understanding Your UPS W-2: What It Includes

Your W-2 form is more than just a summary of your earnings—it’s a legal document that must match your tax filings exactly. The UPS W-2 includes several key pieces of information:

- Box 1 – Wages, Tips, Other Compensation: Total taxable income earned during the calendar year.

- Box 2 – Federal Income Tax Withheld: Amount of federal tax deducted from your paychecks.

- Box 3 – Social Security Wages: Earnings subject to Social Security tax.

- Box 4 – Social Security Tax Withheld: Total Social Security tax withheld.

- Box 5 – Medicare Wages and Tips: Wages subject to Medicare tax.

- Box 6 – Medicare Tax Withheld: Total Medicare tax withheld.

- Box 16 – State Wages: Income reported to your state for tax purposes.

- Box 17 – State Income Tax: Taxes withheld at the state level.

UPS issues W-2s to all employees who worked during the previous calendar year, regardless of employment duration. This includes part-time, full-time, and temporary workers.

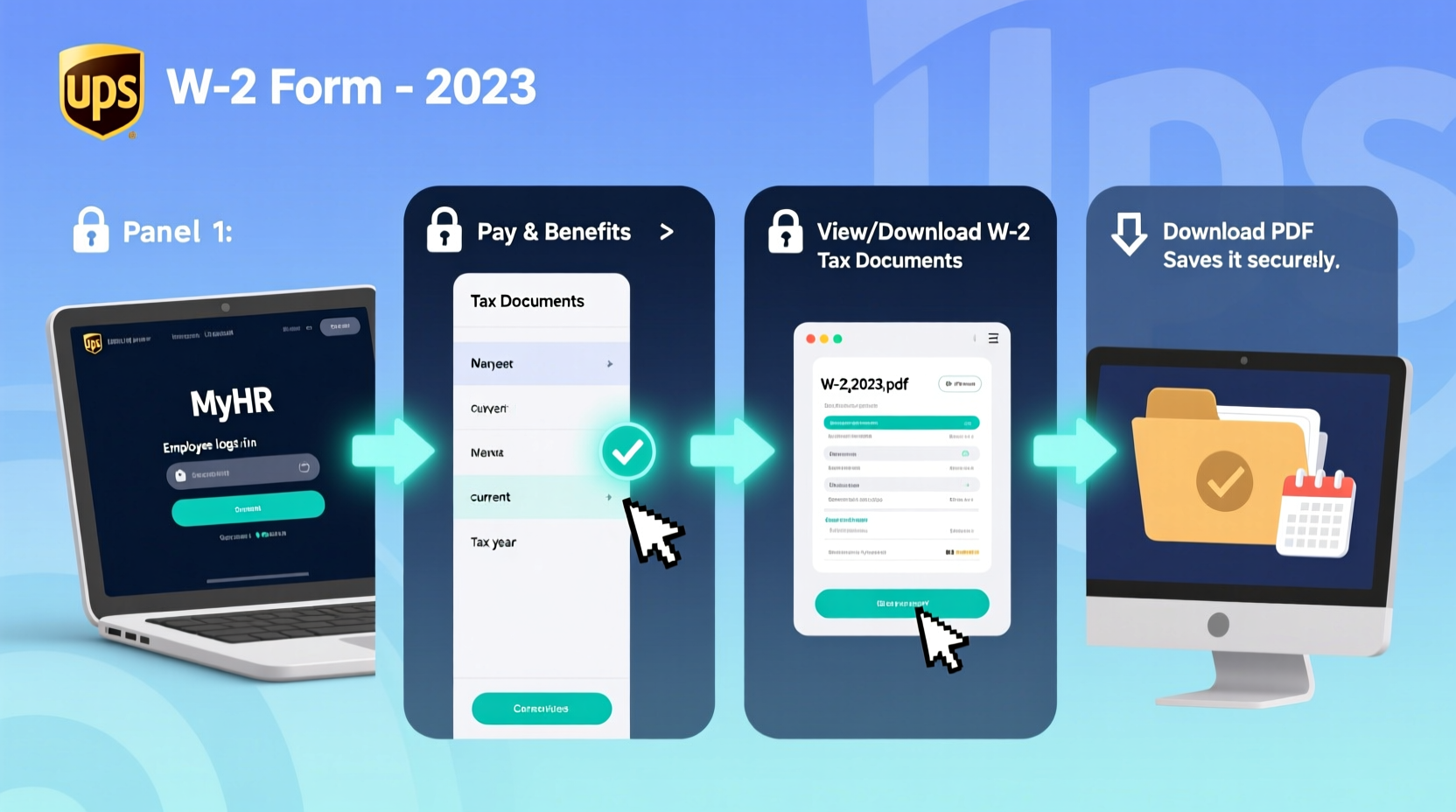

Step-by-Step Guide to Access Your UPS W-2 Online

UPS uses the Workforce.com platform (formerly known as UPSers) to distribute W-2 forms electronically. Follow these steps to retrieve your document securely:

- Visit the official UPS employee portal: Go to https://www.upsers.com using any web browser.

- Log in with your credentials: Enter your UPSer ID (employee number) and password. If you’ve forgotten your login details, use the “Forgot Password” option to reset them via email or security questions.

- Navigate to the Pay & Benefits section: Once logged in, click on “Pay & Benefits” from the main menu.

- Select “View W-2/W-2C”: This option will appear under the payroll tools or tax documents subsection.

- Choose the tax year: Select the appropriate year (e.g., 2023, 2024) from the dropdown menu.

- Download or print your W-2: Click the download button to save a PDF version to your device. You may also choose to print it directly.

If you’re accessing your W-2 for the first time, you may need to consent to electronic delivery. This one-time setup ensures future tax forms are available online without delay.

Important Deadlines and Distribution Schedule

UPS is required by law to provide W-2 forms to employees by January 31st each year. This applies whether the form is delivered electronically or by mail. Most employees receive email notifications shortly after February 1st confirming that their W-2 is ready for viewing.

If you don’t see your W-2 available by February 5th, verify the following:

- You were employed during the tax year in question.

- Your mailing address and email on file are up to date.

- You’ve completed electronic consent for online delivery.

Paper W-2s are typically mailed within five business days of January 31st. However, choosing electronic delivery ensures faster access and reduces the risk of lost or delayed mail.

| Tax Year | Available Online By | Mailed By | Recommended Action |

|---|---|---|---|

| 2023 | February 1, 2024 | January 31, 2024 | Check online first; allow 5–7 days for mail |

| 2024 | February 1, 2025 | January 31, 2025 | Opt for e-delivery to get instant access |

What to Do If You Can’t Access Your W-2

Sometimes technical or account-related issues prevent access. Here’s what to do if you encounter problems:

- Reset your password: Use the “Forgot Password” link on the UPSers login page. Ensure your recovery email is current.

- Clear browser cache: Outdated cookies or cached data can interfere with site functionality. Try logging in using an incognito window or different browser.

- Contact HR Self-Service: Call the UPS HR Service Center at 1-800-504-4359 for assistance with account access or missing documents.

- Request a reprint: If your W-2 is lost or damaged, log into UPSers and re-download it anytime. There’s no limit on downloads.

“Electronic W-2 access not only speeds up tax filing but also enhances security by reducing exposure to mail theft.” — Sarah Thompson, Payroll Compliance Officer, National Tax Association

Mini Case Study: Resolving a Missing W-2 Issue

Jamal, a package handler in Atlanta, couldn’t find his 2023 W-2 in early February. He checked his mailbox and found nothing, and when he tried logging into UPSers, he was locked out due to multiple failed attempts.

He followed these steps:

- Used the password reset tool with his registered email.

- Cleared his browser history and switched to Firefox.

- Successfully logged in and navigated to the Pay & Benefits tab.

- Found his W-2 immediately under “Tax Documents” and downloaded two copies—one for his accountant and one for personal records.

Jamal filed his taxes on February 10th, well ahead of the April deadline, thanks to quick troubleshooting and digital access.

Best Practices for Handling Your W-2 Securely

Your W-2 contains sensitive personal and financial data. Protect yourself from identity theft and fraud with these precautions:

- Store downloaded W-2 files in a password-protected folder on your computer.

- Avoid saving sensitive documents on public or shared devices.

- Shred printed copies when no longer needed.

- Monitor your credit report annually for signs of misuse.

Frequently Asked Questions

Can I get my UPS W-2 if I no longer work there?

Yes. Former employees can still access their W-2s through the UPSers portal as long as they have their login credentials. Account access remains active for several years after separation.

What should I do if there’s an error on my W-2?

Contact the UPS Payroll Department immediately. Common errors include incorrect names, SSNs, or wage totals. They will issue a corrected form (W-2C) as soon as possible.

Is electronic W-2 legally valid?

Absolutely. The IRS accepts electronically issued and signed W-2 forms as long as they meet federal standards. Downloaded PDFs from UPSers are official and printable for submission.

Final Checklist Before Filing

Before submitting your tax return, confirm the following:

- ✅ You’ve accessed the correct tax year’s W-2.

- ✅ All personal information (name, SSN, address) is accurate.

- ✅ Wage and tax withholding figures match your final pay stub.

- ✅ You’ve saved a digital copy and printed a backup.

- ✅ You’ve reported all income sources, including side jobs or freelance work.

Take Control of Your Tax Season Today

Accessing your W-2 from UPS doesn’t have to be stressful or time-consuming. With the right login information and a few simple clicks, you can retrieve your tax documentation quickly and securely. By understanding the process, staying aware of deadlines, and protecting your personal data, you set yourself up for a smooth and successful tax filing experience.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?